Hello my dears,

I have now also realized that there is a lot of potential for the future in uranium energy and that there are some opportunities in the field of SMR mini-reactors. Since I want to invest more broadly in the field of uranium and do not want to and cannot deal with countless shares and areas of uranium, you are in demand.

Do you see more potential in the pure uranium mining or producer sector or would you diversify?

I have picked out several ETFs that I can trade on TR (please no hate for the platform😅).

My goal will be to invest 10k in the sector over the year, which is about 7% of my portfolio as of today.

I would also have the funds to invest in one go, but I sleep better if I spread it out over the next few months, or do you see so much potential in 2026 that you would invest it directly yourself?

Here is the selection of ETFs:

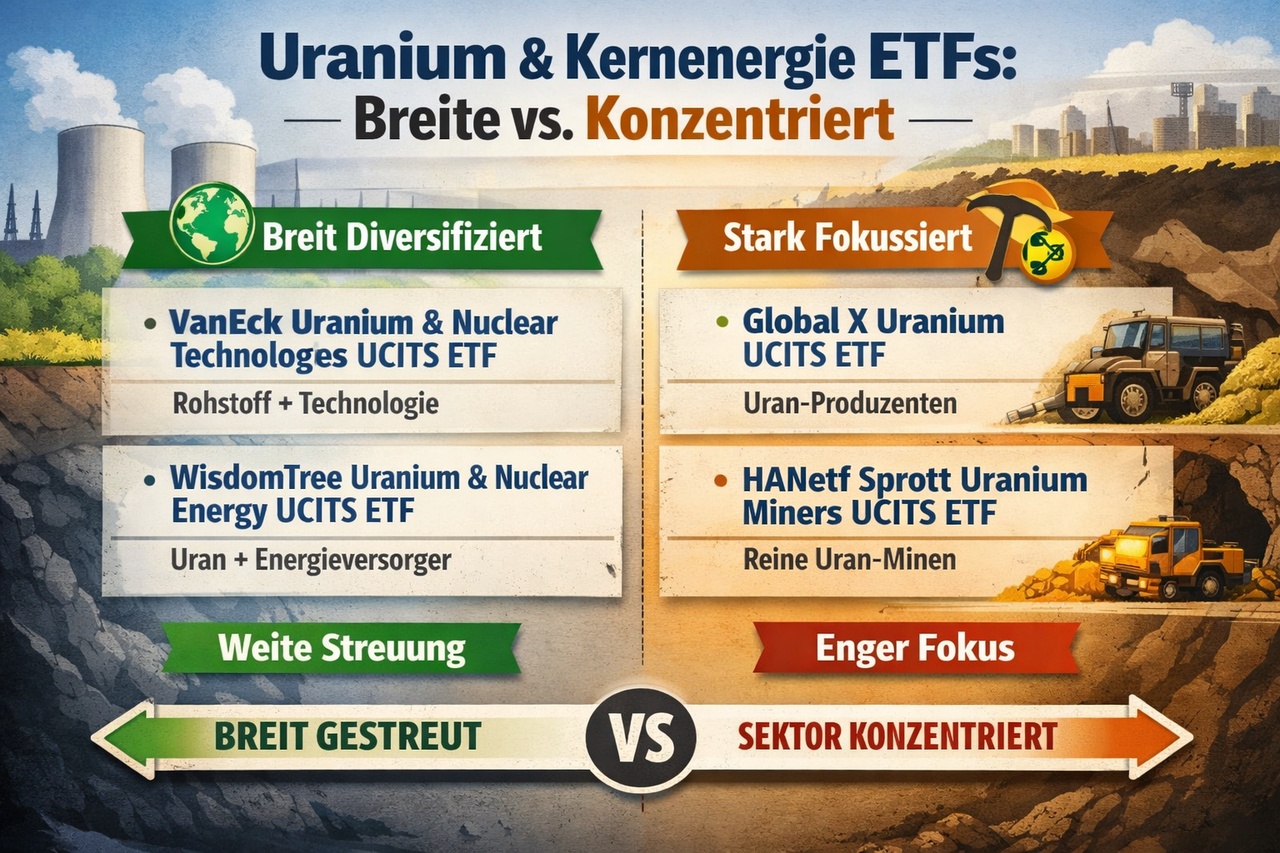

1. VanEck Uranium and Nuclear Technologies UCITS ETF

➡️ Broad thematically in the uranium/nuclear energy sector

👉 Mix of uranium producers, nuclear technology and energy/component companies → More diversification across sub-sectors

2nd Global X Uranium UCITS ETF

➡️ Commodity/producer-centric

👉 Strong focus on uranium mining, exploration and supporting components → More concentrated on commodity/producer sector

3rd HANetf Sprott Uranium Miners UCITS ETF

➡️ Very specialized in uranium miners

👉 Sector segment with a focus on mining and exploration companies → High concentration risk in one sector

4 WisdomTree Uranium and Nuclear Energy UCITS ETF

➡️ Broad across the nuclear energy ecosystem

👉 Includes mining, utilities, suppliers and technology → Broad diversification across different industries in the nuclear sector

$OKLO$CCO (+0,24 %)

$UUUU (+1,39 %)

$3842

$UEC (+1,67 %)

$NXE (-0,28 %)

$BWXT (+0,46 %)

$CEG

$LEU (+0,71 %)