$WBA has just been sold automatically in the securities account (ING). Does anyone have any idea whether this is automatically included in the loss account if you bought through it (like me)? Do I still have to do something or has the delisting issue been resolved?

- Markets

- Stocks

- Walgreens Boots

- Forum Discussion

Discussion about WBA

Posts

58Walgreens agrees to $350 million opioid settlement | Google faces antitrust challenge in the U.S.

Walgreens agrees to $350 million opioid settlement

Walgreens $WBA has agreed to pay up to $350 million with the U.S. Department of Justice after the company was accused of illegally filling millions of prescriptions for opioids and other controlled substances over a period of more than a decade. The well-known drugstore must pay at least $300 million to the government and could owe another $50 million if a sale, merger or transfer occurs before 2032. The lawsuit, filed in January in the U.S. District Court for the Northern District of Illinois, accuses Walgreens of knowingly filling millions of illegal prescriptions between August 2012 and March 2023. Despite these allegations, Walgreens denied the allegations and emphasized that the agreement allows it to settle all opioid-related litigation with authorities and focus on restructuring. The company thus faces the challenge of not only resolving legal issues, but also realigning its business to be more stable in the market going forward.

Google faces antitrust challenge in the USA

In the USA, Google is facing $GOOGL (+0.53%) faces an existential threat as the US government has set itself the goal of breaking up the company due to its monopoly-like behavior in the search engine sector. Hearings began in a Washington court on Monday and it is now being determined how the company should be punished. Federal authorities asked in their opening arguments that the court take drastic action to prevent Google from continuing to enter into monopoly-like contracts with companies like Apple that protect its search engine from competition. Google's lawyer countered that the proposed measures would not promote competition, but could unfairly favor smaller competitors. This lawsuit is the result of a lawsuit filed four and a half years ago accusing Google of using its power on the Internet to hinder competition and innovation. A federal judge has already found that Google has entered into anti-competitive contracts to establish its search engine as the preferred source of information on various devices. The upcoming negotiations will be decisive in determining how the competitive situation in the online sector will be shaped.

Sources:

https://finance.yahoo.com/news/walgreens-pay-350-million-u-024811733.html

https://finance.yahoo.com/news/google-face-off-us-government-002008266.html

Walgreens agrees on settlement

The US pharmacy chain/drugstore Walgreens $WBA has agreed a settlement of 300 million US dollars with the US government. The settlement relates to allegations that the company supplied large quantities of illegal prescriptions for powerful painkillers such as opioids without adequately verifying their validity. The lawsuit was brought as part of the US judiciary's extensive efforts to deal with the opioid crisis. Walgreens said it wanted to take responsibility with the settlement without admitting guilt. The company emphasizes that it has now introduced stricter internal control mechanisms to prevent such incidents in the future.

The news is based on what I personally consider to be reputable sources. No investment advice. Follow me for more updates!

Walgreens Boots Alliance Q2'25 Earnings Highlights

🔹 Adj. EPS: $0.63 (Est. $0.52) 🟢

🔹 Revenue: $38.6B (Est. $38.03B) 🟢; +4.1% YoY

🔹 US Healthcare Sales: $2.15B (Est. $2.27B) 🔴

🔸 Withdrew FY25 Guidance due to pending acquisition by Sycamore Partners

🔹 Merger expected to close in Q4 CY25; WBA will go private

🔸 No FY25 call or webcast held

Segment Performance (Q2 FY25)

U.S. Retail Pharmacy:

🔹 Sales: $30.4B (+5.3% YoY)

🔹 Comparable Rx Sales: +12.2%

🔹 Retail Sales: -5.5%; Comp Retail Sales: -2.8%

🔹 Adj. Op. Income: $487M (↓35% YoY)

International:

🔹 Sales: $6.06B (+0.6% YoY; +4.1% CC)

🔹 Boots UK Comp Pharmacy Sales: +5% CC

🔹 Boots UK Comp Retail Sales: +5.1% CC

🔹 Adj. Op. Income: $234M (↓4.7% YoY)

U.S. Healthcare:

🔹 Sales: $2.15B (↓1% YoY)

🔹 VillageMD Sales: -6.2%

🔹 Shields Sales: +29.7%

🔹 Adj. Op. Income: $117M (vs. loss of $34M YoY)

🔹 Adj. EBITDA: $158M (↑$140M YoY)

Profitability and Cash Flow

🔹 GAAP EPS: $(3.30) (includes $4.2B in impairment charges)

🔹 Adj. Net Income: $543M (↓47.6% YoY)

🔹 Adj. Op. Income: $785M (↓12.8% YoY)

🔹 Operating Cash Flow: $(199)M (improved YoY despite $969M in legal settlements)

🔹 Free Cash Flow: $(418)M (↑$192M YoY)

Management Commentary

“We remain in the early stages of our turnaround... cost discipline and U.S. Healthcare gains were offset by front-end softness and legal settlements.”

— Tim Wentworth, CEO

The S&P 500 inclusions are being announced Friday:

Potential candidates to be added:

$TTD (-0.47%) The Trade Desk

$HOOD (-3.19%) Robinhood

$COIN (-5.1%) Coinbase

$APP (+2.16%) Applovin

Potential candidates to be removed:

$WBA Walgreens

$INTC (-3.2%) Intel

Walgreens is going private in $10 billion deal

$WBA WALGREENS BOOTS ALLIANCE TO BE ACQUIRED BY SYCAMORE PARTNERS IN A DEAL WORTH UP TO USD 23.7 BILLION; SHAREHOLDERS TO RECEIVE USD 11.45 PER SHARE IN CASH $WBA

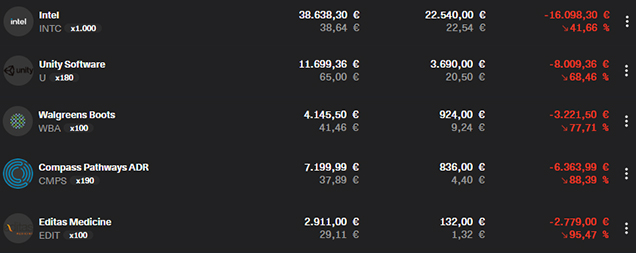

I didn't sell it, so I didn't lose it ... did I? (Loss P0rn)

Everyone only ever shows their winners, but let's be honest - that's boring.

I'm going to turn the tables and present you with my own personal financial disasters. Because who diamond hands need a thick skin.

My investment strategy?

- Hold for at least Hold for 5-10 years (i.e. enough time to ride out a complete market crisis).

- A maximum of 1% of the portfolio in speculative stocks (haha, if only that were the case).

- No stop loss, because I prefer to look straight into the abyss.

Here are my highlights from the "Let's burn down the portfolio!"-category:

Intel (-41%) $INTC (-3.2%)

I thought I was buying a solid chip giant. Turns out: I bought a museum walk through the glory days of 1995. While Nvidia is flying to the moon, Intel is barely keeping its head above water like an old Windows 98 computer.

Unity Software (-68%) $U (-3.5%)

"Gaming is the future! Unity is THE platform for developers!" - At least that's what I thought. In reality, Unity has bugged itself so badly that not even a game patch would help. At least I have the consolation that my shares are more lag than a mobile game with too much advertising.

Walgreens Boots Alliance (-77%) $WBA

Pharmacies? Safe bet! People always get sick! It's just stupid when a company is managed in such a way that even a pharmaceutical giant looks like it has overdosed itself.

Compass Pathways (-88%) $5Y6A

Psychedelic therapy is the future! Or so I thought. But my investment journey was more like a wild drug trip that ended directly in the financial hole. Instead of astral travel, it was just capital destruction.

Edita's Medicine (-95%) $EDIT (-7.76%)

Genetic engineering and CRISPR? Technology of the future! It's just a shame that my investment was deleted faster than faulty DNA. Editas has actually managed to edit itself out - and my capital along with it.

And you?

Do you also have a "Loss P0rn" story you want to share?

Or are you smarter than me and use stop losses? 😂

The only difference: you talk about it publicly. 💪

Honestly, I used to have times when my portfolio looked like this. It was a while ago. But those times prompted me to look for strategies that would save me from looking like that. It can't happen to me like that anymore. 😬

Trump's new tariffs, rising inflation and a trade war on the horizon?

In the following post, I would like to discuss the new US tariffs and their potential economic consequences. The background and the potential impact on inflation and companies, as well as the winners and losers on the stock market, will be discussed.

Again, of course, the stocks mentioned do not constitute investment advice, but merely serve as examples of possible beneficiaries or losers of tightening trade restrictions. Historical developments are no guarantee of future returns.

__________

In this post:

- Influence on inflation

- New tariffs in force

- Reaction of the countries

- Consequences for the global economy

- Winners & losers

- Investment opportunities

__________

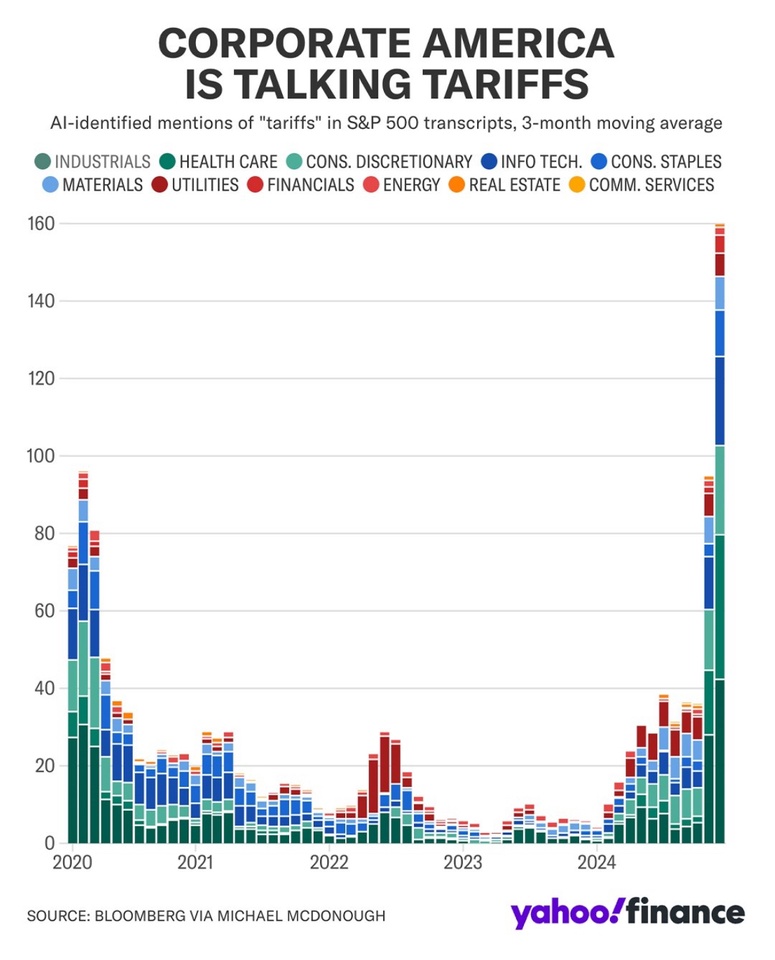

The topic of "tariffs" is currently not only very present in the media, but the term "tariffs" has also been discussed with a strong increase in the past earnings calls of companies in the S&P 500, as the following chart shows [1].

The chart shows that the discussion about tariffs has intensified in recent months and is having an ever greater impact on the outlook in companies' annual reports.

The data is presented as a three-month average and broken down into various sectors, including e.g. industry, healthcare, consumer goods, information technology, etc.

I am curious to see how the stock markets will behave in the coming week. In addition to the current reporting season, the topic of "tariffs" will certainly dominate.

After the tough tariffs announced after Trump took office were not immediately enforced and there was a "slight" sigh of relief, there could now be a new reaction on the markets, as there was on Friday evening. slightly was already slightly noticeable on Friday evening when the markets turned towards the evening.

A looming trade conflict could not only affect individual companies, but also further fuel inflation in the US:

💰 Influence on inflation

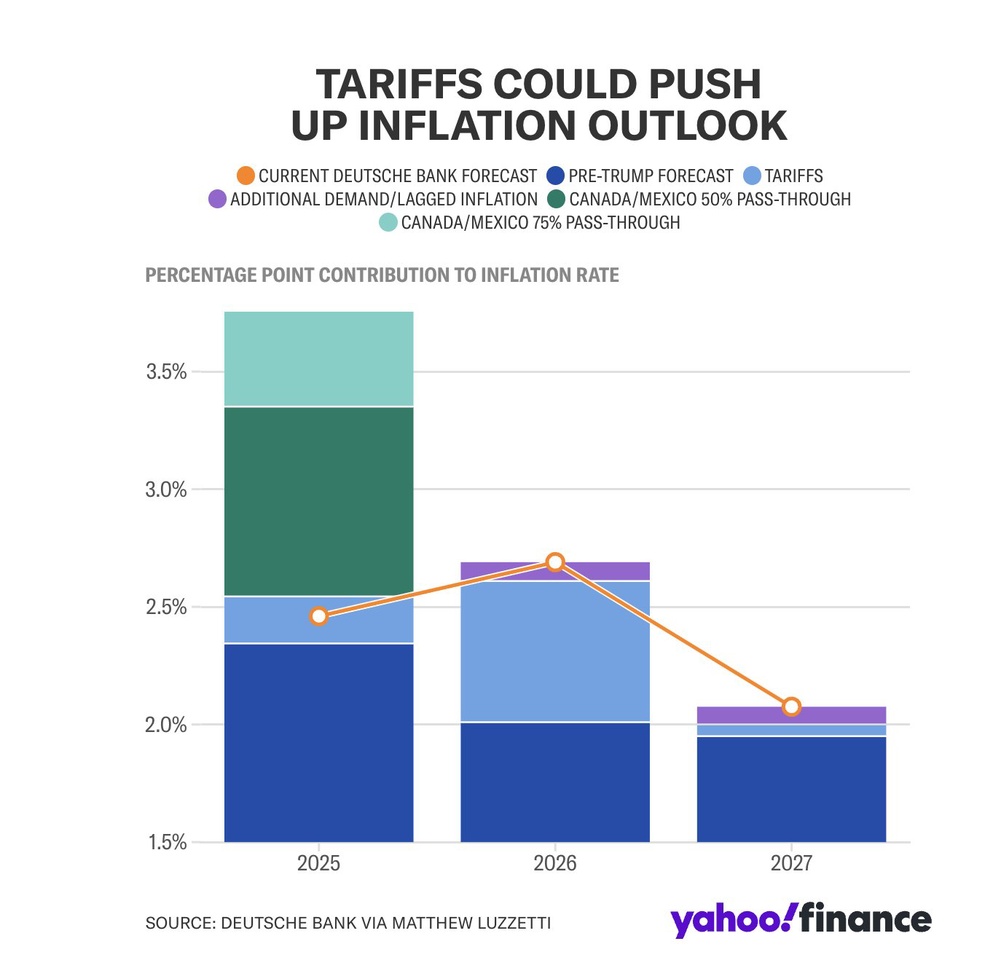

On January 31, Deutsche Bank published a forecast on the potential impact of tariffs on the inflation rate [2]:

The chart compares the current forecast with the forecast before the "Trump" era and takes into account various scenarios for the passing on of tariffs (pass-through) by Canada and Mexico.

Two scenarios are considered: one with a 50% pass-through of tariffs (additional increase shown in dark green) and one with a 75% pass-through (light green). It is clear that the inflation rate could rise sharply again this year and fall again by 2027.

🛃 New tariffs in force & further measures planned

As of today, February 1, 2025, the US government and Donald Trump have imposed new import tariffs on Mexico, Canada and China:

- 25% on imports from Mexico and Canada

- 10% on imports from China

According to the White House spokesperson, these measures are, among other things, a response to the failure of these countries to stop the influx of fentanyl and illegal immigrants into the USA. [3]

But this is just the beginning:

From mid-February, the USA will also impose tariffs on strategic goods [4], including:

- computer chips

- pharmaceuticals

- Steel, aluminum and copper

- Oil and gas imports (but only from February 18 with reduced 10% tariffs so as not to burden US petrol prices immediately).

🚨 Trump relies on escalation - Canada announces retaliation

Yesterday, Canadian government representatives, including Foreign Minister Mélanie Joly, tried to prevent the tariffs in Washington, but to no avail.

Trump made it clear before his departure to Mar-a-Lago [5]:

"We have a 200 billion dollar trade deficit with Canada. Why should we subsidize Canada?"

The EU could also soon be targeted, as Trump hinted:

"Absolutely! The European Union has treated us so terribly!"

🔄 Canada's reaction:

Prime Minister Justin Trudeau announced that Canada will not back down and will respond with "swift and robust countermeasures".

The government is planning a three-stage retaliation strategy [5]:

- 1️⃣ Targeted punitive tariffs on US products coming from Republican states (e.g. orange juice, whiskey, ketchup, peanut butter and motorcycles).

- 2️⃣ Tariffs on steel products and machine parts from the USA.

- 3️⃣ Escalation: Stop exports of oil, gas and electricity to the USA

However, this last step in particular would be a double-edged sword, as Canada is heavily dependent on energy cooperation with the USA.

Economic experts in the US are already warning of the consequences of a trade war [5]:

- The new tariffs could increase the cost of living of an average US household by 800 dollars per year.

- The oil and gas tariffs could increase the price of petrol in the USA by up to 20 cents per liter.

But Trump remains firm:

"Maybe there will be short-term disruption, but in the long run the tariffs will make us very rich and very strong."

🌎 Possible consequences for the global economy

(a) Rising prices in the USA

- Technology & electronicsHigher chip prices are hitting companies such as Apple $AAPL (-1.77%) , Dell $DELL and HP $HPQ (-1.8%) as many of their components come from China.

- Healthcare costs: Pharmaceutical companies such as CVS Health $CVS (-1%) and Walgreens Boots Alliance $WBA are facing higher purchasing costs.

- Construction & InfrastructureHigher steel prices are weighing on companies such as Lennar $LEN (-1.74%) D.R. Horton $DHI (-0.12%) and Caterpillar $CAT (-2.38%) .

(b) Retaliation & new trade wars?

- China could impose tariffs on US products, which could affect e.g. Archer Daniels Midland $ADM (+1.24%) Boeing $BA (-0.19%) and Qualcomm $QCOM (+1.5%) would be affected.

- The EU could make US imports more expensive, which would affect Tesla $TSLA (-0.77%) , Ford $F (-1.11%) and General Motors $GM (+0.99%) could be harmed.

(c) Effects on the stock market

- Volatility is increasing as there is uncertainty about the consequences for various industries.

- Particularly affected: Technology and automotive stocks with global supply chains.

🏆 Winners & losers - which companies will benefit, which will suffer?

Possible beneficiaries of the tariffs

US manufacturers of steel, aluminum & copper

- Nucor $NUE (-2.98%) , U.S. Steel $X and Freeport-McMoRan $FCX (-1.24%) could benefit as foreign competition becomes more expensive as a result of the tariffs.

Domestic pharmaceutical and biotech companies

- Pfizer $PFE (-0.47%) Moderna $MRNA (-5.86%) and Eli Lilly $LLY (+1.53%) could gain market share.

Energy companies with US production

- ExxonMobil $XOM (+1.51%) , Chevron$CVX (+1.02%) and Expand Energy $CHK (-1.88%) could benefit from rising prices for US oil and gas.

Chip manufacturers with US production

- Intel $INTC (-3.2%) and Texas Instruments$TXN (+2.96%) have US factories and could gain market share.

😥 Companies that could suffer from the tariffs

Chip manufacturers with global supply chains

- Apple $AAPL (-1.77%) NVIDIA $NVDA (-1.17%) , AMD $AMD (-4.24%) are dependent on Asian imports and could see higher production costs.

Car manufacturers with global suppliers

- Tesla $TSLA (-0.77%) , Ford $F (-1.11%) , General Motors $GM (+0.99%) are under pressure because components from Mexico and Canada could become more expensive.

Companies with strong export business

- Boeing $BA (-0.19%) and Caterpillar $CAT (-2.38%) suffer from possible retaliatory tariffs.

US retailers with a high import share

- Walmart $WMT (+0.76%) , Target $TGT (-0.15%) and Nike $NKE (+0.76%) could have to pass on rising prices to customers.

🧠 Possible investment strategies

Favor defensive sectors:

- Utilities (e.g. NextEra Energy $NEE (-1.3%) Duke Energy $DUK (+1.01%) ) and healthcare companies (e.g. UnitedHealth $UNH (-1.13%) , Johnson & Johnson $JNJ (+0.17%) ) remain more stable.

Exploit long-term opportunities in "reshoring":

- Intel $INTC (-3.2%) , Eli Lilly $LLY (+1.53%) , Nucor $NUE (-2.98%) could benefit in the long term.

Conclusion: Will the trade conflict escalate further?

With the new tariffs, Trump is taking a confrontational stance and Canada, Mexico and China are preparing for retaliatory measures. If further tariffs on European goods follow, the situation could worsen.

❓Which stocks do you think could be most affected? Which beneficiaries do you see?

Thanks for reading! 🤝

__________

Sources:

[4]

[5] https://www.tagesschau.de/ausland/amerika/usa-trump-strafzoelle-100.html

Trending Securities

Top creators this week