Veeva share: Chart from 02.06.2025, price: USD 278 - symbol: VEEV | Source: TWS

With the breakout above USD 250, a pro-cyclical Kaufsignal with a first Kursziel was triggered at USD 285. Further gains towards USD 300, USD 314-324 and USD 340 are conceivable above this level.

However, if the share falls below USD 265, a setback to the breakout level of USD 250 must be expected.

Fundamental

Over the past ten years, Veeva has massively increased sales from USD 409 million to USD 2.75 billion.

At the same time, profitability improved and earnings climbed from USD 0.51 to USD 6.60 per share and free cash flow from USD 0.41 to USD 6.47 per share.

A top setup

The share performed accordingly well. However, in the course of the stock market madness of 2020 and 2021, the valuation rose to an unreasonably high level, with the P/E at times exceeding 100.

The inevitable happened and the share price plummeted from USD 350 to USD 150.

This was followed by a multi-year Seitwärtsbewegungduring which the share price lagged behind the fundamental data.

While the share price was treading water, profits increased by 15%, 13% and 36% in the 2023, 2024 and 2025 financial years. As a result, the P/E fell from around 50 to 30.

Situations like this are among my favorite setups. Aktienthat are dormant, even though profits are rising steadily.

It is impossible to predict when this imbalance will be resolved, but sooner or later it will happen. This usually results in an impulsive upward movement.

Outlook and valuation

I therefore expressed a positive view on the share in July and December 2024 at prices of USD 183 and USD 243.

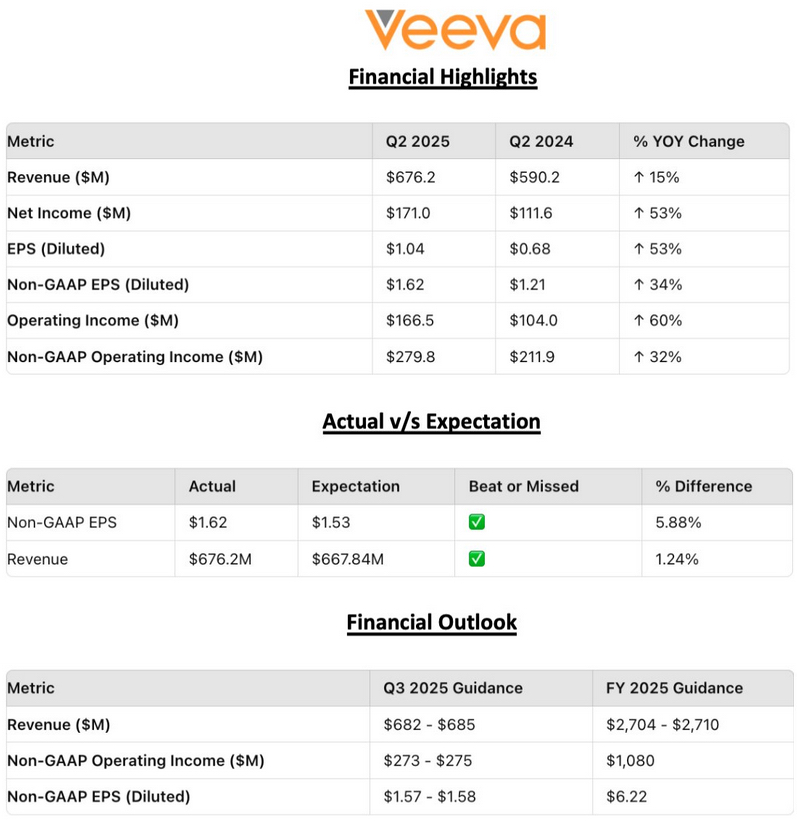

Following the latest quarterly figures, the bulls are likely to have taken full control.

Earnings of USD 1.97 per share in Q1 were well above expectations of USD 1.75. With sales of USD 759 million, the company also exceeded analysts' estimates of USD 728 million.

For the year as a whole, this corresponds to a 17% increase in sales and a 31% jump in profits.

With a run rate of more than USD 3.0 billion, the target set for this year was already achieved in the first quarter.

Turnover is set to double again by 2030.

Veeva is forecasting earnings of USD 1.89 - 1.90 for the second quarter and USD 7.63 per share for the financial year.

This gives Veeva a forward P/E of 36.7.

At first glance, this seems a lot, but in view of the business model and the high growth rates, it is no surprise. Since the Börsengang the P/E has never been below 30; in the past five years, the P/E has averaged 53.