After three years of heavy pressure from inflation, high interest rates, and a volatile market environment, Cathy Wood believes the tide is turning. According to ARK Invest’s Q3 report, the market is moving away from “fighting inflation” and back toward innovation as the main driver of global growth.

Wood’s investment thesis is built on the idea that the global economy is entering a deflationary phase. Growth, she argues, will no longer be driven by price increases but by productivity and technological advancement. After a cycle of tight monetary policy, companies can no longer pass rising costs on to consumers, pushing them to find new ways to maintain profitability—through innovation, automation, and energy efficiency.

This marks the beginning of a new investment cycle centered on technology and creativity. Productivity is back at the forefront, and investors are reassessing companies with the ability to generate efficiency independent of capital costs. Essentially, capital is flowing once more into innovation—an asset class that had been underestimated during periods of high interest rates.

Policy Shifts Fuel the Turnaround

Another crucial catalyst comes from shifts in U.S. economic policy. The budget law introduced this summer reduces corporate tax burdens, accelerates investment depreciation, and expands various business incentives. At the same time, regulatory easing in cryptocurrencies, artificial intelligence, and healthcare is fostering a more favorable environment for innovators.

Even the stronger U.S. dollar—once seen as a threat—is now acting as a deflationary force

supporting technological growth. This new environment, shaped by moderate inflation and predictable monetary policy, offers fertile ground for long-term innovation-driven investment strategies like ARK’s.

Innovation Thrives in Transitional Periods

According to Wood, transitional stages—when the economy begins to emerge from a downturn and uncertainty starts to ease—create the best conditions for technological progress. As she emphasizes, “Innovation gains strength in times of turbulence. When fear gives way to opportunity, growth begins.”

Wood believes the global economy is nearing the end of the “rolling recession” that began in early 2022 after a sharp rate hike cycle. As stability returns and businesses adapt, firms focused on efficiency-enhancing technologies now have a clear advantage. In an environment of moderate inflation and cooling demand, technology is not merely a tool—it’s the primary mechanism for resilience and adaptation.

The Sectors Driving the Future

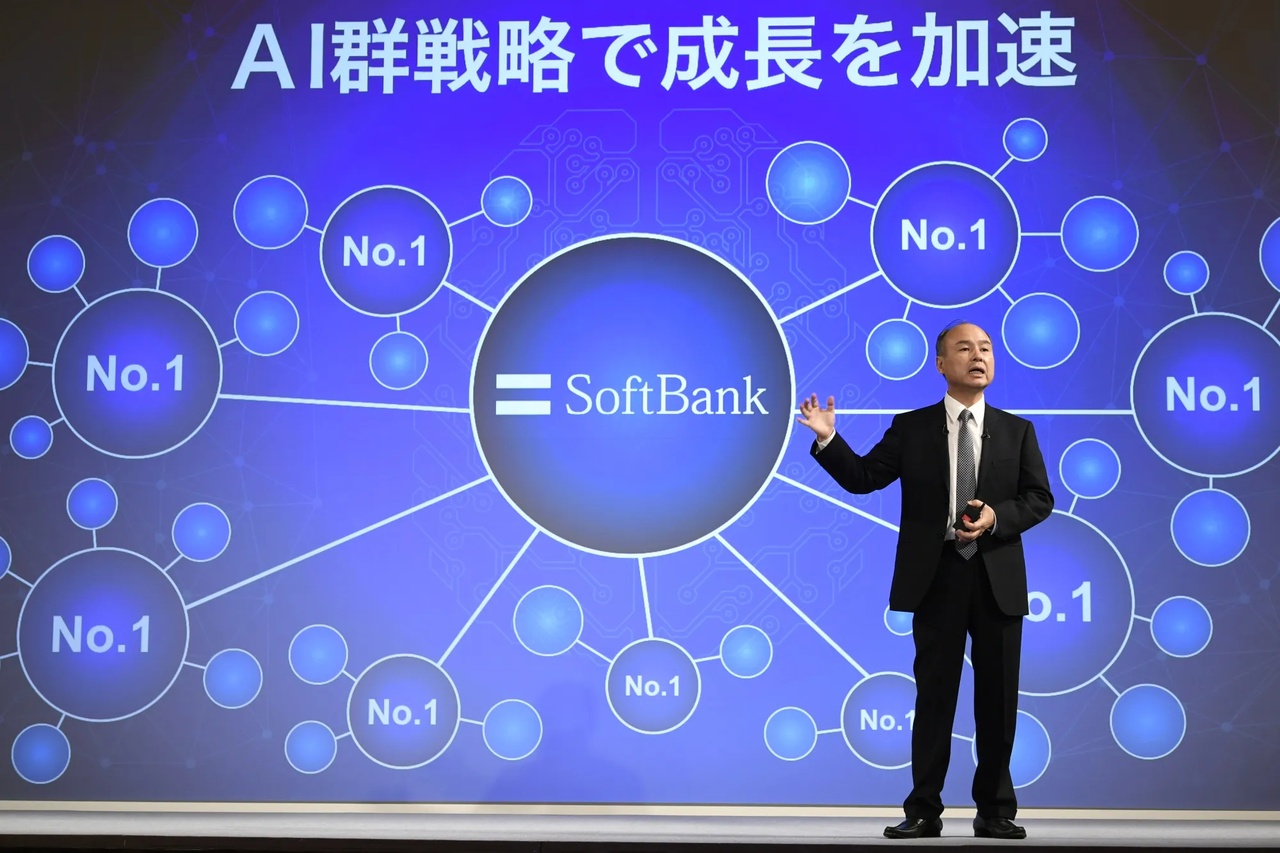

ARK’s investment focus revolves around five transformative sectors:

- Artificial Intelligence

- Robotics and Autonomous Technology

- Energy Storage

- Blockchain and Digital Assets

- Multiomics (comprehensive biological data analysis, the next step beyond DNA sequencing)

These sectors, Wood argues, are reducing costs, boosting productivity, and laying the groundwork for long-term structural growth.

The recent performance of ARK’s funds validates this vision. All six of ARK’s ETFs outperformed global benchmarks in Q3. The ARK Innovation ETF rose 11%, compared to 6% for the MSCI World Index, while the ARK Next Generation Internet ETF gained nearly 10%.

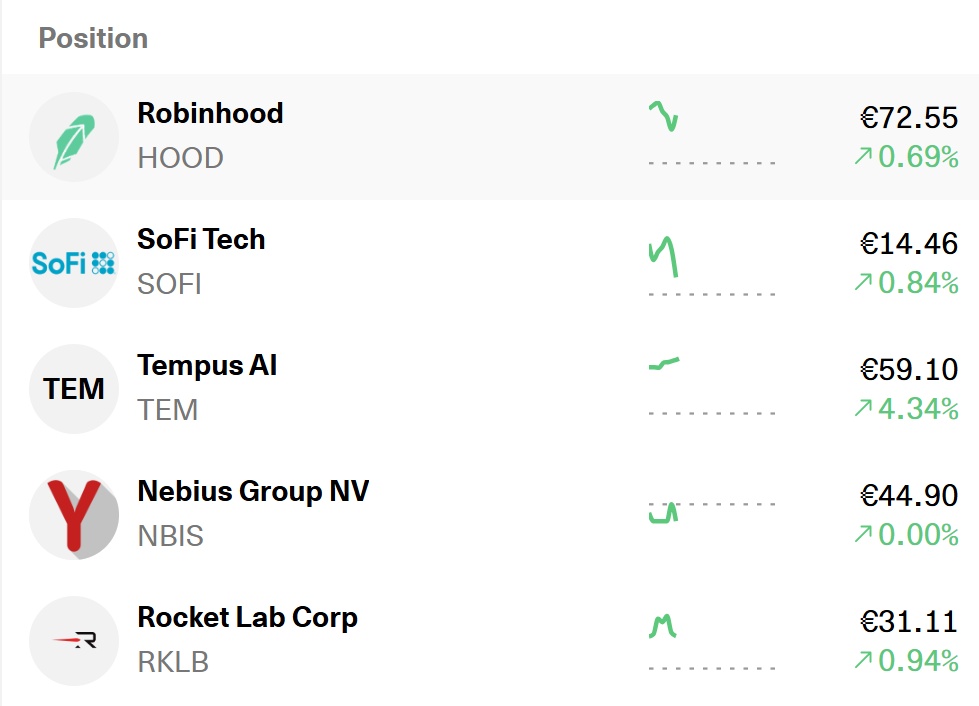

Leading this performance were standout holdings such as $TSLA (-3.07%) and $KTOS (+1.77%) in robotics and autonomous tech, $HOOD (+4.02%) and $SHOP (+3.64%) in fintech and next-generation internet, $CRSP (+0%) and $TEM (+1.99%) in biotechnology, and $RKLB (+1.36%) in the space sector. These companies embody the key forces driving the next phase of the technological revolution—a phase ARK believes is already underway.

As Cathy Wood concludes, the market is returning to its fundamental engine: innovation as the core source of value and growth. This isn’t just a rebound in tech; it’s the dawn of a sustained era where automation, intelligence, and productivity define economic expansion.