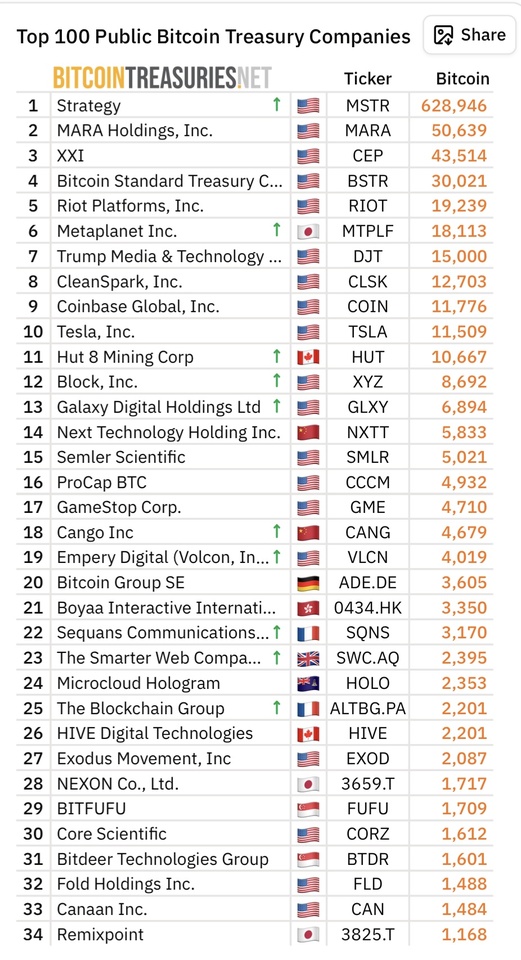

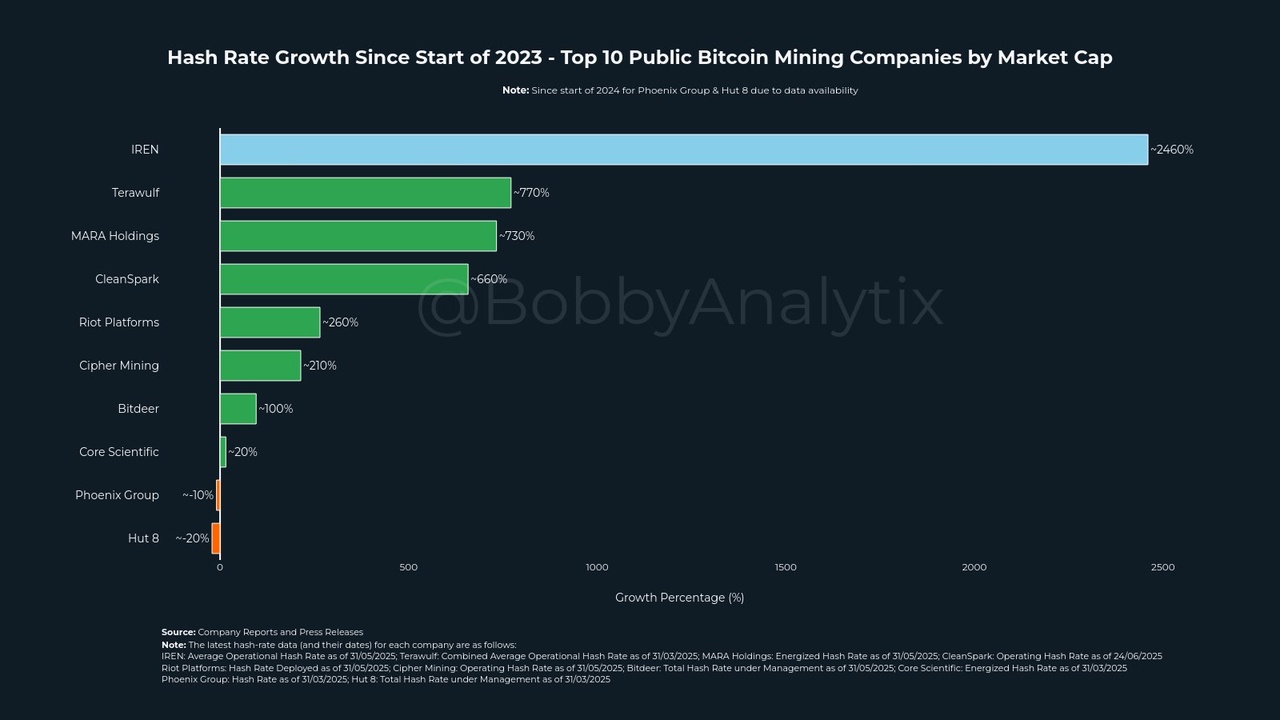

$CLSK (-11.23%) could also be an exciting company in the data center sector that also comes from the Bitcoin division.

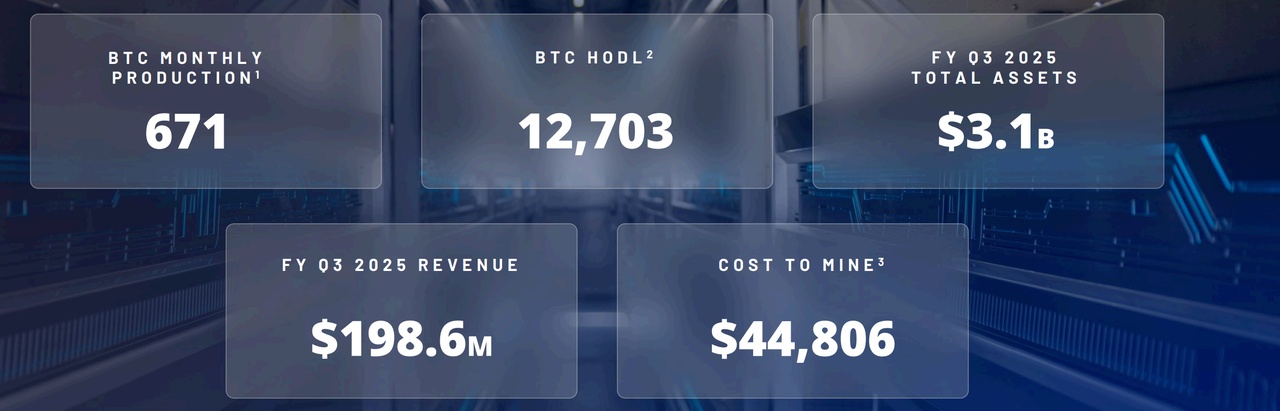

The advantage of CleanSpark is that they have not yet started so strongly, have a favorable valuation and have also secured contracts of 1GW and 1.7GW in the long term (almost 1/3 of Irish). However, CleanSpark is at the beginning of the transition and needs to show real initiatives in the data center area and needs more time to gain a proper foothold here, and is still deeper in the mining business:

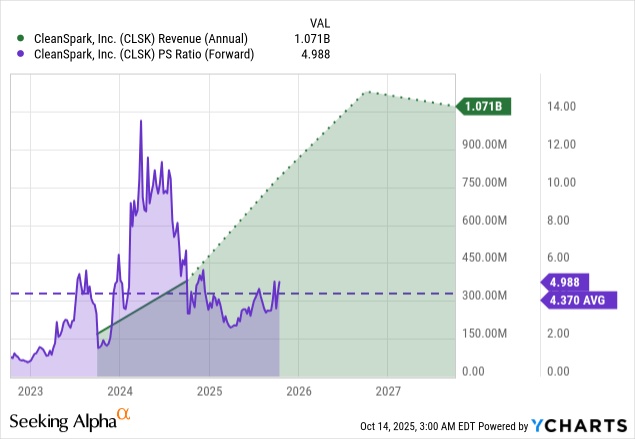

Valuation:

If we look at the valuation we have a current PS ratio of 8x (IREN 26x) and generally has a low valuation, but also has a different company/growth structure. They also have a 4.9x FWD P/S ratio. Cleanspark is therefore valued up to 3x lower purely from a fundamental perspective!

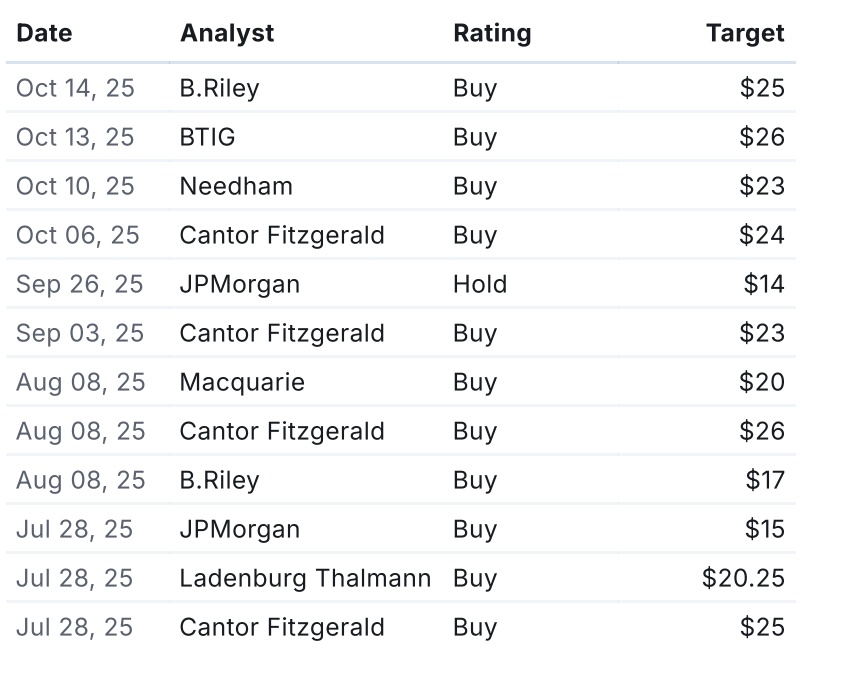

Banks: Upside potential to $25 per share

Technical rebound possible:

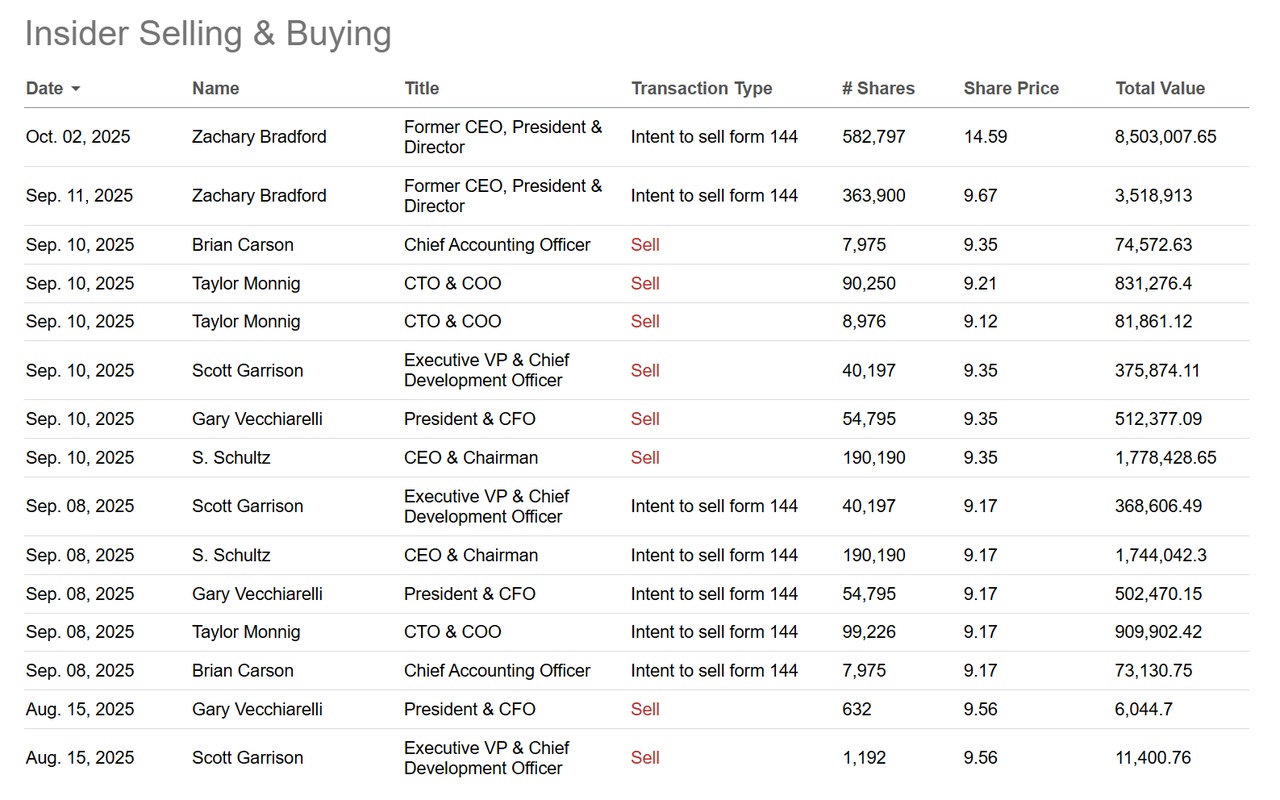

On the negative side, however, the massive insider selling should be noted:

Generally very exciting and will be analyzed further over the next few days!