At the end of July, I made the decision to break up my portfolio. This is just a visual change, but it will take me back below 100,000 euros.

What did I do?

I decided to split my portfolio into three parts. Of course, as I said, this is only a visual change. But it allows me to make a somewhat more concrete evaluation.

But first, as usual, let's take a look at the S&P500:

For once, the S&P500 was up almost continuously in July. There was only a dip at the end of August. The main reason for the rise was the regulated tariffs.

In my opinion, the stock market reacts very quickly and very positively to any regulations, which, as we all know, can also be quickly discarded.

In the end, the S&P500 gained +3.97% (USD). In EUR terms, it is even up 6.1%.

Now let's move on to my new portfolio allocation. For the time being, nothing has changed in terms of positions. However, I have turned one portfolio into three or simply sorted things out.

On the one hand, of course, I have my share portfolio, which also serves as a review here.

Secondly, I have taken out my XEON. It's still running, of course, because that's the money that will be used to pay off the loan in five years' time. I don't need to keep that in retrospect.

I have also created a "pension portfolio". This contains my ETFs, which I save a total of €650 per month. This doesn't need to be included in the review either, as the savings plans are running there and there shouldn't be any changes until retirement.

What remains is my share portfolio, which contains the individual shares and gold.

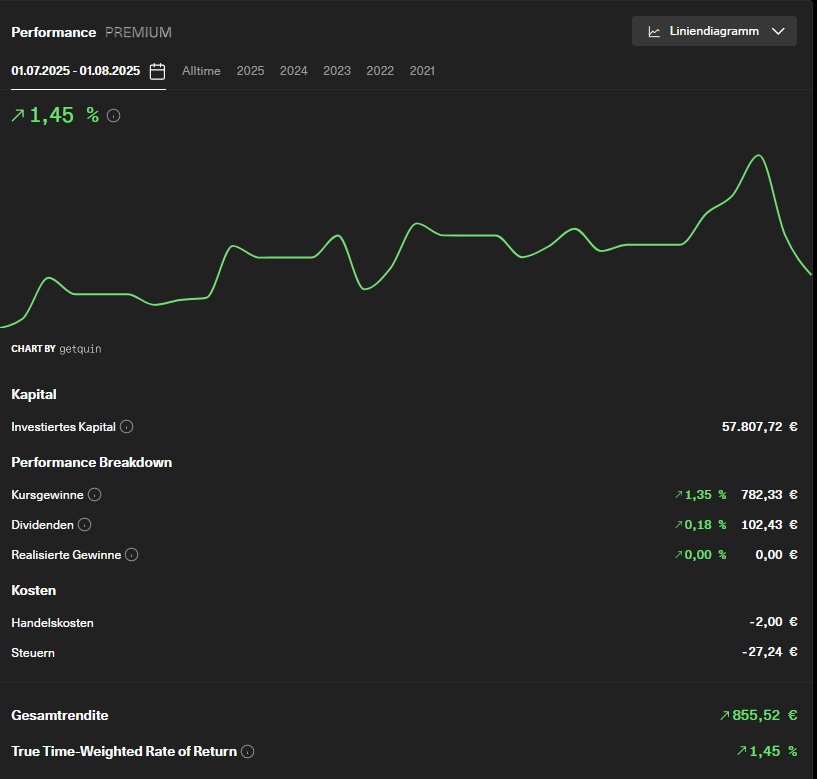

As you can see, my performance is +1.45%.

The S&P500 has massively outperformed me here. At the same time, the MSCI World has also risen by 4.4%. Over the year as a whole, my portfolio is now down -1.7%, while the MSCI World is still down -2.7%. The S&P is even at -4.1%

Only the DAX is still outperforming everyone. Over the year, it is now up +17.7%.

My high and low performers in July were (top 3):

Tractor Supply ($TSCO (+0.6%) )+15,85%

British American Tobacco ($BATS (+1.74%) ) +15,59%

Ping An insurance ($2318 (-0.97%) ) +13,52%

Nestlé ($NESN (-0.91%) ) -9,32%

Nintendo ($7974 (-1.25%) ) -11,07%

United Health ($UNH (-1.13%) ) -16,29%

Dividends:

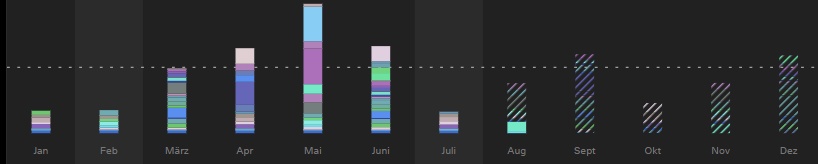

In July, I received €56.87 net from a total of 8 distributions.

Compared to July 2024 (€74.17), this was a reduction of 23.32%.

The difference is due to the fact that Ping An already paid in June this year.

Due to my new portfolio allocation, I have excluded the ETF dividends in each case and therefore the dividend is now of course also visually much lower. The dividends received in the bond portfolio flow 1:1 back into the ETFs.

Investments:

The bill for the car has finally arrived. It amounts to around €1200. Of course, that sets me back enormously. But the worst is yet to come.

The tax was due on 31.07. Well, I was already aware that I had to pay it. However, the sum amounts to €4,000 in arrears. But where does that come from? My old employer paid me a special payment from the old year (i.e. 2023), which was untaxed except for the pension contributions. I got away with it and of course I have to pay an enormous amount as a result. This is also deducted from my nest egg, which makes it worthwhile to have a nest egg.

This means I'm starting almost from scratch again with my nest egg. However, the inspection is due next month at the latest, including an oil change and possibly a brake change.

That would probably use up the nest egg completely. If the brakes don't need to be changed, I can also use the coffee money.

Let's see what August or September at the latest brings.

Buying and selling:

There were no sales in July either.

I added to Gladstone Invest ($GAIN (-0.42%) ) (150 shares) and Hercules Capital ($HTGC (-0.72%) ) (14.45 shares)

savings plans (125€ in total):

Goals 2025:

I have to change my targets slightly - together with the portfolio. Overall, the €130,000 at the end of the year will remain, but this target will of course be made smaller and the focus will only be on the dividend portfolio.

To be honest, I haven't thought about the target there yet.

Target achievement at the end of July 2025 (in relation to the €130,000): 58.33%

How was your July?

What else would be of interest or what could I do better in the review?

If you liked the report and would like to read more, feel free to follow me,

If you're not interested, you can keep scrolling or use the block function.