April was here and it's already over again. Trump's liberation day was not as liberating as we now know. Nevertheless, a lot happened and the stock market remained very volatile in April. After initially falling sharply, it stabilized towards the middle of the month and ultimately rose again, leaving the S&P500 at -3.62% at the end of the month.

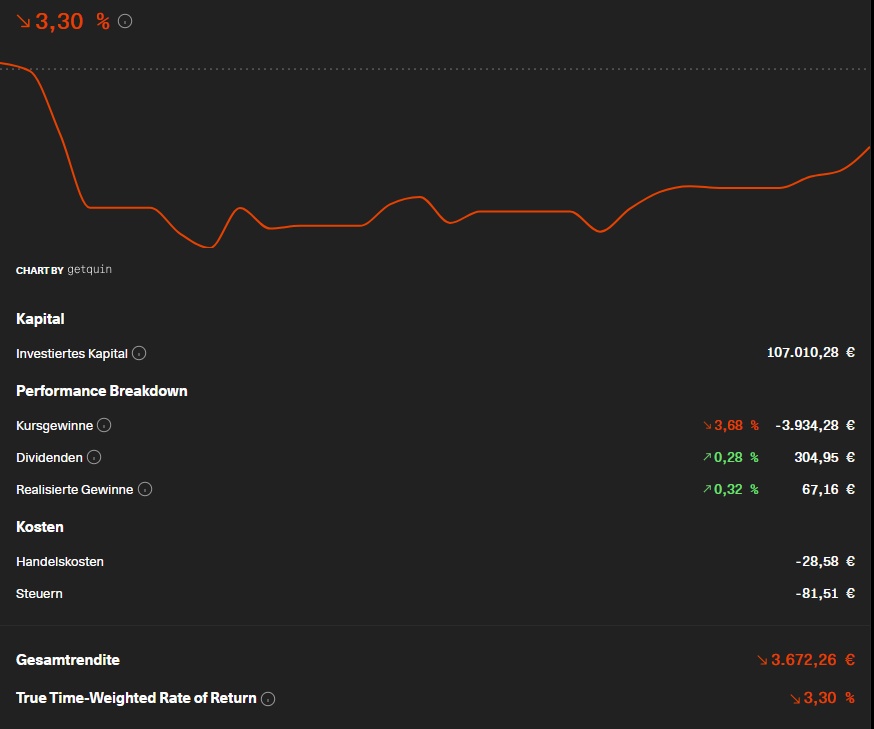

In April, I recorded a loss of 3.68%. Given the size of my portfolio, this corresponds to a value of almost €4,000.

Thanks to the dividends, which are gross here in the picture (net = €272.65), this amount is then reduced to just under €3,700.

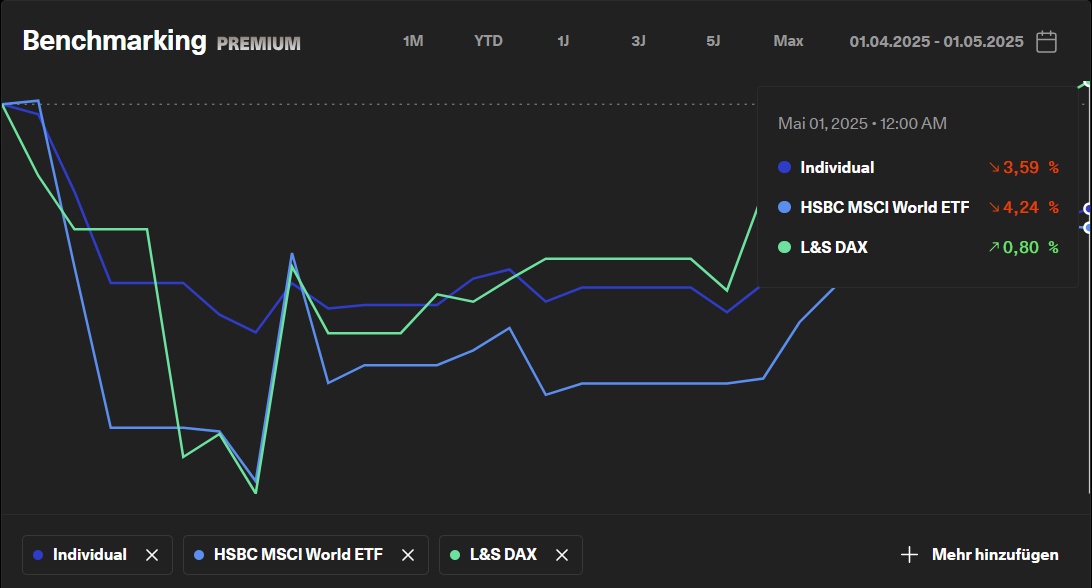

The Dax (+0.80%) has beaten me again, but compared to the HSBC MSCI World (-4.24%) I am doing better again.

Over the year as a whole (YTD), I have lost ground again to the DAX, which has risen again. At the same time, however, I was able to further extend my lead over the MSCI World. However, as can be seen above, the MSCI World caught up considerably towards the end of the month.

April again showed that my portfolio is quite stable. That's the price you pay if you give up positive returns. Of course, everyone has to decide for themselves how well they can sleep.

My high and low performers in April were (top 3):

Nintendo ($7974 (-1.41%) ) +15,32%

Eon ($EOAN (-1.01%) ) +10,42%

Tesla ($TSLA (-3.14%) ) +8,87%

Pepsi ($PEP (-0.79%) ) -14,93%

UnitedHealth ($UNH (+2.11%) ) -20,62%

Petroleo Brasileiro ($PETR4 (-0.75%) ) -20,89%

Interesting that UnitedHealth was the second-worst stock in February, the second-best in March and now the second-worst again. A very volatile stock at the moment. Understandable, however, after the recent events.

Dividends:

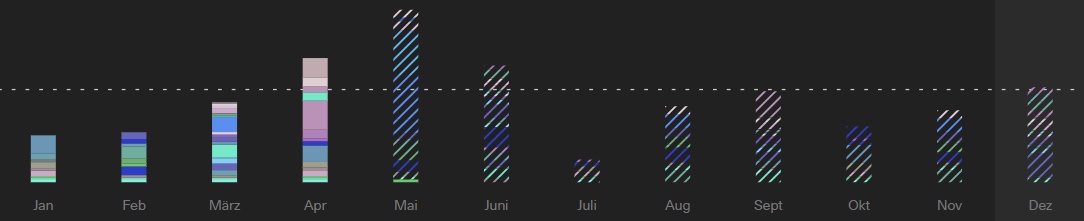

In April, I received €272.65 net from a total of 15 distributions.

Compared to March 2024 (€182.13), this was an increase of 49.7%.

I now expect another increase in May before it falls sharply again afterwards.

Investments:

As in February and also in March, I am still building up my nest egg again. This was actually planned to be completed in April or May at the latest. But now the car is broken and the repairs will cost a lot. So the replenishment continues.

The special payment in April went into the $XEON (+0.01%). I also treated myself to a South African government bond, which will also mature in the year the first loan is due. I'm happy to take the 8% until then and if I don't see the money again, then it was a try and I can cope with it.

Buying and selling:

I sold Monster with a plus of 12.3%. Simply because I want to reduce the size of the portfolio, Monster does not pay a dividend and we were very close to the all-time high in April.

I bought or increased Gladstone Investment (I'm happy to take the special dividend in June), Texas Instruments, LVMH, Rio Tinto, United Health, Lockheed Martin and Waste Management.

Savings plans (125€ in total):

- Cintas ($CTAS (-0.37%) )

- LVMH ($MC (+2.11%) )

- Microsoft ($MSFT (-0.59%) )

Target 2025:

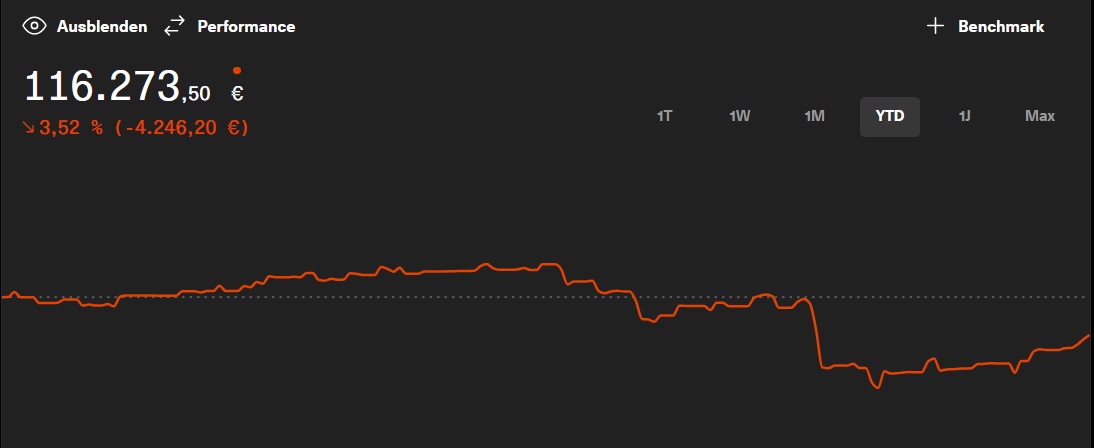

My goal is still to have € 130,000 in my portfolio at the end of the year. The goal is to be achieved by reinvesting the dividend, making payments and, of course, increasing the share price. The share price increase is of course impossible to predict in any way, so the motto is: if the share price falls or does not rise enough, more cash is needed.

This comes from selling useless stuff on eBay, additional income from e.g. "neighborhood help" etc.

The worse the share price, the more additional cash has to be raised.

Target achievement at the end of April 2025: 22.22%

I'm slowly lagging behind the average. It's definitely going to be very sporty this year.

Let's see what else is coming. Now that Trump has probably signed a commodities deal with Ukraine, the share price will rise again somewhat, at least in the next few days. After that it will be uncertain again.

How was your April? As the getquin monthly report for March was not published, I am now looking forward to the April report.

If you liked the report and would like to read more, feel free to follow me,

If you're not interested, you can keep scrolling or use the block function.