Here in the link my previous portfolio (unfortunately can no longer be updated here at the moment) and the train of thought of the last months briefly summarized:

-----------------------------------------------------------------------------------------------------------

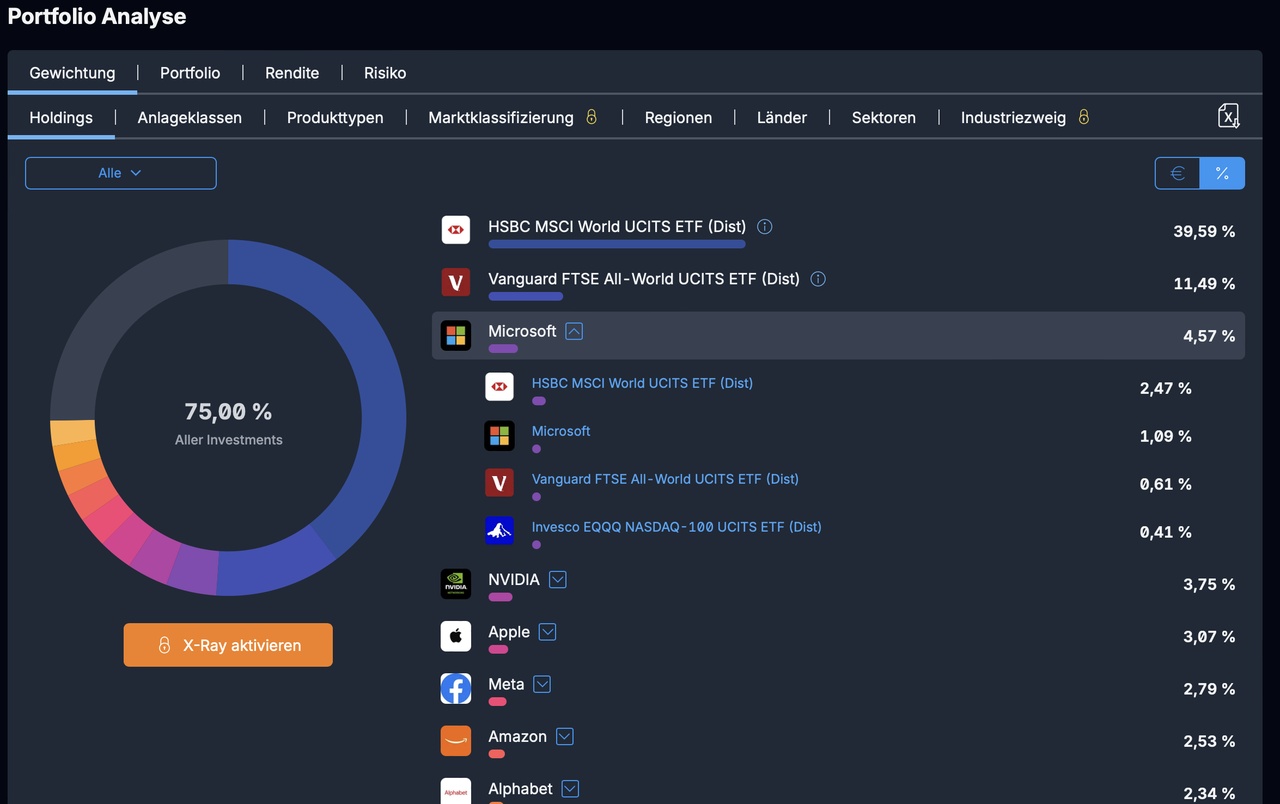

This is my portfolio as of today.

-----------------------------------------------------------------------------------------------------------

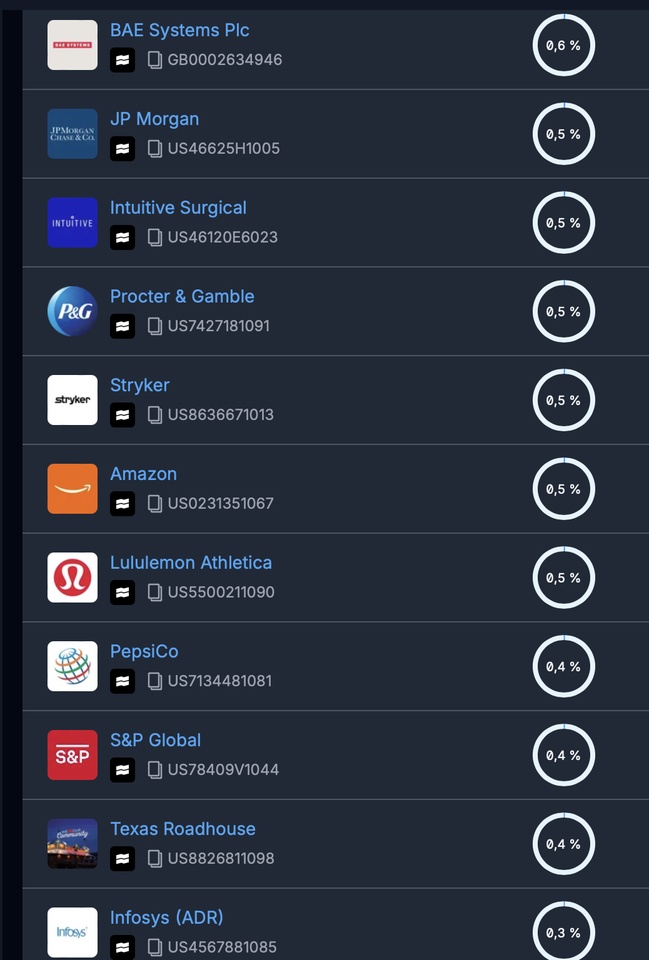

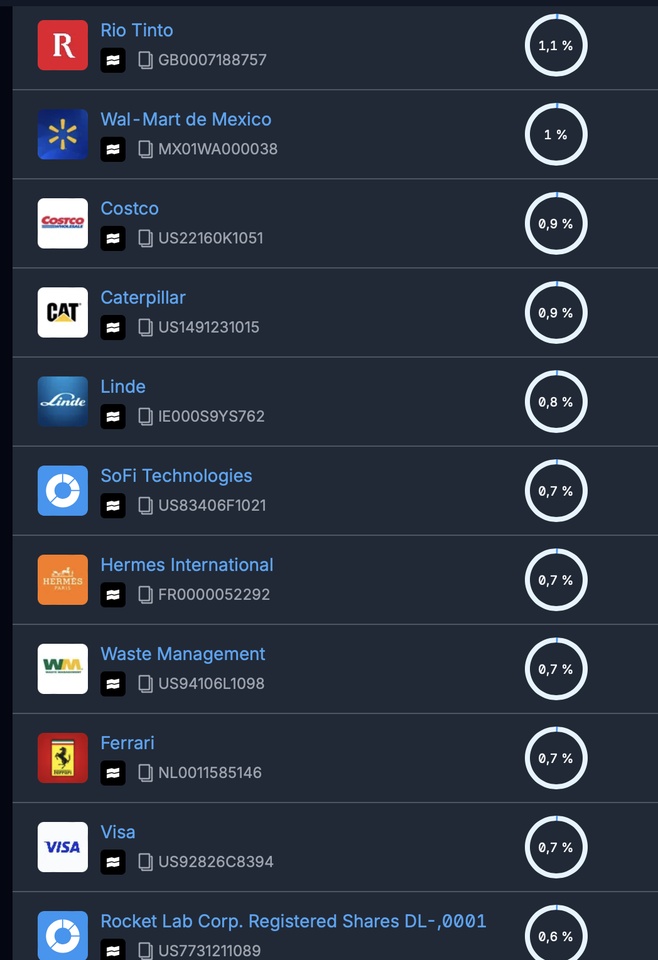

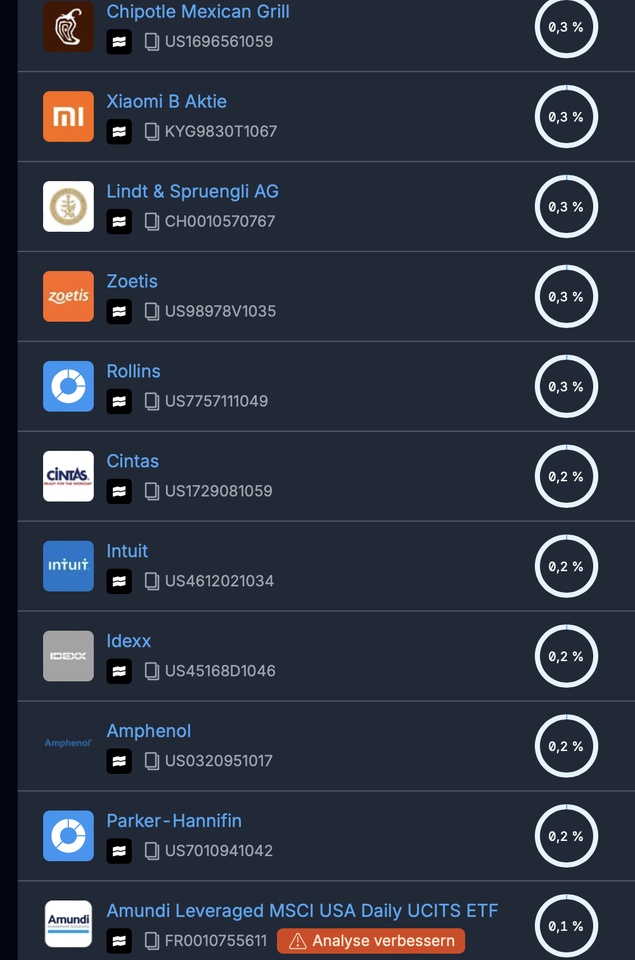

I probably won't manage to get rid of individual stocks completely.

But at least I could eliminate supposedly unnecessary overweightings and overlaps and focus more on second-tier stocks, such as $CALM (-0.31%)

$TXRH (+0.31%)

$SOFI (-0.4%)

In any case, I haven't reallocated much since the article linked above.

I'm taking it rather slowly, as it still feels wrong to me, although the opposite would be more accurate.

So far I have sold the following stocks:

Lotus $LOTB (+0.72%) -7,3 %

Hims $HIMS (-0.29%) +202 %

DE Telekom $DTE (-0.45%) +-0

Church&Dwight $CHD (-0.01%) -6 %

Ecolab $ECL (-0.23%) +1 %

-----------------------------------------------------------------------------------------------------------

Below is the X-Ray, which illustrates overweightings and allocations. Nvidia and Apple are not in my portfolio as individual stocks, but are strongly represented due to the ETFs. However, I have $MSFT (-0.09%) and $GOOGL (-1.11%) shares in the portfolio, which leads to an overweighting. Alphabet convinces me in many ways, so the overweight could make sense here. But with Microsoft, the ETF share could actually be enough for me. I am therefore considering adding an SL to Microsoft, for example 7% below the current price level.

-----------------------------------------------------------------------------------------------------------