$RKLB (+1.36%)

$9984 (+4.85%)

$CADLR (-1.75%)

$MTRS (+22.78%)

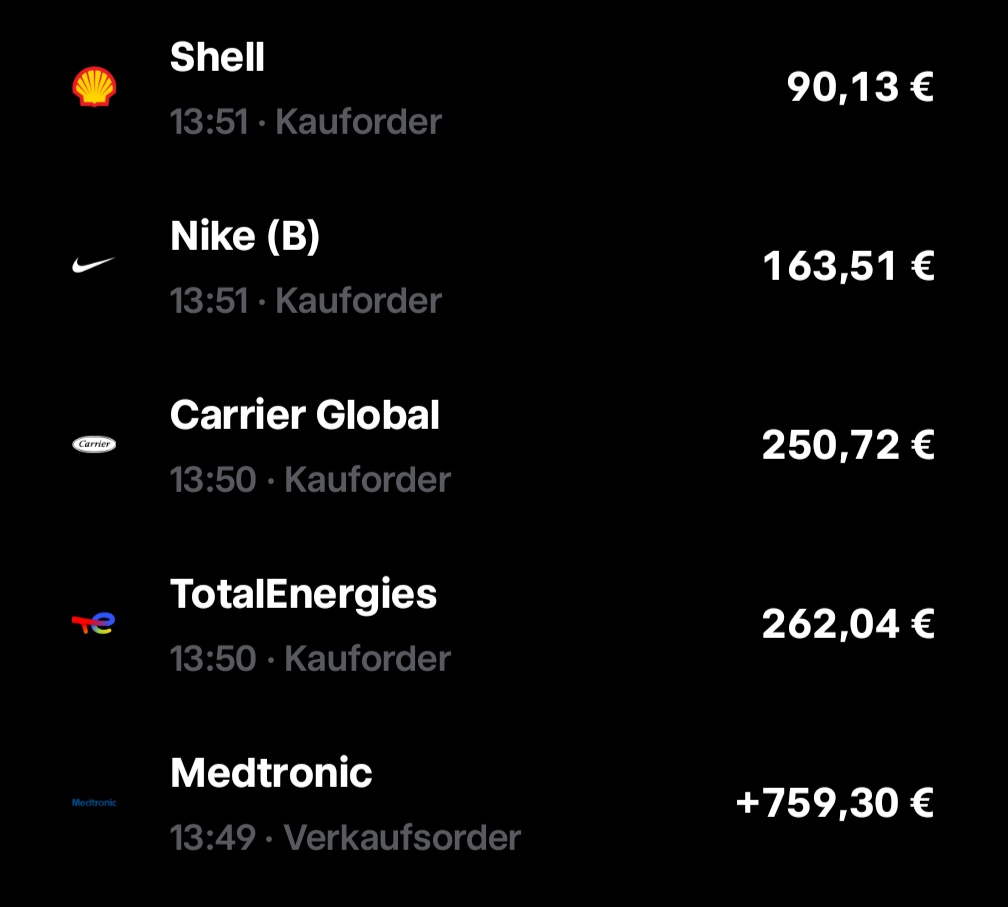

Yesterday I was at Rocket Lab $RKLB (+1.36%) and SoftBank $9984 (+4.85%) took profits, with Rocket Lab even over 1000%to further diversify my portfolio.

The strategy remains the same, namely to invest in future-oriented individual stocks with a lot of upside and stable finances, but the Rocket Lab share in the portfolio is growing and growing, so I have decided to reallocate a little.

Two new stocks from Scandinavia have been added.

1) Cadeler

$CADLR (-1.75%)

Cadeler is a world-leading Danish company specializing in the installation of offshore wind turbines. The offshore wind power market is expected to grow to approx. 70-250 billion dollars by 2035 (depending on estimates). Cadeler is ideally positioned to benefit from this trend. They maintain long-term customer relationships with companies such as Ørsted, Equinor or Siemens Gamesa. The barrier to entry is generally regarded as high (moat).

Turnover (2025e)approx. € 500 million (of which 10-20% is usually recurring)

Profit (2025e)approx. 150 mio €

Order backlog (current)approx. 2.5 billion €

Market capitalization (current)1.6 billion €

P/E ratio (current): approx. 17

P/E ratio 2029 (forecast)approx. 3-4

Cadeler will benefit from the global trend towards decarbonization and political initiatives in this area, and many countries are only just getting started. My AI analysis of the company has shown that we will probably 2035 we are likely to have a profit of around €1.4 billion which, with a P/E ratio of 18.6 (Danish average), this implies a market capitalization of around € 26 billion. would mean. With a more conservative P/E ratio of 12 it would be around 17 billion €. In the first scenario, an investment would therefore be around 16x and in the second scenario 11x in the second scenario. The company therefore fits well into my investment strategy, high potential with comparatively low risk.

2) Munters Group $MTRS (+22.78%) (Edit: sold in the meantime)

The Munters Group is a Swedish company that specializes in air treatment and drying solutionsespecially for air conditioning, dehumidification and industrial air technology - with a focus on data centers, pharmaceuticals, food and industrial plants. The data center business in particular is currently booming. The battery factory business has recently experienced problems due to weak demand, which is also reflected in the share price, but this is only a short-term problem.

The company is a technological leader in the field of dehumidification and energy recovery. They are also ahead of the competition when it comes to sustainability. In addition, they always rely on a very local production structurewhich largely frees them from trade policy risks. Competitors such as Daikin Industries $6367 (+1.91%) or Carrier $CARR (+1.05%) are more broadly based and less specialized, which is why they do not pose a major threat either. It is also difficult for customers to switch suppliers.

Turnover (2025e)approx. € 1.3 billion (of which 20-30% is usually recurring)

Profit (2025e)approx. 60 million €

Order backlog (current):

Market capitalization (current)2.2 billion €

P/E ratio (current): approx. 31

P/E ratio 2029 (forecast)approx. 10-11

The Munters Group is benefiting from several trends such as the data center boom, electrification and sustainability. This development is only just beginning. My AI analysis has shown that the profit in 2035 will be around € 300 million. in 2035. With a constant P/E ratio, that would correspond to a valuation of € 9.3 billion would correspond. If one assumes a lower P/E ratio of around 20 it would be 6 billion €. So in the first scenario 4x and in the second 2,7x. The Munters Group therefore represents a rather conservative addition in my growth-oriented portfolio. They will definitely perform well, but for the really big multiples you need other stocks.

What do you think of the two new additions? I think it's particularly nice that there are two European companies are 🇪🇺🇪🇺