The 17 largest pharmaceutical companies were written to and given a deadline of September 29 to lower their prices, otherwise Trump himself will come by. 😈

The S&P500 pharma sector was the weakest sector today with -2.2 %.

Posts

88The 17 largest pharmaceutical companies were written to and given a deadline of September 29 to lower their prices, otherwise Trump himself will come by. 😈

The S&P500 pharma sector was the weakest sector today with -2.2 %.

$XDWH (-0.08%)

$XLV (+0.1%)

$CSPX (+0.08%)

$VUSA (+0.08%)

$UNH (+0.11%)

$OSCR (+11.59%)

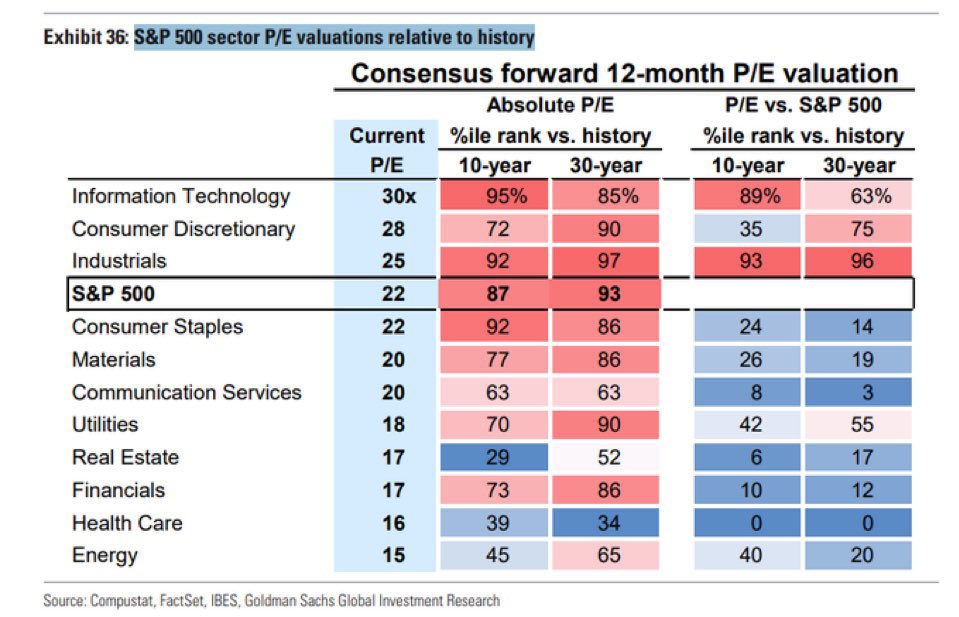

According to Goldman Sachs, healthcare is the only sector in the S& P 500 that is cheaper than the 10- and 30-year averages.

This is an extremely attractive risk/reward ratio and the coming months will be exciting.

$ELV (+0.33%)

$CNC (+0.43%)

$DHR (-0.36%)

$SRT (-0.54%)

$LLY (-0.01%)

$NOVO B (+0.12%)

$NVO (+0.49%)

$ISRG (-0.03%)

$JNJ (-0.03%)

$ABBV (+0.1%)

$PFE (+0.41%)

$SAN (+0.11%)

$MRK (-0.13%)

$BMY (+0.18%)

$TMO (-0.29%)

$UNH (+0.11%)

$OSCR (+11.59%)

$XDWH (-0.08%)

$ELV (+0.33%)

$LLY (-0.01%)

$XLV (+0.1%)

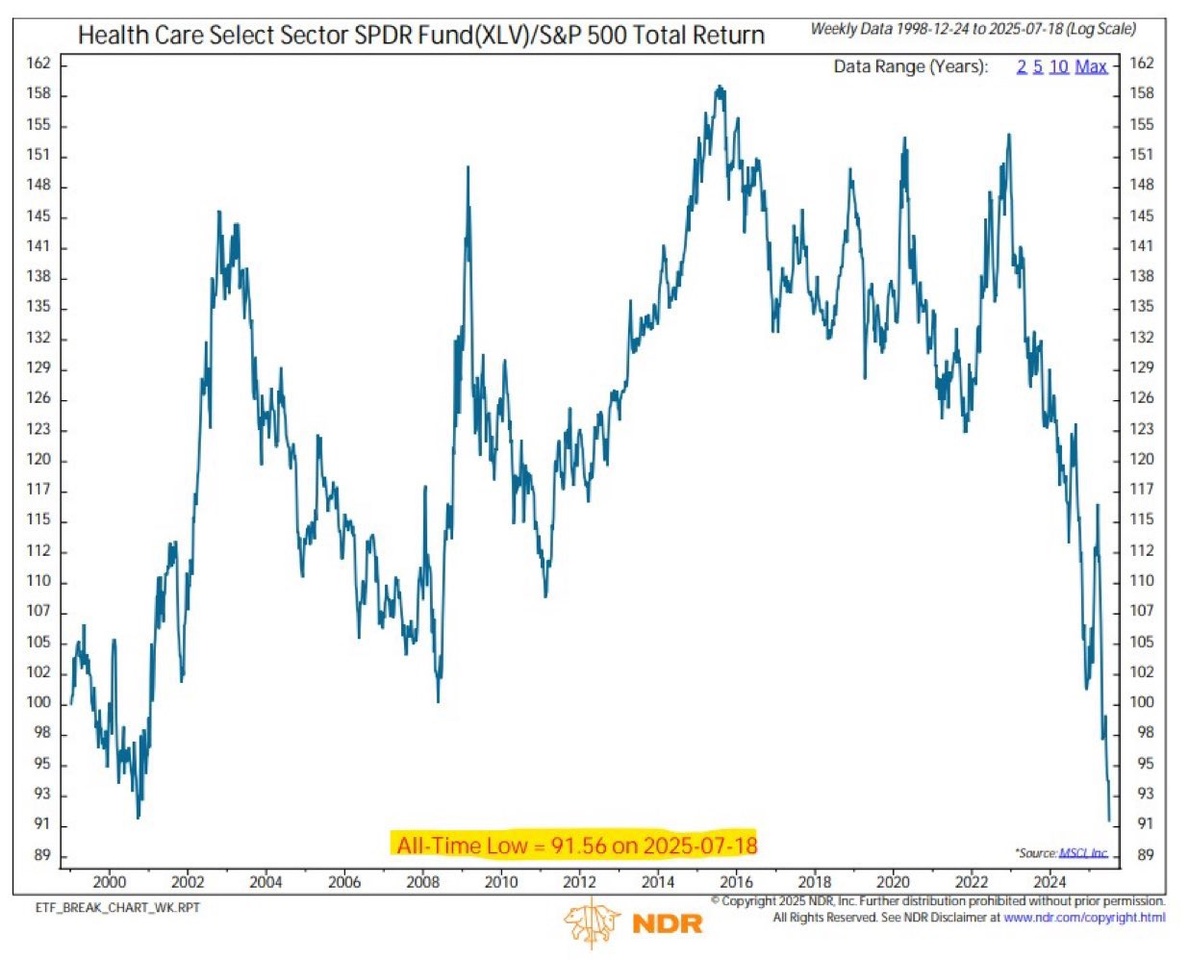

The US healthcare sector is experiencing its biggest crash in the last 20 years.

If the strong weighting no. 1 $LLY (-0.01%) (over 12%), one would have to go back even further/longer. (probably before the existence of the ETF).

I have positioned myself strongly here as I believe this is a great opportunity.

I also believe that a lot of capital will flow into the sector in the coming months. ✌️

Do you have a similar view? ✌️

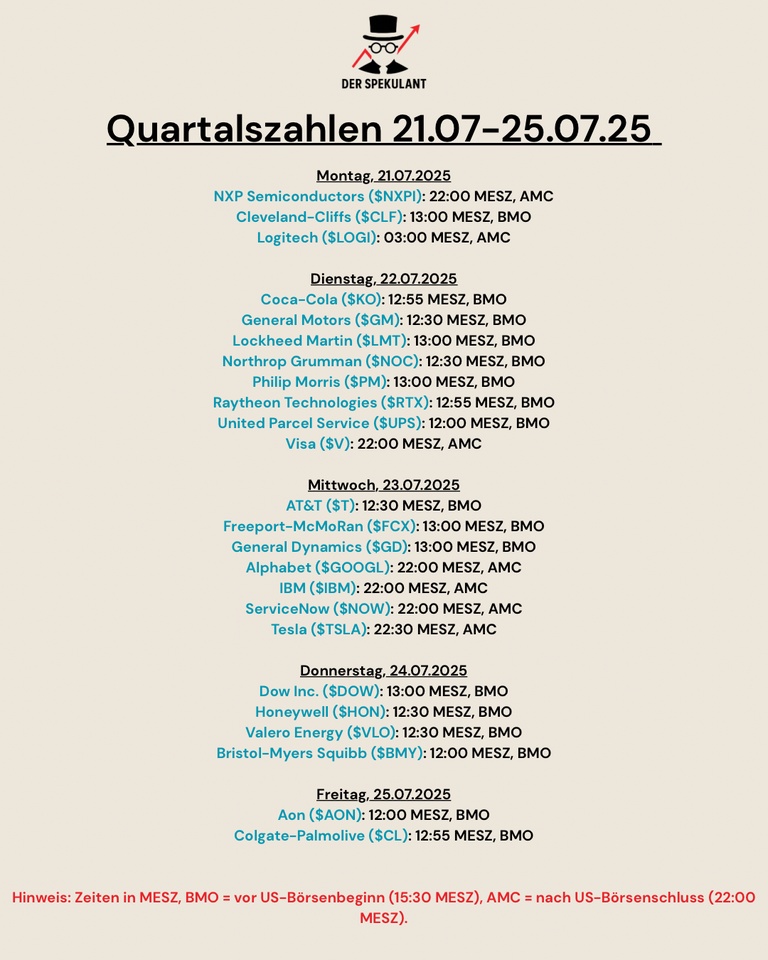

Here is a clear overview of the quarterly figures due next week.

$NXPI (-0.5%)

$CLF (+0.1%)

$LOGN (+0.11%)

$KO (+0.25%)

$GM (-0.71%)

$LMT (+0.3%)

$NOC (+0.21%)

$PM (+0.59%)

$RYTT34

$UPS (+0.34%)

$V (+0.03%)

$T (+0.03%)

$FCX (+1.38%)

$GD (+0.06%)

$GOOGL (+0%)

$IBM (+0.09%)

$NOW (-0.12%)

$TSLA (+0.35%)

$DOW (-0.12%)

$HON (-0.03%)

$VLO (+0.02%)

$BMY (+0.18%)

$AON (+0.18%)

$CL (+0.14%)

The semi-annual rebalancing of the SPDR S&P Developed Quality Aristocrats ETF ($QDEV (+0.01%) ) has just been completed, bringing notable changes to the composition of this quality-focused investment vehicle.

Outgoing Companies:

Incoming Companies:

This rebalancing aligns QDEV with evolving market conditions while maintaining its focus on quality companies with strong financial foundations. For investors seeking exposure to financially robust global corporations, these changes appear strategically sound, particularly with the inclusion of resilient tech giants and hospitality leaders positioned for growth.

Will this prove to be a winning choice? The fundamentals certainly suggest so.

Google's advertising business defies AI rivals and Trump's tariffs + New Intel boss announces 'painful decisions' + Procter & Gamble lowers forecast + Pepsico cuts profit target due to tariff dispute + Evotec beckons with 75 million dollars from research alliance with Bristol-Myers Squibb

Google's $GOOGL (+0%)Advertising business defies AI rivals and Trump's tariffs

New Intel boss $INTC (+0.26%)announces 'painful decisions'

Procter & Gamble $PG (+0%)lowers forecast

Pepsico $PEP (+0.25%)cuts profit target due to customs dispute

Evotec $EVT (+0.13%)will receive 75 million dollars from research alliance with Bristol-Myers Squibb $BMY (+0.18%)

Friday: Stock market dates, economic data, quarterly figures

Stock exchange holiday Australia

08:00 DE: Construction industry, new orders and sales February

08:00 UK: Retail Sales March FORECAST: -0.4% yoy/+1.6% yoy previous: +1.0% yoy/+2.2% yoy

08:45 FR: Business Climate Index April FORECAST: 96 previous: 96

16:00 US: Consumer Sentiment Index Uni Michigan (2nd survey) April FORECAST: 50.8 1st survey: 50.8 PREV: 57.0

16:15 US: Atlantic Council, fireside chat with member of the Monetary Policy Committee of the Bank of England, Greene

19:30 US: IMF and World Bank Spring Meetings, IMF Steering Committee (IMFC) press conference.

What a crazy rollercoaster this month it is.

$TXN (+0.21%) was my smallest position. I originally opened it to start and buy more later on so as to have a complete portfolio of 10 stocks what I was aiming for. The reason why I've sold it is I expect them to have financial issues that will lead to a dividend cut. I work in the electronics industry and TI has one of the nicest portfolios of electronic semiconductors, but financially I don't like how much debt they have at this moment and how small FCF they are generating. Furthermore, trump trade wars can also impact this company quite significantly so for me it is nota good fit at this moment.

$LMT (+0.3%) I believe is one of not many US stocks that will not be impacted that significantly in the upcoming years.

$VEUR (+0.04%) adding this ETF was a bit surprise, but since my priority at this moment are EU stocks it fits really nicely in my portfolio.

Transactions:

$ASML (+0.77%) - Bought x0.5 at €690.00

$LMT (+0.3%) - Bought x0.35 at $440.00

$VEUR (+0.04%) - Bought x3 at €42.70

$TXN (+0.21%) - Sold x0.35 at $184.14 (full position)

Dividends:

$ASML (+0.77%) x1 Dividends at €1.52

$MAIN (+0.06%) x10 Dividends at $0.25

$TXN (+0.21%) x0.35 Dividends at $1.36

$BMY (+0.18%) x3 Dividends at $0.62

Unrealized gain/loss: +1.47%

Realized gain/loss: -8.83% (-€5.977)

My development in this area has been very mixed. After I sold in December $WBA after a risky purchase - to lower the buy in - with +/- 0, my investment in $AFX (+0.26%) was abruptly terminated, leaving me with a hefty loss, and shortly afterwards I unfortunately also lost my shares in $UNH (+0.11%) but still with a profit of 8%. Today I decided to recoup my losses and sold my $BMY (+0.18%) sold. It was a nice trade, plus the €245 dividend plus the payment on February 3rd. The uncertainty in the sector has become too great for me and I want to watch from the sidelines what the new US government will do. Marty Makary as the planned head of the FDA will certainly not strike as brutally as some fear, but there could be changes and difficulties in the area of approval procedures. This would also affect Bristol, which should and must bring a few good products from its pipeline onto the market in the next few years. The acquisition of Karuma together with the approval of KarXT has provided a brief boost, but is not enough to compensate for the expiry of patent protection for Revlimid, Opdivo and especially Eliquis in the next few years. They account for over USD 12 billion of sales and patent protection expires in the EU in 2026 and in the US in 2028. This does not mean that Eliquis will no longer be sold, but a not insignificant proportion is likely to be lost to generics. In addition, CMS has already negotiated price reductions of 56% for 2026. Coupled with the political uncertainties, I have taken the money with me for the time being and will wait and see. I still have to deal with $NOVO B (+0.12%) ...., which is currently the biggest loss-maker in my portfolio with a drop of almost 17%.

Please let me know your assessment of the market in this sector.

Analyst updates, 04.12.

⬆️⬆️⬆️

- BARCLAYS raises the price target for SIEMENS from EUR 125 to EUR 130. Underweight. $SIE (-0.13%)

- BARCLAYS raises the target price for SIEMENS ENERGY from EUR 35 to EUR 36. Equal-Weight. $ENR (-1.12%)

- JEFFERIES raises the target price for ADYEN from EUR 1695 to EUR 1797. Buy. $ADYEN (+0.4%)

- JPMORGAN raises the target price for SALESFORCE from USD 340 to USD 380. Overweight. $CRM (+0.13%)

- HSBC raises the target price for ZALANDO from EUR 37 to EUR 40. Buy. $ZAL (-0.5%)

- JPMORGAN raises the target price for RHEINMETALL from EUR 680 to EUR 800. Overweight. $RHM (-1.69%)

- DEUTSCHE BANK RESEARCH raises the target price for COCA-COLA HBC from GBP 31.50 to GBP 32. Buy. $CCH (+0%)

- BARCLAYS raises the target price for KNORR-BREMSE from EUR 55 to EUR 60. Underweight. $KBX (+0.06%)

- BARCLAYS raises the price target for ABB from CHF 40 to CHF 42. Underweight. $ABBNY (-1.1%)

- BARCLAYS raises the price target for ALSTOM from EUR 8 to EUR 9. Underweight. $ALO (+0.04%)

- HSBC upgrades MERCK & CO to Buy. Target price USD 130. $MRK (-0.13%)

- JPMORGAN raises the target price for DSV from DKK 1685 to DKK 1800. Overweight. $DSV (-0.67%)

- JPMORGAN raises the target price for LUFTHANSA from EUR 4.80 to EUR 5.50. Underweig$LHA (-0.34%)

- UBS raises the target price for AROUNDTOWN from EUR 2 to EUR 3.30. Neutral. $AT1 (-0.06%)

⬇️⬇️⬇️

- JPMORGAN lowers the target price for DHL GROUP from EUR 47 to EUR 42.50. Overweight. $DHL (-0.23%)

- WARBURG RESEARCH lowers the target price for UNITED INTERNET from EUR 38.50 to EUR 37.30. Buy. $UTDI (-0.07%)

- WARBURG RESEARCH lowers the target price for 1&1 from EUR 23.50 to EUR 19.10. Buy. $1U1 (+0%)

- WARBURG RESEARCH lowers the target price for KWS SAAT from EUR 89 to EUR 88. Buy. $KWS (-0.15%)

- DEUTSCHE BANK RESEARCH downgrades HEINEKEN from Buy to Hold and lowers target price from EUR 95 to EUR 76. $HEIA (+0.09%)

- EXANE BNP lowers the price target for SCHOTT PHARMA from EUR 36 to EUR 28. Neutral. $1SXP (+0.23%)

- BARCLAYS downgrades SIGNIFY to Underweight. Target price EUR 18. $LIGHT (-0.13%)

- CFRA downgrades BRISTOL-MYERS SQUIBB to Hold. Target price USD 60. $BMY (+0.18%)

- MORGAN STANLEY downgrades MOLLER-MAERSK to Underweight. Target price DKK 12200. $AMKBY (-0.29%)

- BARCLAYS downgrades ANDRITZ to Underweight. Target price EUR 40. $ANDR (-0.04%)

- JPMORGAN lowers the price target for HAPAG-LLOYD from EUR 85 to EUR 80. Underweight. $HLAG (-0.22%)

$ABBV (+0.1%)

AbbVie Reports Phase 2 EMPOWER Trials For Emraclidine In Schizophrenia Miss Primary Endpoint; Treatment Well-Tolerated, Further Data Analysis Underway

$BMY (+0.18%) Bristol-Myers Squibb seems to benefits from this +13%

Top creators this week