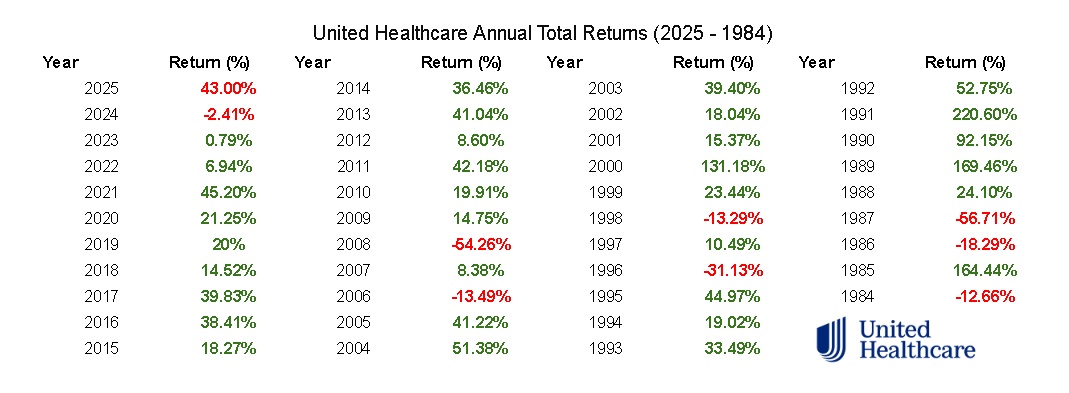

$UNH (-5.78%)

$BRK.B (-2.44%)

$BRK.A (-1.94%)

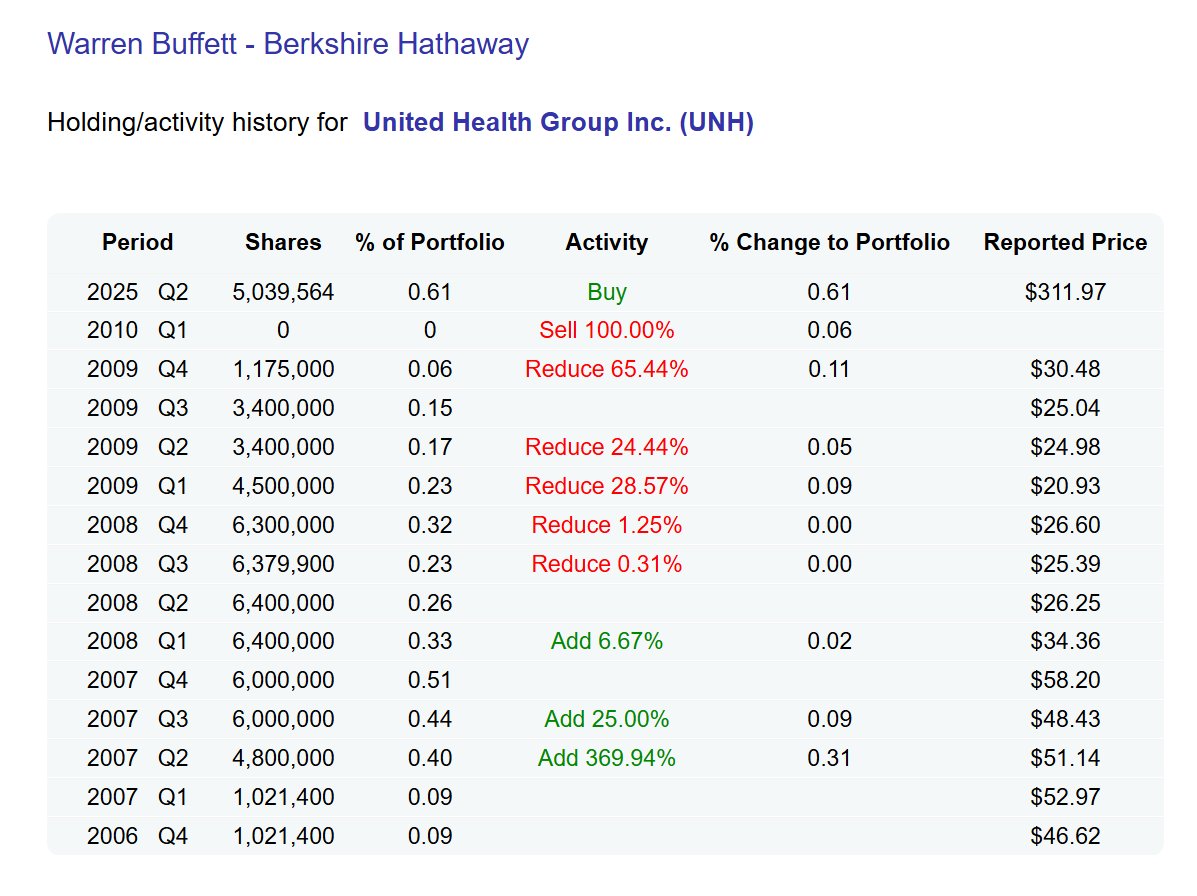

Buffett has probably bought far more than the stated 5 million shares of $UNH (-5.78%) probably much more.

This can be concluded from the fact that Berkshire Hathaway no longer requires a confidentiality note for the current quarter.

Today's 13F only covers transactions through June 30, we don't know how much he bought after that.

The closing price on this day for $UNH (-5.78%) was $311.97.

In between there are another 45 days where the price has mostly fallen further.

Therefore, confidential treatment of $BRK.B (-2.44%) is no longer necessary.

We will find out exactly how much he has collected in 3 months, but I believe that he was not satisfied with the initial purchase with the share price continuing to fall and so much cash on hand 💪

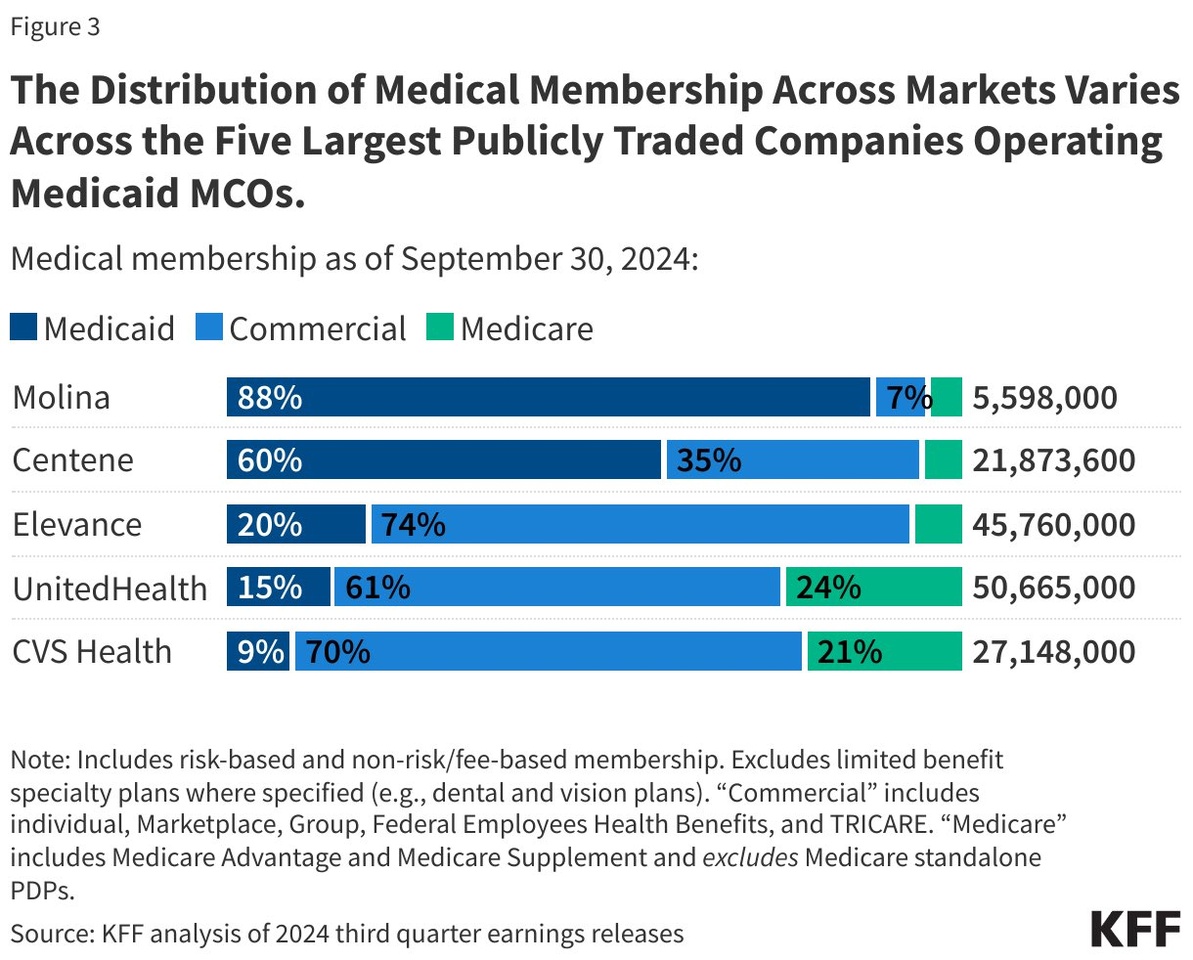

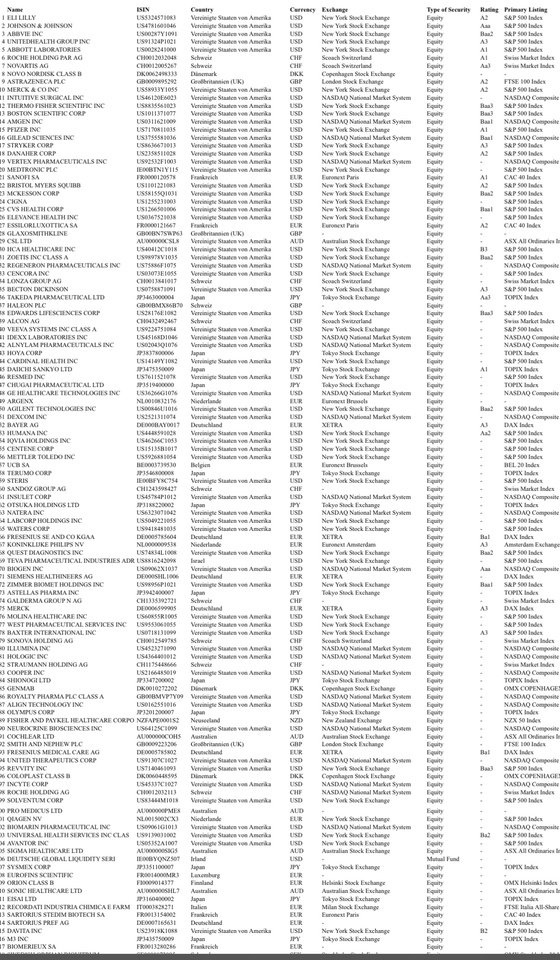

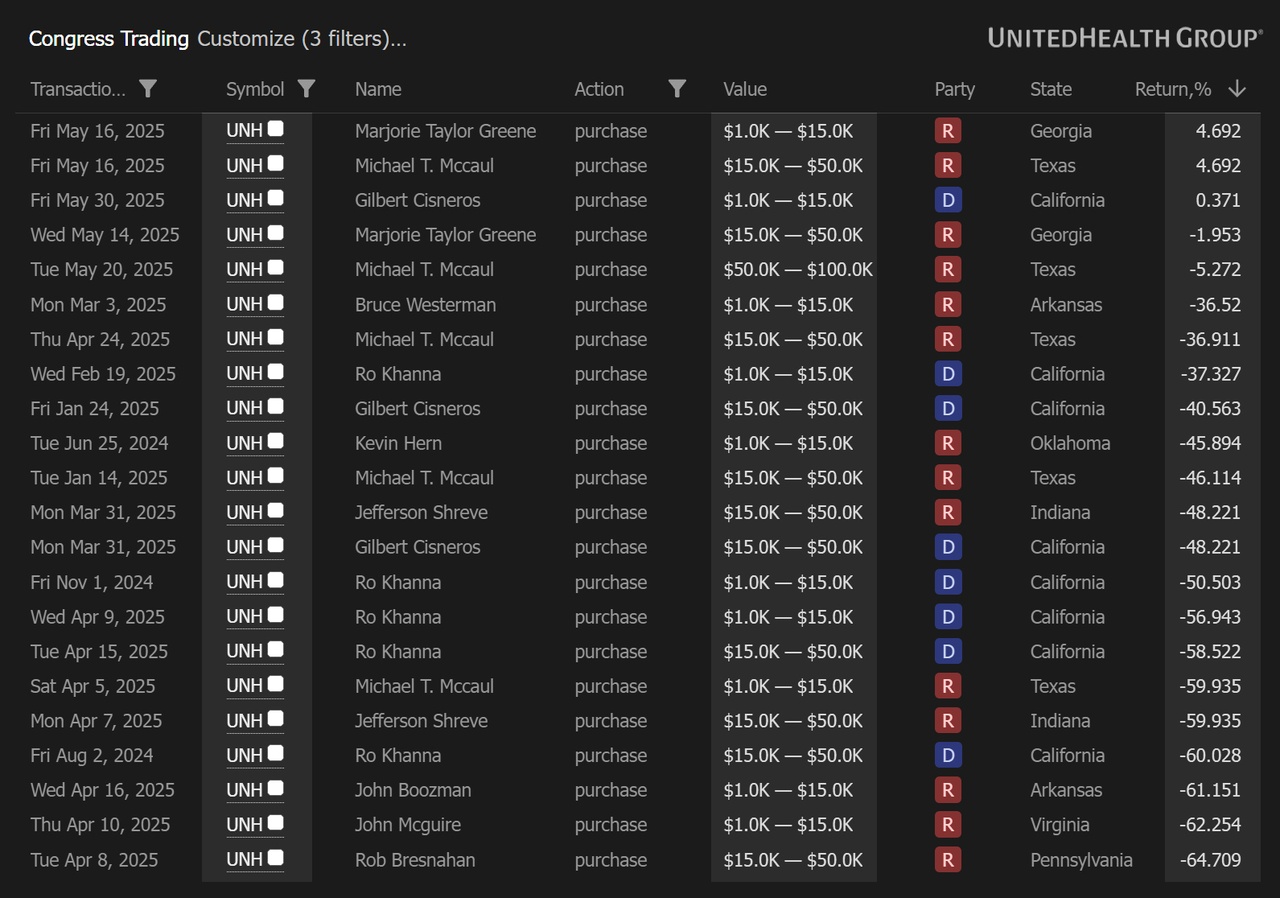

Other buyers:

- Tepper

- Burry

- Simons - Renaissance

$CNC (-6.52%)

$OSCR (-4.92%)

$CVS (-0.22%)

$CI (-2.28%)

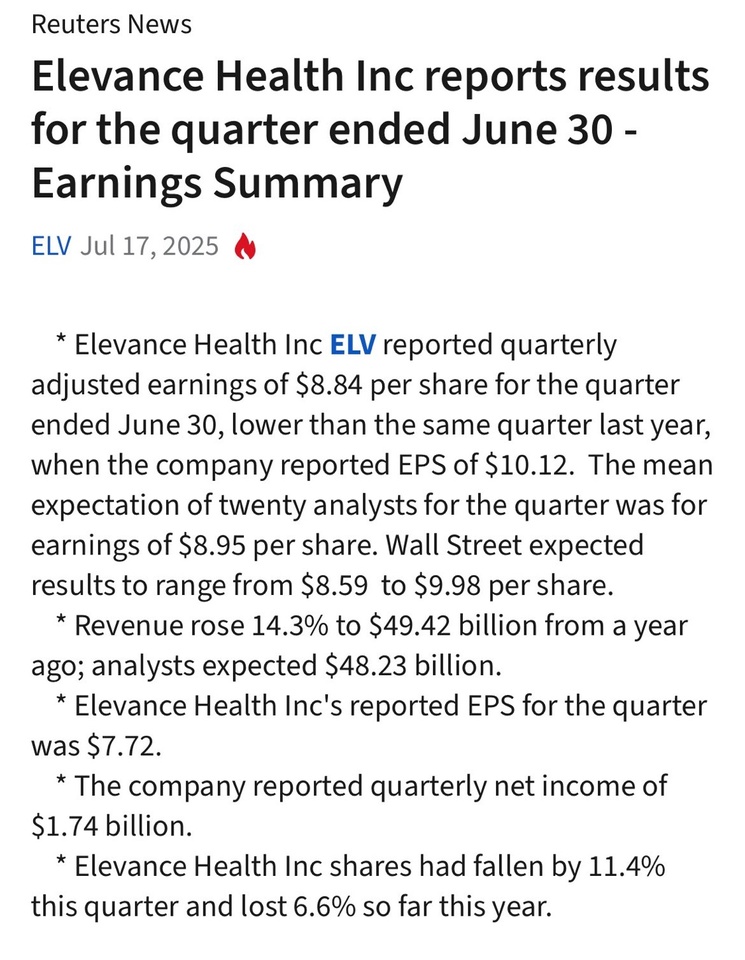

$ELV (-2.36%)