1st Vinci (DG: SGE) $DG (-4.15%)

* Quantitative valuation:

* P/E ratio: approx. 12 (6 points)

* P/B ratio: approx. 1.8 (8 points)

* ROE: approx. 12% (6 points)

* Leverage ratio: approx. 0.5 (8 points)

* Dividend yield: approx. 4% (10 points)

* Sales growth: approx. 5% (6 points)

* PEG ratio: approx. 1.5 (6 points)

* Cash flow yield: approx. 7% (6 points)

* Valuation table:

| Metric | Share Value | Reference Values | Share Rating | Weighted Score |

|---|---|---|---|---|

| P/E | 12 | 10-20 (6 points) | 6 | 6 |

| P/E | 1.8 | 1-2 (8 points) | 8 | 8 |

| ROE | 12% | 8-15% (6 points) | 6 | 6 |

| Debt/equity ratio | 0.5 | 0.3-0.6 (8 points) | 8 | 8 |

| Dividend yield | 4% | >4% (10 points) | 10 | 10 |

| Sales growth | 5% | 4-8% (6 points) | 6 | 6 |

| PEG Ratio | 1.5 | 1-2 (6 points) | 6 | 6 |

| Cash flow yield | 7% | 5-10% (6 points) | 6 | 6 |

* Qualitative assessment:

* Market position: 9 points

* Competitive landscape: 7 points

* Management quality: 8 points

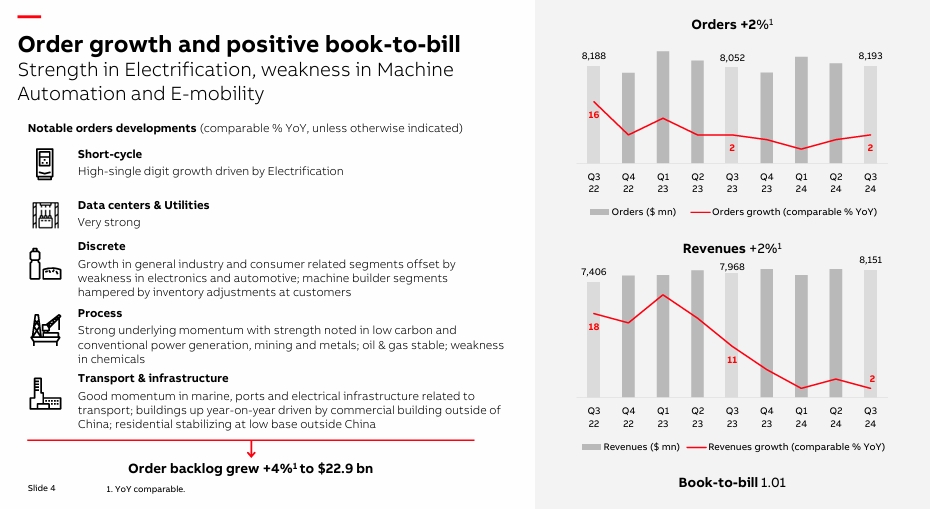

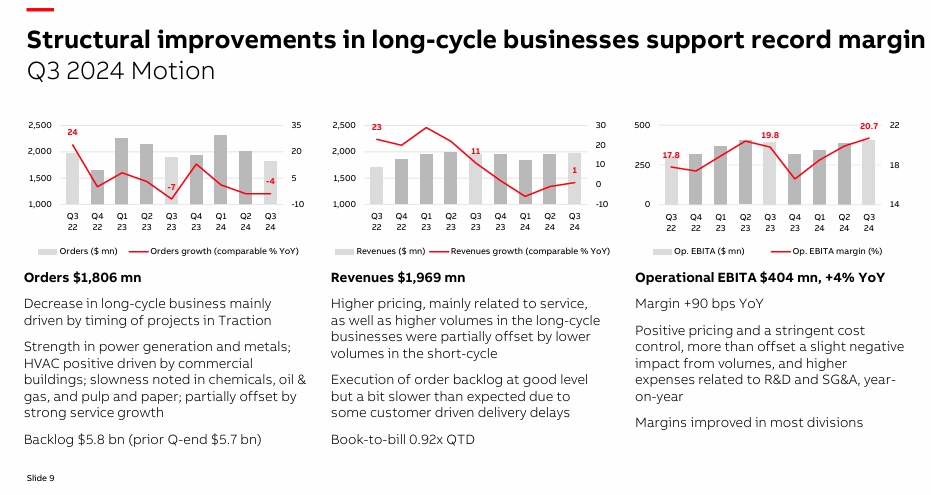

2. ABB (DG: ABBN) $ABBNY (+0.47%)

* Quantitative assessment:

* P/E ratio: approx. 26 (1 point)

* P/B ratio: approx. 3 (1 point)

* ROE: approx. 16% (10 points)

* Leverage ratio: approx. 0.4 (8 points)

* Dividend yield: approx. 2% (1 point)

* Sales growth: approx. 6% (6 points)

* PEG ratio: approx. 2.2 (1 point)

* Cash flow yield: approx. 5% (6 points)

* Valuation table:

| Metric | Share Value | Reference Values | Share Rating | Weighted Score |

|---|---|---|---|---|

| P/E | 26 | >20 (1 point) | 1 | 1 |

| P/B ratio | 3 | >2 (1 point) | 1 | 1 |

| ROE | 16% | >15% (10 points) | 10 | 10 |

| Leverage ratio | 0.4 | 0.3-0.6 (8 points) | 8 | 8 |

| Dividend yield | 2% | <2% (1 Punkt) | 1 | 1 |

| Umsatzwachstum | 6% | 4-8% (6 Punkte) | 6 | 6 |

| PEG Ratio | 2,2 | >2 (1 point) | 1 | 1 |

| Cash flow yield | 5% | 5-10% (6 points) | 6 | 6 |

* Qualitative assessment:

* Market position: 9 points

* Competitive landscape: 8 points

* Management quality: 9 points

3rd Randstad (DG: RAND) $RAND (+0.58%)

* Quantitative assessment:

* P/E ratio: approx. 10 (10 points)

* P/B ratio: approx. 1.5 (8 points)

* ROE: approx. 13% (6 points)

* Debt-equity ratio: approx. 0.5 (8 points)

* Dividend yield: approx. 4% (10 points)

* Sales growth: approx. 4% (6 points)

* PEG ratio: approx. 1.3 (6 points)

* Cash flow yield: approx. 8% (6 points)

* Valuation table:

| Metric | Share Value | Reference Values | Share Rating | Weighted Score |

|---|---|---|---|---|

| P/E | 10 | <10 (10 Punkte) | 10 | 10 |

| KBV | 1,5 | 1-2 (8 Punkte) | 8 | 8 |

| ROE | 13% | 8-15% (6 Punkte) | 6 | 6 |

| Verschuldungsgrad | 0,5 | 0,3-0,6 (8 Punkte) | 8 | 8 |

| Dividendenrendite | 4% | >4% (10 points) | 10 | 10 |

| Sales growth | 4% | 4-8% (6 points) | 6 | 6 |

| PEG Ratio | 1.3 | 1-2 (6 points) | 6 | 6 |

| Cash flow yield | 8% | 5-10% (6 points) | 6 | 6 |

* Qualitative assessment:

* Market position: 8 points

* Competitive landscape: 6 points

* Management quality: 8 points

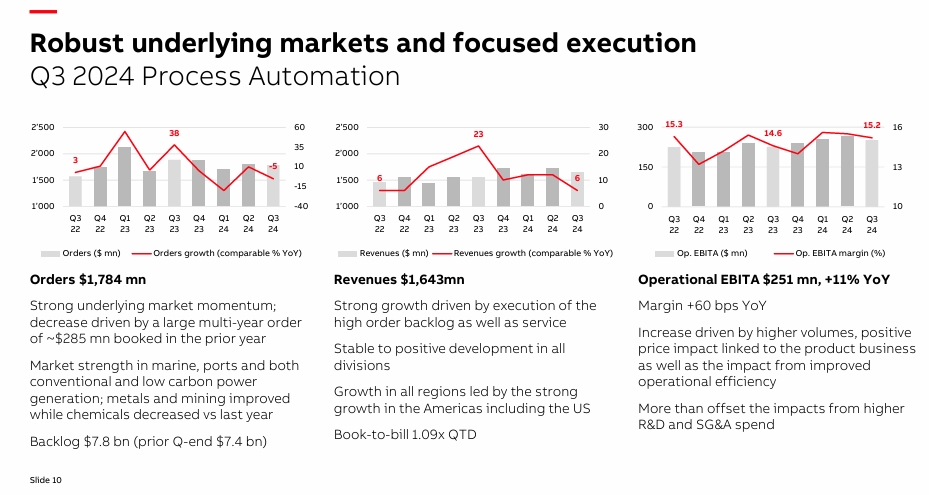

4th Schneider Electric (DG: SU) $SU (+1.65%)

* Quantitative assessment:

* P/E ratio: approx. 23 (1 point)

* P/B ratio: approx. 3 (1 point)

* ROE: approx. 15% (6 points)

* Leverage ratio: approx. 0.5 (8 points)

* Dividend yield: approx. 2% (1 point)

* Sales growth: approx. 7% (6 points)

* PEG ratio: approx. 2.1 (1 point)

* Cash flow yield: approx. 6% (6 points)

* Valuation table:

| Metric | Share Value | Reference Values | Share Rating | Weighted Score |

|---|---|---|---|---|

| P/E | 23 | >20 (1 point) | 1 | 1 |

| P/B ratio | 3 | >2 (1 point) | 1 | 1 |

| ROE | 15% | 8-15% (6 points) | 6 | 6 |

| Debt/equity ratio | 0.5 | 0.3-0.6 (8 points) | 8 | 8 |

| Dividend yield | 2% | <2% (1 Punkt) | 1 | 1 |

| Umsatzwachstum | 7% | 4-8% (6 Punkte) | 6 | 6 |

| PEG Ratio | 2,1 | >2 (1 point) | 1 | 1 |

| Cash flow yield | 6% | 5-10% (6 points) | 6 | 6 |

* Qualitative assessment:

* Market position: 9 points

* Competitive landscape: 7 points

* Management quality: 9 points

Summary:

* Randstad appears to be the most attractive in quantitative terms due to its low P/E ratio and high dividend yield.

* ABB and Schneider Electric have higher growth and profitability ratios, but are also valued higher.

* Vinci offers a good middle ground.

Randstand and Vinci will therefore move in. Until such time as Swiss shares are tradable throughout the EU again, I am considering whether to add Schneider Electric or ABB.

I wish you a sunny start to the week!