Today I wanted to give you my outlook for next year. Many in the community are already busy buying shares, and there are always exciting sectors (currently pharmaceuticals and some commodities). As far as the tech sector is concerned, however, I think you should be careful about buying too early. With a look at my watchlist, I have created an overview that shows that 2026 is likely to be a weak year in the tech sector (and also in crypto). Apart from the fact that midterm years tend to be weak anyway. The companies on my watchlist are almost all behaving similarly. In the course of the bull market, new highs have always been reached in purely technical terms, while the RSI levels are already showing weakness. Some of the stocks are already starting to fall below the RSI average. My current desired scenario would be to strike exactly where it matters, and that is the 200 week average. The drawdown for the stocks mentioned, for example, is somewhere between -40% and -70% of the 200-week average. If this scenario materializes, then I think there will be lifetime entries at the 200 week in fundamentally good companies (as well as crypto) next year.

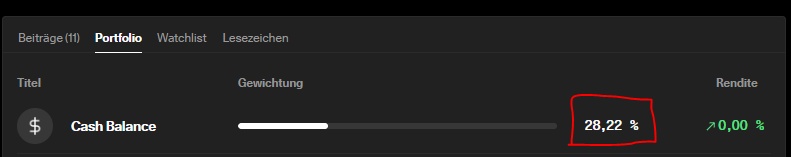

For your own portfolio, this means lower risk and higher cash. Whether you have to short is another story, I don't know much about that 😁

Investors who trade according to "time in the market beats timing the market" should not be interested in this. But for those who regularly work with cash ratios, I think it does.

How do you see the situation next year? Will you even go along with it or do you see it completely differently?

$PLTR (+1.89%)

$TFBANK (-1.27%)

$APP (+6.06%)

$AXON (-2.15%)

$PNG (+1.11%)

$CORT (+4.37%)

$VRT (-1.2%)

$IESC (+4.55%)

$MOD (+0.5%)

$ORCL (+2.41%)

$HIMS (+3.34%)