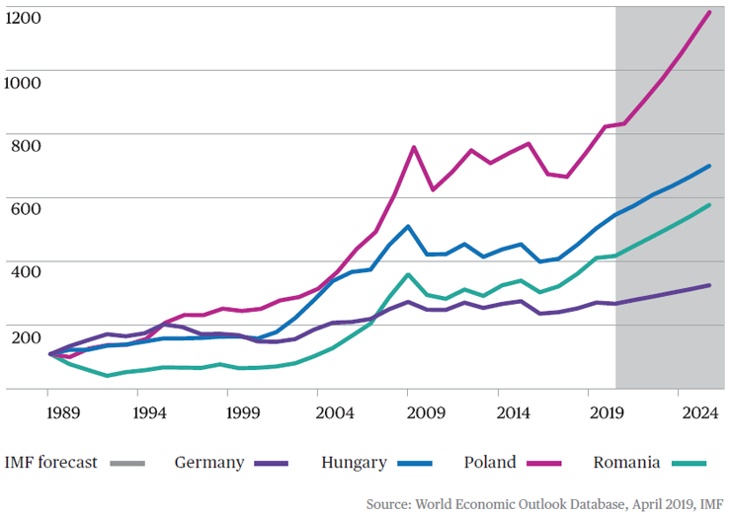

I came back from a trip to Poland with my girlfriend a couple days ago. We went to the city of Szczecin for a citytrip. And just like in december, when I went to the city of Poznań for its cristmas market🎄. I noticed Poland isn’t as underdeveloped like most people are always saying. And that’s exactly what I noticed in the news lately aswell. Poland is the strongest and fastest growing economy in the whole of Europe.🇪🇺🫱🏻🫲🏼🇵🇱

🇩🇪🇭🇺🇵🇱🇷🇴🫱🏻🫲🏼🇪🇺

While Germany 🇩🇪 (our biggest economy in Europe) is staying behind. Poland is flying to the sky🚀. The other countries, Hungary 🇭🇺 and Romania 🇷🇴 which are both upcoming economies in Europe aswell. Which I also both visited not a long time ago. Are growing fast too, But still, they cannot withstand to the Polish growth. I went in to the Romanian city of Timișoara last year. And in Hungary I’ve been to the Hungarian capital city of Budapest. When walking around in those countries you will immediately notice they are developing extremely fast too. But they simply can’t get theirselves to Polish tempo-level of growth. And ofcours, this was based on what I saw with my own eyes. So this is no hard evidence which is verified by a external. This is just based on my own experience trough what I’ve seen there.

Eventhough all of the rumors going around. About Poland being extremely extremistic on some fronts. We cannot ignore, nor can’t we admit that Poland ruling a special role in our beautyfull continent. Due to my own experience and the number, which again, are not lying to us (number) I think it is a beautyfull country. Which deserves some extra focus from abrought. So again, due to my own experience and the beautyfull numbers. I searched around in Poland and I did some research to companies all around Poland. And I found two (2) of them pretty interesting. those are $PKN (+1.4%) ans $PKO (+1.81%) Of which, I bought one today.

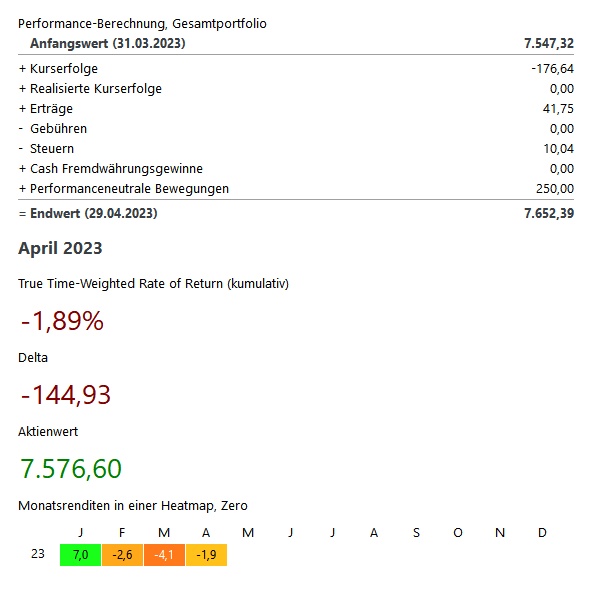

The stock I bought today is $PKO (+1.81%) or, Powszechna Kasa Oszczędności Bank Polski. The company is headquarterd in the Polish captial city of Warszawa. I started with a small allocation, Because, let’s be honest. We all have to start somewhere. I accept the risk of the stock staying close to an alltime high. That is because I truly believe the country is yet close to its maximum of preformance economy wise🇵🇱📈🇪🇺

Why I chose for $PKO (+1.81%) ? 🏦

I chose this bank because I truly believe banks are the companies which are crucial in developing a country. For some that is also the reason why they are against banks. But we can all have our opinions about banks generally. (That’s why a lot of people choose for crypto nowadays). But we eventhough crypto exist. Most people still use banks for their loans, executing transactions and so on. We cannot go around them. So back to my point of business. I think if you add a new economy/country to your portfolio as a form of diverification. It is always smart to take a look at local banks. Because, those banks are going to be crucial in financing the country its development. I did basically the same with an Austrian Bank 🇦🇹. And that worked out fine for me aswell. I gained around +37,36% in a time range of a half year excluding the recieved dividend. I’ll be making a post about that story/ company aswell.

For now, I’m curious about your opinions about Poland and its economy. Are you invested in Poland? And if you are, why did you decide to invest in it? Maybe we can talk about it. Feel free to blow with your critism about any subject. Also, feel free to start a discussion. Thanks to all of you guys, and thanks to Poland as a country for existing and being as beautyfull as it is. From it’s mountainous forests, to it’s nicest cities. 🇵🇱

_____________________________________________

For those who are interested, I’m 21 years old. So I’m not a profesional investor. But i’ve been around since when I reached the age of 18. Which means i’ve already been around for 3,5 years now on the stock market. I hope, and I truly believe. That concisistency will get us all higher up to our personal financial goals as long as we are busy with our finances.💰📈I think everyone from my generation should be involved in someway here aswell. But unfortunately. Most of them choosing partying above investing and their finances. And I think, when I make a bad decision. I’m still better of than them. Because actually all their financial decisions are directing them deaper and deaper into the ravine of financial unhappiness. By spending all their hard earned euro’s on drinks and parties. So I think I’m blessed with my mindset from the beginning of my investment journey all the way to the day of today. And I’m working hard to make something out of my life, And I hope you are trying your best aswell of getting the best out of your life. God blessed you all. The message is simple, never give up🫱🏻🫲🏼📊📉📈

_____________________________________________

€ = Euro ~ $ = Dollar ~ zł = Złoty

Valuta values in comparison with each other:

€1 = zł 4,26

$1 = zł 3,62

These values are accurate on the following date:

~ 24-JUL-2025 ~