$4519 (-1.86%) bought the second tranche today. A very exciting share from Japan. Here, the pharmaceutical giant $RHHBY (-2.97%) a very large share, this makes the share even more interesting 🚀

- Markets

- Stocks

- Chugai Pharm

- Forum Discussion

Chugai Pharm

Price

Discussion about 4519

Posts

2𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

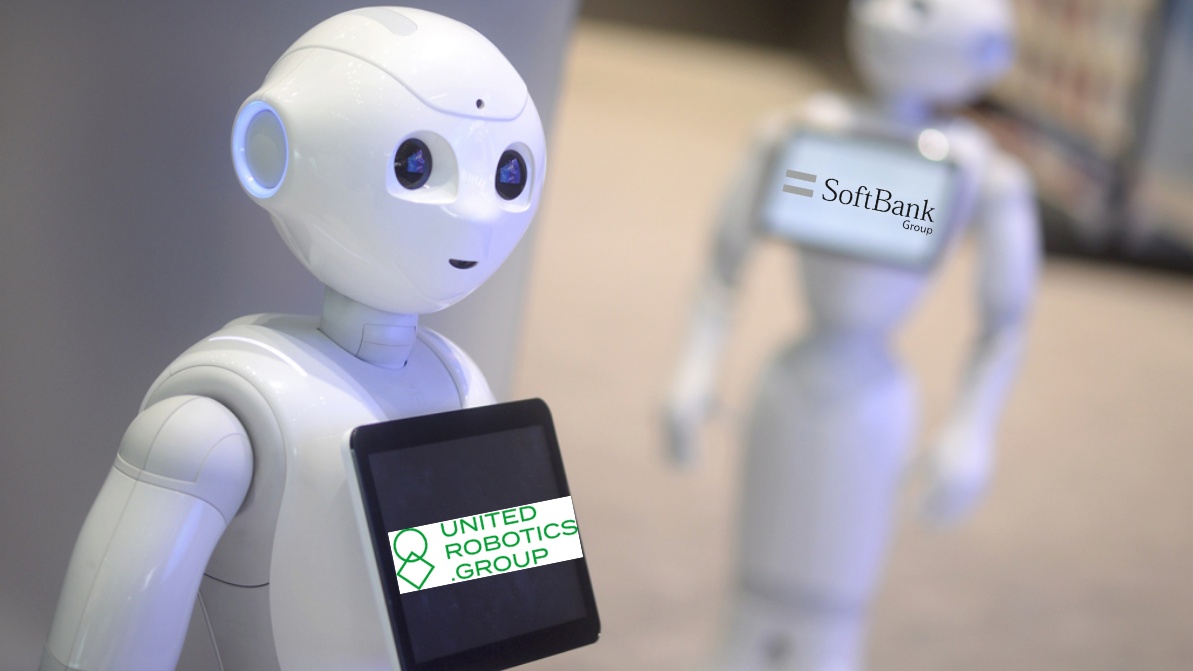

𝗕𝗲𝗮𝘂𝘁𝘆 𝗶𝗻 𝗜𝗻𝗱𝗶𝗮 / 𝗣𝗲𝗽𝗽𝗲𝗿𝘀 𝗻𝗲𝘂𝗲𝗿 𝗕𝗲𝘀𝗶𝘁𝘇𝗲𝗿 / 𝗭𝗮𝗵𝗹𝘂𝗻𝗴𝘀𝗮𝘂𝘀𝗳𝗮𝗹𝗹 𝗴𝗲𝘀𝘁𝗼𝗽𝗽𝘁 / 𝗕𝗶𝘁𝗰𝗼𝗶𝗻-𝗘𝗧𝗙 𝗯𝗼𝗼𝗺𝘁

𝗜𝗣𝗢𝘀 🔔

Nykaa - On October 28, the Indian company FSN E-Commerce Ventures, the parent company of India's largest cosmetics retailer Nykaa, plans to go public and is aiming for a valuation of 7.4 billion US dollars. A total of 41,972,660 shares will be available for sale by the first of November. Nykaa was founded in 2012 and already has 1,500 beauty product brands in its portfolio.

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, Caterpillar Inc. ($CAT1 (-3.78%)), Kaiser Aluminum Corp. ($KLU1 (-2.76%)), Pmbina Pipeline Corp. ($P5P (+0.95%)), The RMR Group Inc. ($PMR (+0.91%)), Simulations Plus, Inc. ($SD3) and SM Energy Company ($SJL (+2.74%)) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, American Express ($AEC1 (-2.1%)), BB Biotech ($BBZA (-1.48%)), Chugai Pharmaceutical Co. Ltd. ($CUP (-1.86%)), Honeywell ($ALD (-1.78%)), Reliance Industries Ltd. ($RLI (-1.13%)), Roper Industries Inc. ($ROP (+0%)), Schlumberger ($SCL (-1.59%)) and V.F. Corp. ($VFP (-4.8%)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Softbank ($SFT (-3.24%)) - According to insiders, the Japanese technology investor Softbank is negotiating with the German company United Robotics to acquire the French robotics business based around the humanoid robot Pepper. The Bochum-based company United Robotics is already working with Softbank and distributes its Pepper and Nao robots in Europe. Neither company has officially commented on the takeover rumors.

Evergrande ($EV1) - Shortly before the deadline, the Chinese real estate group Evergrande was able to make an interest payment worth millions. 83.5 million US dollars were transferred to the bondholders. As a result, the share price rose by more than seven percent in the meantime. So far in 2021, the shares have lost more than 80 percent of their value. But further interest payments are also due soon. The next grace period for a bond expires on October 29. In order to pay banks, suppliers and bondholders on time, Evergrande must therefore continue to raise money.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

ProShares Bitcoin Strategy ETF Update - The ETF is so extremely popular that there is now a risk that it is well on its way to hitting the existing futures limit. One way to counter this bottleneck would be to extend the investment contracts. However, there is a risk that the fund could diverge too much from the actual Bitcoin price and no longer track it one-to-one. The ETF created by ProShares was the first fund ever to have more than one billion US dollars in assets under management in just two days.

Solana ($SOL/EUR (-0.9%)) - One of the strongest gainers in recent days was once again the cryptocurrency of the Solana blockchain SOL. After growing by 36.8% in the last seven days, the current price of SOL stands at $205.28, resulting in a market capitalization of $61.56 billion. SOL thus overtakes Ripple XRP ($21XX (-3.19%)) and ranks sixth among the world's largest cryptocurrencies. One of the main reasons for SOL's strong growth is likely to be the booming DeFi (Decentralized Finance) sector of the Solana blockchain. Solana differs from other blockchains, such as Ethereum or the Binance smart chain, due to its incredible speed and extremely low transaction fees.

Trending Securities

Top creators this week