Your opinion about $GRP (-0.47%) ? I find it much more interesting due to diversification at similar valuation than $UKW (+1.64%)

Greencoat

Price

Discussion about GRP

Posts

5Greencoat member?

by the way, I joined $GRP (-0.47%) by the way. To the $UKW (+1.64%) Board members, does that count? Can I at least become an honorary member? By the way, the only reason is that UKW is not available at Consorsbank. In addition, I also think GRP is a good Unternehmen🙌🏽.

(and before anyone here talks about blindly buying. I have had both companies on my watchlist for longer than people here have had them in their portfolios. My Excel watchlist on the PC with a creation date of over a year ago proves that😌).

What are your opinions on Greencoat Renewables?

Here in the community, Greencoat UK Wind seems to be quite popular. No matter if as a "joke" or a normal investment.

But if you look at the portfolio of the two power producers, Greencoat Renewables seems to be/becomes much more diversified. One focuses on photovoltaic and wind power and also operates outside the UK.

So why does everyone here prefer to invest in the less diversified option at very similar valuations. There has to be a catch somewhere, right?

Also, since there is Encavis in Germany for example, I wonder why they are comparatively valued so expensively compared to the Greencoat alternatives. Am I missing something besides the currency risk that is pushing the price down so much, or are the Greencoat stocks under the radar of many investors, so to speak?

I would be very interested in your opinions.

If there are no objections from your side, I would probably think about getting into Greencoat Renewables.

🌬️🍃𝐀𝐤𝐭𝐢𝐞𝐧𝐯𝐨𝐫𝐬𝐭𝐞𝐥𝐥𝐮𝐧𝐠 🌬️🍃

𝑮𝒓𝒆𝒆𝒏 𝑬𝒏𝒆𝒓𝒈𝒚 𝒎𝒂𝒍 𝒂𝒏𝒅𝒆𝒓𝒔!

You asked for it and here is the analysis! I am asking the leadership team, consisting of. @MScottInvesting

@GoDividend

@Divmann

@California_Dreamin

@InvestmentPapa

@christian

@Barsten

@Der_Dividenden_Monteur

@Simpson

@Dr27589

@RealRose

@Klambam@RoronoaZoro

@Zackdela79

@Doe to contact me to transfer my consultant fee. Normally, advance payments are not common. The matter is accordingly urgent!

Greencoat UK Wind PLC $UKW (+1.64%)

GB00B8SC6K54

𝗜. 𝗨𝗻𝘁𝗲𝗿𝗻𝗲𝗵𝗺𝗲𝗻𝘀𝗽𝗿𝗼𝗳𝗶𝗹:

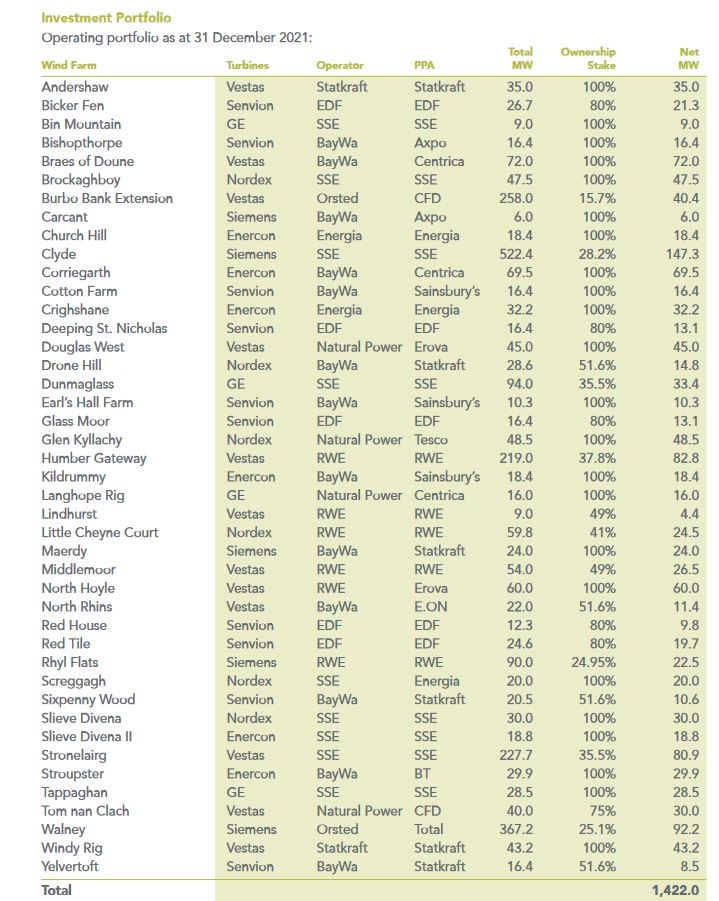

Greencoat UK Wind PLC is a closed-end investment company based in the United Kingdom. The company has a diversified portfolio of interests in approximately 40 operating wind farms in the United Kingdom with a total net capacity of 1,289.8 megawatts (MW). The company's portfolio consists of investments in special purpose vehicles (SPVs) that hold certain wind farm assets. [1] [2] The strategy, which specifically targets dividend streams, is also explicitly communicated on the company's website.

Greencoat UK Wind PLC is managed by Greencoat Capital LLP, which owns other investment trusts. Greencoat Renewables PLC is also worth mentioning here. Greencoat Renewables also invests in wind farms in Ireland, Sweden and France. In addition, Greencoat Renewables plans to establish a further foothold in the solar market, which at this point in time is hardly existent. The business model is similar and based on dividend streams.

In the pictures I have added a map showing the wind farms in which Greencoat UK Wind (UKW) is invested.

The company's investment objective: to provide investors with an annual dividend that increases in line with retail price index (RPI) inflation, while maintaining the capital value of the investment portfolio on a long-term real basis through the reinvestment of excess cash flow and the use of debt. [1]

According to NAV Factsheet June 2022:

"The Company's aim is to provide investors with an annual dividend that increases in line

with RPI inflation (7.72p with respect to 2022) while preserving the capital value of its

investment portfolio in the long term on a real basis through reinvestment of excess cash

flow." [6]

So you can already see that UKW is not a typical Green Energy stock. UKW is simply an investment company focused exclusively on wind power in the UK. But which wind turbines does UKW invest in? There are several and the operators are large corporations that you might recognize (list not exhaustive):

-RWE

-EDF

-Orsted

-BayWa

A large portfolio comes directly from RWE. The largest turbine manufacturers in these wind farms are Vestas (44%) and Siemens (23%). [3]

There are different shareholdings by UKW in the wind farms. In the appendix an overview of the wind farms, their operators and the share ratio of UKW. [3]

Wind farms by region according to NAV Factsheet June 2022 and in brackets according to GB 2021 [3]:

-Scotland: 47 (46%)

-England: 37% (38%)

-Northern Ireland: 11% (11%)

-Wales: 5% (5%)

But how exactly does FM generate revenue and profit? Quite simply! As an investment company with corresponding holdings, UKW mainly receives dividends. In addition, the investments and wind farms must be valued annually, which is done using a DCF valuation method. If the valuations increase, this generates a revaluation, which is directly reflected in the sales. It is important to understand that no cash flows from the valuation adjustments. In the Annual Report, this is presented as "Unrealized movement in fair value of investments".

Sales components summarized according to Annual Report 2021 (2020) [3]:

-Dividends received: 226,328 (123,748)

-Unrealised movement in fair value of investments: 155,551 (9,763)

-Interest on shareholder loan investment received: 39,804 (20,793)

Thus, if the investment activities as well as the valuations of the investments increase, the revenue increases. The valuations are carried out classically using the DCF method. Therefore, valuations could well fall if the electricity price falls or the wind blows less.

𝗜𝗜. 𝗞𝗲𝗻𝗻𝘇𝗮𝗵𝗹𝗲𝗻 [𝟰]*:

-KGV 2021: 7.68

-KGV 2022e: 2.87

-KGV 2023e: 6.48

-KGV 2024e: 7.28

-PEG 2022e (P/E/growth rate): = I do not permit myself to pass judgment here. EBIT growth is extremely volatile due to the current situation and electricity price development. A reasonable statement cannot really be made here. For classification: A favorable PEG ratio would be achieved with growth of 8-10% (rule of thumb: < 1 = very favorable).

-KBV 2022: 1.15

-Sales growth: 2022: 312%; 2023: -46%; 2024: -8%

-EBIT growth: 2022: 325%; 2023: -49%; 2024: -8%

-Dividend yield: 2021: 5.11%; 2022: 5.45; 2023e: 5.87%; 2024e: 6.09%

*As of 10/16-22

Sector Key Figures Europe [5]:

-Investment & Asset Management Companies P/E : 11.72

-Growth Investment & Asset Management companies : 14.02%

-PEG Investment & Asset Management Companies: 0.84

But is UKW now favorably valued? One could almost think so. But in order to make a final judgment, we need to take a closer look at the business model and the financials, based on the next section.

𝗜𝗜𝗜. 𝗥𝘂𝗯𝗿𝗶𝗸 - 𝗪𝗮𝘀 𝘄ü𝗿𝗱𝗲 𝗕𝘂𝗳𝗳𝗲𝘁 𝘀𝗮𝗴𝗲𝗻 (𝗗𝗮𝘁𝗲𝗻 𝗮𝘂𝘀 𝗱𝗲𝗺 𝗔𝗻𝗻𝘂𝗮𝗹 𝗥𝗲𝗽𝗼𝗿𝘁 𝟮𝟬𝟮𝟭 [𝟯]):

Criteria to be read in detail:

https://app.getquin.com/activity/XcuRrJwmyP

Due to the very manageable business model, I deviate somewhat from my usual "Buffett Approach". UKW has hardly any operational activities, focuses on investments and divende - Thats it!

A. Income Statement:

For fiscal 2021, we have achieved a net margin of 92%. The EBIT is almost equal to the revenue. However, this is not surprising and therefore not unusual for an investment company. Profit has been rising steadily for 3 years. However, this is mainly due to new acquisitions, which in turn pay dividends: There have also been no significant devaluations of the investments during this period.

Profit 2021: 363.22 million GBP

Profit 2020: GBP 104.40 million

Profit 2019: 43.29 million GBP

Profit 2018: 202.38 million GBP

Profit 2017: 59.87m GBP

B. Balance Sheet:

The balance sheet looks similarly "boring". The asset side consists almost entirely of the investment holdings. The liabilities side has a loan of GBP 950,000, which is repaid annually and represents about 23% of total assets. Depending on demand, the credit line is also increased again.

The business model is simply explained: receive dividends, pay dividends and increase the credit line or perform a capital increase as needed. Nothing else actually happens. The cash flow is fully utilized. If you increase the credit line, it is fully used for investments and dividend payments. It is the same with capital increases. Depending on the need, one of the two (credit vs. capital increase) is used as a source of cash. Since the dividend is based on inflation, we are currently forced to do this to a certain extent.

But does this kind of dividend policy make sense? I would like to take a brief look at the cash flow statement! Because here it becomes even clearer how UKW's strategy looks exactly.

C. Cash Flow Statement:

Cash relavant transactions for UKW summarized:

Annual repayment of loan (-)

Increase in credit facility (+)

Payment of dividends (-)

Receipt of dividends (+)

Cash from capital increases (+)

As mentioned above, not much is happening. As a result, the operating cash flow and also the free cash flow can sometimes be negative. This leaves little strategic room for maneuver, as the company is always trying to cover its dividends and investments through capital and credit increases. But that is simply also the business model.

Capital increases 2020: 400,000 GBP

Capital increases 2021: 450,000 GBP in November 2021 and 197,618 GBP in February 2021

A relevant article re. the 450,00 GBP capital increase:

https://quoteddata.com/2021/11/greencoat-uk-wind-raises-450m-high-demand/

We can see that UKW needs capital increases, which have an impact on the share price (share price dilution). If you look at the share price development of UKW, you can see that there is hardly any share price performance possible. On the other hand, UKW has a good dividend yield.

From 2014 to the peak in 2022, the share price "soared" from the original €1.19 to €1.95. [7] The share is therefore not a particular high performer and should not be expected to be.

Such a dividend strategy is not unusual and neither positive nor negative. However, one should be aware of the yield expectations!

So what would Buffett say? Probably not much. The share does not really have a moat and in all likelihood it will not be able to beat the market. Unless wind turbines are the outperformers in the next few years 😊

𝗜𝗩. 𝗞𝗲𝘆 𝗡𝗼𝘁𝗲

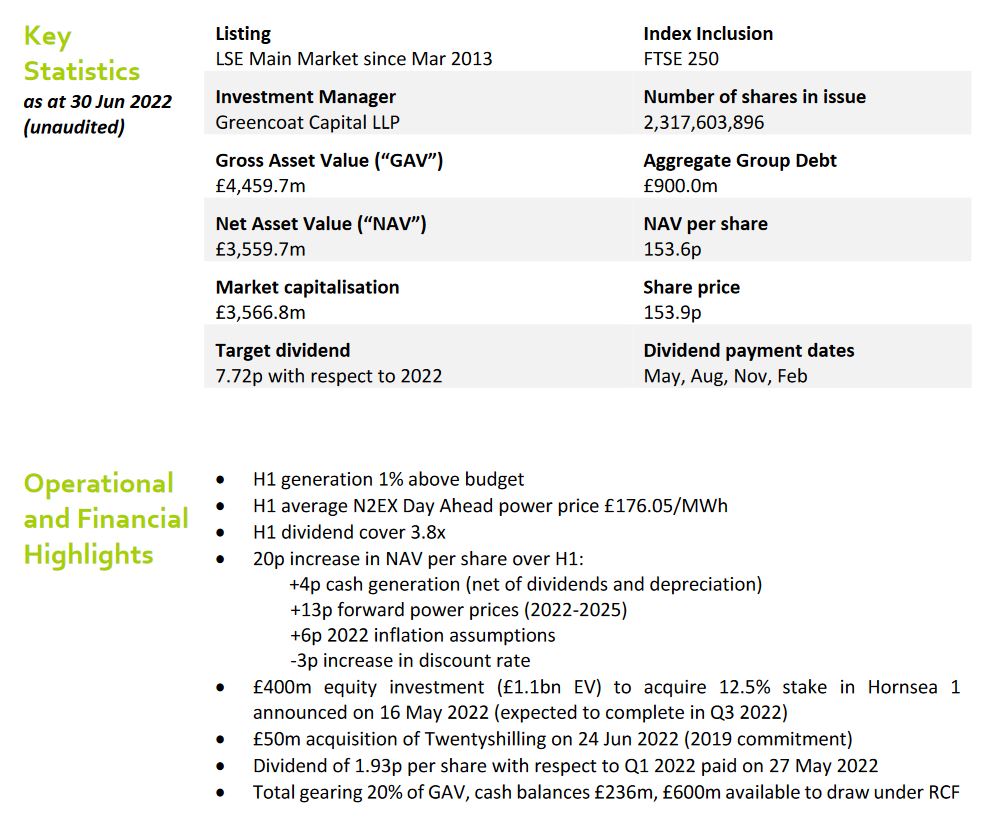

UKW regularly publishes net asset value (NAV) reports that assess the value of assets (wind farms). This provides regular information on business development and asset valuation.

The assets are valued according to the DCF method.

Excerpt from the semi-annual report:

"The DCF valuation is produced by discounting the individual wind farm cash flows on an unlevered basis."

For more information on the valuation of assets and companies, please refer to the following articles:

Little guide of valuation:

https://app.getquin.com/activity/laOUVhfFDI?lang=de&utm_source=sharing

Impairment according to IAS 36:

https://app.getquin.com/activity/vCLDnzrHFv?lang=de&utm_source=sharing

In the NAV reports, the relevant information is compared, such as NAV, market capitalization (shares x price) or target dividend, based on inflation (RPI). So you can already deduce something from the reports, how the business (wind, electricity price), the valuations and the cash requirement for the dividend will develop.

NAV 30.06.2022: 3,559.7 million GBP

NAV 31.03.2022: GBP 3,459.2 million

NAV 31.12.2021: 3,093.7 Mio GBP

NAV 30.09.2021: 2,549.0 Mio GBP

Market capitalization 30.06.2021: 3,566.8 Mio GBP

Market capitalization 31.03.2022: 3,531.6 Mio GBP

Market capitalization 31.12.2021: 3,257.8 Mio GBP

Market capitalization 30.09.2021: 2,564.7 Mio GBP

In this context, I also refer to the revenue component "Unrealized movement in fair value of investments", which may change accordingly based on the valuations.

In the valuation, UKW benefited primarily from electricity prices and further acquisitions. From 2020 to 2021, the NAV valuation increased mainly due to investments (GBP 569 million) and valuation adjustments (GBP 116 million) [3].

Likewise, the June 2022 NAV Report shows that GBP 400 million cash via a capital increase was necessary to acquire 12.1% of the "Hornsea 1" wind farm. Therefore, in the long term, this acquisition should recoup the GBP 400 million.

𝗩. 𝗣𝗲𝗲𝗿 𝗚𝗿𝗼𝘂𝗽/𝗞𝗼𝗻𝗸𝘂𝗿𝗿𝗲𝗻𝘇 [𝟯]:

Since FM is not a classic green energy stock, the peer group is also completely different. In summary and for your own analysis, a small list of relevant investment companies:

-Foresight Solar Fund $FSFL

-Bluefield Solar Income Fund $BSIF

-John Laing Environmental Assets Group $JLEN

-The Renewables Infrastructure Group $TRIG

-Next Energy Solar Fund $NESF

𝗩𝗜. 𝗥𝗶𝘀𝗶𝗸𝗲𝗻/𝗡𝗮𝗰𝗵𝘁𝗲𝗶𝗹𝗲:

-Exclusive dependence on wind farm development and electricity price.

-Valuation risks in the wake of electricity price changes.

-Dividend linked to retail price index (RPI) inflation. Provides for attractive dividend, but also for borrowing and capital increases (share of FC, however, low). Startegic scope thus limited.

-Limited investments outside UK possible through Greencoat Renewables PLC, which limits growth opportunities.

𝗩𝗜𝗜. 𝗩𝗼𝗿𝘁𝗲𝗶𝗹𝗲:

-No operational risks from operations, maintenance and thus hardly any operational costs.

-Because of focus UK no currency risks.

-Stable environment/weather conditions for wind turbines in UK.

𝗩𝗜𝗜𝗜. 𝗙𝗮𝘇𝗶𝘁:

FM is doing what, in terms of climate change, is a respectable business. However, those looking for high returns will not be happy here. UKW is intent on using its cash flow each year for investments and dividends. If further cash is needed, a capital increase is carried out, which dilutes the share price. The business model is simple and involves low operational risks. However, one should not expect high returns. In addition, the business is not very diversified.

I also see a disadvantage in the strategic orientation and the growth potential. Due to other investment trusts, such as Greencoat Renewables PLC, which is run by the same management, it is unlikely that they will invest in France, Sweden or Ireland, so that they do not get in each other's way. At the very least, there is a certain barrier here.

Greencoat Renewables PLC $GRP (-0.47%) is somewhat more diversified due to its European business and also holds growth prospects in the PV market. Its market cap and NAV are still somewhat smaller than UKW's, in part because of its lower sales and profits. However, I have not done a major analysis for this investment company. For all UKW fans, however, this company could also be interesting 🌝

However, those who want a regular dividend with an unexciting share price development, as a supplement in the portfolio, could be right with UKW. Because the dividend will remain high and the investments serve climate change.

As always, no investment advice!

Sources:

[1] https://de.marketscreener.com/kurs/aktie/GREENCOAT-UK-WIND-PLC-12888956/unternehmen/

[2]

https://www.greencoat-ukwind.com/about-us/who-we-are

[3]

[4]

https://de.marketscreener.com/kurs/aktie/GREENCOAT-UK-WIND-PLC-12888956/fundamentals/

[5]

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html

[6]

[7]

https://www.boerse.de/aktien/GREENCOAT-UK-WIND-Aktie/GB00B8SC6K54

Graphic:

Portfolio Map:

https://www.greencoat-ukwind.com/portfolio

Wind turbines: -direct from Annual

Report 2021-->

Company homepage:

https://www.greencoat-ukwind.com/disclaimer-country

Greencoat Renewables PLC:

Now to keep you all up to date on how things are going with the "management" of $UKW (+1.64%) Getquin, I am creating an overview here and will update it regularly, we all know there is an acute shortage of skilled workers and we are also desperately looking for new employees. 😁👍

We pay 1.93 pence per share every 3 months. Salary comes in February, May, August, November 😁👍

In May there was a salary increase of 13% to 2.19 pence per share.

There will be a further salary increase of 14% in 2024 😁👍

Greencoat UKW is a public limited company, the 10 largest investors "worldwide" are currently

🥇@PortfolioTrackerJO

22500🚀

🥈@GoDividend

4151🚀

🥉@InvestmentPapa

3250🚀

@DaddysInvestDiary

3000 🚀

@dividendsearch 3000 🚀

@businesspepe

3000🚀

@Simpson

2750🚀

@teschi

2300🚀

@TopperHarley

2250 🚀

@California_Dreamin

2222 🌹

Executive officers

CEO

@GoDividend

4151🚀

Down-to-earth, relaxed, calm personified, I can't imagine a better CEO than this friendly family father.☺️👍

He has been part of the "hype" since the beginning💪😁 ,

He proved his skills directly as Vice President,

Since 1.8.2023 our new CEO and will finally take $UKW to new spheres führen👨🚀🚀

Chief Financial Officer

@InvestmentPapa

3250🚀

For me he is one of the brightest minds on the market, with his often critical and serious opinion he brings many of us back down to earth and thus saves us from further disaster.☺️👍

Chief Operating Officer & Windmill Inspector

@California_Dreamin 2222 🌹

Our sunshine from England is the only person who can confirm that UKW is not a letterbox company and that the wind turbines actually exist 😁👍

Institutional investor & Richie Rich of UKW

@PortfolioTrackerJO

22500🚀

On February 15, 2024 we have the first institutional investor who has "massively" joined UKW. He will now ensure that all employees squeeze the last juice out of the wind turbines.😂👍

Chief of Investment & Analytic (thanks Stefan😁)

@TheAccountant89 New to the team as a freelancer 💪😁

Here you can find his first job begutachten☺️👍

https://app.getquin.com/activity/wrsdYFrLHz

Honorary Chairman

Founder of UKW 😁👍1 year as CEO successfully made UKW what it is today 💪😁

Career ended on 31.7.23 and his sheep are dry 😁👍

Chief Security Officer & bodyguard of Chief Financial Officer

@TopperHarley

2250 🚀

Chief Party Officer

@Zackdela79

1220 🚀

Even though our motto is "Work Hard - Play Hard", the dividend parties are a must 😁

Junior Vice President & Personal Manager

@Simpson

2750🚀

Been there from the start and successfully twiddled my thumbs on the Supervisory Board.

After the personnel budget 22/23 got completely out of hand and the share price$UKW (+1.64%) course has come under massive pressure as a result, his first task will be to cut the positions.😁

Salary Manager

@teschi

2300🚀

He will now take care of our "salaries" so that they end up in our accounts down to the penny. 😁👍

Supervisory Board

@DaddysInvestDiary

3000 🚀

@dividendsearch 3000 🚀

@businesspepe

3000🚀

@Nichthenri

2000 🚀

@Patrick-2800

1800 🚀

@Dr27589

1500 🚀

@ErwinPetersen 1200 🚀

@-RB-

1000🚀

@ETFJUNKIE

963🚀

@RealRose

873🚀

@Rentner

777🚀

Law & Order Officer

@lawinvest

700🌹

If employees who have left sue us for severance pay or one of the wind turbines collapses and catches a cow or a donkey on the green pasture, we now have Sina on board 💪😁

Law & Order Assistant

@Specter

150🚀

Security Service Crew

So that nobody secretly taps free electricity from our windmills at night, putting our dividend at risk 😁

@Klambam

651 🚀

@MichaelPfalz

600 🚀

@meonmonday

600 🚀

@Swain

600 🚀

@Reinecke

600🚀

@GreenWash

580 🚀

@Tabularasa

500🚀

@npiontek

450 🚀

@financial_ninja_60

406 🚀

@Paddy011

375🚀

@SAUgut77

350🚀

Electric Manager

@1Chrischi1

700 🚀

We finally have an electrician in the team💪😁 He will now ensure that the wind turbine doesn't go up in smoke but reliably supplies us with cash flow 💪😁

Chief Facility Manager

As a fitter, he assembled all the windmills all by himself 😁

Now as janitor, he will ensure that the windmills continue to run like clockwork. 😁👍

Facility Manager

@Zony

130 🚀

We've hit the transfer market and brought in a second janitor in Robert to strengthen our team so that our Kevin never has to work 80-hour weeks again 😁

First Aid Manager

@Therealjim

450🚀

In case you get dizzy from the cleaning crew or the managers faint from the high dividend 😁

Cut the lawn manager

Not all wind turbines are offshore, there are also a few in the countryside. We spared no effort and expense and hired the world's best lawn mower driver 💪😁

Lawnmower

crew

@Sjet669

320🚀

@AE23

295🚀

@AlterMann

290 🚀

@Marcie

250🚀

@Inosuke 250 🚀

@WienerGfrast

200 🚀

@Servus_Lea

200 🌹

@GuenDolf

200 🚀

@devnerd_daddy

200🚀

@Aktienfabe

150 🚀

@Scepp

145🚀

@DasistderWeg

134 🚀

@Invi_S

125🚀

Gate Service Manager

@ginlos

146 🚀

This squirrel will personally scrutinize every bag to make sure no one steals extra dividends from us 😁👍

Windmill Cleaning Manager

@Souli1984

166💪😁

After months of hard work in the cleaning crew, he has more than earned his first promotion. He now gets a whip and will make sure the crew works even harder 😁👍

Windmill cleaning crew

@LukeH

100 😁👍

@DerMartin

100 😁👍

@StnrFinn 100 😁👍

@Bklauz

100 😁👍

@MCS_1983

100 😁👍

@cito93

72 😁👍

@Philipp1100101

61 😁👍

@McCrispy

52😁👍

@JakMuc

50 😁👍

@DividendenSchwabe

60 😁👍

@jh1987 59😁👍

@Alefu

50 😁👍

Dishwasher

@Pogorausch 43 😁👍

@TJeff

43 😁👍

@Infinity

38 😁👍

@Shiya

23 😁👍

@Divrich

20😁👍

Industrial Espionage Officer

He has been awarded 100 shares in $GRP (-0.47%) and will provide us with secret information and make sure that we are always $UKW (+1.64%) is always a few steps ahead 💪😁

Saboteur

He was hired to secure our margins. From now on he will sabotage the plants of our "competitors" so that we can sell our electricity at a higher price.

Advertising mascot

@Dan27 😁

Please write to me if I have forgotten one, the supervisory board has 10 places, if there are too many you will be promoted or demoted 😁

PS. On the gif you can see the pioneers who dared to take the first step and joined UKW, on the left our founder and on the right our CEO😁👍

Don't worry, we're not taking off yet and there are still plenty of places available 😁👍

Trending Securities

Top creators this week