As I have noticed again and again recently that some people are interested in $BTC (-1.06%) and crypto, but they lack the background knowledge to be able to judge what Bitcoin is apart from a "number go up technology", what problem it solves, how it works, what actually distinguishes Bitcoin from altcoins, etc., I thought I'd start a little "Bitcoin for beginners" series here on GetQuin. Then maybe I won't be "Please deal with Bitcoin first" with the question "Which cryptos would you currently buy?", but simply refer to this series of articles. I hope that I can provide you with some added value. For some of you, this series will probably be rather boring, for others it might be a good introduction to the topic.

In order to be able to assess which problem Bitcoin solves, you first have to deal with money. After all, we all spend almost our entire lives trying to earn money, but not a second on the question of what money actually is. That's why I chose the topic "From Barter to Magic Internet Money" for part 1 of this series.

What is money

First of all: money is not an invention of the state, but an invention of people. Unfortunately, people often forget this nowadays, as it is hard to imagine a non-state money. After all, money today is inextricably linked to the state. Money is one of the greatest human inventions - comparable to the wheel. It is an instrument of man, born out of the practical needs of trade.

Before there was money, people traded goods directly for goods. Although this system of exchange in kind worked, it required both parties to offer exactly what the other was looking for - which was quite rare and severely restricted trade. For example, a farmer with surplus grain could only trade with the blacksmith when the blacksmith needed grain.

Because this was too complicated in the long term, simple credit systems were initially set up in smaller communities. People traded "on trust" by owing each other something.

However, as the community grew, this system quickly reached its limits: Not everyone trusted everyone, and without trust, trade no longer worked.

To overcome such difficulties, people eventually began to look for goods that almost everyone was happy to accept and which were used as a "medium of exchange" - such as salt or animal skins. This medium of exchange enabled trade that would otherwise not have taken place.

-> And this is how money was created.

But which goods were used as money?

This has to do with the so-called "salability" of a good. Saleability refers to the relative ability of a good to be sold on a particular market at a particular time and price (Carl Menger in The Origins of Money).

Menger described that the "most marketable good" within a society became money. In other words, the commodity that was most in demand in society. The commodity that nobody could get enough of. The good that could be sold best on the market.

Saifedean Ammous describes in his book The Bitcoin Standard describes three key categories that determine how suitable a particular commodity is as money:

- Time-based salability: Does the asset retain its value over time?

- Spatial salability: Can the good be easily transported?

- Quantity-related salability: Can the good be easily divided into smaller units?

These three categories can then be used to six central characteristics that a good should fulfill in order to become optimal money:

- Scarcity and durability (time-related salability)

- Acceptability and transportability (spatial salability)

- Divisibility and fungibility (quantity-related salability)

A commodity that combines these six properties is perfectly suited as money.

The evolution of money

The history of money from primitive means of payment to Bitcoin is briefly explained below. The history of money is far from complete and of course very abbreviated - I don't want to bore you with it. For more insights into the topic, I can highly recommend the book "Broken Money" by Lyn Alden :)

Primitive means of payment

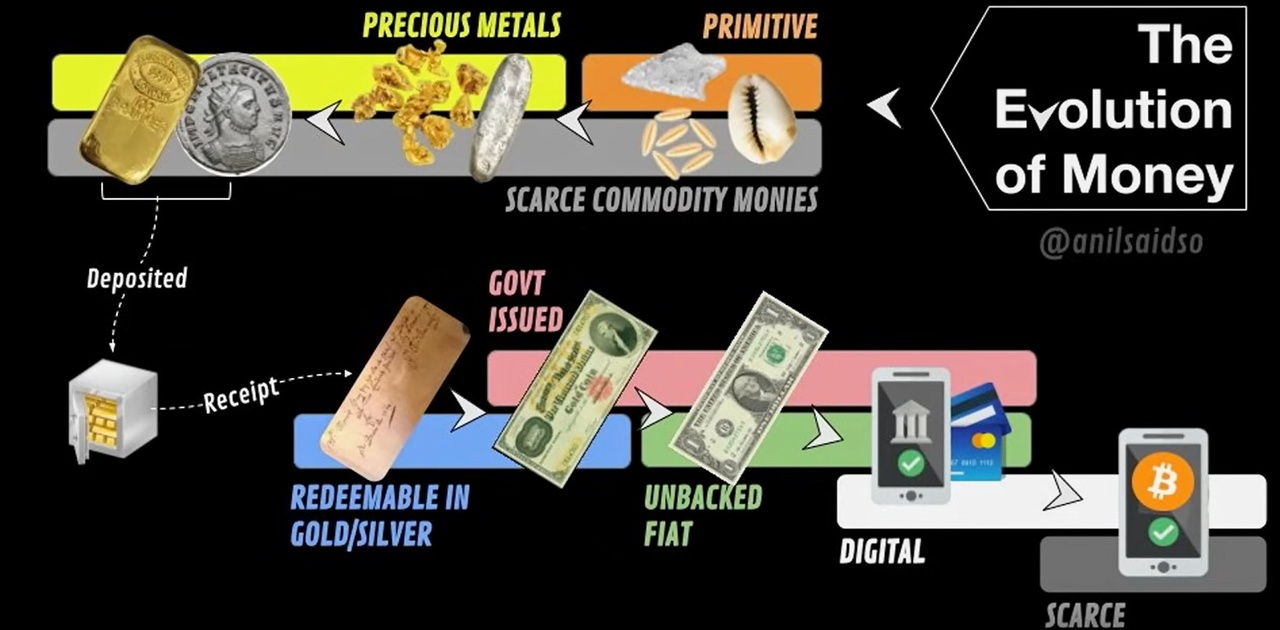

The evolution of money can be seen very clearly in this picture. People first used primitive means of payment such as salt or shells. These were scarce, stable, locally accepted in the respective communities, relatively easy to transport and divide and reasonably fungible.

With increasing technical progress, however, it became easier and easier to produce or mine such primitive means of payment, which is why they were replaced over time because they could no longer fulfill their properties.

Precious metals

Scarce commodity money or precious metals was the next step in the history of money. Precious metals have an extraordinarily high stock-to-flow ratio (S2F). In a way, the S2F ratio means "How much of a good exists in total and how much is added per year in percentage terms?" - These two values are divided and the result is the S2F ratio. This was (and still is) very high for gold and silver, which means that it was relatively rare and could not be increased at will. Furthermore, precious metals do not spoil and retain their properties over very long periods of time. This promoted general acceptance and allowed gold and silver to become money.

However, there were three main problems:

- Precious metals are not forgery-proof

- Precious metals are relatively difficult to divide, especially for small transactions

- Precious metals are heavy and therefore cannot be transported easily and quickly over long distances

For this reason, the first banks developed over time, as explained below.

The emergence of banks

Traders and private individuals began to deposit their precious metals with service providers (banks). In return, they received a receipt for the amount deposited.

These receipts soon became a means of payment themselves: anyone in possession of the receipt could exchange it for the deposited precious metal at any time. This was more practical and safer than transporting gold coins around. What's more, no one had to worry about being sold counterfeit gold or silver. This pre-form of paper money accelerated trade and made larger transactions practicable.

At first, depositors' gold and silver holdings were 100% covered. Over time, the banks then began to lend on parts of the deposited precious metals at interest. This led to the system becoming increasingly unstable.

Redeemable in gold/silver - the gold standard

From the 19th century onwards, the gold standard was officially introduced in many countries. This means that

- Governments undertook to exchange the banknotes they issued for a fixed amount of gold on presentation.

- The money supply was thus tied to the existing gold reserves.

This link ensured confidence and stability. Anyone holding gold standard currencies could be sure that there was a real value behind them. This worked for decades, but came under pressure in times of crisis, as governments regularly printed more gold than they deposited new gold. With the end of the Bretton Woods system in 1971 at the latest, the US dollar - and subsequently almost all other currencies - finally broke away from the gold backing. At that time, US President Richard Nixon "temporarily" removed the link between the dollar and gold in the middle of the Vietnam War (war is expensive😅) and blamed the "speculators" for this. This temporary state of affairs continues to this day and leads us to the next statiion.

State-issued fiat money

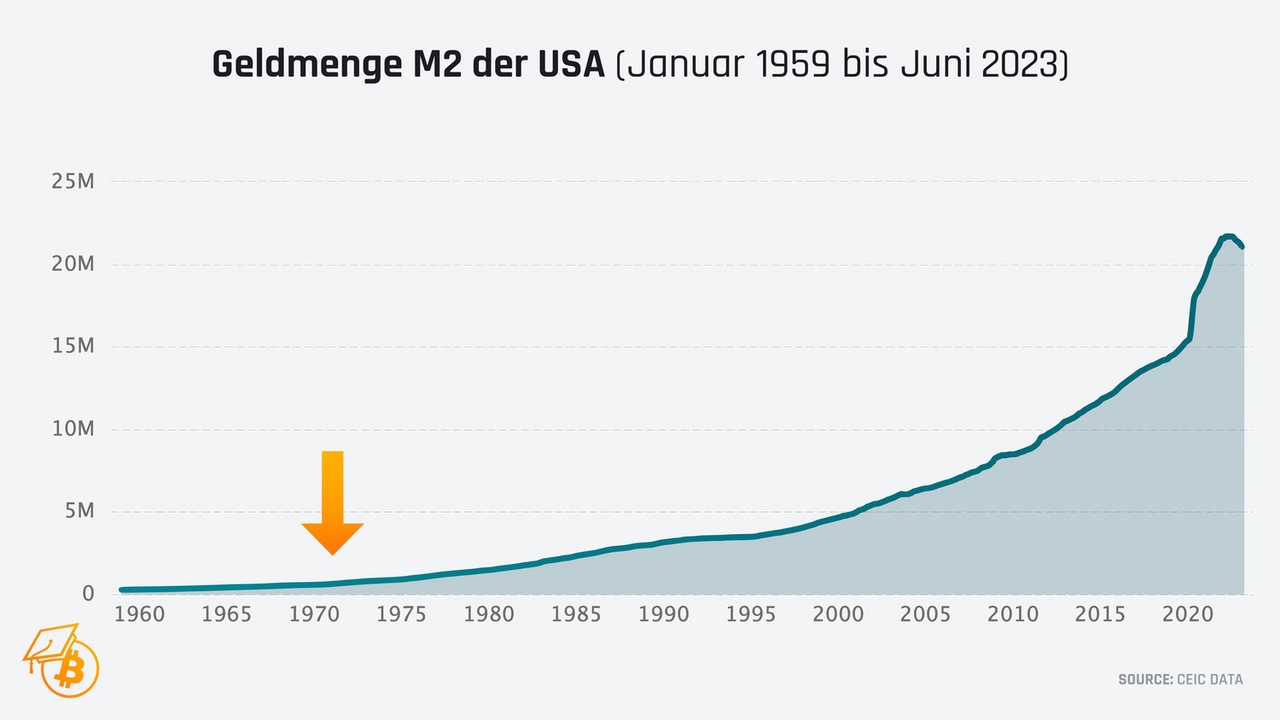

Fiat comes from the Latin and means something like "it shall be" or "it shall happen". From this point onwards (1971), money was no longer linked to any commodity and could be created by states or central banks in virtually unlimited quantities at the touch of a button. And of course they did, as can be seen very clearly from the M2 money shortage in the following image:

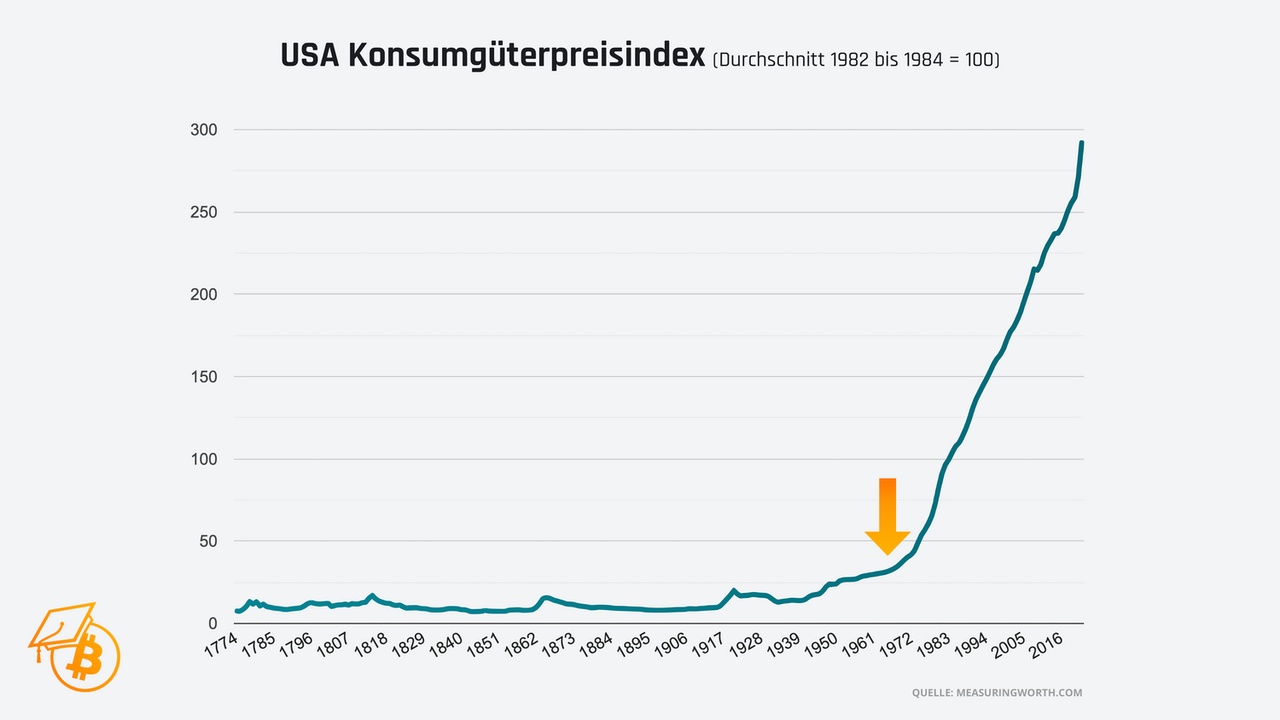

This glut of money also ensured a continuous, sharp rise in the consumer price index, i.e. inflation:

The pictures are from https://www.blocktrainer.de/blog/wtf-happened-in-1971-die-katastrophalen-auswirkungen-von-ungedecktem-papiergeld and I would really recommend that you take a look at these statistics. You can really see how the world changed after the abolition of the gold standard and the immense problems this caused.

However, like everything in life, there are two sides to the coin with fiat money and there are also advantages. For example, central banks can react flexibly to crises and adjust the money supply to the economic situation. Banknotes and digital account balances are also easy to handle and there is no longer any need to move cumbersome gold in the background when transferring money. Above all, this made trading between different countries easier.

Of course, fiat money is not scarce and is not necessarily stable. It doesn't go bad in that sense, but it continuously loses purchasing power. On the other hand, it has (enforced) acceptance by the state and is transportable, divisible to a certain extent and completely fungible (a €20 bill is worth just as much as another €20 bill. The appearance, weight etc. is irrelevant).

Fiat money therefore has some monetary properties, but not all. This is where the next step and the topic of this series of articles comes into play: Bitcoin

Digital scarcity - $BTC (-1.06%)

Bitcoin was the logical next step in the history of money because, for the first time in human history, it was possible to create a digital good that is scarce, stable, transportable, fungible and divisible at the same time - and all without a central controlling authority such as states or banks. Bitcoin thus combines the advantages of fiat money and gold without inheriting the weaknesses of these two systems.

Bitcoin was created in 2008 by a still unknown person or group with the pseudonym Satoshi Nakamoto and solves one of the most fundamental problems of digital goods: the double-spending problem. Before Bitcoin, it was not possible to create a digital good (such as money) that could not be copied as often as desired. If you send a picture via WhatsApp, for example, you have simply made a copy available to the other person. However, the picture has not really changed hands - you still have the picture. This is because information is shared on the internet and information can only ever be copied. For example, if I have an idea and share it with you, then we both have that idea. It's different with physical objects. If I have a coin and give it to you, then you have the coin and I no longer have it. Satoshi Nakamoto has therefore succeeded in digital scarcity to create digital scarcity.

Bitcoin achieves this by using a decentralized database (blockchain) that is distributed across a global network of computers and is constantly updated. Each transaction is recorded in a block, physically secured and attached to the existing chain of transaction blocks. This chain is publicly visible, which makes forgery or manipulation virtually impossible.

But what makes Bitcoin the optimal combination of the advantages of fiat money and the gold standard?

Scarcity and stability

Bitcoin is limited to (just under) 21 million units, which means that there can never be more than this amount. This absolute limitation is mathematically guaranteed and cannot be influenced by political decisions or central banks. Bitcoin is therefore scarcer than gold, because even gold has no absolute upper limit. Nobody knows how much gold is in the ground. No one knows whether we will be able to produce gold in a laboratory at some point. No one knows whether we will be space mining at some point.

Acceptance and transportability

Bitcoin does not require physical storage and can be easily transferred worldwide. This solves the transportation problems of the gold standard. Bitcoin is an open source protocol. Anyone can check it at any time - but no one is able to change it to suit their wishes. No one can corrupt it. No one can create Bitcoin out of nothing. Bitcoin is independent of any person, any politician, any state. It is money by people for people. Nobody should work for money that others can simply create out of nothing. Bitcoin is this money.

Bitcoin is still far from being accepted globally as money or a store of value. However, the properties of Bitcoin will create this acceptance over time. The more people understand these characteristics and recognize them for themselves, the more acceptance Bitcoin will gain. If you look at where we were a few years ago and where we are now, you can see this development very clearly.

For example, the ECB's "Bitcoin is on its way to irrelevance" became "It is unfair that Bitcoin holders are getting richer compared to everyone else" (-> https://getqu.in/vfltld/).

Divisibility and fungibility

Each Bitcoin can be divided into 100 million smaller units (Satoshis), which makes it perfect for any type of transaction - whether it's a large real estate purchase or a small coffee. What's more, each Bitcoin unit, or satoshi, is worth the same worldwide.

In short, Bitcoin combines the robustness and stable value of gold with the ease of use and flexibility of digital fiat money. At the same time, it avoids the serious disadvantages of both systems: Bitcoin cannot be manipulated like fiat money, nor is it physically difficult to handle like gold.

Bitcoin thus represents the next evolutionary step in the history of money and offers the opportunity to build a financial system based on fair and transparent rules - free from political influence and centralized control.

Conclusion

Bitcoin is the logical evolution of a history of money that spans thousands of years. From impractical bartering, to gold with its transportation and divisibility problems, to state fiat money, which is practical but can be inflated indefinitely - all these historical forms of money had their weaknesses.

Bitcoin now combines the advantages of gold (absolute scarcity, stability) and fiat money (digital usability, simple transferability and divisibility) for the first time, without their disadvantages. No state, no central bank and no individual person can increase or manipulate the money supply. Bitcoin creates digital scarcity, is globally transportable, divisible at will and completely independent of centralized control. It is an absolutely limited, fair, democratically regulated, censorship-resistant monetary network consisting of tens of thousands of computers.

In the next part, I will try to explain as simply as possible how Bitcoin works technically. For part 3, I currently have my eye on the topic of self-custody. Feel free to let me know in the comments what you think of the idea of the "Bitcoin for beginners" series and whether you see a need for it at all. I'm also open to suggestions for the series :)

I hope you have/had a great holiday!

Grüße✌️

PS: My miner unfortunately still hasn't found a block🙄😂

Click here for part 2 -> https://getqu.in/3riEoO/