As (real) interest rates fall, my overnight money reserve loses its appeal. 😏

In addition to the weekly $VWRL (-0.17%) -savings plan, I am therefore allocating capital specifically to the copper sector for the first time - tactically, not as a permanent core position.

🚀 Fundamental drivers:

- Electrification & AI boom: E-cars, charging infrastructure, grid expansion, data centers.

- Demand > supply: WoodMac/IEA see a structural deficit from 2025.

- Falling ore grades: Head grade < 0.5% ⇒ rising AISC.

- Recycling is not enough: By 2030, scrap covers < 50% of the increase.

- Geo-lump: 60% of concentrate comes from Chile, Peru, DR Congo.

🚨 Risk: In a recession, copper usually crashes first.

For me, this would be more of a buying opportunity than an exit signal.

📍 Position 1:

$COPA (-0.73%)

- WisdomTree Copper ETC

- Spot exposure

- Pure play on the price without company risk

📈 Chart:

Cup-&-Handle since 2006: Cap at ~€41 (2011 top) is currently under attack.

SMA 200 W (white) positive - first upward trend since 2012.

Volume profile: Largest cluster €30-33 → now support. - Above €41 "volume gap" begins with room for trend acceleration.

📍 Position 2:

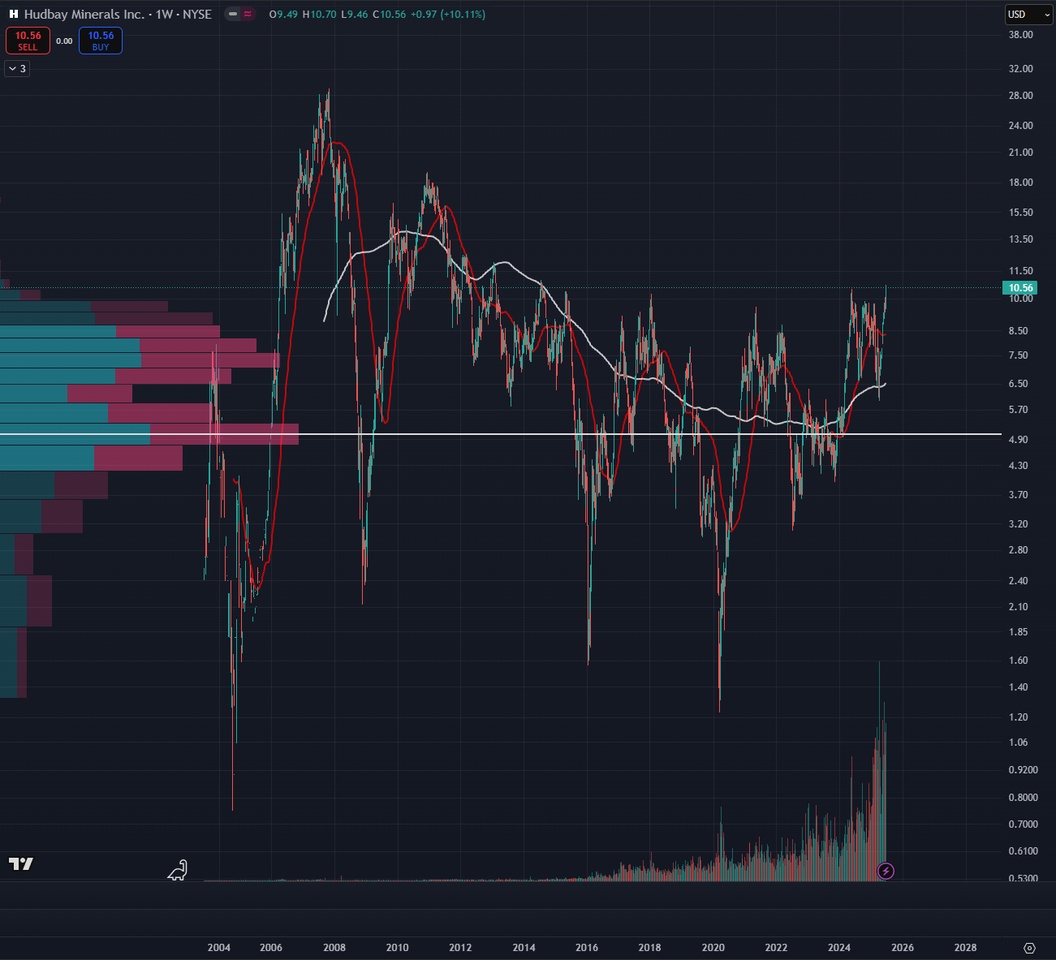

$HBM (+0.43%) - Hudbay Minerals

- Multiple ≈ 5 x - cheap vs. majors

- Three Tier 1 assets plus Copper World (Arizona) could lift production by 50% by 2027

- Relatively ESG-friendly, stable legal systems

📈 Chart:

Weekly close > $11.6 would be a multi-year breakout with projection $14-16.

SMA 200 W rising: recent volume spike points to institutional accumulation.

Volume profile: Point-of-control at ~$6 serves as a massive floor.

📍 Position 3:

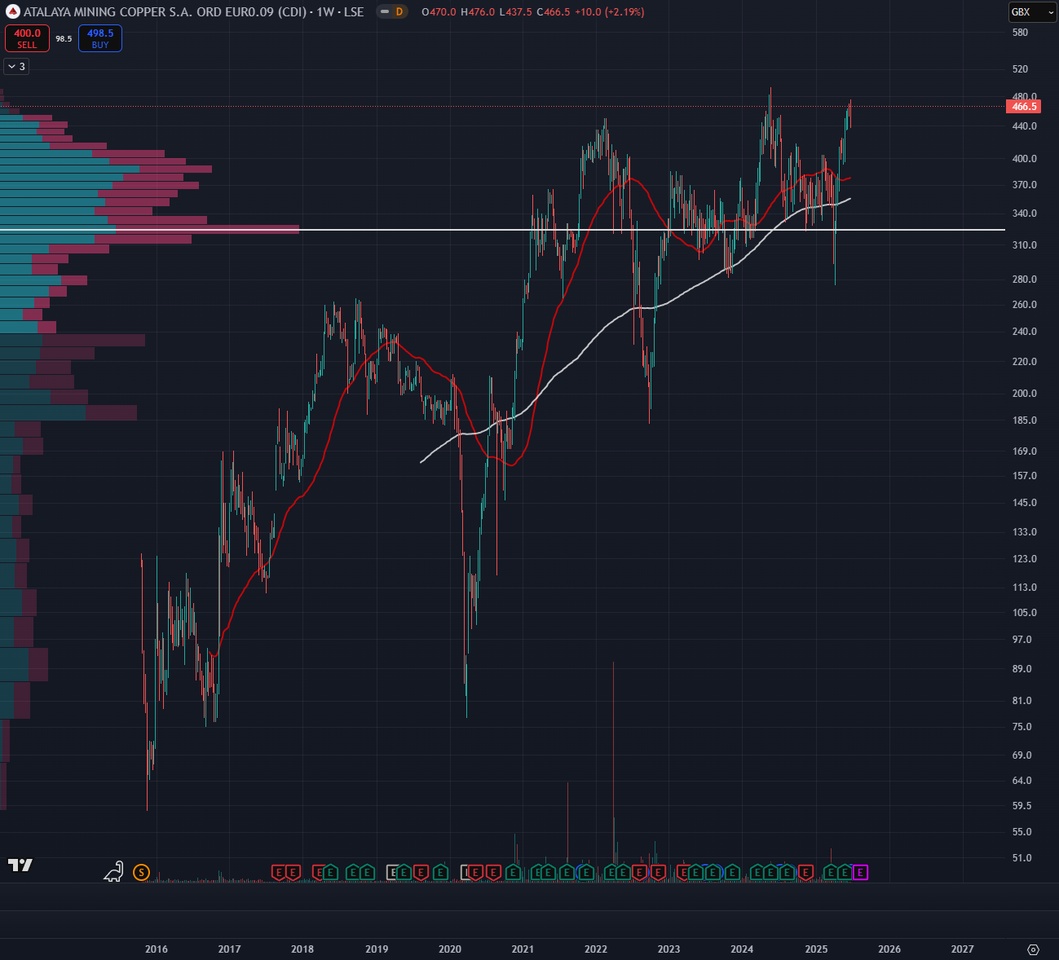

$ATYM (+1.32%) - Atalaya Mining

- The only major western EU copper mine (Proyecto Riotinto)

- Multiple ≈ 8 x, but pure copper story.

- E-LIX hydrometallurgy could reduce costs & extend life-of-mine.

- Minimal geo risk, € cash flows match EU demand

📈 Chart:

(The chart shown is quoted in British pence and has the longest history. Uses ticker E5S1 for the € price)

Ascending triangle 340 p (support) × 470 p (cap).

Close > 470 p confirms breakout with technical target 550-580 p.

SMA 200 W supports every dip since 2020.

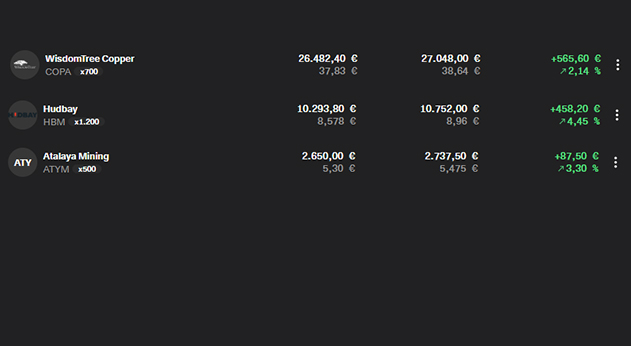

My current copper positions:

That's it already 😁

What do you currently think of copper and are you invested?