Getquin rewinds - All that glitters is not gold ☄️

Now that the majority of the rewinds shared are performing really well and most of them are in the top 10% of the community, it's time to show the other side of the coin.

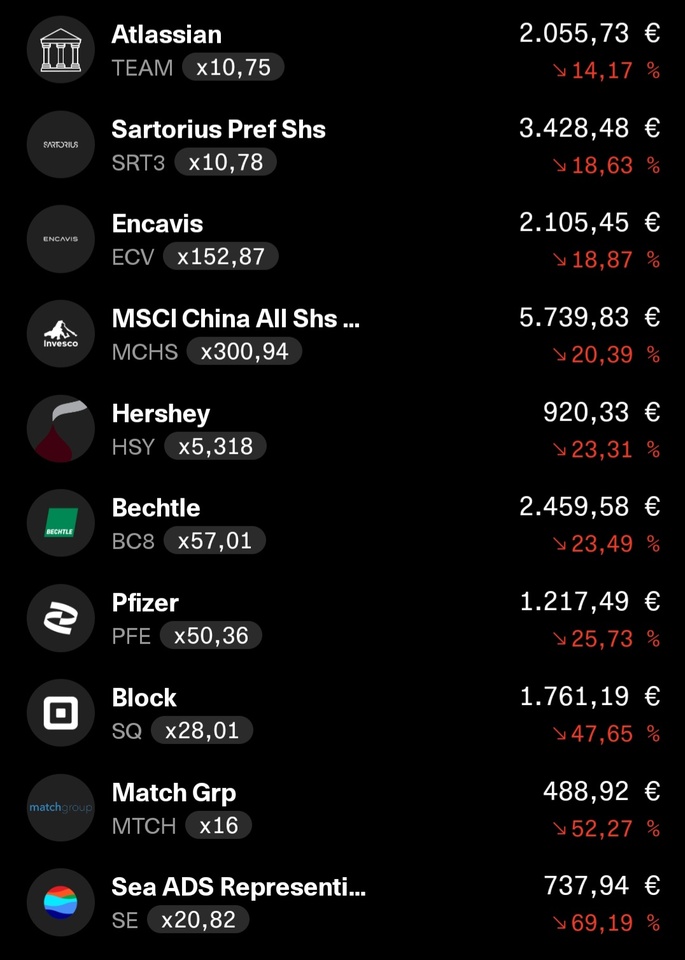

Even though my performance is supposedly better than 95% of the community, I would like to show the shit list of my portfolio here 😂

Please make some noise for:

Sea $SE (-1.77%) Match $MTCH (+2.45%) and Block $SQ (-1.1%) all of which have losses of ~50-70%.

But even a Pfizer $PFE (+0.03%) at the moment I would prefer to assign Waste Management $WM (-0.14%) from @Simpson for recycling 😂

The purchase of Hershey $HSY (-0.99%) has not paid off so far - but I'm convinced in the long term and simply started the savings plan at the wrong time in the middle of the year. Sartorius $SRT3 (-0.64%) continues to suffer from the normalization after Corona and China in general is simply not doing well, which is reflected in my China ETF $MCHS (+0.23%) shows.

With Teladoc $TDOC (+4.99%) and BASF $BAS (+1.85%) I have already sold two more pipe-drawers this year.