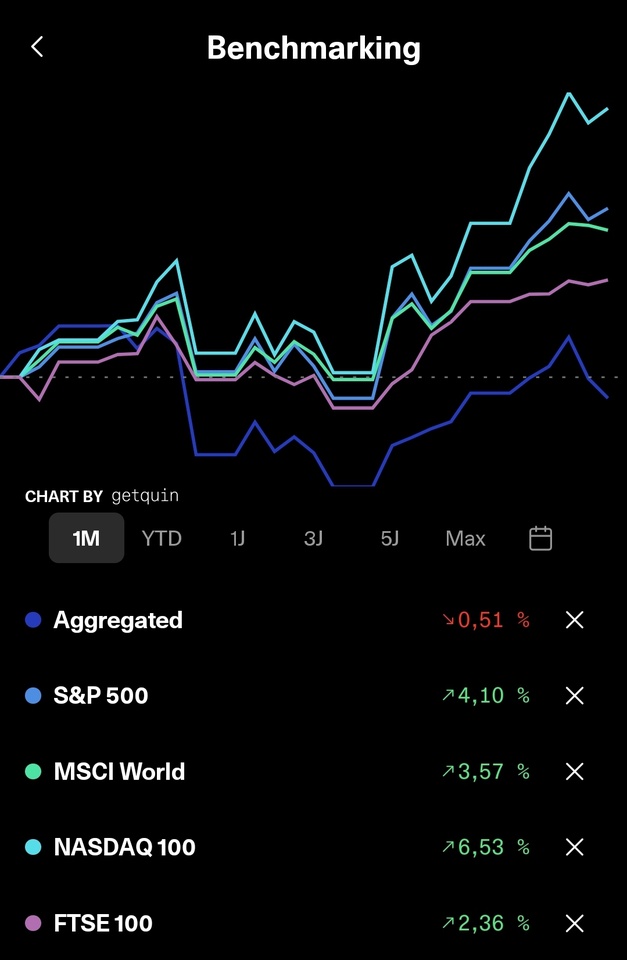

Hi everyone, here's a little insight into the October results of my portfolio, and well, there are also some down months - it can't always be a steep upward trend.

However, I am basically satisfied with everything and the minus in October is really within a very manageable range.

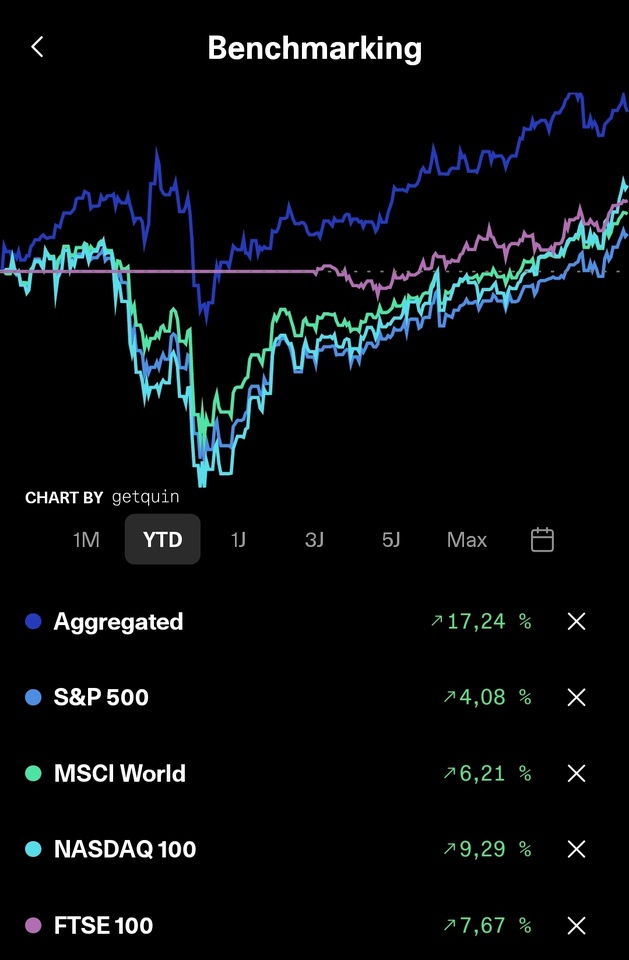

If you look at the current year as a whole...

...you quickly realize why I am still very satisfied with the future. It may not be a high performer, but for a value dividend portfolio it's still enough to build on 🫠

》IRR 21.22%《

》TTWROR 61.01%《

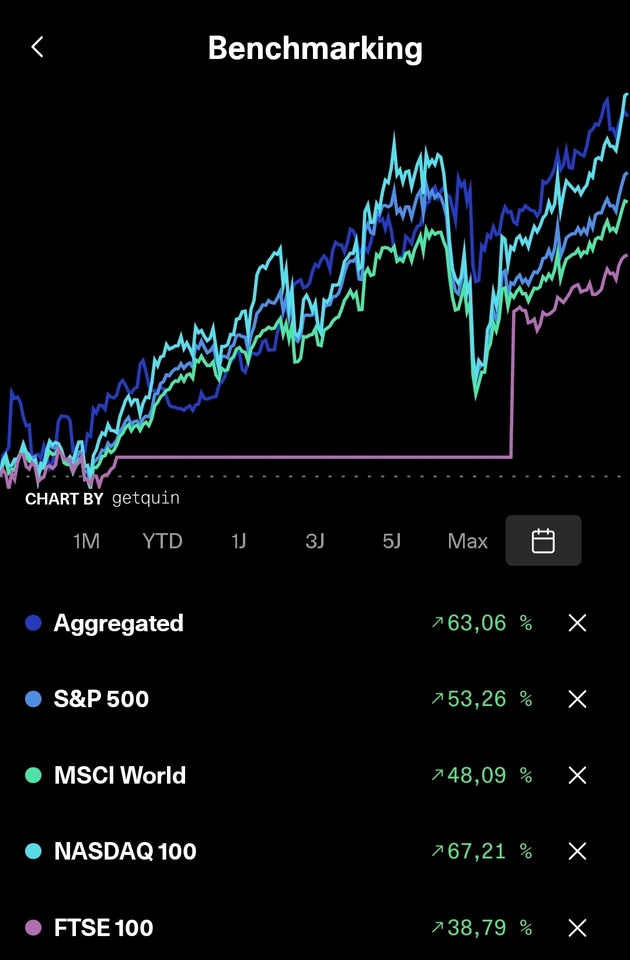

I am also relaxed about the future in the long term, because...

...everything is still relaxed at the upper end and let's see what else the crystal ball has in store for the future 🍊 😅

Especially since the goal of generating the FSA 1000/2000€ as quickly as possible through dividend payments has been optimally achieved, creating the potential for me to simply let profits run and not be dependent on sales, although sometimes a small take-away and later re-entry will probably be on the program more often...but that's how you keep feeling your way 🤫

However, as well as dividends, there is also some really good news: the second check-up after my operation in June was still negative and the third is due next month. The first year is always the most critical and so it's important to keep 👍🏻 and push through da....

...but let's stick to the subject of dividends...

In October, the yield was a bit lean and there was only €64.01 net dividend, which still means +76.02% YTD 💪🏻

But things are looking much better again this month, well, minus the beloved tax...

...which brings us to the top and flops of the month:

Top 3

🟢 $RIO (+3.23%) +10,32% (+16,32%)

🟢 $FTWG (+1.15%) +3,93% (+10,65%)

🟢 $YYYY (+1.16%) +3,87% (+7,46%)

Flop3

🔴 $HAUTO (+5.55%) -12,47% (+13,96%)

🔴 $MUX (-0.72%) -6,16% (+20,82%)

🔴 $DTE (+1.02%) -5,96% (-4,68€)

Purchases:

Disposals:

》none《

And so we continue into November with the year-end forecast, which has already been raised twice...and I wish us all a successful November ✌🏻