First of all, thank you very much for all the positive feedback and helpful comments on my last post. In particular, the comments from @Dr27589 pointed out significant errors and blind spots in my calculations. I would now like to correct them.

My errors - and a correction

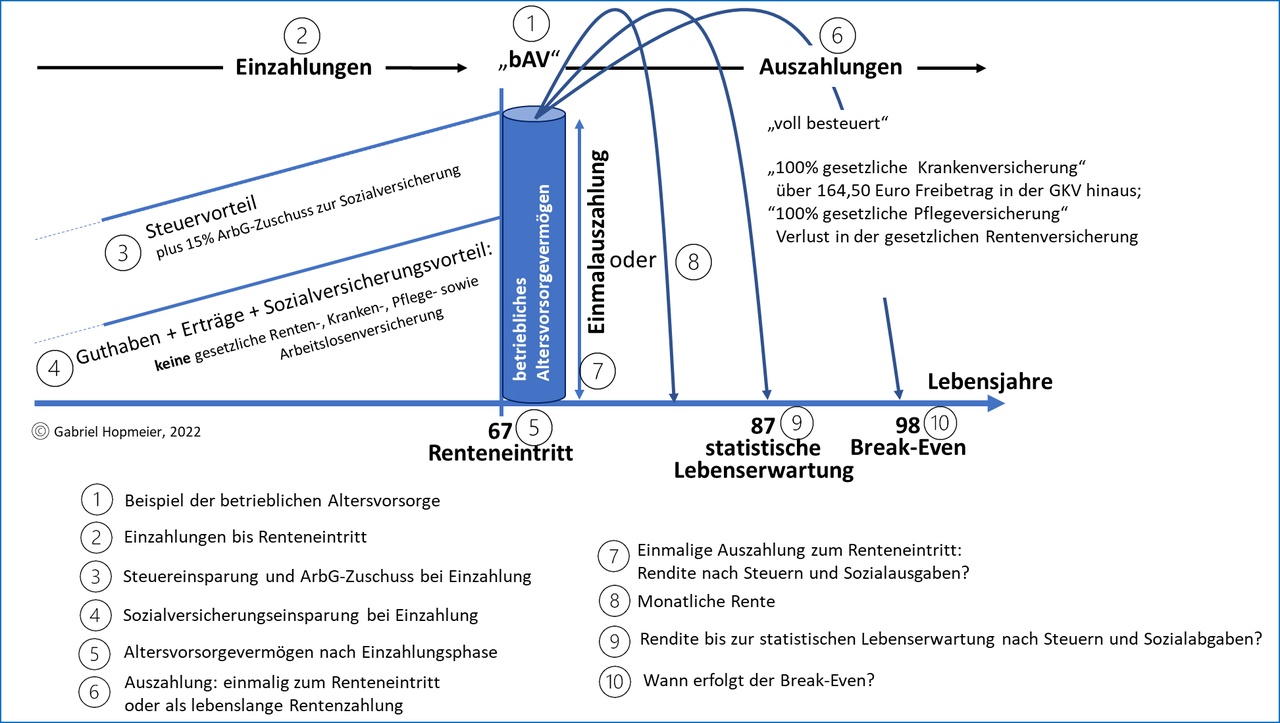

1. taxes: I assumed that the rules for private pension insurance would apply when taxing the payout capital. But that is wrong! The capital of the occupational pension scheme is taxed at the personal income tax rate of the year of payment (other income). It is not entirely clear where this will stand with a payout of €200,000. There is currently still the "fifth rule", i.e. the capital income is spread over 5 years, so that €40,000 pa of additional income is taxable. The top tax rate is currently 42%, the marginal tax rate for senior citizens is probably 30%. And nobody knows what it will be in 2044 anyway. I'm going to assume a low 30%, which would be €12,000 pa for 5 years or a total of €60,000 on an income of €200,000.

2. social security contributions: I also assumed that you only have to pay back the SV contributions saved (15% GKV + 3% PV). Fiddlesticks. The 18% SV contributions are credited to the entire payout capital - including the capital gains! The sum of the payout capital is divided over 10 years / 120 months, the social security contributions are calculated on these 120 months and then debited from the account on a monthly basis. According to the Test.de calculator, this would be €300pM SV contributions for 10 years for a payout of €200,000, i.e. a total of €36,000.

3. pension points: The loss of pension entitlements due to the "detour" of pension contributions to the occupational pension scheme is greater than I initially thought. The online calculator predicts a loss of €80pM for a deposit of €300pM over 20 years. Calculated over 20 years of retirement, that's just under €20,000.

4. not a mistake, but I want to say it again. There are allowances in the payout phase on which you don't have to pay tax or social security contributions. They should be around €300 per month in 2044. However, the prerequisite for this is the decision to opt for a guaranteed pension. This means that you transfer your entire capital to the insurance company, which then pays you a monthly pension, i.e. approx. 3%pa on the initial capital. So you have to become Metusalem in a world without inflation for this to be worthwhile. Inheritance is not. An absolute dealbreaker and not recommended.

The corrected calculations

bAV 300€pM gross/ 150€ net:

Payments in 2024-44: €72,000

Savings capital at 7%pa: €149,700

bAV costs: €4,900

Taxes (30%): €43,400

SI contributions (according to calculator): 140€pM = 16,800€ (10 years)

Loss of pension entitlements (according to calculator): 80€pM = 19.200€ (20 years)

Final sum: 65.400€

vs. broker (150€pM, 7%): 70.300€.

bAV 600€pM gross/ 300€pM net

(I'll keep it short)

Final sum: 151.200€

vs. broker (300€pM, 7%): 175.900€.

Conclusion

My dear Scholli! I would never have thought that our state would devise such a devious system behind a wall of complicated rules to fleece its citizens. In fact, the state lets the capital lever and the compound interest effect work against the occupational pension saver, so that all the positive effects are lost.

So even with a very favorable occupational pension scheme, maximum state subsidies and a dream return of 7%pa, after 20 years you end up with massive losses compared to a broker savings plan ACWI. Most of you will probably be in an even worse position. So if you don't have a company that sinks its money into your occupational pension, you'd be better off investing your money elsewhere. I will probably do the same.

Ciao, dear capital leverage, interest effect and tax savings! I'll look for you somewhere else! I'll let you know when I've found something. Next stop probably my private pension insurance. 🫣

Your Epi