Like hopefully many of you, I have built up my retirement provision in various ways: B&H, GTAA, shares, precious metals, brokers, private pension insurance - and, to a small extent, a company pension scheme (bAV). I took a closer look at the latter recently and asked myself how much I actually want to pay in and for how long in order to get the most out of it. I'm not yet sure whether my calculations are correct, but in the end they could well mean a considerable(!) advantage over a normal broker ETF savings plan. So watch out!

The idea

I'll assume that you know the basics of the occupational pension scheme, I'll spare you that part here, everyone can read that and the many details for themselves on the Internet. However, the main feature of the occupational pension scheme is that payments are made from the gross salary. Up to 302€pM (as of 2024) are completely tax-free (approx. 50%), up to 604€pM are tax-free (approx. 25%). So I pay approx. 300€pM/600€pM into the occupational pension scheme, but I only have 150€pM (=300€x0.5)/ 375€pM (=150€+300€x0.75) less net. Or to put it another way: I pay 150€pM and save 300€pM. Sounds too good to be true? That's right. At least in part. Because in the payout phase, the state takes everything back, i.e. the tax and social security contributions saved are deducted directly from the payout amount (deferred taxation).

But wait! The shrewd Getquinler suspects hidden possibilities here. If, in the end, only the SSV contributions saved have to be repaid, then this portion could be understood as an interest-free loan from the state for old-age provision. Capital leverage - I hear you tapsen!

Then there is the tax exemption on profits during the down payment phase. Compound interest effect - ick hör dir schneller loofen!

And don't forget: the tax relief in the payout phase (partial exemption, marginal tax rate, 50% tax exemption). Example: € 200,000 profit x 0.85 (15% partial exemption) x 0.5 (50% of profits tax-free) x 0.3 (tax rate) = € 25,500 in taxes, i.e. only 12.75% tax. Tax savings are still running!

Capital leverage, compound interest effect and tax savings - let's do the math and compare a standard broker savings plan with my occupational pension scheme.

My bAV

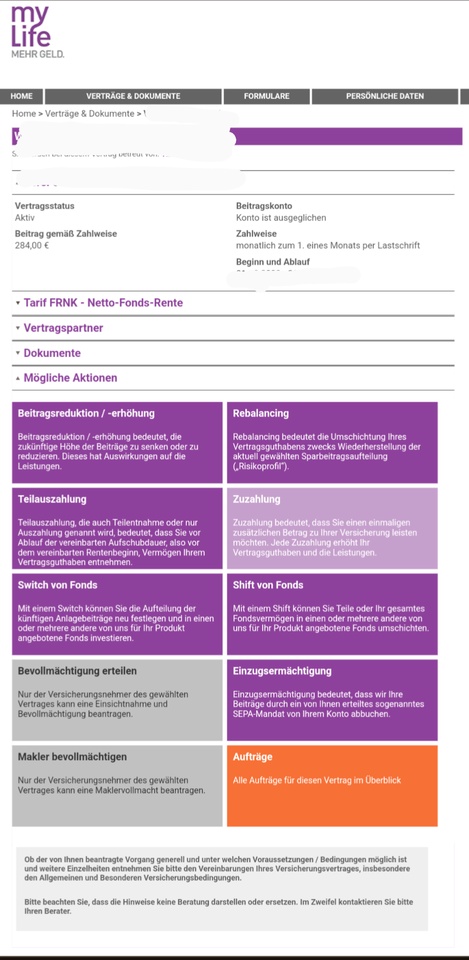

My pension plan is from mylife (fondsrente), a net policy without commission via a fee-based advisor. The costs: 36€pa, 1% on each deposit amount, 0.2%pa on the fund assets. There are 200 ETFs/ funds to choose from, you can buy and sell them yourself via the online portal like a broker (once a month free of charge).

The assumptions

Let's take a middle-aged person who still has 20 years until retirement. She saves 150€pM or 375€pM from her net salary into an ACWI with an expected 7%pa return incl. TER. For the sake of simplicity, I leave the deposits constant. I also let this person spend the saver's lump sum on other investments (e.g. dividend shares). I also assume that the capital is paid out in full at retirement, so that all applicable taxes can be taken into account. I create the calculations with https://www.zinsen-berechnen.de/ and https://www.finanzfluss.de/rechner/sparrechner/ Of course, everyone can adapt the calculations to their own circumstances.

The comparison

Scenario 1: 150€ savings rate

bAV (€150 net deposit):

Deposits 2024-2044 (240 installments of €300 each/ net: €150): €72,000

Savings capital: €149,700

bAV costs: 36€x20 + 1% of 72,000€ + 0.2% TER = 4900€

Gross capital: €144,800

Taxes on lump-sum settlement 2044:

50% of contribution share (€72,000) = €36,000

13% of income share (€72,800) = €9,500

Net capital: €99,300

Broker:

Deposits: 240 installments of €150 each: 36.000€

Broker costs: -

Interest income: €42,100

Taxes (incl. 30% partial exemption, capital gains tax, without lump sum): 7.800€

Net capital: €70,300

Advantage bAV: €29,000 (+41%)

Scenario 2: €375 savings rate

bAV (€375 net deposit):

Deposits 2024-2044 (240 installments á 600€/ net: 375€): 144.000€

Savings capital: €306,400

bAV costs: 36€x20 + 1% of 144,000€ + 0.2% TER = 9,200€

Gross capital: €297,200

Taxes on lump-sum settlement 2044:

37.5% of contribution share (€144,000) = €54,000

13% of income share (€153,200) = €18,400

Net capital: € 224,800

Broker:

Deposits: 240 installments á 375€: 90.000€

Broker costs: -

Interest income: € 105,400

Taxes (incl. 30% partial exemption, capital gains tax, without lump sum): 19.400€

Net capital: €175,900

Advantage bAV: €48,900

Conclusion

With 150€pM savings rate in 20 years with ACWI after all costs a capital of almost 100,000€ and thus almost 30,000€ more than with a broker savings plan? With a savings rate of €375pM, almost a quarter of a million by the time you retire? You'd have to do the math with 10%pa! The advantage of the occupational pension plan quickly goes into the six-figure range. I would say that this compensates for some of the undeniable disadvantages of the occupational pension scheme: Employer-linked, payment option only on retirement, dependence on insurance.

I have never seen a comparative calculation like the one I have made here. You probably haven't either. Why not? The reasons are, in my opinion, 1. that most ETF savers are not interested in such things as occupational pension schemes, especially as most occupational pension schemes have some kind of contribution guarantees without ETF choice and with horrendous commissions. And secondly, most people who are interested in occupational pension schemes only want to take the measly employer contributions, but are otherwise not interested in investing in the occupational pension scheme. Very few employers are also not interested in the investment options within the occupational pension scheme, which they only offer out of obligation and installed at some point 20 years ago. And thirdly, the variant with lump-sum settlement calculated here is unattractive for the insurance companies, who like to advertise with a guaranteed pension and its allowances. But which Getquin investor wants a "guaranteed annuity" of approx. 3%pa, where the remaining capital in the event of death goes completely to the insurance company?

So my calculation above completely misses the intentions of the inventors and the usual players in occupational pension schemes. Perhaps this is why the capital leverage, compound interest effect and tax savings of occupational pension schemes have so far been a blind spot on the investment map (and will remain one as soon as this article has disappeared into the infinite depths of the Getquin archive).

But perhaps I have made a mistake somewhere? If so, I would be grateful if someone could point it out to me. Because if not, I would probably soon increase my net savings rate in the occupational pension scheme to the maximum subsidy amount of €375pM, make full use of the capital leverage and make my occupational pension scheme a serious part of my investment strategy (and with GTAA and a bit of luck, collect an additional half a million in about 20 years).

So: if you are not yet taking advantage of these occupational pension opportunities - where is the fault: with me, with your boss or with you? I'm curious.

Your Epi

Edit: Please also note the 2nd part on occupational pension schemes, in which I have corrected important errors in this article.