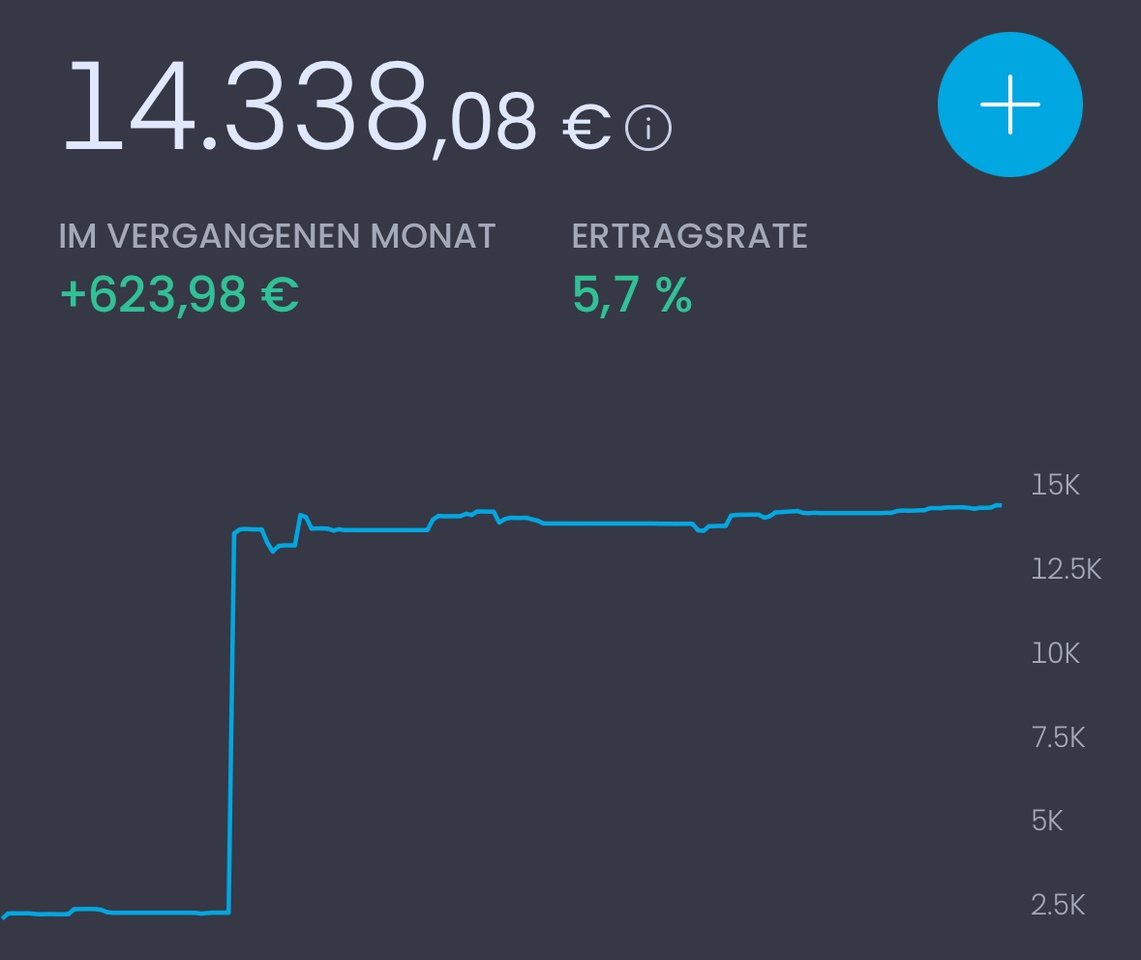

After making my first small investments of a few hundred euros in the stock market in February '25, I added a larger amount in the course of April. It also took some time to develop an investment strategy; where do I want to invest? What risk do I want to take? Accumulating or distributing? ETFs and/or individual shares? If so, which ones and why? Are there specific countries and/or sectors I would like to focus on?

Only at the end of last week were all the answers to these questions clear: a long-term investment horizon of just over 35 years with relatively low risk. A healthy ETF/share mix of 60/40. Distributing portfolio with high-yield and high-growth positions and with a relative focus on the USA and Europe.

I have a good feeling that I am happy with my strategy in the long term and finally no longer have to constantly turn the entire portfolio inside out.

My ETFs and individual stocks are $HMWO (-0.79%)

$TDIV (+0.07%)

$DGSD (-0.51%)

$MAIN (-0.47%)

$NOVO B (-0.81%)

$PGR (+3.61%)

$PSA (+2.09%)

$UKW (+0.23%)

$APH (-3.16%)

$DHL (+0.51%)

$HSBA (+1.07%)

$MUX (+1.44%)

$NEE (-3.59%)

$ZTS (+0.73%)

$AFL (+1.45%)

$O (+0.97%)

$SHEL (-0.94%)

$VID (+0.06%)

$RACE (+0.17%)

$PLD (+1.97%)

$OMV (-0.81%)

$PAL (+0.26%)

$RIO (-1.82%) and last but not least $VOW (+0.79%)

#dividende

#dividends

#etfs

#growth

#personalstrategy

#portfoliofeedback