The year is not quite over yet and a lot can still happen 😁

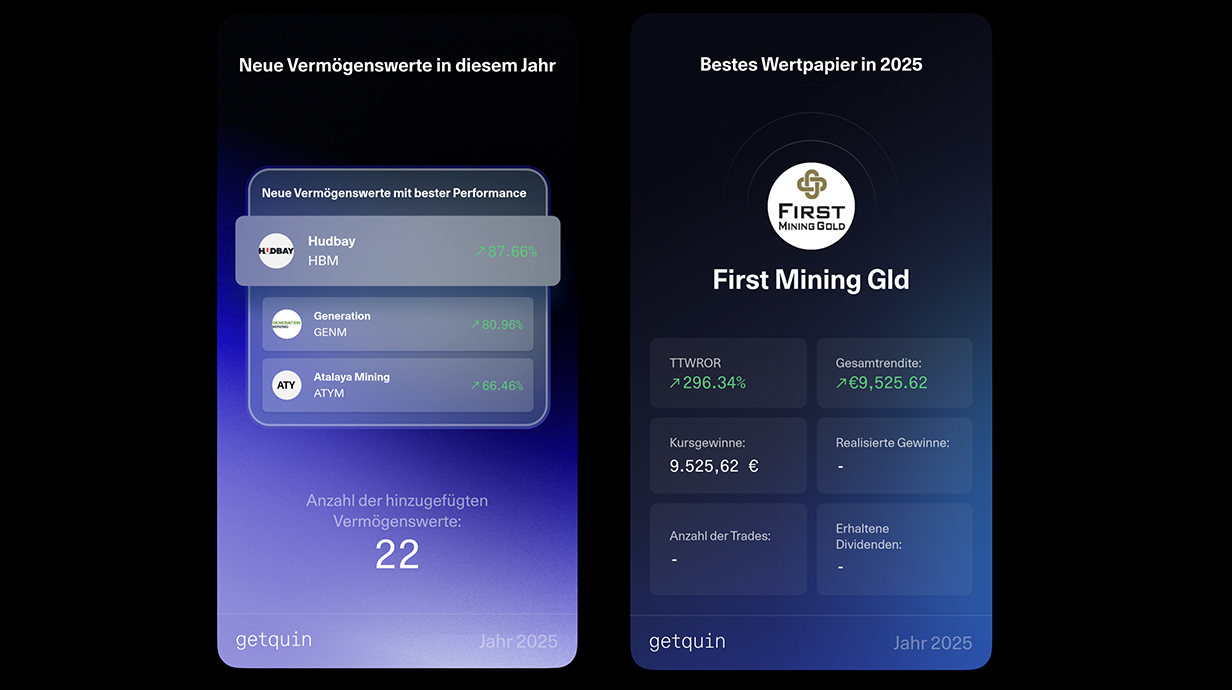

As I probably won't have time for this in the near future, here is my portfolio review for 2025.

🥳 The overall performance was +9.4%, which I am quite satisfied with.

The reference value of the equity portion of my B&H target allocation is $VWRL (+0.98%) which stands at +4.4% YTD (EUR basis of course).

I tried Gemini to break down the exact sector performance of my portfolio, which might be interesting for you as well:

Sector / Portfolio share / YTD performance

Bitcoin / 27,08 % / 📉-17,70 %

Metals & precious metals / 18,42 % / 📈+60,28 %

cash / 15.60 % / 📈~2% (overnight money not included in performance)

Big Tech - Chips - AI /11,89 % / 📈+25,51 %

Armaments / 8,80% / 📈+21,23 %

Core ETFs / 8,59 % / 📈+5,16 %

Energy (oil & gas) / 7,46 % / 📉-6,61 %

Others / 2,17 % / 📈+4,53 %

Metals and mines were the clear outperformers, while energy in particular $BTC (+0.01%) and my energy bet, left a lot to be desired this year.

I was able to invest a lot this year, but also held a fairly high cash ratio, which of course also depressed performance accordingly.

For 2026, I will continue to overweight armaments, commodities and energy.

In the event of setbacks, I will also continue to $VWRL (+0.98%) core in particular.

I wish you all well! ❤️