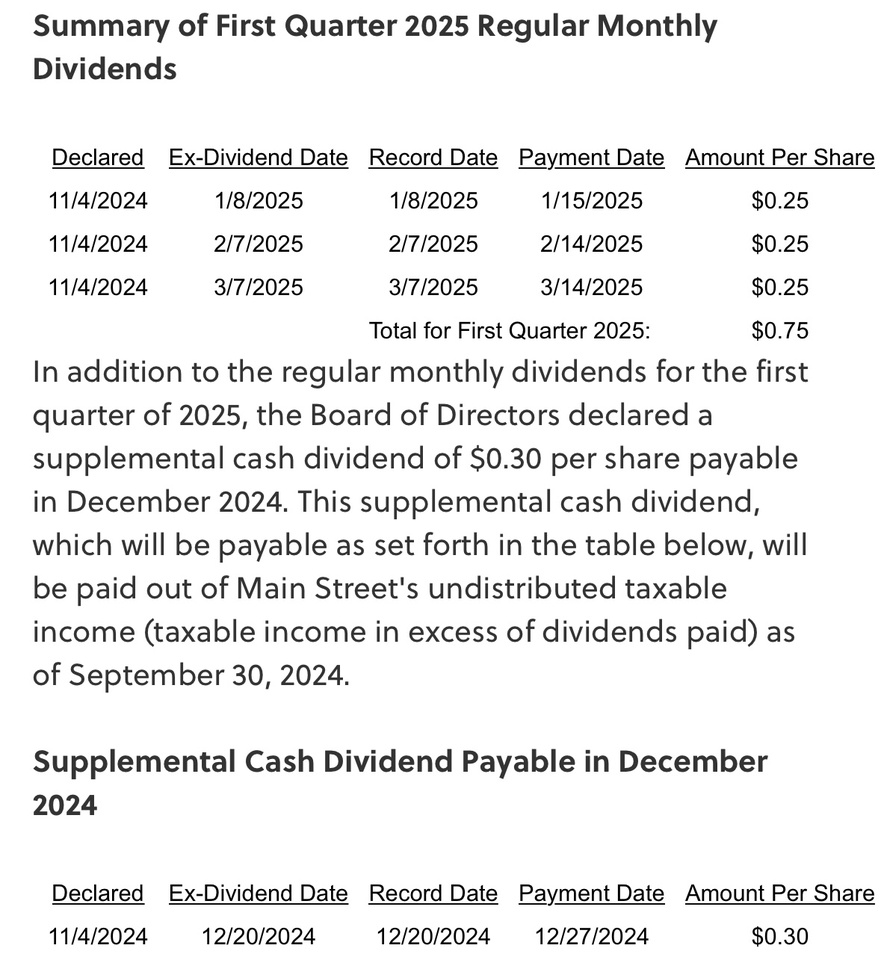

$MAIN (+0.69%) with dividend increase from $0.245 per month to $0.25 and special dividend in December 😍

- Markets

- Stocks

- Main Street Capital

- Forum Discussion

Main Street Capital Stock Forum

StockStockDiscussion about MAIN

Posts

172I need community support for $MAIN (+0.69%) .

A solid monthly payer that also pays out a special dividend 4 times a year. However, I am now up 27.5% in terms of performance and 37.73% in terms of return. Should I continue to hold and take the monthly dividend? Or sell everything (can still be balanced with a loss).

How about an SL? Then reinvest the dividends in a savings plan and enjoy the profits

$MAIN (+0.69%) I’m thinking of buying, what’s your opinion about this stock?

Duplo for the family. So that everyone stays fat, round and healthy

$MAIN (+0.69%) yum yum yum 🎁

Greetings to all,

I started investing a good year ago. Never really been on the dividend track until now. Wanted to ask which dividend stocks or ETF's you can recommend such as $O (+2.65%)

$VICI (+1.98%)

$OBDC (+0.43%)

$MAIN (+0.69%) or SP500 dividend aristrocrats and etc.

Thanks in advance for the feedback and have a nice day

As some of you may know, a few weeks ago I started the battle to reduce my portfolio from 77 positions to 25-35.

At first it was quite easy to find stocks that I no longer wanted, but gradually it has become more and more difficult. In the meantime, I have already sold quality companies 🤦♀️ and often toyed with the idea of keeping the rest.

---------------------------------------------------------------------------------------------------------

However, in my opinion this would be a mistake, as there are still many positions in my portfolio that do not fit in with a growth strategy.

So today, I have added the obvious dividend stocks and placed an SL order on each of them.

---------------------------------------------------------------------------------------------------------

I proceeded as follows:

Agree Realty $ADC (+3.68%) SL set at 59,70€

National Retail $NNN (+3.7%) 40,-€

Hercules $HTGC (+0.27%) 16,07 €

Omega $OHI (+2.74%) 29,14€

Bats $BATS (+0.49%) 30,00€

Ares Cap. $ARCC (+1.62%) 17,- €

Main Street Cap. $MAIN (+0.69%) 43,43€

--------------------------------------------------------------------------------------------------------

I am open to suggestions for improvement and comments 🧘

Nobody knows how big your positions are because you don't share the absolute values. I don't think it's a bad thing to have a lot of positions if they have a certain value.

I feel more comfortable with 30-40 positions of 1000-2000.

We've reached yet another milestone 💚💚💚

With the big dividend payouts in September we have reached a new high of 1253.28$ for 09/2024. This marks the second time (after 06/2024 were I've reached a >1000$/month in dividend payment outs. 💰 I couldn't be happier, especially since this portfolio is only 10 months old.

For those you read my recent posts and are aware of my goals for this year and beyond, but here is a quick reminder.

My initial goal for 2024 was to have about 400$/month, when I saw how things progressed, I updated that to 500$/month, but looking ahead we are expected to end up with more than 800$/month, which would simply be insane. (TTM >650$/month)🤪

(For clarification I don't calculate that as TTM, but rather as the average of trailing 6 months, trailing 3 month, future 3 months, future 6 months. This is simply because I am still building my positions aggressively so that the trialing months significantly under-represent the status quo. I am aware of the uncertainty of future dividend payouts, which is why they are approximated conservatively. )

At the moment the total value of the portfolio stands at just above 170k$ with the plan for >180k$ end of 2024

>270k$ end of 2025

>370k$ end of 2026

I also decided to sell off one property and throw most of the money into the marker. If that happens the above number will be updated with my next post. I did lose my job recently, but hope something else comes up rather shortly, fingers crossed. 🤞This obviously also affects my investments.

My overall goal is to consistently have 4k$/month at my disposal for retirement (ideally without dipping into the principal of the investment). About 2k$/month will be provided by rental income and thinking that I will be more than one third to the 2k$/month needed from dividend payouts by the end of the year gets me very giddy.

This is the list of all dividends for this month:

$MAIN 21.81$

$MAIN 26.70$ (special dividend)

$JEPI 124.34$

$JEPQ 117.50$

$SPYI 102.43$

$QQQI 68.05$

$O 104.41$

$SPLG 67.10$

$SCHD 620.95$

________________

Total: 1253.28$

I also did some changes to the portfolio in minimizing the positions I hold.

I sold $MAIN (+0.69%) , $EPR (+1.76%) , $EPRT (+3.87%) and $VICI (+1.98%) not really because I don't thing they are good companies, but rather to stock up on securities I surely want to hold forever ($SCHD , $O (+2.65%) and $SPLG ) with some cash flow options like $QQQI and $SPYI sprinkled in for good measure.

I am sure there will be people saying that judging from that list, the portfolio is too conservative... and I would somewhat agree with you, but my objective is to build mainly a dividend portfolio that will consistently help with my expenses in retirement.

That being said, I am planning on expanding my $SPLG and $SCHD positions as well as adding to my cash for a potential market downturn so don't judge me too harshly.😜

Happy investing 📈, happy compounding💸!

#fire

#retirement

#financialfreedom

#dividends

#compoundeffect

#nextstop250k$

Trending Securities

Top creators this week