I'm deliberately swimming against the tide, let's see how it goes down😅

There are plenty of complaints about Trade Republic here on getquin.

And rightly so! I say.

I also have problems with the BYD split.

Nevertheless, I find it very pleasant to use Trade Republic.

The app is very easy to use and I always find my way around.

The 1% cash back is great and the round up is a great feature.

You really can't complain about free savings plans up to €10,000 and €1 order fees for any order size.

In contrast to ING, which I also use, everything is clearly listed for dividends and sales. How high the fees were, withholding tax, final withholding tax, conversion, etc.

This is completely missing at ING, at least I have never seen where this is done -> point TR for clarity.

At ING it just says "securities purchase" and after 2 months I don't even know what that was exactly.

Even as a Gen Z, I don't find my way around the ING app very well, and I haven't even figured out how to activate cash back there yet.

In addition, there are 2.2% fees for payments abroad. I'm on vacation in Nicaragua and here they charge 5% for card payments, so there are 7.2% fees just because I don't have 120€ cash in foreign currency in my pocket because there are simply no ATMs here.

The customer service is poor I know, but what do you expect from a neobroker.

This is not a bank. Trade Republic already has to finance 0€ savings plans and ECB interest of 2-4% on cash, so expensive employees are simply not an option.

Yes, if things go really wrong, I'd rather have a real person on the other line.

But does that happen?

Couldn't the problem be solved somehow in the end?

7.5€ in order fees for a 1000€ investment is pretty hefty for the fact that I might need customer support once in the next 40 years.

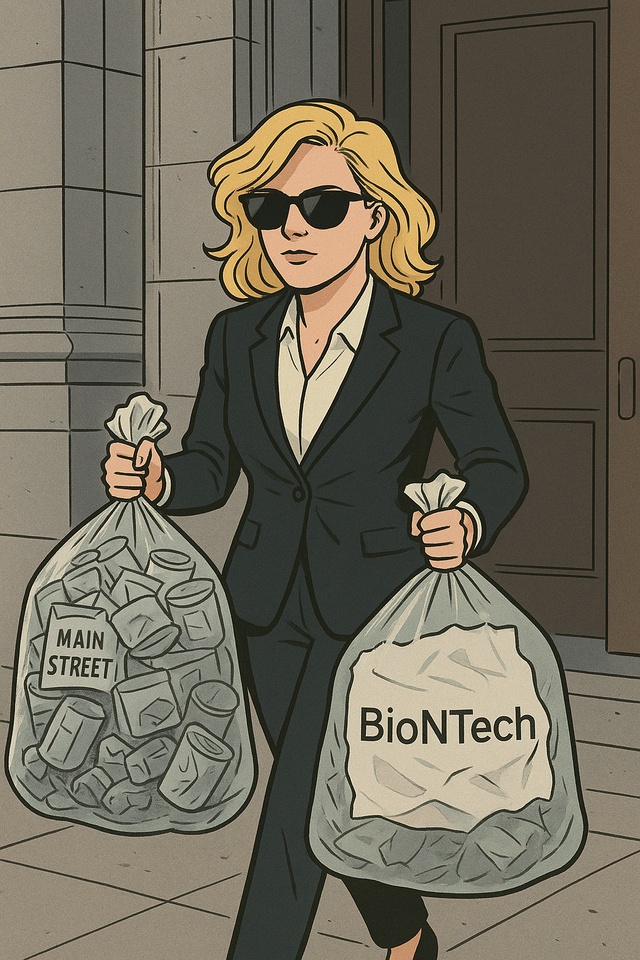

What also bothers me a lot is that the savings plans at ING are very poorly set up. In $MAIN (-0.5%) I can't invest at all via a savings plan, reinvesting dividends is also not possible> 5€ order fees because I want to reinvest 20 cents $MAIN (-0.5%) dividend reinvestment.

And due to the free savings plans, there are also hidden fees when selling, but I have to read up on this again.

My conclusion is: to each his own.

But if you use Trade Republic then it's still your conscious decision and then you have to deal with all the stuff.

People always like to see the negatives, but there are reasons for this and the advantages are not so bad here.

I myself will stay with Trade Republic, but in future I will only pay into ING, as a reputable bank may ultimately be more stable.

More steadfast! Our money is just as unsafe here as it is at Trade Republic!