Intuitive Surgical Earnings | $ISRG (+2.71%)

Intuitive Stock Forum

StockStockDiscussion about ISRG

Posts

29Intuitive Surgical Q3 2024

The Q3 figures from $ISRG (+2.71%) Surgical, Inc. show impressive growth and strategic progress.

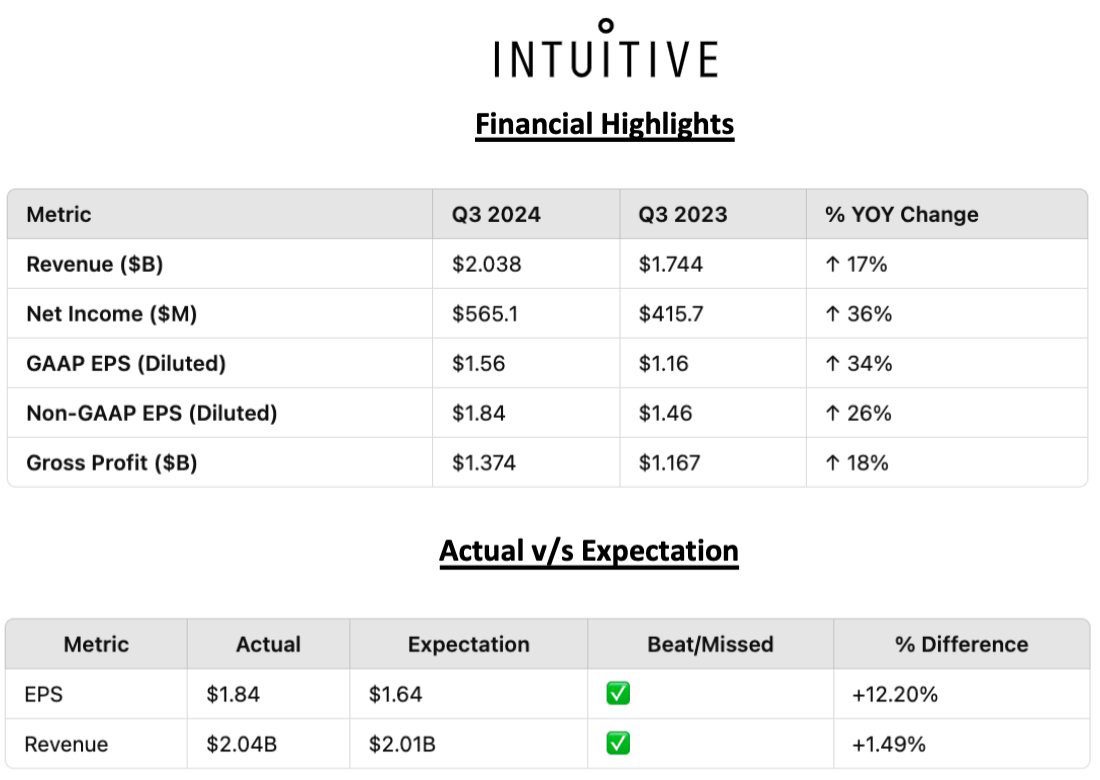

The company reported a 17% increase in revenue to $2.04 billion for the third quarter of 2024, compared to $1.74 billion in the same quarter of 2023. This growth was largely driven by an 18% increase in da Vinci surgical volume and a 15% increase in the installed system base, which now totals 9,539 systems.

In the third quarter of 2024, the company placed 379 da Vinci surgical systems, compared to 312 in the previous year, including 110 of the newly launched da Vinci 5 systems. Revenue from system sales amounted to USD 445 million in the quarter, compared to USD 379 million in the previous year.

Intuitive Surgical's GAAP net income for the third quarter of 2024 was $565 million, or $1.56 per diluted share, compared to $416 million, or $1.16 per diluted share, in the third quarter of 2023. On a non-GAAP basis, net income was $669 million, or $1.84 per diluted share, compared to $524 million, or $1.46 per diluted share, in the same period of 2023.

At the end of the third quarter of 2024, ISRG had $8.31 billion in cash, cash equivalents and investments, an increase of $628 million for the quarter.

Positives:

- Revenue growthIntuitive Surgical reported revenue growth of 17% in the third quarter of 2024, which amounted to USD 2.04 billion, compared to USD 1.74 billion in the same period of 2023.

- Increased use of the da Vinci systemsThe volume of da Vinci procedures increased by 18%, contributing significantly to overall sales growth.

- Expanded installed baseThe installed base of da Vinci systems grew by 15% to a total of 9,539 systems as at September 30, 2024.

- Net revenue growthGAAP net income for the third quarter of 2024 was $565 million, or $1.56 per diluted share, an increase from $416 million, or $1.16 per diluted share, in the third quarter of 2023.

- Strong financial positionAt the end of the third quarter of 2024, the company had $8.31 billion in cash, cash equivalents and investments, an increase of $628 million over the quarter.

Negative aspects:

- Increasing share-based compensationThe company's stock-based compensation increased to USD 176 million in the third quarter of 2024, compared to USD 157 million in the prior-year quarter.

- Higher costs: Despite sales growth, the cost of sales also increased, which negatively impacted the gross profit margin.

- Competitive pressureThe company continues to face strong competition in the market for robot-assisted surgery, which could impact future growth.

- Financial risks from leasing modelsThe dependence on operating lease agreements for the placement of the systems could entail financial risks if market conditions change.

- Complexity due to strategic investmentsThe company's strategic investments and expansions could lead to increased operational challenges and possible integration problems.

Overall, Intuitive Surgical is showing a strong quarter and strategic progress, with significant growth in both sales and net profit.

Companies that I find interesting but do not yet have in my portfolio and that have a 10-year average ROIC of over 10% and a 5-year average ROCE and ROIC of over 10%, $ANET (+0.19%), $MA (+0.88%) , $VRTX (+3.85%) , $RMS (-3.64%) , $PGHN (-0.51%) , $COLO B (+0.18%) , $ACN (-0.5%) , $MNST (+1.28%)

$FICO (+8.02%) , $MCO (+3.79%) , $KNIN (-0.47%) , $S&P Global, $ISRG (+2.71%)

$III (-2.83%) , $BKNG (+1.31%)

$HLAG (-2.26%) , $QCOM (-0.3%) , $CFR (-5.99%) and $IFX (-0.83%) . Already blatant companies

Outperformer in weak stock market times.

Hello my dears,

Due to the current weakness on the stock markets, I took a deep dive into the engine room. I have found a long-term outperformer. As the chart comparison with the S&P 500 shows.

Due to the high P/E valuation, the stock is still on my watch list to buy in due course.

When would be a good time for you to buy?

But now let's take a look at the company

UFP Technology $UFPT (+0.37%)

company. And as usual, there is a short and sweet analysis with important key figures that can be increased.

(in USD)

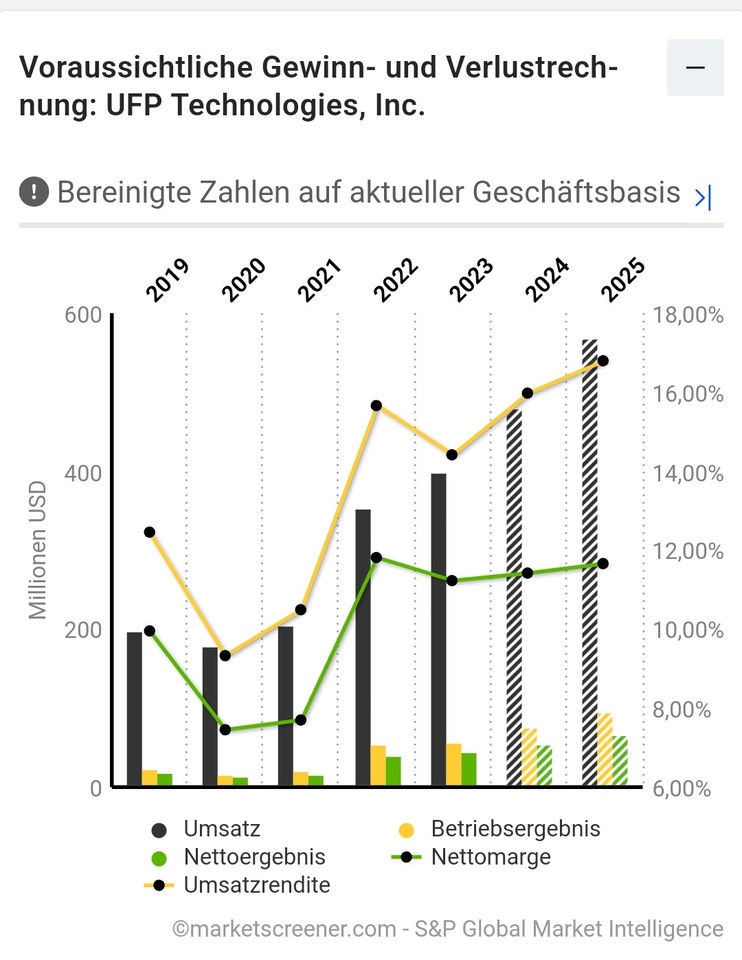

Turnover: 2024: 479.30 million 2025: 567.99 million

Net income: 2024: 44.92 million

2025: 57.74 million

2026: 66.22 million

Free cash flow: 2024: 32.70 million 2025: 50.50

EbiT margin: 2024: 15.97% 2025: 16.79%

Earnings per share: 2024: 7.01 2025: 8.26

KGV: 2024: 45.8. 2025: 38.9

Profit growth: 2024: 20.75%

2025: 17,19%,

About UFP Technologies, Inc.

UFP Technologies is a designer and manufacturer of comprehensive solutions for medical devices, sterile packaging and other advanced customized products. UFP is a key link in the medical device supply chain and a valued outsourcing partner for most of the world's leading medical device manufacturers. The company's disposable and single patient devices and components are used in a wide range of medical devices and packaging for minimally invasive surgery, infection prevention, wound care, wearables, orthopedic soft goods and orthopedic implants.

The company has acquired AQF Medical, a specialist in medical device solutions, for around 48 million US dollars. This is UFP's fourth acquisition in a series of strategic moves that also includes the purchase of ARJ Enterprises, Welch Fluorocarbon and Marble Medical.

Among other things, UFP is a supplier of

The company's expansion strategy was positively received by analysts. Lake Street Capital Markets has maintained a Buy rating on UFP Technologies and raised the price target to USD 392. The company forecasts a strong Q2 earnings report and GAAP earnings per share of $9 in 2026, which could potentially exceed $10 in 2027. However, KeyBanc has reiterated its Sector Weight rating on UFP Technologies on valuation grounds.

These recent developments reflect UFP Technologies' commitment to its growth strategy and financial targets, which include a revenue growth rate of 12-18%, a gross profit margin of 28-31% and an operating profit margin of 15-18%. The company's recent acquisitions are expected to positively impact its financial performance and expand its medical device product offering.

+ 1

Things that I think will happen 👇🏼

1. $PLTR (+5.8%) 👨💻 -- Your AIP will eventually become the foundational platform for businesses.

2. $TSLA (+9.97%) 🛺 -- They are in the process of making their FSD software as ubiquitous in electric vehicles as $SHOP (+2.94%) already the case with SMEs in the e-commerce sector.

3. $RKLB (+1.69%) 👽 -- Becoming a full-fledged space company, positioned as a major player in the new space economy -- focusing on satellite launches, space logistics and possibly interplanetary missions.

4. $TTD (+3.69%) 🕵️♂️ -- They will redefine digital advertising and become as important to online marketing as search engines are to Internet discovery.

5. $TMDX (+1.8%) 🫀 -- Your Organ Care System (OCS) aims to revolutionize organ transplants and is expected to have as much of an impact in this field as minimally invasive surgery. $ISRG (+2.71%) minimally invasive surgery.

6. $SNOW (-1.55%) ❄️ -- They are becoming the central hub for companies to store, process and analyze huge data sets.

7. $MDB (-1.61%) 🥭 -- They could become the backbone of modern application development.

@7Trader the position was opened today with a little thought for you.

Although I have to say that with Exor's $PHIA (-2.73%) share I am already a little bit positioned. It's a shame that they've stopped developing robotics. I would have liked to have seen a 2 $ISRG (+2.71%) seen. Especially as Siemens has invested a lot of human capital in it.

Maybe things will go better with $AFX (-2.96%) better with the robots

The week will be pure entertainment.

Monday:

- Release of the Empire State Manufacturing Index (July)

- Start of the Republican National Convention

- Statements by FED Chair Jerome Powell and San Francisco

Fed President Mary C. Daly - Quarterly results from Goldman Sachs ($GS (+2.22%) ), BlackRock ($BLK ) and Servis1st Bancshares ($SFBS )

Tuesday:

- Start of the ⚠️Amazon Prime Day⚠️

- Continuation of the Republican National Convention

- Publication of retail sales (June), business inventories (May), import/export prices (June) and the real estate market index (July)

- Quarterly results from UnitedHealth ($UNH (+3.09%)), Bank of America ($BAC (+1.3%)), Morgan Stanley ($MS (+1.35%)), Charles Schwab ($SCHW (+2.16%)), PNC Financial ($PNC (+1.07%)), State Street ($STT (-0.14%)) and J.B. Hunt Transport ($JBHT (+2.61%))

- Statements by FED Governor Adriana Kugler

Wednesday:

- End of of the ⚠️Amazon Prime Day⚠️

- Continuation of the Republican National Convention

- Publication of housing data (June) and industrial production (June)

- Publication of the FED Beige Book

- Quarterly results from Johnson & Johnson ($JNJ (+0.03%)), US Bancorp ($USB (+2.13%)), Kinder Morgan ($KMI (+2.78%)) and Discover Financial Services ($DFS (+0.81%))

Thursday:

- Publication of the weekly Jobless Claims (until July 13)

- Publication of of the Philadelphia Fed Manufacturing Index (June)

- Quarterly results from TSMC ($TSM (+0.91%)), Netflix ($NFLX (+0.37%)), Novartis ($NVS (+0.2%)), Abbott ($ABT (+2.48%)), United Airlines ($UAL (+3.22%)) and Intuitive Surgical ($ISRG (+2.71%))

- ⚠️Abschluss of the Republican National Convention with speeches by Donald Trump (not sure)⚠️

Friday:

- Quarterly results from American Express ($AXP (+0.52%)), Travelers Cos. ($TRV (+2.63%)), Halliburton ($HAL (-0.29%)), Fifth Third Bancorp ($FITB (+1.7%)), Huntington Bancshares ($HBAN (+0.19%)) and Regions Financial ($RF (+0.84%))

- Statements from New York

FED President

John C. Williams and Atlanta Federal Reserve President Raphael Bostic

Here is a summary of important events & the Formatting is Getquin's fault!

US MARKET🇺🇸

Monday

Publication of the Empire State Manufacturing Survey of the New York Fed for April.

Publication of the retail sales in the USA for March.

Publication of the business inventories for February.

Publication of the homebuilder confidence for April.

Speeches by Lorie LoganPresident of the FED of Dallasand Mary C. DalyPresident of the FED Bank of San Francisco.

Quarterly reports from Goldman Sachs ($GS (+2.22%) ), Charles Schwab ($SCHW (+2.16%) ) and M&T Bank ($MTB (+1.41%) ).

Tuesday

Publication of the building permits for March.

Publication of the industrial production for March.

Quarterly reports from UnitedHealth Group ($UNH (+3.09%) ) , Johnson & Johnson ($JNJ (+0.03%) ), Bank of America ($BAC (+1.3%) ), Morgan Stanley ($MS (+1.35%) ), BNY Mellon ($BK (+0.21%) ) and PNC Bank ($PNC (+1.07%) ).

Wednesday

Publication of the mortgage applications for the week ending April 12.

Publication of the FED Beige Books.

Quarterly reports from United Airlines ($UAL (+3.22%) ), Abbott Laboratories ($ABT (+2.48%) ), U.S. Bancorp ($USB (+2.13%) ), Travelers Cos. ($TRVC34 ), Citizens Financial ($FCNCA (+0.5%) ), First Horizon ($FHN (+1.66%) ) and Discover Financial Services ($DFS (+0.81%) ).

Thursday

Publication of initial jobless claims for the week ending April 13.

Publication of the Philadelphia Fed Manufacturing Survey for April.

Release of existing home sales for March.

Speeches by John C. WilliamsPresident of the FED of New Yorkand Raphael BosticPresident of the FED of Atlanta.

Quarterly reports from Netflix ($NFLX (+0.37%) ), Intuitive Surgical ($ISRG (+2.71%) ) and Infosys ($INFY ).

Friday

Speech by Austan GoolsbeePresident of the FED of Chicago.

Quarterly reports from Procter & Gamble ($PG (+3.31%) ), American Express ($AXP (+0.52%) ), Fifth Third Bancorp ($FITB (+1.7%) ) and Huntington Bancshares ($HBAN (+0.19%) ).

Saturday

Possible events in connection with the Bitcoin halving.

EU MARKET

Monday

Release of industrial production

Speech by Philip Lane, Member of the Executive Board of the ECB

Quarterly reports from Pagegroup ($PAGE (+21.84%) ) 🇬🇧, Playtech $PTEC (-0.29%) ) 🇬🇧

Tuesday

Trade Balance (Feb)

ZEW Economic Sentiment

Eurogroup Meetings

Publication of the quarterly reports of Ashmore ($ASHM (-0.23%) ) 🇬🇧

Wednesday

Publication of CPI data

EU Summit & Eurogroup Meetings

Speech by Isabel Schnabel, Member of the Executive Board of the ECB

Quarterly figures from Severstal ($CHMF ) 🇷🇺, Volvo B ($VOLV B (-3.37%) ) 🇸🇪, Viscofan $VIS (+1.06%) ) 🇪🇸, Petershill Partners ($PHLL ) 🇬🇧, Hays ($HAS (-1.04%) ) 🇬🇧

thursday

Speech by Luis de GuindosVice President of the ECB

EU Summit & Eurogroup Meetings

Speech by Isabel Schnabel, Member of the Executive Board of the ECB

- Quarterly figures from EQT AB ($EQT (-2.29%) ) 🇸🇪, EssilorLuxottica ($EL (+0.83%) ) 🇫🇷, Nordea Bank ($NDA FI (-0.25%) ) 🇸🇪, Sartorius Stedim ($DIM (-1.61%) ) 🇩🇪, Nokia Oyj $NOKIA (-0.81%) ) 🇫🇮, Inter Cars SA ($n/a) 🇵🇱, Tauron Polska Energia ($TPE (+1.04%) ) 🇵🇱, Forvia ($FRVIA (-2.55%) ) 🇫🇮, Dunelm ($DNLM (+0.75%) ) 🇬🇧, Adtran Networks SE ($ADV (+0%) ) 🇩🇪, Olvi Oyj A ($OLVAS (-0.17%) ) 🇫🇮, Econocom ($ECOM ) 🇧🇪, Talenom Oyj $TNOM (+2.33%) ) 🇫🇮, Alisa Pankki Oyj ($ALISA (-0.42%) ) 🇫🇮

Friday

Eurogroup Meetings

CFTC EUR speculative net positions

Quarterly figures from Sodexo ($SW (+0.51%) ) 🇫🇷, Linea Directa Aseguradora ($LDA (-3.21%) ) 🇪🇸, Alma Media ($002950 ) 🇫🇮, Gofore ($GOFORE (+1.34%) ) 🇫🇮

Hello

I would be interested in your opinion on the following 2 shares: $BKNG (+1.31%)

$ISRG (+2.71%)

I have been looking at these two companies for some time and have missed the entry several times so far.

Now both shares have already performed well and are not exactly cheaply valued, which is why I am asking myself whether it is worth getting in as I currently have cash reserves.

Perhaps you have some ideas or approaches that will make it easier for me to buy or not to buy.

Thank you and have a nice evening.

That's what I'm currently doing with Booking.

Trending Securities

Top creators this week