Outperformer in weak stock market times.

Hello my dears,

Due to the current weakness on the stock markets, I took a deep dive into the engine room. I have found a long-term outperformer. As the chart comparison with the S&P 500 shows.

Due to the high P/E valuation, the stock is still on my watch list to buy in due course.

When would be a good time for you to buy?

But now let's take a look at the company

UFP Technology $UFPT (+2.1%)

company. And as usual, there is a short and sweet analysis with important key figures that can be increased.

(in USD)

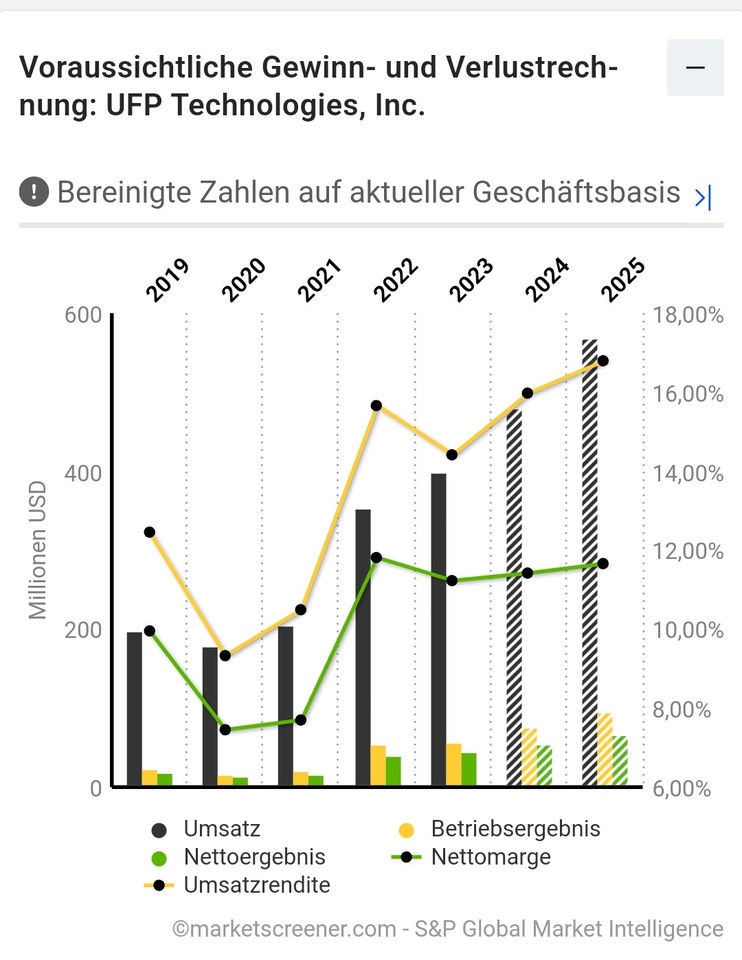

Turnover: 2024: 479.30 million 2025: 567.99 million

Net income: 2024: 44.92 million

2025: 57.74 million

2026: 66.22 million

Free cash flow: 2024: 32.70 million 2025: 50.50

EbiT margin: 2024: 15.97% 2025: 16.79%

Earnings per share: 2024: 7.01 2025: 8.26

KGV: 2024: 45.8. 2025: 38.9

Profit growth: 2024: 20.75%

2025: 17,19%,

About UFP Technologies, Inc.

UFP Technologies is a designer and manufacturer of comprehensive solutions for medical devices, sterile packaging and other advanced customized products. UFP is a key link in the medical device supply chain and a valued outsourcing partner for most of the world's leading medical device manufacturers. The company's disposable and single patient devices and components are used in a wide range of medical devices and packaging for minimally invasive surgery, infection prevention, wound care, wearables, orthopedic soft goods and orthopedic implants.

The company has acquired AQF Medical, a specialist in medical device solutions, for around 48 million US dollars. This is UFP's fourth acquisition in a series of strategic moves that also includes the purchase of ARJ Enterprises, Welch Fluorocarbon and Marble Medical.

Among other things, UFP is a supplier of

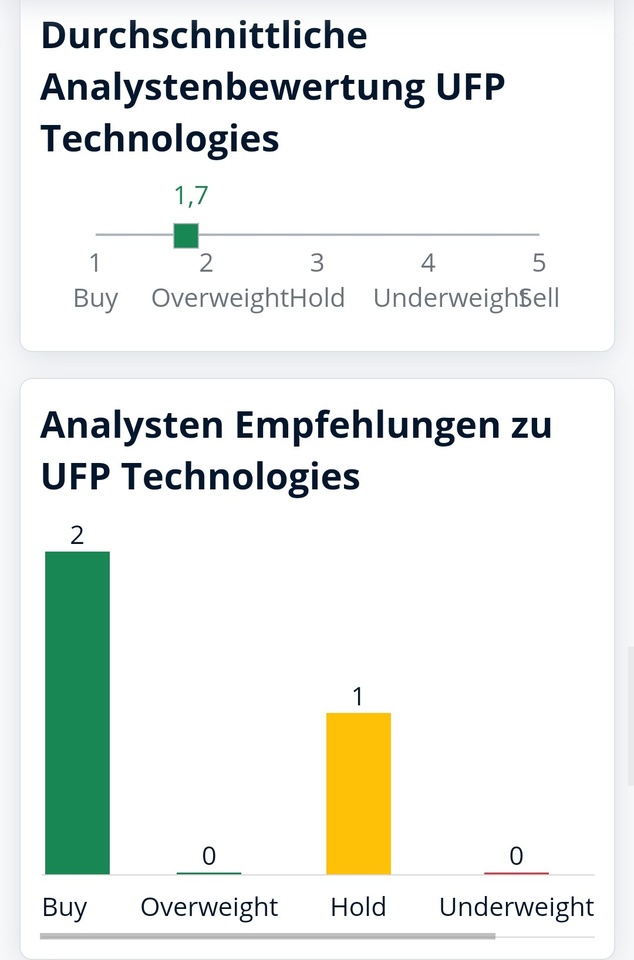

The company's expansion strategy was positively received by analysts. Lake Street Capital Markets has maintained a Buy rating on UFP Technologies and raised the price target to USD 392. The company forecasts a strong Q2 earnings report and GAAP earnings per share of $9 in 2026, which could potentially exceed $10 in 2027. However, KeyBanc has reiterated its Sector Weight rating on UFP Technologies on valuation grounds.

These recent developments reflect UFP Technologies' commitment to its growth strategy and financial targets, which include a revenue growth rate of 12-18%, a gross profit margin of 28-31% and an operating profit margin of 15-18%. The company's recent acquisitions are expected to positively impact its financial performance and expand its medical device product offering.