Donald Tusk: The Polish head of government has confirmed that drones from Russia were shot down over his country.

Let's see how the market will react (if at all). $RHM (+0.7%)

$ASWC (+1.51%)

$EUDF (+0.02%)

$DFEN (+0.67%)

$DRO (+0%)

Posts

12Donald Tusk: The Polish head of government has confirmed that drones from Russia were shot down over his country.

Let's see how the market will react (if at all). $RHM (+0.7%)

$ASWC (+1.51%)

$EUDF (+0.02%)

$DFEN (+0.67%)

$DRO (+0%)

Thinking to (partially) sell my $DFEN (+0.67%) position. What do you think? Peace or ceasefire deal will have an significant impact on $DFEN (+0.67%) or $EUDF (+0.02%) in the short-, mid-, and/or long term?

I bought this ETF a month ago and save €50 a week in it.

00:00:00 Introduction

00:03:50 WisdomTree Europe Defense ETF (WKN: A40Y9K)

00:27:58 Rheinmetall (WKN: 703000)

00:38:58 Airbus (WKN: 938914)

00:49:20 Hensoldt (HAG000)

Spotify

https://open.spotify.com/episode/6ykwFYV8kqqbTrzAHOqMXw?si=7BU7fBseTh2zHOqH8wpksQ

YouTube

Apple Podcast

$RHM (+0.7%)

$HAG (-1.61%)

$AIR (+0.05%)

$BA (+0.53%)

$EUDF (+0.02%)

#etf

#etfs

#podcast

#spotify

The UBS recently carried out an extensive screening of the European equity market. There are a few stocks that were rated very positively by the analysts.

These include the French energy supply group Engie $ENGI (-0.56%) the Italian logistics and postal company Poste Italiane $PST (-0.15%) the British online real estate broker Rightmove

$RMV (+0.3%) and the French technology service provider SPIE $SPIE (-0.76%).

In addition, the Irish specialist insurer Beazley $BEZ (+1.04%) the Spanish energy group Iberdrola

$IBE (+0.02%) and the Swedish telecommunications company Telia

$TELIA (-0.64%) are on the list.

The chances of a positive development are good - according to "Welt". Reason:

In Europe, politicians are investing massive amounts of money in infrastructure and defense while promising reforms to stimulate the economy. Added to this are interest rate cuts by the European Central Bank (ECB) and bulging savings accounts, which could flow into consumption and investment if the mood improves.

And overall, it is all about long-term growth: government investments are planned for years to come and the ECB is likely to cut interest rates even further.

The combination of government stimulus, cheap financing and private capital is providing a tailwind on the markets. There are some European ETFs that have been performing very well since the beginning of the year.

At the forefront is the Global X Euro Infrastructure Development $BRIP (+0.65%) with a return of 23.1 percent.

Also strong is the Xtrackers Dax $DBXD. (+1.25%)

The ETF achieves 20.3 percent and costs just 0.09 percent per year.

Also exciting is the WisdomTree Europe Defensive $EUDF (+0.02%). With 18.9 percent since its launch in March, it has made a solid start and costs just 0.40 percent.

The classic among the European ETFs, the iShares Core Euro STOXX 50 $CSSX5E (+1.52%)is somewhat more defensive at 11.8 percent, but scores with minimal fees. Europe is therefore back on the ETF radar.

Source (excerpt) & image: "Welt", 17.07.2025

I am 42 years old and have an investment horizon of 20 years. I would like to combine some growth with dividends as a retirement provision.

Even though the portfolio is currently quite red, I am generally satisfied with the stocks. $RKLB (-1.47%) was once a gift and $MSFT (+0.15%) would be a bonus, so they are not self-selected.

I would like to invest a total of 6,000 euros per year for the time being, i.e. an average of 500 euros per month.

I have now changed the distribution as follows:

150 euros go into the $VWRL (+0.3%)

75 euros to the $ZPRG (+0.34%)

45 Euro to the $QYLE (-0.79%)

30 Euro in the $EUDF (+0.02%)

Would you weight differently here?

Up to now, I have saved 10 euros a month in the individual shares represented, but I will be making a quarterly one-off purchase of 500 euros. In this way, I can take advantage of opportunities and gradually build up the stocks or say goodbye to one or the other or add something new.

400 euros remain free each year, which I would like to use flexibly for $BTC (-0.07%) for example.

I like the mix of regular long-term passive investment and the opportunity to be more active on a quarterly basis.

Hello everyone,

what do you think of a defense ETF like the $EUDF (+0.02%) to continue to profit from all defense and military goods?

Or would you prefer a Nasdaq like the $EQQQ (+1.22%) which, however, with my core $IWDA (+0.72%) which of course brings a high USA overweight into my portfolio.

I am looking forward to your opinions🙏

Minimizing the US cluster risk is currently a major topic for investors. It is perhaps even THE topic since the second Trump administration has been throwing tariffs and isolationist positions around.

As part of an incipient reallocation in the portfolio $DFEN (+0.67%) and $ASWC (+1.51%) recently, but was bothered by the high proportion of US shares and the heavy weighting of Blackbox $PLTR (+5.5%) among others.

Today I stumbled across the recently launched ETF from WisdomTree, which compiles purely European defense companies: $IE0002Y8CX98 (+0.02%)

Some quick raw data:

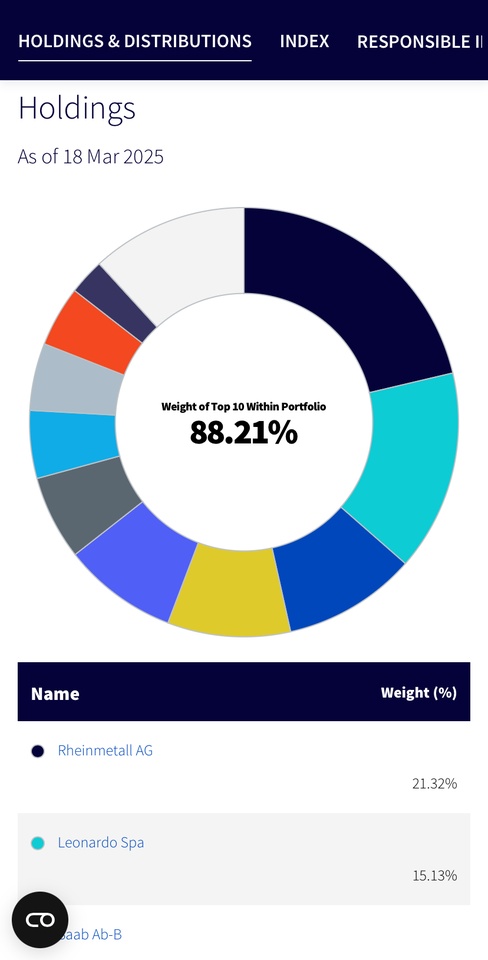

Listed for the first time on 3/4/2025

TER: 0.4% p.a.

Physical

Accumulating

WKN: A40Y9K

IE0002Y8CX98

Largest positions:

Rheinmetall (approx. 20%) $RHM (+0.7%) 🇩🇪

Leonardo (approx. 15%) $LDO (+0.58%) 🇮🇹

Saab (approx. 10%) $SAAB B (-2.39%) 🇸🇪

BAE (approx. 10%) $BAE (+0%) 🇬🇧

Thales (approx. 9%) $THALES (+0.71%) 🇫🇷

This investor will reallocate a little. He is not giving investment advice, but rather enjoying the diversity of Europe. 🇪🇺

Sources:

https://www.wisdomtree.eu/en-gb/etfs/thematic/wdef---wisdomtree-europe-defence-ucits-etf---eur-acc

https://www.wisdomtree.eu/en-gb/strategies/european-defence

https://www.justetf.com/de/etf-profile.html?isin=IE0002Y8CX98#chart

It seems like my post about Europas F-35-Sicherheitsdilemma could not have come at a better time:

Dependence on US armaments is increasingly perceived as a risk factor for Europe's military and security sovereignty and is now being publicly addressed at the highest political level faster than I would have expected.

French President Emmanuel Macron

President of France Emmanuel Macron has made it clear in an interview with Le Parisien that he is critical of Europe's purchase and use of US armaments and proposed replacing them with European alternatives.

Macron was also quite clear: "Those who buy Patriot systems should be offered the next generation of the Franco-Italian SAMP/T. Those who buy F-35s should be offered the Rafale fighter aircraft."

His main concern is greater strategic autonomy for Europe:

Macron is thus sending a clear signal for more European cooperation in the defense sector and against an excessive focus on US technology.

#emmanuelmacron

#usa

#defense

#verteidigung

#rüstungsindustrie

#europa

$R3NK (-1.38%)

$IE0002Y8CX98 (+0.02%)

$HAG (-1.61%)

Top creators this week