Nvidia: the brain behind the AI cycle

Quarterly introduction: Nvidia

$NVDA (+2.78%) based in California, is a leading technology company that focuses on the development of graphics processing units (GPUs) and specialized chips for a wide range of industries. Since its founding in 1993 by Jensen Huang, Chris Malachowsky and Curtis Priem, Nvidia has become a pioneer in visual and AI-powered computing.

Historical development

Originally focused on graphics solutions for the gaming industry, Nvidia presented its first major multimedia accelerator for PCs and games consoles with the NV1. However, the big breakthrough came in 1999 with the introduction of the GeForce 256, which is considered the world's first GPU and laid the foundation for Nvidia's supremacy. In the 2000s, Nvidia significantly expanded its portfolio to include applications for artificial intelligence and deep learning, particularly with the introduction of the CUDA platform, which enables developers to use GPUs for general computing tasks. This strategic realignment helped Nvidia to play a key role in the AI revolution.

Business model

Nvidia's business model follows a platform strategy that seamlessly integrates hardware and software to offer comprehensive solutions. The majority of revenue comes from the sale of GPUs, which account for approximately 87% of revenue. Nvidia serves a broad range of markets, including gaming, professional visualization, data centers and the automotive industry. The unified architecture of its products allows Nvidia to invest efficiently in research and development, covering several billion-dollar markets with the same technology.

Core competencies

Nvidia's core strengths lie in the development of cutting-edge graphics solutions and the integration of AI technologies. The company's GPUs are essential for applications in the fields of gaming, artificial intelligence, autonomous driving and professional visualization. The CUDA platform and the flexible, programmable architecture of the GPUs enable the development of versatile software solutions that can be used in numerous industries.

Future prospects and strategic initiatives

Nvidia is pursuing several strategic initiatives to further expand its market leadership:

- Expansion of the "Accelerated Computing" platform: Nvidia is striving to handle complex calculations faster and more efficiently by breaking through the traditional boundaries of Moore's Law.

- Leadership in AI and visual computing: Nvidia plans to further cement its pioneering role by providing cutting-edge technologies such as GPUs and CUDA.

- Autonomous driving: With the "DRIVE" brand, Nvidia is investing heavily in the development of hardware and software solutions for autonomous vehicles.

- Use of intellectual property: Nvidia aims to license its brand and expand its market presence through development agreements.

These initiatives demonstrate Nvidia's commitment to further strengthening its position in the technology industry through continuous innovation and strategic partnerships.

Current performance of the Nvidia share

Over the year, Nvidia shares have gained an impressive 147%, driven by the booming AI trend and the growing demand for GPUs for the cloud sector. Since the IPO on January 22, 1999, the share has recorded an extraordinary increase in value of 320,901.68%. Particularly noteworthy is the performance of the last two years, during which the share has risen by 573.87%, making it one of the best investments of recent times.

The AI-GPU trend

Although the current hype around AI GPUs may not have been exactly predictable, it is by no means a coincidence that Nvidia is once again at the forefront. Over the years, the company has always picked up on the right trends and consistently developed its technologies further. The current product portfolio is unrivaled in many respects and offers such added value that Nvidia now achieves better margins than some pure software companies. So far, Nvidia has done everything right strategically and consolidated its position as market leader in a fast-growing and forward-looking segment.

The current figures

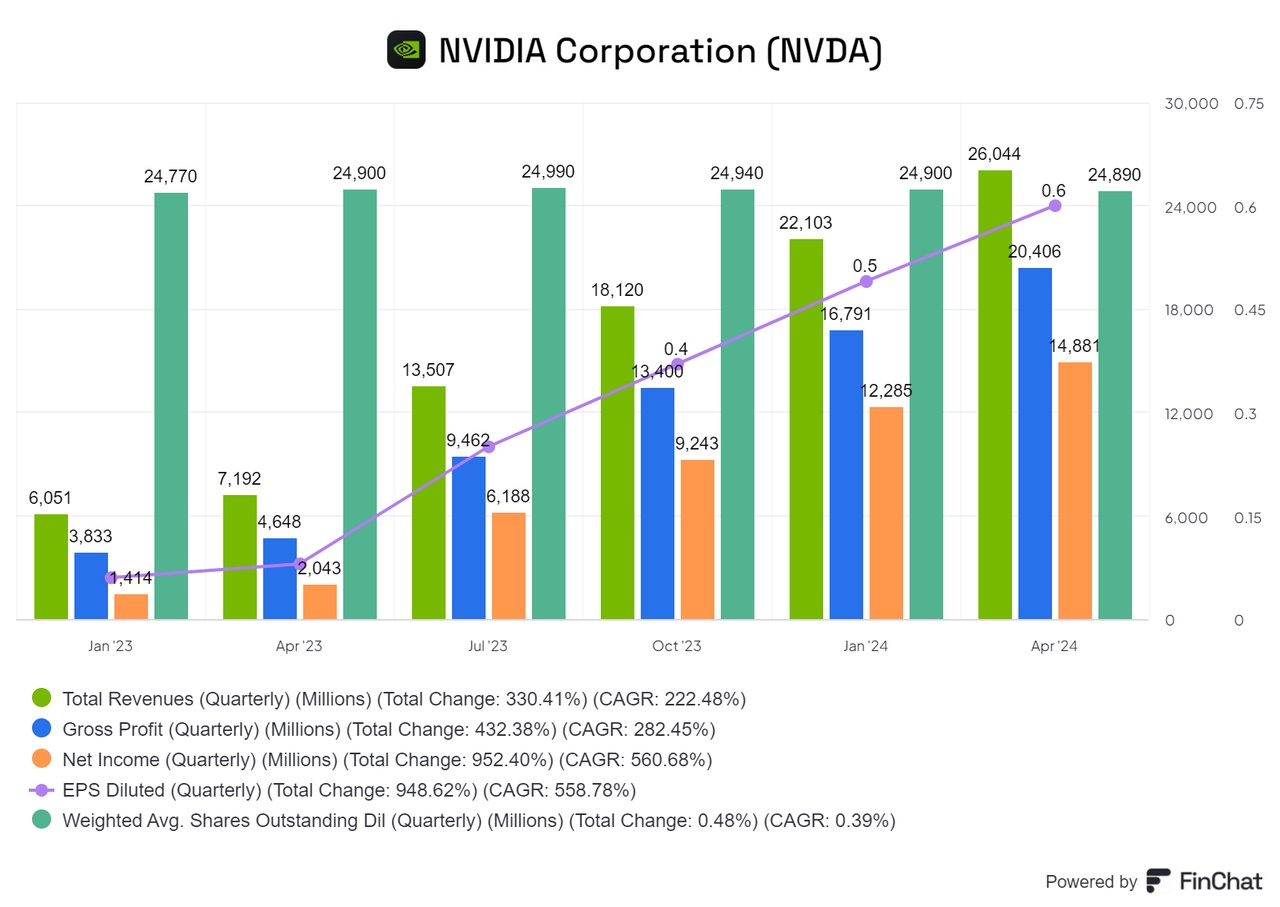

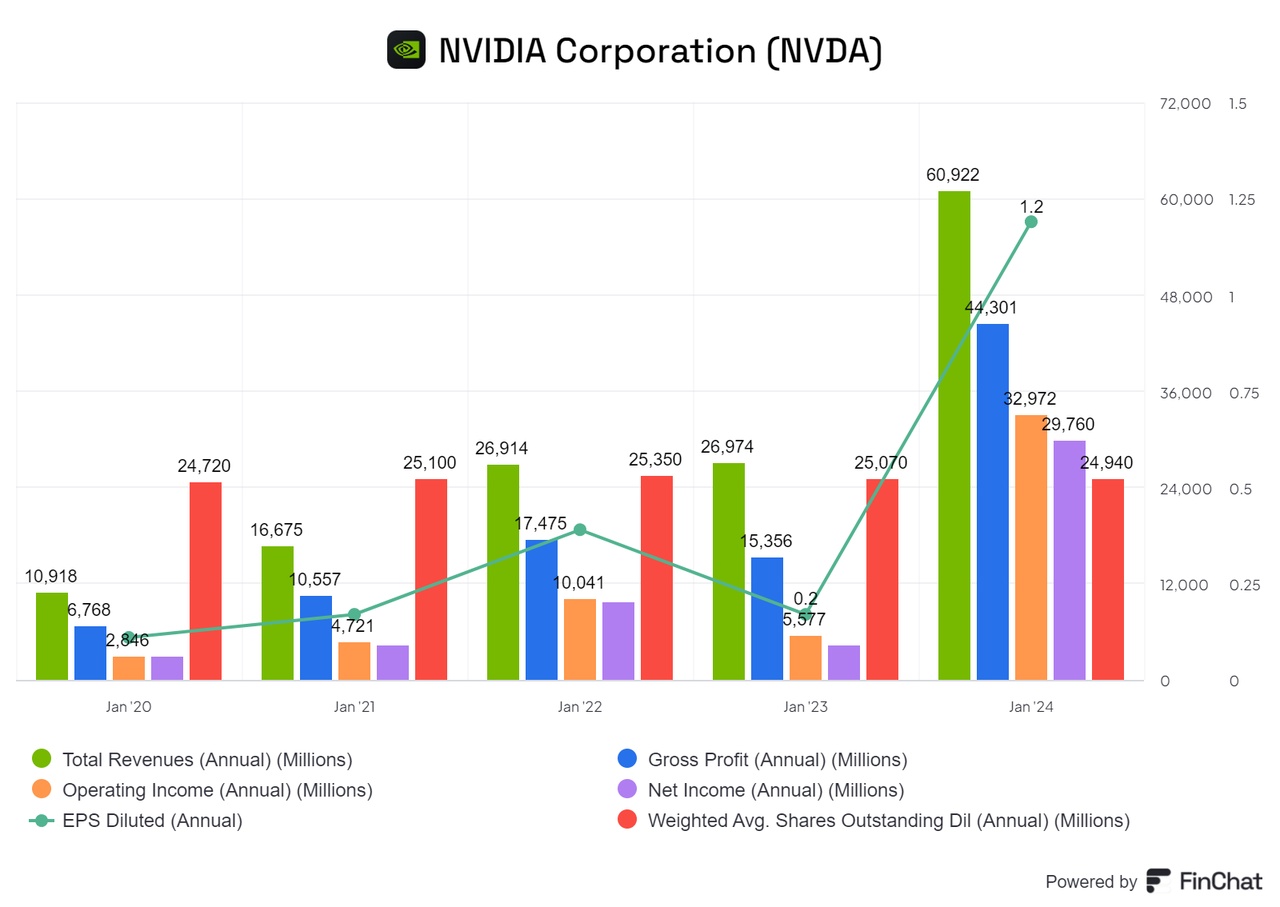

The latest business figures show solid results, which, however, fall short of the high market expectations. Here is a brief overview:

- Turnover: USD 30,040 million, an increase of 15.3% compared to the previous quarter.

- Gross profit: USD 22,574 million, an increase of 10.5% QoQ.

- Net income: USD 16,599 million, an increase of 11% QoQ.

- Diluted EPS: USD 0.67, an increase of 12% QoQ.

Although these figures are impressive, they do not seem sufficient for the current valuation of the company. For example, the market had already expected sales to reach the USD 31 billion mark. It is becoming increasingly difficult to maintain the previous growth rates both quarter-on-quarter and year-on-year, which could limit the potential for future share price increases.

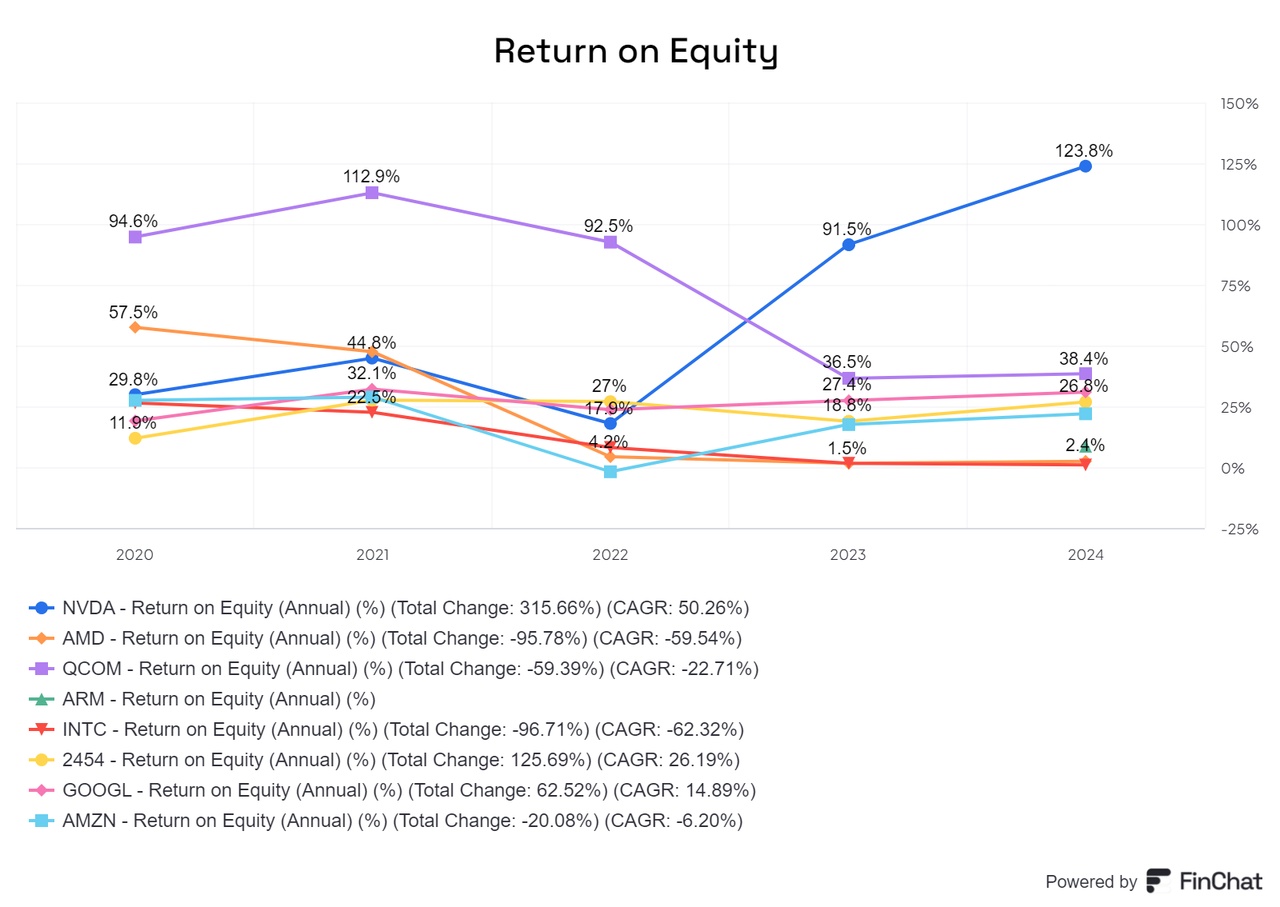

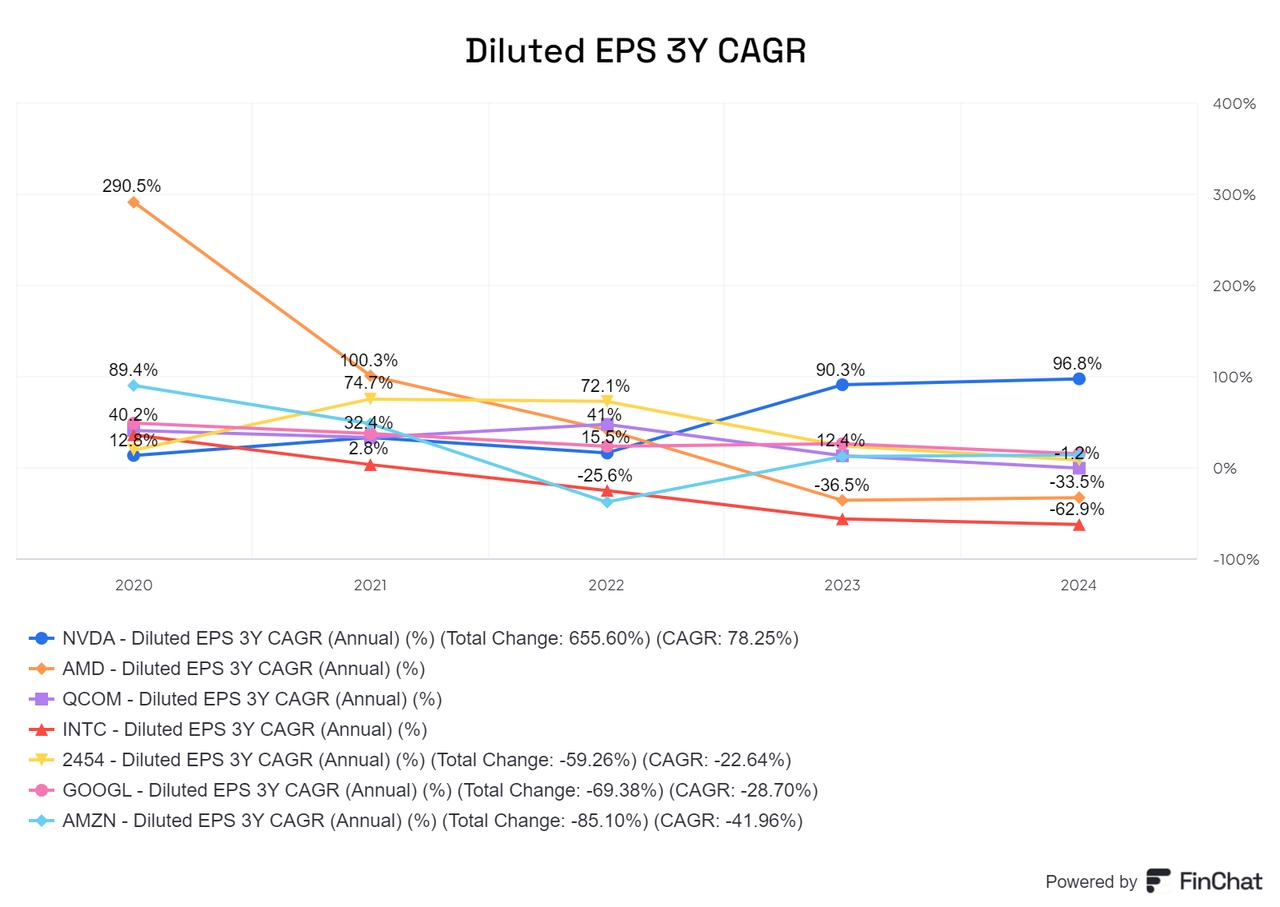

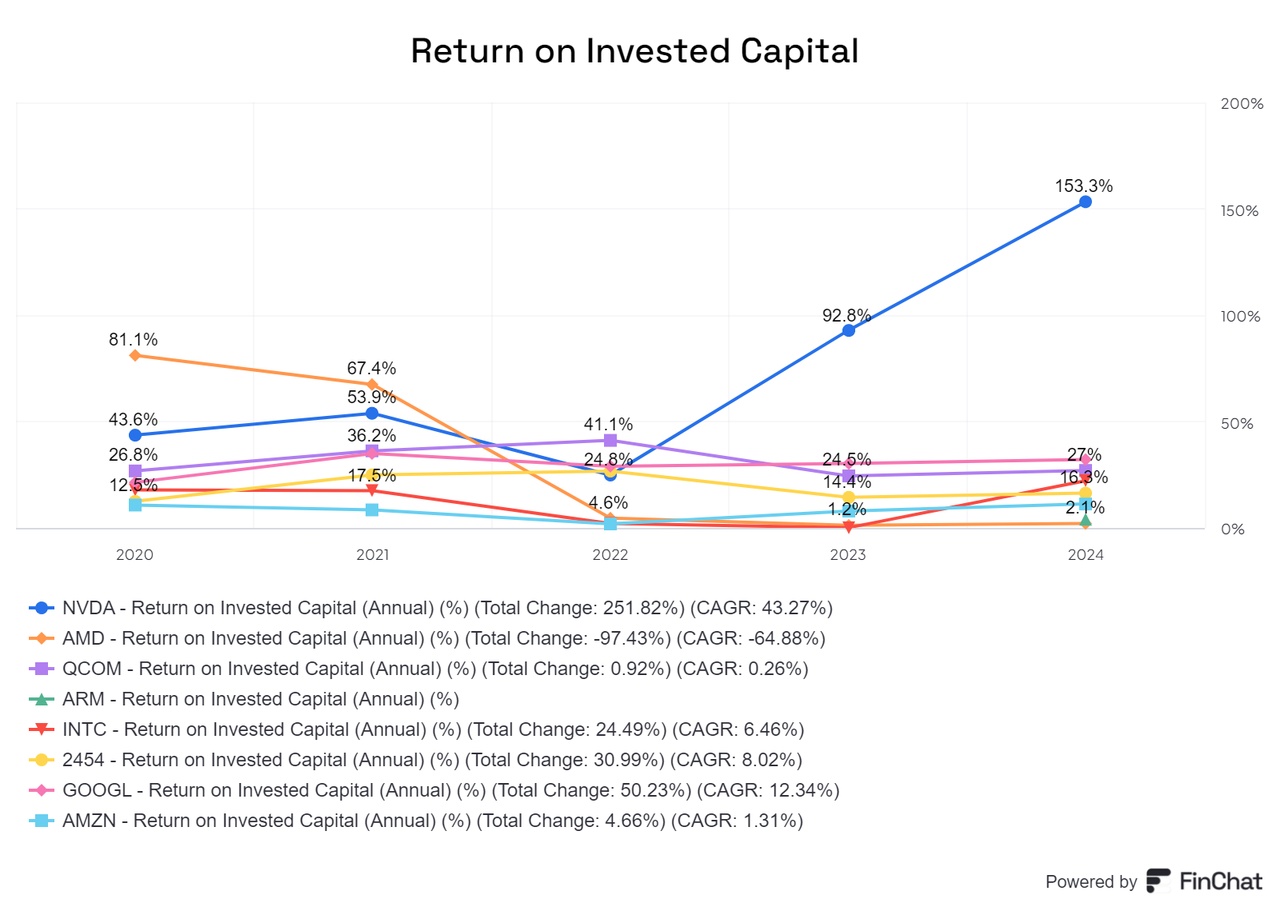

(Image 1&2 )

Risks and opportunities

Even though the company is optimistic, there are still some challenges that should not be ignored:

- Production delays for new chips: The targeted annual cycle may not be met as the new "Blackwell" and "Rubin" chips are unlikely to be released on time. Delays in the market launch could reduce the competitive advantage and weigh on sales expectations.

- Sustainability of margins: The current extremely high margins may not be sustainable in the long term. They are significantly higher than those of many big tech companies. If these companies increasingly use less expensive processors and simply scale their systems, this could cost Nvidia market share and sales.

- Growing competition: Competitors could catch up technologically. While Nvidia's lead is significant, this can change quickly in the dynamic tech industry, especially if competitors accelerate their developments.

- Dependence on TSMC: Nvidia is heavily dependent on manufacturing at TSMC. Disruptions in the supply chain or capacity bottlenecks could have a significant impact on production and product availability.

- High expectations: Expectations for Nvidia are currently very high. Even a small mistake could lead to sharp price corrections, as investors are sensitive to deviations from the growth story.

- Headcount and productivity: The growing number of employees brings with it the risk of a loss of productivity. With increasing size, it becomes more difficult to maintain the corporate culture and efficiency at the previous level.

Nvidia therefore faces the challenge of securing its current market position while at the same time responding appropriately to external and internal risks. Nevertheless, thanks to its innovative strength and market leadership, the company continues to offer enormous opportunities to play a central role in the tech industry in the future.

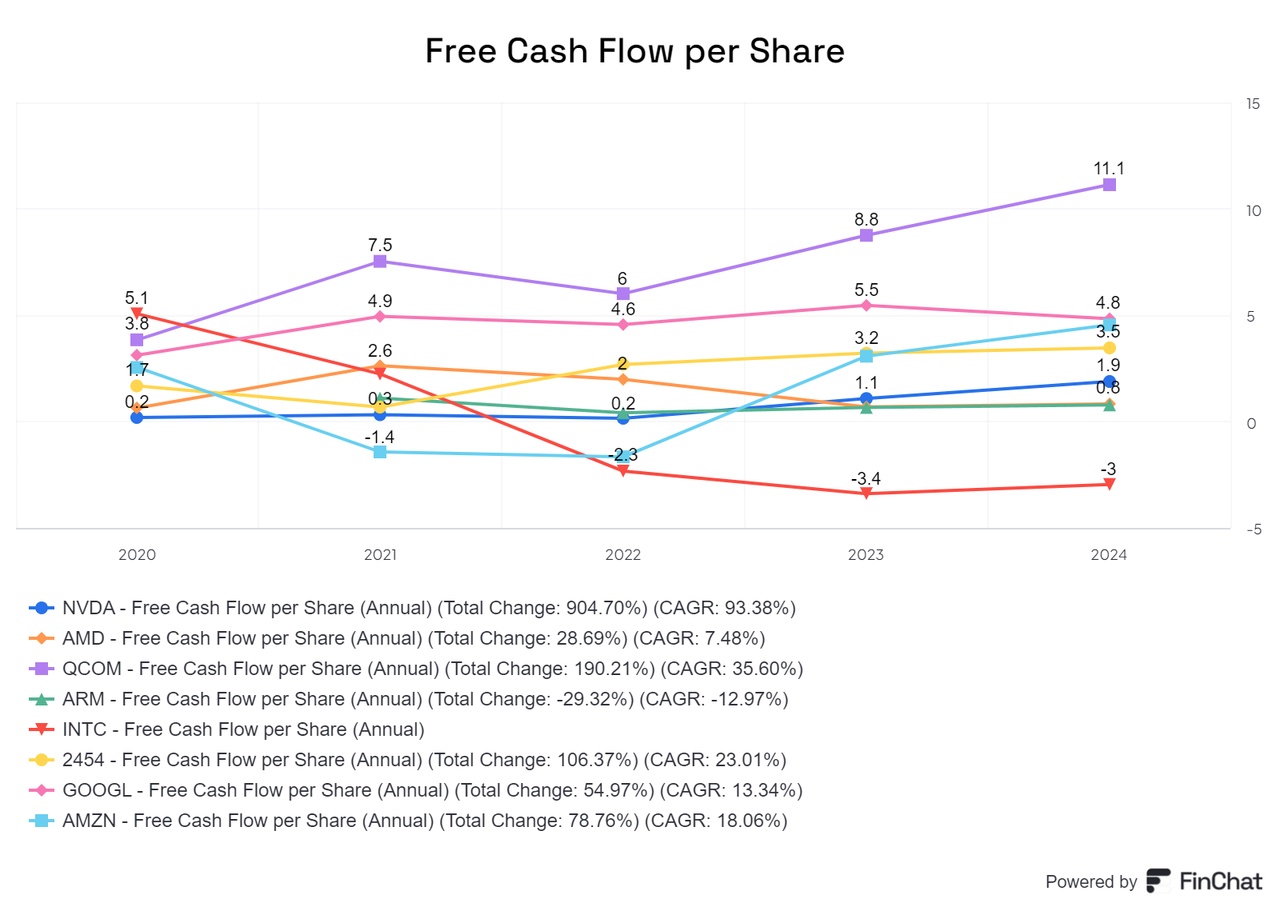

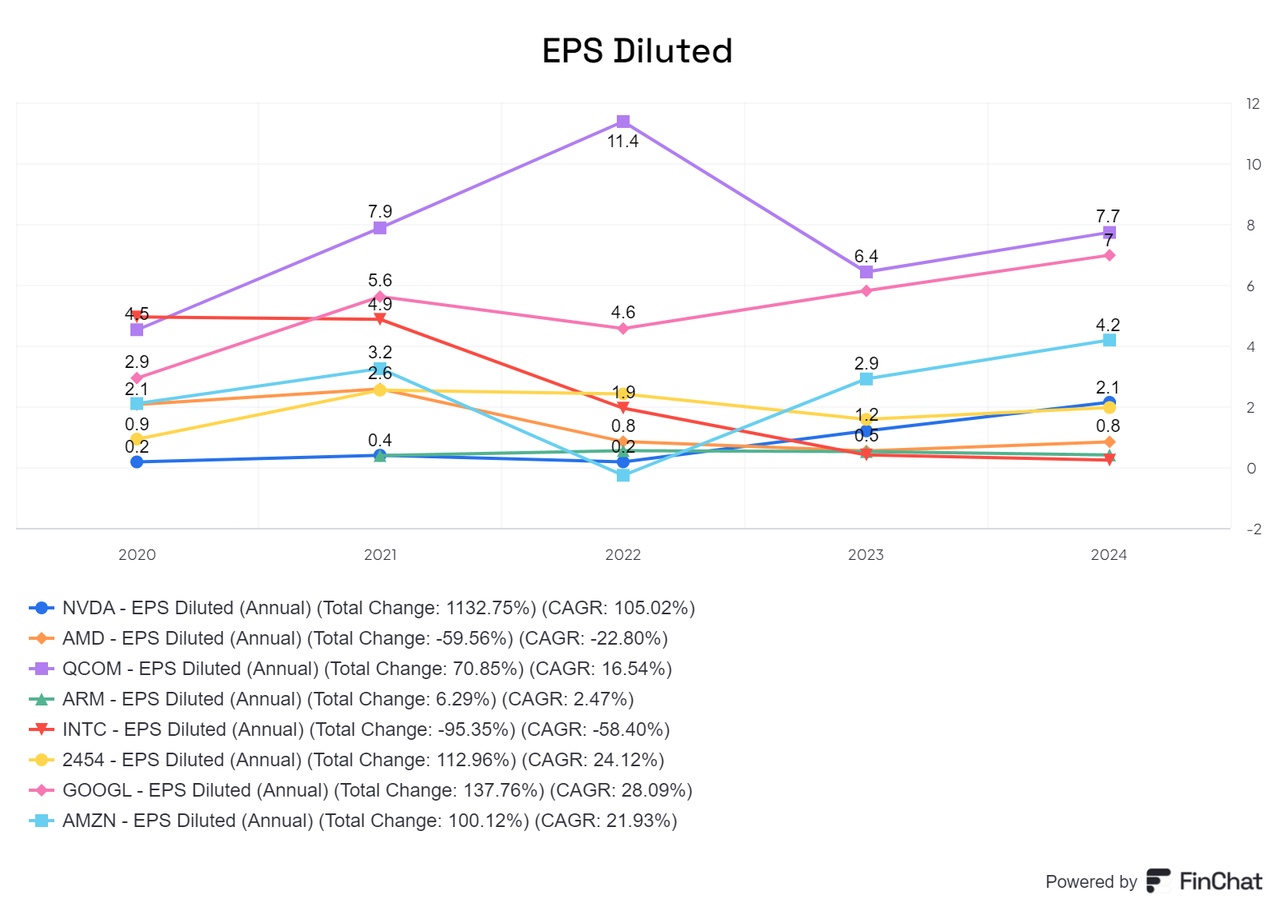

The competition

The competitive situation is currently relatively relaxed for Nvidia. The competitors in the first class are lagging far behind technically and do not currently pose a serious threat. Competitors in the second class are in a difficult position between trying to catch up and considering withdrawing from the race and falling back on their own processors.

A look at the main competitors clearly shows that Nvidia remains the dominant company in its segment and the best investment in this area. Its superior technology, strong market position and consistent innovative strength make it extremely difficult for competitors to catch up.

(rest of pictures)

$AMD (+3.66%)

$QCOM (+0.13%)

$ARM (+0.72%)

$INTC (+1.05%)

$2454

$GOOGL (+2.02%)

$AMZN (+3.14%)