Part 4 of 5: During part 1 and 2 were my apprenticeship years on the stock exchange, Part Part 3 highlighted the very positive years 2019-2021. In part 4 it is now the turn of 2022 and 2023. Part 5 will then conclude my investor story (so far) and shed light on 2024.

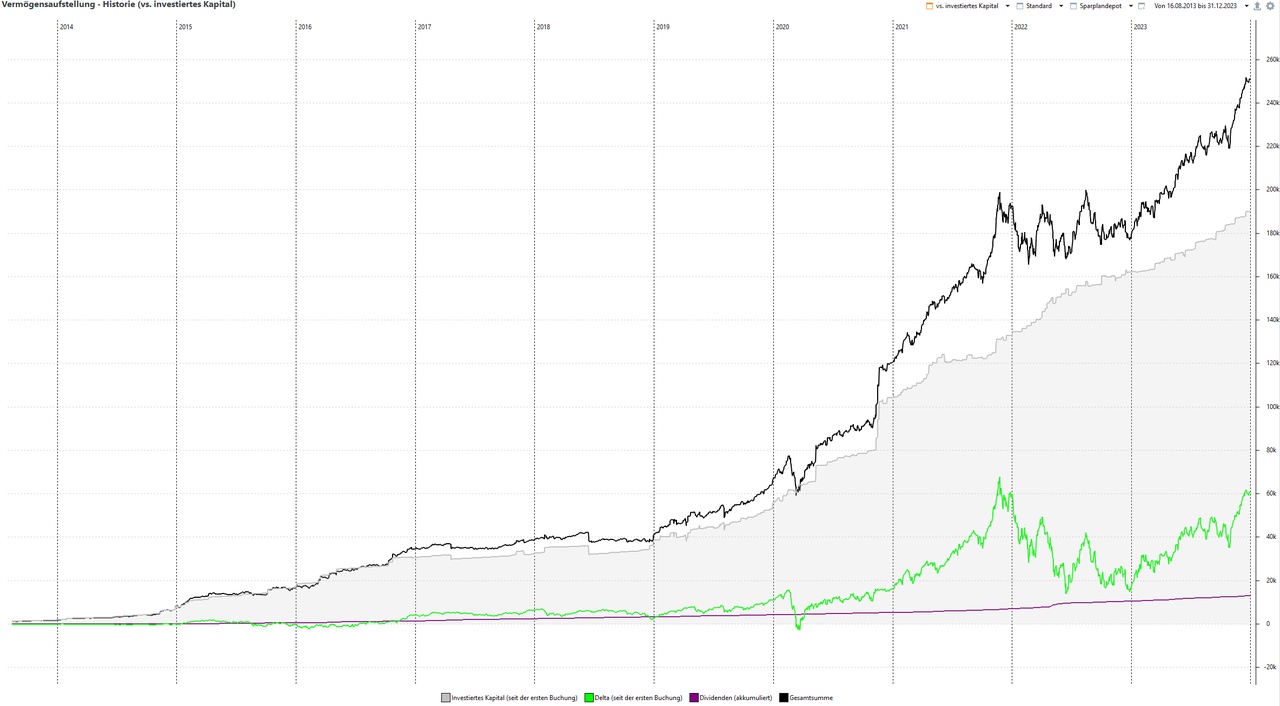

2021 was an extremely positive year with a performance of over 30% and assets of almost €200,000 at the end of the year.

However, from mid-2021 onwards, you could already sense that something was slowly changing. Inflation has picked up significantly worldwide. The main reasons for this are the global supply chain problems and the massive money printing by the central banks. Both are direct consequences of the coronavirus pandemic.

The year 2022 - inflation & interest rate turnaround

The year 2022 began with a significant setback in January. My portfolio was down 8% in January. There was a lot of unrest on the markets, inflation was still far too high and it was not clear how much the Fed would raise interest rates. In addition, there were fears that Russia could invade Ukraine - four weeks later this was unfortunately a sad certainty.

Uncertainty - something that the markets do not like at all. In addition to inflation, the war in Ukraine suddenly created another risk: what impact will the war and the sanctions have on global supply chains, which are still under heavy strain? Will this

inflation even further and thus put even more pressure on the central banks?

The stock market was therefore under fire from all sides:

- Supply chains are weighing on companies

- Higher interest rates lead to higher interest costs for companies

- Higher inflation increases salary and purchasing costs, while sales fall as consumers (have to) save more

- Suddenly, call money accounts and bonds become more interesting again and there are alternatives to shares (TINA = there is no alternative was therefore off the table)

Above all tech and growth stocks suffered from further problems:

Many growth companies were not yet profitable, but could borrow money cheaply from anywhere - profits were irrelevant as long as sales were growing. By 2022, this had changed and unprofitable companies were even shunned. Another reason is the valuation of future profits. If inflation is 0%, profits will be worth the same in five years' time as they are today. If inflation is 5%, I have to discount the profit in five years at 5% and suddenly the profit in five years is worth much less in real terms.

If I invest in my portfolio 2022 there are only a few winners:

At the top were defense companies like Lockheed Martin $LMT (+0.54%)

and Northrop Grumman $NOC (+0.77%) . This was followed by safe-haven stocks like Pepsi $PEP (+1.12%)

Unilever $ULVR (+0.55%) or Johnson & Johnson $JNJ (-0.27%) Also Encavis $ECV (+0.17%) was also in demand as an electricity producer due to the lack of gas from Russia.

At the bottom was everything to do with tech had to do with technology. The hardest hit were the unprofitable tech companies like Teladoc Health $TDOC (+3.19%) or Match Group $MTCH (+0.35%) caught - both with 70% losses each.

But also Meta $META (-0.22%)

had price losses of 60%! The reason was not only the general situation but also the lack of faith in the Metaverseso that Meta also had an internal problem. In 2022, Meta was already counted as the next GE or IBM.

But also NVIDIA

$NVDA (-1.81%) also lost -45% got a good beating. Microsoft $MSFT (-0.92%)

Apple $AAPL (-0.15%) and Alphabet $GOOG (-0.82%) saw their share prices fall by -20 to -35% were also unable to escape.

What has me in the year 2022 keep going in 2022?

On the one hand, the thought that I can now buy many top companies much more cheaply, but on the other hand also the dividends. My dividends increased by almost 50% in 2022 compared to 2021 and at the end of the year I had dividends of over €1,800.

That's an average of €150 per month and that's with dividend growth companies and not high-dividend ETFs or similar.

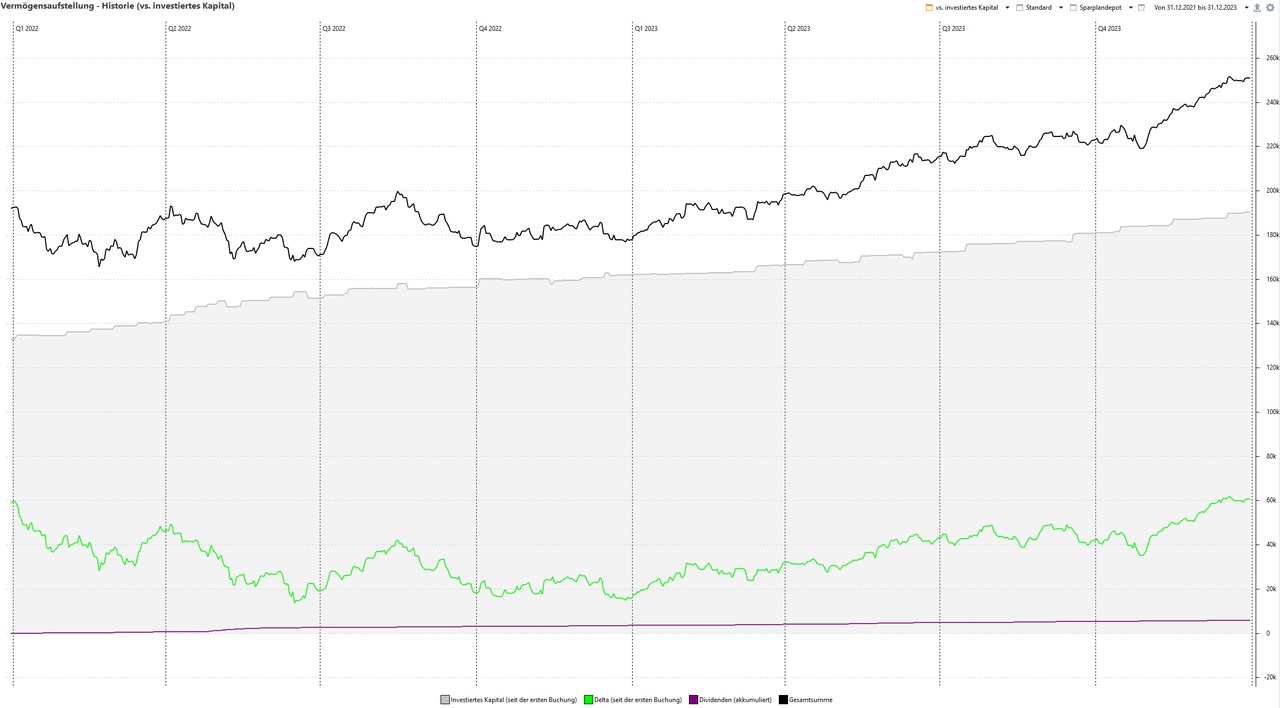

Nevertheless, the statement at the end of the year didn't exactly look rosy. Having started with €193,000, at the end of 2022 the portfolio only stood at 178.000€ even though I had over 30.000€ invested. Price losses of ~€45,000 hit like a bomb.

After another slap in the face in December 2022 with -5%, everything should suddenly be forgotten at the turn of the year.

The year 2023 - Inflation, high interest rates? Never mind, we have AI!

On November 30, 2022, the world ChatGPT and since then we have been in an AI rallythat still has no end in sight at the end of 2024. The performance of the portfolio has turned 180 degrees. Everything that was at the top in 2022, such as pharma or consumer staples (Procter & Gamble, Pepsi,...) was suddenly at the bottom.

Suddenly at the top were NVIDIA and Meta with almost +200%.

With Crowdstrike, Salesforce and Palo Alto Networks there were

another three doublers in the portfolio. One Apple was with +40% already

rather a low performer.

The stock market got used to the normalized interest rate environment, supply chains were relatively intact again and inflation began to fall. All in all, a positive environment for the stock market, which was driven back up by a megatrend (artificial intelligence).

On the home stretch in December 2023, my portfolio was just about able to make up for all the price losses from 2022. In addition to price gains of ~€45,000, I also invested another ~€30,000, so that my portfolio increased by ~€75,000 in absolute terms.

My portfolio ended the year at ~178.000€ and at just over 250.000€ ended the year.

The dividends have also continued to rise nicely - from 1.900€

to almost 2.400€ upwards.

Asset development & return:

Year Deposit value Return

2022 179.000€ -21%

2023 252.000€ +24%

Vermögensentwicklung 2022-2023:

Outlook:

Vermögensentwicklung 2013-2023:

Outlook:

In the next part, I will look ahead to the year 2024 and thus also my portfolio update / annual overview cover.

The year 2024 continued to be characterized by AI, but also by falling interest rates and some political upheavals (Trump, traffic lights out,...).

The portfolio continued to perform extremely well in 2024, although the savings rate was lower than in previous years due to a number of private issues. Nevertheless, for the first time the 300.000€ in the portfolio was to be significantly exceeded.

Part 1: https://app.getquin.com/de/activity/PElWrODsmV

Part 2: https://app.getquin.com/de/activity/LUkWiLtZKX

Part 3: https://app.getquin.com/de/activity/mQAzDvfidK