Short and sweet:

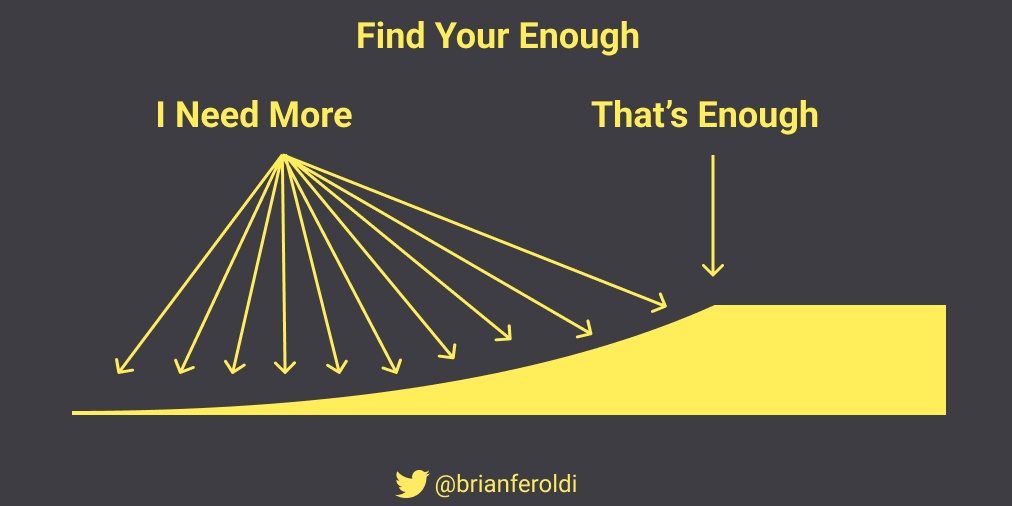

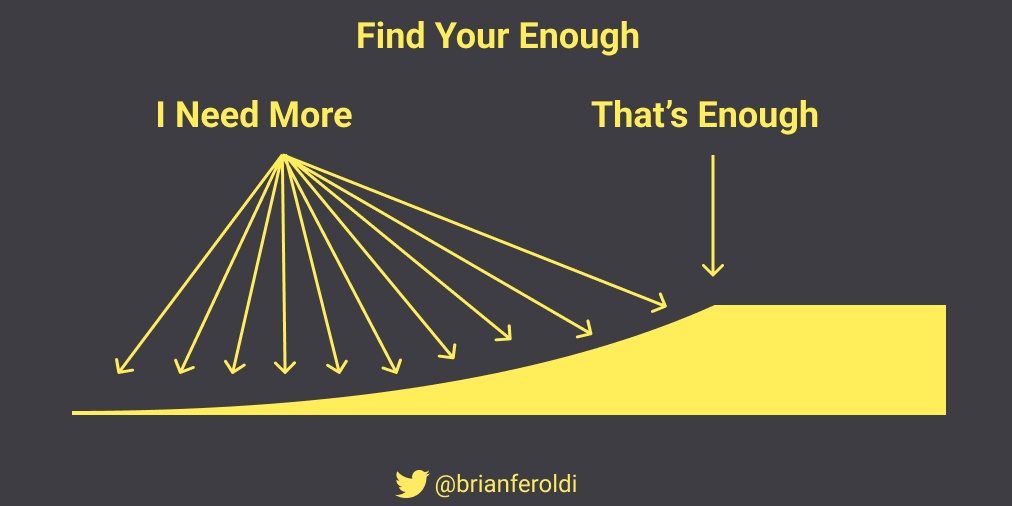

How much capital would be enough for you?

When do you have "enough"?

And to those who don't understand, can't or don't want to answer this question: What does that say about you? 😳

Short and sweet:

How much capital would be enough for you?

When do you have "enough"?

And to those who don't understand, can't or don't want to answer this question: What does that say about you? 😳