MSCI World in $VWRL rebalance?

Hello everyone,

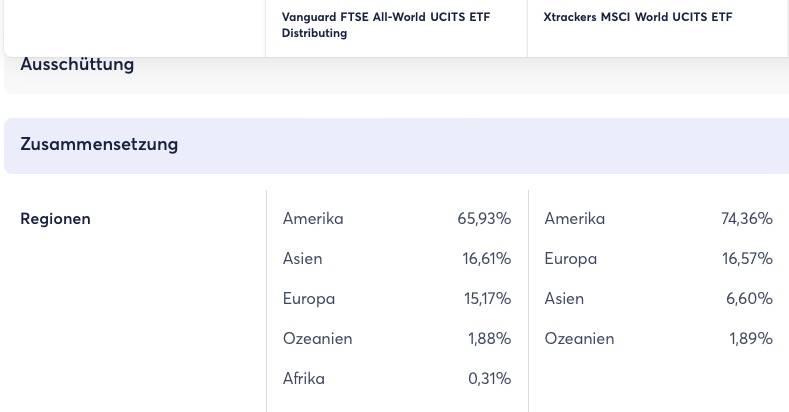

I am considering (to reduce risk) switching my positions (approx. 900€) from the MSCI World $XDWD into the FTSE All World $VWRL to the FTSE All World.

Do you think this is worthwhile? $VWRL The FTSE All World has significantly more positions but "only" about 10% less American weighting...

Would you just leave it as it is or switch to the All World?

Have a nice evening 📈