Die “Welt” Finanzredaktion hat einen Vorschlag erstellt für ein solides Aktien Portfolio, das jede Woche Dividenden bringt. Das funktioniert mit einer Zusammenstellung von Einzelaktien, die zeitversetzt ausschütten.

Besonders geeignet sind dafür US-Titel, bei denen die Ausschüttung meist viermal im Jahr erfolgt. Hierbei sollten sich Anleger nicht von der reinen Höhe der Dividende blenden lassen. Hajek (Rheinische Portfolio) warnt vor einer Konzentration auf vermeintlich dividendenstarke Branchen: „Wer beispielsweise ausschließlich auf Versorger, Pharma und Banken setzt, verzichtet auf Wachstumsdynamik aus Tech und Innovation.“

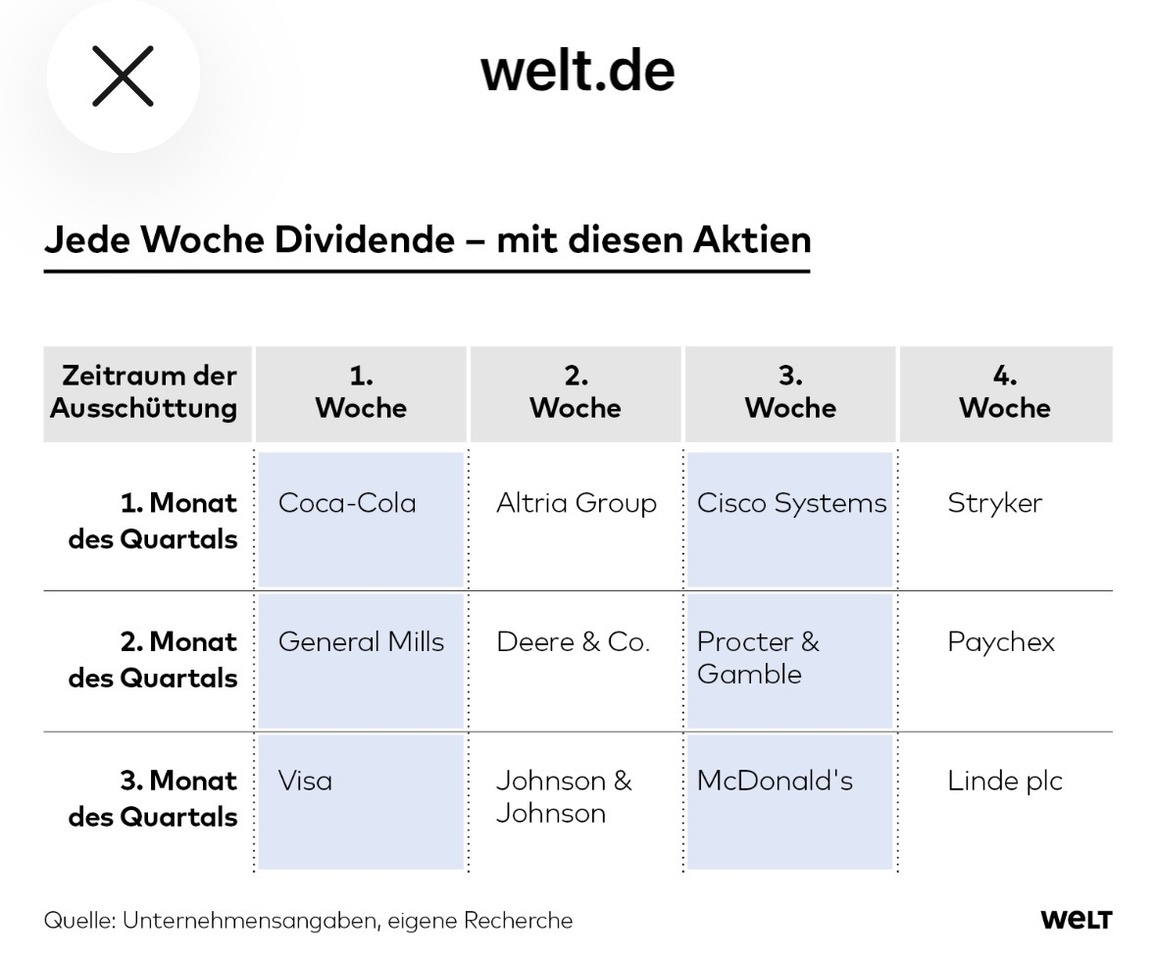

Bei ausländischen Aktien müssen Anleger auf Tücken wie Quellensteuer oder Währungsrisiken eingestellt sein. Dafür lassen sich mit nur zwölf amerikanischen Standardwerten 48 Wochen des Jahres abdecken, durch zwölf mal vier zeitversetzte Ausschüttungen.

Das geht etwa mit diesem Portfolio:

- Monat 1 des Quartals

Coca-Cola $KO (+1,01 %), Altria Group $MO (-0,54 %), Cisco Systems $CSCO (+0,68 %), Stryker $SYK (+0,17 %)

- Monat 2 des Quartals

General Mills $GIS (+0,16 %), Deere & Co. $DE (+1,14 %), Procter & Gamble $PG (+1,69 %), Paychex $PAYX (+0,88 %)

- Monat 3 des Quartals

Visa $V (+1,51 %), Johnson & Johnson $JNJ (+2,31 %), McDonald $MCD (+1,51 %) und Linde plc. $LIN (+0,49 %)

Quelle Text (Auszug) & Grafik: Welt, 26.12.25