Also divided into subtopics due to excessive length:

Part 1 (Basics)

https://app.getquin.com/activity/TmavYdCLhk

Part 2 (classic derivatives)

https://app.getquin.com/activity/KxTamfJhwK

Part 3 (Knockouts and factor certificates)

https://app.getquin.com/activity/uCAjxpUmhS

Part 4 (Practice)

https://app.getquin.com/activity/fLGLJHmwkb

Foreword

This post does not constitute a recommendation of any kind, but is merely intended to serve as a basis for information;

Around 80% of private investors (or more, depending on the study) make high losses with derivatives, so I personally would only use them after a few years of market experience.

And... this article is long. Reading time: approx. 15 minutes

If you are only interested in parts of the content, you can access individual topics via the links above!

At the request of @markusnowak

@KapriolenSonne

@Derebete

@Lorena

@Gally

@DiFigiANo

@GoDividend

and for @EurieNet and @Clermit possibly also interesting due to a discussion :)

Table of contents

Basics

1) When do you use "leverage products"?

2) Overview: What are derivatives?

Theory

Classic (medium/long-term price development, rather complicated)

3) Options

4) Warrants

Short-term price development (rather simple)

5) Factor certificates (factor warrants)

6) Knock-out products (turbo warrants)

a. Classic Turbos

b. Unlimited Turbos

c. Smart Turbos

d. Best Turbos

Practice (Subjective)

7) Basic requirements

8) Examples

[everything in these brackets] = additional information

1) Why and when to use derivatives?

Derivatives are actually intended as an instrument for hedging against price fluctuations of certain underlying assets. (See example 3)

However, a large part of derivatives trading consists of speculation (mainly institutional, partly private). Here, investors use derivatives to try to exploit a probability of occurrence that they believe has been misjudged by the market.

If you buy a share, you want to profit from rising prices. However, if you want to profit from falling prices, you can also do this with a suitable derivative.

[Forward transactions in particular are also used for hedging and arbitrage]

Derivatives are used for speculation, as the investor does not directly acquire a share certificate with a derivative, but a theoretical right to buy the share at a later date at a certain price. Logically, the price of this right fluctuates and depends, among other things, on how much the base price moves.

This also results in the leverage effect of some derivatives. While a direct investment in the share only generates a profit of 20% when the share price rises from EUR 100 to EUR 120, the same increase in the underlying (20%) enables a much greater profit of several hundred percent with a reduced stake. [Theoretically]

! However, this is offset by the risk of a total loss of the capital invested!

This is because if the share is quoted below the price when the warrant matures and the right to acquire the share has also been fixed, the corresponding warrant is worthless and expires.

2) Generic term derivatives

Derivatives are financial products that represent an underlying asset. If you are looking for a leveraged product based on a share, bond or commodity, you are looking for a derivative.

[Derivatives can also be derived from price, interest rate, volatility changes or key figures, among other things.]

! They are by no means just high-risk toys for risk-loving private investors; many derivatives are an important financial instrument for institutional investors!

[Not only hedge funds and banks, but also companies from other sectors use options, especially those that are dependent on buying and selling prices]

Types of derivatives are for example options, warrants, futures, certificates and reverse convertibles. These are best sorted into:

Forward transactions (later trading date, obligatory trading at the option price)

Options transactions (later trading date, possible trading at the option price)

Swaps (later possible trading dates, mandatory trading)

⭐- Rating= THEORETICAL complexity of the respective derivative

Listed here in descending order

Classic derivatives

3) Options ⭐⭐⭐⭐⭐ 5/5

When you buy an option, you purchase the right to buy or sell the underlying asset at a certain point in time. For this possibility (not the realization), you pay the option seller an option premium. [Since this point in time is in the future, options transactions are also referred to as forward transactions.]

Thinking logically, you now come to the following conclusion: if I assume that share X will rise in the near future, I want to buy the share at a lower price in the future; I therefore buy the corresponding option from the option seller. A call option.

If, on the other hand, you expect the underlying to fall, you want to SELL the share at a higher price in the future; the corresponding option is called a put option. put option.

Options are only traded on futures exchanges traded.

They also have no WKN; a special options broker is required.

Fictitious simplified example:

You run a company that has a certain monthly requirement for oil. The oil price is currently €100, but due to the macroeconomic situation you assume that it could rise sharply in the future.

So you buy a call option to continue to have the right to buy oil for €100 in the future. The options trader must therefore sell to you for €100 even if oil prices rise. If prices fall, you can let the option expire and buy at a lower price. You have to pay the option premium in both cases. [This is an option transaction, as trading at the option price is not obligatory.]

Price of the option:

While I hold the option to buy the underlying asset at the end of the term at the strike price [The strike price indicates the value at which the option can be bought or sold], its value changes.

The term of the option plays an important role here, as the price depends on the following factors: strike price, term (time value), price of the underlying product, interest rate and the option premium (which in turn depends on time and intrinsic value). intrinsic value and intrinsic value...) [Reference quantity * (price of underlying asset - underlying asset)]

The important factor for the premium time value means in simplified terms: As the term progresses, the probability of the expected development from the perspective of the option buyer increases.

[Option premium: Black-Scholes model, made up of intrinsic value and time value.]

In the option pricing models, the variables that are relevant for pricing are abbreviated with Greek letters and thus also called "Greeks" (delta, theta, vega and rho) (see "Valuation of warrants").

There are also differences in the type of exercise of the options:

- American options can be executed on any trading day prior to their expiration date

- European options are only executed on the maturity date

- Bermuda options can be exercised at various fixed times

4) Warrants ⭐⭐⭐⭐⭐ 5/5

In contrast to options, warrants can be put together by issuers at will. They are issued by banks and securities firms, with their own WKN, but can also be traded on standard stock exchanges. *8

Warrants are also subject to issuer risk. This means that if the issuer becomes insolvent, the warrant is also worthless.

*8 They can be traded OTC

Implementation:

As with options, investors can trade warrants on call and put warrants warrants.

The chances of winning with classic call warrants are theoretically unlimited. With put warrants, on the other hand, there is a "natural" profit limit because the price of an underlying asset can never fall below zero.

The maximum risk of loss for both types of warrant is always limited to the capital invested.

Each classic warrant has the following 3 key components:

The strike pricethe subscription ratio and the term.

Valuation (based on "Option price"):

The strike price

The buyer of the warrant can buy or sell the underlying asset at the strike price.

The higher the price of the underlying asset, the higher the price of a call warrant. The opposite is true for a put warrant.

Subscription ratio

The subscription ratio of options, also known as the "contract size", "option ratio" or "contract size", provides information on how many shares of the underlying asset an option contract relates to. For example, one share option relates to 100 shares.

Delta

Delta indicates by how much the price of an option changes if the underlying asset changes in price by one unit. Call options can have a delta between 0 and 1, put options have a delta between 0 and -1 (logically, as the price moves in the opposite direction to the underlying).

https://www.ideas-magazin.de/informationen/wissen/was-ist-eigentlich-das-delta/

But: The delta is a snapshot, which relativizes the significance with regard to the selection of a warrant. This is more important:

Omega

The omega indicates the theoretical percentage by which the price of the warrant changes if the price of the underlying rises or falls by 1 percent. The figure is a combination of the leverage and the delta and is also referred to as theoretical leverage.

The simple leverage is calculated from the price of the underlying asset * the subscription ratio / the warrant price. If you multiply the result by the respective delta, you can use the omega to get a feeling for the price development of the warrant.

However, this value also changes logically as soon as the simple leverage or the delta change.

https://www.ideas-magazin.de/informationen/wissen/was-ist-eigentlich-das-omega/

Gamma

Delta changes depending on how other market parameters change. The base price in particular has an extreme influence on the delta when it changes; the strength of this change is described as gamma.

In principle, this can be summarized as follows: The steeper the slope of the delta [= the more delta at the money is], the greater the gamma. Since delta tends to become steeper and steeper as the remaining term of the warrant becomes shorter and shorter, gamma also becomes higher and higher here.

! Gamma therefore describes the actual "leverage effect" that a warrant can build up!

[A gamma definition from a mathematical, issuer's point of view and more precise overall: https://www.ideas-magazin.de/informationen/wissen/was-ist-eigentlich-das-gamma/]

[

Vega

Another influencing factor is volatility. However, this is less the historical vola (standard deviation of past changes in the base price) and more the expected fluctuation range; implied volatility.

The influence of (implied) volatility on the option price is measured using the vega figure. Vega indicates by how many euros the value of a warrant changes (adjusted for the subscription ratio) if the implied volatility rises or falls by 1 percentage point.

Ultimately, this means that the higher the volatility, the higher the price.

Like delta and gamma, vega is also a dynamic variable and represents a snapshot in time.

With warrants that are far out of the money (small delta), however, even a small vega has an enormous influence. The low volatility is higher in relation to the already low warrant value.

https://www.ideas-magazin.de/informationen/wissen/was-ist-eigentlich-das-vega/

Theta "Time is money"

Defines the time value loss of a warrant. Since I am betting on rising prices with a call warrant, it constantly loses value if all other parameters remain the same.

This also means that in-the-money warrants (strike price = exercise price of the option) have a high theta value, whereas out-of-the-money warrants have hardly any loss of time value.

[ https://www.ideas-magazin.de/informationen/wissen/was-ist-eigentlich-das-theta/ ]

Rho

Influence of the interest rate change of 100 points on the option price.

No chance of a short explanation. Fortunately, in practice, Rho is the least important of all the Greeks. On the one hand, in the futures market mostly at and out of the money

quoted options quoted options, i.e. those with a lower Rho,

so the influence of interest rates is not as pronounced.

On the other hand, the Rho influence can be controlled via the Vega, because the Rho is positively correlated with the volatility indicator Vega.

However, it should not be completely disregarded when using warrants purchased by central banks during interest rate hikes....

https://www.ideas-magazin.de/informationen/wissen/was-ist-eigentlich-das-rho/

]

"This is far too complicated!"

Correct.

That's why neobrokers (where the majority of customers are trading for the first time) are much more likely to offer simpler derivatives.

They are a much simpler way to lose money.... generate a return.

From short-term price trendsprofit from short-term price movements:

5) Factor certificates (factor warrants) ⭐⭐⭐ 3/5

Differences to other derivatives

Factor warrants offer the opportunity to participate in price movements within a day or to follow entire trends with leverage.

Price rises can be capitalized on with the help of a long- strategy and from price falls with the help of a short- strategy.

The term of this special type of warrant is not limited, so the warrant must be sold in order to realize economic value.

In addition, the issuer is generally entitled to terminate a factor warrant.

Valuation

The factor warrant uses the "factor value" to indicate the leverage with which the warrant reflects the daily price change.

Means: price moves 5%; factor *2 warrant moves 10%.

There are also financing costs. For many issuers, these consist of

- Costs for raising capital

- Possible fees

- An IC (individual cost rate)

Meaning: If I go long with a factor of 5, but the price does not change at all, the bill loses value over time due to the costs.

Special features

Daily chaining

The value is calculated by the daily change, always based on the closing price of the previous day. A new reference price is therefore determined with each closing price of the underlying, which in turn forms the basis for the percentage performance of the following day.

This daily adjustment of the capital value takes place automatically and is known as chaining.

Path dependency

Concluding from the daily chaining: not the price of the reference value, but the daily developments of the value are relevant.

Example:

(factor certificate without financing costs for simplification)

Base value day1 day2

Base rate 100€ -20% ---> 80€ +25% ---> 100€

Factor *2 Opt. 100€ -40% ---> 60€ +50% ---> 90€

Although the base price is back at the same price value, the *2 factor has lost value

Daily chaining can be of benefit to the investor in the event of positive developments, but it can also be detrimental if the bond does not perform as expected.

[ https://www.sg-zertifikate.de/faktor-optionsscheine-ehemals-faktor-zertifikate ]

6) Knock-out products ⭐⭐ 2/5

(Turbos = turbo warrants)

Differences to other derivatives

Also known as knock-out certificates, mini futures and turbo warrants.

As with factor warrants, a long and a short strategy can be applied.

In contrast to traditional warrants, turbo warrants have a knock-out barrier. If it is touched by the underlying asset, a knock-out event occurs and the product matures prematurely.

With a turbo warrant, you can again benefit from the leverage effect and thus theoretically multiply your profits. (The share rises by 5%, the long knockout product with a leverage of 5 rises by 25%).

However, if the share performs unfavorably for the investor and, contrary to expectations, touches the strike price, the capital invested by the investor is used up.

In this case, the so-called knock-out barrier comes into play. If the share price touches the knock-out barrier, the turbo call warrant is "knocked out" and matures. The investor suffers a loss up to the total loss of the capital invested.

a) Classic Turbos (Limited term)

The strike price, on which the knock-out barrier lies, is below the current underlying price in the case of a turbo call warrant and above it in the case of a turbo put warrant. If the price of the underlying moves in the right direction, the distance to the knock-out threshold increases (value increases).

The price consists of the difference between the current price of the underlying and the strike price in the case of a turbo call warrant, taking into account the subscription ratio.

Of course, all turbo warrants also have a financing component. The amount to be financed in the case of a classic turbo call warrant is determined by the level of the strike price. This is financed in full by the issuer.

In addition, the liquidity risk must be financed. This describes the risk that the issuer will not be able to liquidate the hedging transaction at the strike price (should a knockout occur).

This so-called premium decreases as the term of the Turbo progresses and is partially returned to the investor in the event of a premature sale.

b) Unlimited Turbos /Mini Futures (Unlimited)

The knock-out barrier does not lie on the strike price, but is placed before it. Once this barrier is reached, the securities mature immediately and a residual value is paid out.

Residual value = difference between underlying and knock-out

Costs are taken into account by a daily adjustment amount, as there can be no fixed final maturity. This is again made up of financing and risk costs. In the case of a turbo call, the adjustment amount will generally lead to a daily increase in the strike price - even on public holidays and weekends.

At the beginning of a new trading month, the knock-out barrier is tightened so that the risk increases steadily while the underlying remains stable.

The price should therefore move with increasing volume in the direction you have planned, not slowly over several months. An Unlimited Turbo is not really suitable for this.

c) Smart Turbos

At first, they sound like every trader's dream: they basically work according to the principle of Unlimited Turbos, BUT reaching the upstream knock-out barrier during the trading period of the underlying does not matter!

Only if ...

...the price touches the underlying, the warrant is still knocked out.

...the index closing level has reached the knock-out barrier, the warrant is knocked out

d) Best Turbos/ Open End Turbos

This is basically a mixture of a classic turbo warrant and a mini future. They are issued without a maturity limit AND strike price = knock-out barrier.

The warrant therefore behaves like the Classic variant with regard to the knock-out barrier and like the Unlimited Turbo warrants with regard to financing costs.

The result of this mix: Open End Turbos can generate the highest leverage, as this can be fully utilized by the characteristics (it is not reduced by a higher or lower knock and it can theoretically continue to run without any time limit).

https://www.sg-zertifikate.de/knock-out-produkte

Practical basics (subjective! )

7) Basic requirements

Of course, anyone who has access to a broker can trade derivatives. However, it is so difficult to make a profit with them in the medium and long term that some prerequisites should be fulfilled beforehand.

1. strategy

Only with the help of a trading strategy can the use of derivatives lead to profit opportunities. This consists at least of a defined target and various scenarios according to which long or short derivatives are traded.

2. market understanding (macro)

If you do not prepare for the market influence, you will often experience surprises which, in the case of derivatives, often end in total losses. Questions you should ask yourself, for example

What effect do key interest rate hikes have?

What are other ways in which the central bank can intervene in the market?

Current political situation?

Issuer situation?

Influence of exchange rates (currencies)?

Witches' Sabbath? When, where and what can happen?

3. TA understanding

Nobody needs to be able to draw the one-legged gorilla in the chart, but I think it is naive to use derivatives, especially short-term ones, without a basic understanding of support, resistance and other indicators such as TA. Using derivatives without this knowledge can at best be described as gambling.

4. product understanding

I have not yet explained many situations that can arise with derivatives. Personal research is just as relevant here as in the acquisition of individual shares.

5. risk management

Before the first trade is executed, it is not a disadvantage to have a plan for both the take profit and the stop loss (yes, you can also set a stop loss above the knockout for knockout products). This way you can also influence the risk after choosing the warrant. This, the choice of derivative and the position size are the most relevant risk management factors.

If you ignore one of these factors, you are probably a child of the Wall Street and will either become a gambling addict or lose everything in the long term. Or both. @getquinfuermerchverkauft <3

If you are interested in the basics of TA, risk management, a trading strategy, etc:

https://www.amazon.de/Trading-mit-Hebelprodukten-Schritten-erfolgreichen/dp/3898798615

I don't get anything for it and I don't know the author, the book just helped me a lot at the beginning.

7) Examples

So where to start?

You can usually trade derivatives with the most common neobrokers, special trading brokers or CFD brokers. In the beginning, I would not pay much attention to this in order to gain a basic understanding. Basically, the selection at Trade Republic or Scalable is sufficient.

It is possible to set up demo accounts on some platforms to "test" investing. This is only useful for one aspect: to test your strategy.

With regard to TA: if you use Tradingview Papertrading, you can test your strategy with simple long and short trades before implementing it, regardless of the type of derivative.

Otherwise, the greatest danger (even more so with derivatives than with share purchases) is that emotions can influence the sale or purchase. "It's bound to go up" is no reason for a long certificate, "the figures are bound to be bad" is no reason for a put warrant.

If you use the demo accounts, the emotions do not really come to light, as there can be no real losses. They therefore fail to serve their purpose of preparing you for a real trade.

To better understand all the dry theory, here is a trade in practice that worked out wonderfully:

Approach:

At the beginning of the war in Ukraine, the defense stock Hensoldt rose from €14 to €28. This was followed by weeks of high volatility and a sudden focus on defense stocks.

On 03.03. the Hensoldt price was at 21€, !TA confirmed the long position!

The war had only just begun, the oil price was on an upward trend and there were hardly any public assessments of the length of the war. Days before, the 100 billion package was announced; Hensoldt was to receive small orders, but at the same time was supposedly working on a project with the White House.

Market capitalization 2 billion, rather niche business, but would benefit from increased military spending.

Assumption: Oil-dependent shares will be punished, armaments rather constant/rising, should the crisis continue. Private investors would jump on the arms bandwagon.

Implementation:

First approach:

Call warrant that is in the money, as the duration of the whole thing is difficult to estimate -> rather longer-term

Actual execution:

Open End Turbo, news on defense stocks increased more and more on 03.03. + probability for good news/ new orders/ further hype of the stock increased

Trade size:

trade, only based on news and TA, therefore 4% position size (in relation to the portfolio) when buying the derivative (should never be more than 6/7% anyway with sensible risk management)

Knockout underlying:

Choose derivative so that the knockout is slightly below 5% below the next support= 16,40€, as a support at 17,50€ can still hold the stock in case of a sell series.

(I (personally) do not choose the leverage, but the amount of the knockout)

Stop loss:

At €17.20, (if the price falls below the support -> damage limitation)

Take profit:

Profit is taken at the previous high (because then bearish TA/profit taking)

Result:

Ran longer than planned, thus the base value of the Open End Turbo was set higher (see pictures: Long @16.40 -> Long @16.43), but since the course was fine until then and the situation has not changed-> SL pulled higher and let it run.

Sold on 25.03. because previously determined take profit was reached. (see picture 3)

Follow-up plan:

If the price rises above € 30 -> new bull chart signal, possibly new trade

If the price falls again -> bearish chart formation, cooling of the trend, possibly wait for the market situation,

Since then, no more Hensoldt trades have been made

And how not to do it/ Why emotions are dangerous:

Palantir short (see picture; above purchase price, below selling price)

I had already given the premonition (short justification) here: https://app.getquin.com/activity/tzxiDVkAjc

Why did I sell it a day later?

THERE IS nOt ANYtHING THAT HAPPENS THEN BECAUSE OF SUCH AN INCREASE IN LIFE.

If I had acted rationally, it would have been a nice profit.

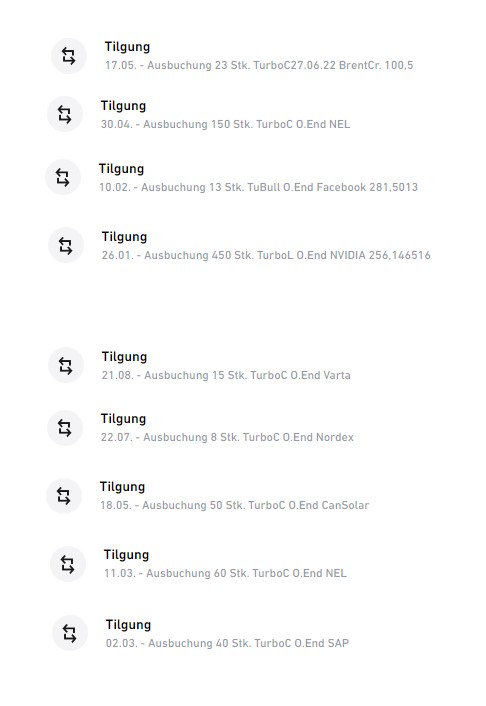

To conclude this novel, I would like to point out the 3rd picture for the diligent reader. These are knockouts.

#knockoutlove

#learn

#hebel

#zertifikate

#derivate

(PS: is there a record for the longest post on getquin?)

:)

Sources:

https://docs.google.com/document/d/1aJ9WiPeiHhXtXaOj7Ek8_sdMIdH4c00ONAnPKWgG_4o/edit?usp=sharing