Part 3

In Part 1, we looked at the basics and the theory behind making a financially sensible buy or rent decision. You can find it here: https://app.getquin.com/activity/FoLdCxttXY

In part 2, we put this theory into practice with a detailed calculation example. The tenant emerged as the clear winner. You can find part 2 here: https://app.getquin.com/activity/evjQvBldso

In this 3rd and final part, we will look at the influence that changed parameters and variables have on the result. We will outline a possible scenario in which the buyer beats the tenant. We will also take a look at other properties and calculate the buy vs. rent decision for them.

tl;dr & Conclusion

Unsurprisingly, the purchase costs in relation to the rental prices have a very large influence on whether the tenant or the buyer is better off in the end. This ratio can differ significantly even in the same region for similar properties, which is why an individual comparison should be carried out for each property in question according to the scheme presented in this series of articles. As mentioned in Part 1, we cannot live in the global average. Although an ETF allows us to save for the global average for the stock market, this is unfortunately not possible for our own home. Blanket statements from any "studies" about the regions in which buying or renting would allegedly be worthwhile should therefore be viewed critically. In addition, the assumptions made in such publications are not always transparent (e.g. how much return was calculated for the alternative investment). They are also usually produced on behalf of an interest group (e.g. building societies) - don't trust any statistics that you haven't falsified yourself. Speaking of the return on alternative investments: for renting to be worthwhile, it must be decent and on a par with a global portfolio. An even combination of shares, bonds and call money account is unlikely to yield enough to beat the buyer.

Interestingly, with a purchase and the assumed framework conditions, the equity should be as low as possible - it simply works more effectively on the stock market than in your own home. Of course, higher loan interest rates due to lower equity must be avoided. This is because the interest rate on the first loan in particular has a noticeable impact on the final result - much more so than with follow-up financing. In addition, the costs of maintenance and modernization reduce the buyer's return and should not be underestimated. After all, you want to live in a nice house for several decades and not in a dilapidated building. On the other hand, the effects of varying rent increases and changes in the value of the property on the result should be self-explanatory.

In order to make the house purchase from the example in the second part of the series of articles financially attractive, the variables would have to be adjusted quite strongly in favor of the buyer. On the other hand, small adjustments in favor of the tenant are already sufficient to increase their capital by 1-2 million euros. The recommendation from Part 2 therefore remains valid: Under the described or similar conditions, the purchase of a property should be refrained from from a purely financial point of view. However, the other examples show that there are certainly regions with offers in which the buyer's assets are ultimately higher or at least not quite as far below those of the tenant. In particular, it has a positive effect for the buyer if the tenant does not move into a property that suits their circumstances over time, but always lives in a similar property to the buyer. For example, because there is no desire to have children and the number of people living in the property always remains the same. As a tenant, on the other hand, you should take advantage of the simple option of moving in order to always live according to your needs - this can give you a clear economic advantage over the buyer, who will probably rarely or never move.

What has happened so far

In this part, we will focus on the realistic scenarios 5 and 6 from Part 2. Ideally, you should read Part 2 again (https://app.getquin.com/activity/evjQvBldso) before you start with this last part. Otherwise, the short version is also available in this section.

General

- Property for sale: Mid-terrace house for 750,000 euros

- Service charges: 9.07%

- Appraiser: 2,000 euros

- Provisions for maintenance and modernization: 300 euros / month

- Loan 1: 2.65% interest, 2.5% repayment, 15-year term

- Loan 2: 4% interest, 8.149% repayment, 10-year term

- Property value growth per year: 2.6%

- Inflation / annual adjustment provisions: 2%

- Property for rent: Mid-terrace house for 1,970 euros basic rent

- Deposit: 4,400 euros

- Rent increase every 4 years: 9.09% (2.2% per year)

- Performance of global portfolio per year: 6%

- Equity capital: 200,000 euros

- Period under consideration: 60 years

Scenario 5

The tenant does not live in the mid-terrace house all the time, but in an apartment adapted to their circumstances. The buyer reduces the provisions in the last 10 years, otherwise the assumptions under General apply.

- Apartment for rent year 1-5: 1,528.82 euros, deposit 4,000 euros

- House for rent year 6-25: 2,196.45 euros, deposit 5,500 euros, removal costs 2,000 euros

- Apartment for rent year 26-60: 2,374.97 euros, deposit 5,500 euros, removal costs 3,000 euros

- Rent increase every 4 years: 9.09% (2.2% per year)

- Buyer's assets after 60 years: 2.9 million euros

- Tenant's assets after 60 years: 7 million euros, growing deposit

Scenario 6

The buyer sells his house after 25 years, buys a smaller apartment (comparable with a tenant) and invests the profit in a global portfolio. The general conditions for the mid-terrace house remain unchanged.

- Apartment for sale Year 26-60: 1,000,000 euros + ancillary costs

- World portfolio buyer Year 26-60: EUR 277,194.75 + increase in value

- Provisions + non-recoverable operating costs Year 26-60: 320 euros + adjustment for inflation

As the tenant and buyer occupy an apartment from the 26th year onwards, both have to bear apportionable ancillary costs such as the maintenance of an elevator and not just the tenant, as in scenario 5. The rent relevant for the comparison is reduced accordingly in this period, all other parameters remain unchanged.

- Apartment for rent year 26-60: EUR 2,331.90 (rent increase unchanged every 4 years)

- Buyer's assets after 60 years: 2.5 million euros apartment + 2.1 million euros deposit = 4.6 million euros

- Tenant's assets after 60 years: 6.9 million euros, growing deposit

How much return does maintenance cost?

The initial maintenance costs of 287.50 euros per month ensure that the property retains its value. This means that the value of the property increases by the assumed 2.6% every year. This means that the provisions for maintenance reduce the return on the property. Of course, no one wants to live in a run-down property, so there is no getting around maintenance. But it is certainly interesting to look at how much maintenance costs us in terms of returns.

In the first year, the value of the mid-terrace house increases by 2.6% to 750,000 euros * 1.026 = 769,500 euros. The buyer sets aside 287.50 euros * 12 = 3,450 euros for maintenance. We have therefore invested an additional EUR 3,450, which reduces the return to EUR 769,500 / (EUR 750,000 + EUR 3,450) ~ 2.13%. In the 59th year, the value of the property without modernization has increased to 3,410,009.19 euros, reaching 3,498,669.43 euros in the 60th year - provided that maintenance measures have been carried out throughout. The provisions for maintenance amounted to EUR 11,097.60 in the 60th year. The return in the last year is therefore approx. 2.27%.

Provisions for maintenance are necessary, but noticeably reduce the return until the end. It is also logical that the return adjusted for maintenance costs increases over time, as the assumed increase in the value of the property per year is higher than the annual adjustments to the provisions. Why? For example, because the price of the property also increases over time and significantly lower maintenance costs are required.

What influence do the purchase price and rent have?

Purchase price and rent are of course two very important parameters, but they also depend on each other. If the purchase price rises, the rent will very likely rise too. So we cannot adjust these parameters independently of each other. Nevertheless, there are areas where the purchase price/rent ratio is different. First, however, let's look at the impact of lower purchase and rental costs if the purchase price/rent ratio remains the same.

The ratio between purchase price and annual basic rent is EUR 750,000 / (EUR 1,970 * 12) = 31.7. If this ratio is maintained, but assuming lower prices - for example, a basic rent of EUR 1,400 and a purchase price of EUR 1,400 * 12 * 31.7 = EUR 532,560 - the maintenance costs must of course be adjusted accordingly. Instead of EUR 287.50 + EUR 12.50, we assume a purchase price of EUR 217.50 for maintenance and retain the EUR 12.50 for modernization. In scenario 5, the portfolio value at the end of the 60 years is only around EUR 5.6 million (instead of EUR 7 million), while the value of the property falls to around EUR 2.1 million (instead of EUR 2.9 million). The value of the custody account thus increases from 2.4 times the value of the property to 2.7 times. The increase in the value of the portfolio over the past year also rises from 4.7% to 4.9%.

Scenario 6 paints a similar picture. The house is worth EUR 532,560 * 1.026^25 = EUR 1,011,701.89 when it is sold after 25 years. In addition, the modernization costs remain unchanged at 6,891.74 euros, making a total sales value of 1,018,593.63 euros, resulting in proceeds of 976,636.87 euros after deduction of the sales costs. The new apartment has a value of 791,776.70 euros, which can be reduced to 750,000 euros. To this must be added the ancillary purchase costs, resulting in a total price of 820,025 euros. After deducting the relocation costs of 3,000 euros, the buyer now has a more suitable apartment and a share deposit of 153,611.87 euros. The maintenance costs for the new apartment initially amount to 240 euros. The final value of the buyer's deposit is approximately 1.2 million euros. The value of the apartment is approx. 1.8 million euros. In total, the buyer has therefore built up assets amounting to 3 million euros. In contrast, the tenant's assets amount to 5.5 million euros. The tenant has thus increased his assets from 1.5 times those of the buyer to 1.8 times. The increase in the value of the portfolio also rises from 4.9% to 5% in the last year.

It is therefore of no benefit to the buyer to simply purchase a cheaper property if it is located in a region with lower rents. On the contrary. This is partly due to the higher (unchanged) equity ratio. The equity works much better with the assumed return on the stock market than in your own property. This can be easily confirmed by increasing or decreasing the equity with all other parameters remaining the same. The lower the equity, the better off the buyer is. However, as a lack of equity has a negative impact on the interest on the loan or the credit rating in general, the equity ratio cannot be reduced arbitrarily for owner-occupation. This also increases the monthly installment, which a buyer may no longer be able to afford.

If the purchase price/rent ratio is reduced to 25, the house can be purchased for 591,000 euros instead of 750,000 euros. If the remaining parameters remain unchanged, the tenant in scenario 5 ends up with a deposit value of approx. 2.75 million euros, which is still significantly higher than the value of the property of approx. 2.25 million euros. The tenant's portfolio grows by around 3% until the final year.

With a purchase price/rent ratio of 25 and a corresponding adjustment of the property prices, the tenant in scenario 6 generates a portfolio value of approx. 2.6 million euros, which increases by approx. 3.2% in the 60th year. After 60 years, the buyer owns a portfolio worth approx. 1.2 million euros and a property worth approx. 2 million euros. This means a total of 3.2 million euros. The buyer's assets are therefore just under 25% higher than those of the tenant.

Unsurprisingly, the purchase price/rent ratio has a very high influence on the overall result. This ratio fluctuates extremely within Germany alone. It can therefore be said that a statement as to whether buying or renting makes more sense depends extremely on the regional circumstances and the properties in question.

What influence does the return on the portfolio have?

A very big influence! Even small changes to the average yield can have a significant impact on the result. If the average yield in scenario 6 is reduced from 6% to 5.8%, the tenant will only have 5.9 million euros available after 60 years instead of 6.9 million euros. With a yield of 5.3%, it would only be around EUR 4 million, although this would grow until the final year. Of course, in this case the buyer's total assets would also be reduced to 2.5 million euros + 1.7 million euros = 4.2 million euros. However, if we assume a slightly higher return of 6.1%, the tenant's assets grow to around 7.5 million euros.

Of course, the picture is similar in scenario 5, where a return of 5.8% instead of 6% costs the tenant around EUR 1 million in the end. However, in order to generate lower total assets than the buyer, the average annual return must fall to 4.9% - and even in this case, the tenant's assets grow until the last year.

We always calculate with average values - average rent increase, average increase in value, average return on the stock market. However, we all know that these average values can fluctuate extremely in the short term. What happens if the first few years on the stock market don't go as planned? What happens, for example, if the performance in the first 4 years on the stock market is negative, is -3% per year and the assumed 6% is only generated from year 5 onwards? In scenario 5, this ensures that the tenant's portfolio shrinks from EUR 7 million to almost EUR 4.75 million after 60 years. However, we are also saying goodbye to our estimated return of 6% per year, as the first few years deliver significantly lower returns. Strictly speaking, the average return is then only 0.97^4*1.06^56=x^60 => 5.375%. Due to the regression to the mean, these lean years should be followed by years with higher returns in order to achieve the 6% on average. If the negative return in the first few years can be offset by a higher return in the following years, the tenant's assets will be even higher in the 60th year, as the tenant was able to acquire units at a favorable price in the first few years. If, on the other hand, the global portfolio falls in the later years, this has a negative impact on the tenant's assets. However, this is nothing more than crystal ball reading, which is why we continue to calculate with the average value. However, as a crash on the stock market in recent years can be painful, it is important to have a sufficiently large portfolio to be able to withstand these fluctuations. Moreover, the housing market or the buyer's local situation in particular can of course also deteriorate drastically in recent years. The risk is therefore borne not only by the tenant, but also by the buyer.

In order to beat the buyer as a tenant, we therefore need a good return. It must be clear to everyone that a tenant with a balanced combination of fixed-term deposits / call money, bonds and shares will very probably achieve too low a return to beat a buyer.

What influence do value appreciation and rent increases have?

If property purchase prices rise more or less sharply in the future, this has no impact on the tenant's assets. Only the value of the property changes. For example, if property prices rise by an average of 3% instead of 2.6% per year, the value of the house will increase from 3.5 million euros to 4.4 million euros after 60 years without modernization and with constant maintenance. With a value development of only 2.2% per year, the value of the property after 60 years is only 2.75 million euros.

It is very likely that rents will also rise more sharply as real estate prices increase. These have a direct impact on the tenant's assets. If we assume average rent increases of 3% instead of 2.2%, the tenant's capital will only grow by 4.25 million euros in scenario 5 and 4.15 million euros in scenario 6. If, on the other hand, rents rise less sharply than assumed, namely by only 1.5%, the tenant's portfolio value will be around 9 million euros in scenario 5 and 8.9 million euros in scenario 6.

What influence do the conditions of the loans have?

Realistically, we will not see falling interest rates in the near future. Even the 2.65% assumed in the example for the first loan seems almost too low. However, the conditions for the second loan may well be lower again. As the buyer's assets considered here are not affected by changes in interest rates, let's take a look at the change in the tenant's assets.

If we assume an interest rate of 3.5% for the first loan and otherwise unchanged conditions, the tenant's assets in scenario 5 increase by over EUR 1.5 million to around EUR 8.6 million. Scenario 6 paints a similar picture with a final value of the deposit of approx. 8.45 million euros. This increase cannot even be offset by completely interest-free follow-up financing (e.g. in the form of a loan within the family). If we calculate with 0% interest and 10% repayment for the follow-up financing, the tenant still ends up with higher assets of approx. 7.85 million euros in scenario 5 and 7.75 million euros in scenario 6.

If we stick with the original assumption of 2.65% interest on the first loan and hope for an interest rate of 1% for the follow-up financing instead of the estimated 4% from the example, the tenant's final assets fall to 6.45 million euros in scenario 5 and 6.35 million euros in scenario 6. However, if the buyer somehow manages to reduce the interest rate on the first loan to 1%, the tenant's assets will fall to around EUR 3.95 million in scenario 5 and EUR 3.85 million in scenario 6 - despite the interest rate of 4% for the follow-up financing.

We note that the conditions for the first loan have a far greater influence on the final result than the conditions for the follow-up financing. Realistically, however, the conditions for the first loan are more likely to rise than fall in the foreseeable future, making the purchase of a property less attractive - even if we hope for very good conditions for the follow-up financing.

What has to happen for the buyer to win?

For the buyer to win, we have to adjust a few parameters. However, we will not change the initial rent or the purchase price, as these were taken from real existing offers and it would not be realistic to adjust them. Similarly, we will not adjust the loan costs for the first loan, as the chance of obtaining better conditions in the near future is very unlikely.

Assumption: Housing becomes scarcer, rents rise more sharply, interest rates fall. In this scenario, the interest rate for the follow-up financing could fall from 4% to 2%, for example. In addition, rents could rise by 2.8% instead of 2.2% per year. In addition, a broker is dispensed with, which would reduce the 3.57% brokerage fee to 0%. With these assumptions, the tenant's final assets in scenario 6 amount to EUR 3.9 million. Although it also grows in the final year, it is significantly (approx. 15%) lower than the buyer's assets. In scenario 6, these assumptions therefore lead to a slight advantage for the buyer. In scenario 5, however, this is not enough. For the buyer to win in scenario 5 as well, the rent would have to be increased by an average of 3% annually. The tenant will no longer feel these increases every 4 years, but every 2 years. If the interest rate for the follow-up financing then falls to 1%, the buyer is also the winner in scenario 5. It should be emphasized that even under these assumptions, the tenant's deposit grows until the last year.

Assumption: Rents rise slightly faster, the global economy cannot repeat the performance of recent decades. In this scenario, we assume slightly higher rent increases and that the tenant's deposit will not reach the 6% return per year. For the buyer to narrowly win the comparison in scenarios 5 and 6, rent increases would have to rise to 2.6% and the annual return on the portfolio would have to fall to 5.4%.

Significant adjustments to the assumptions are therefore necessary for the buyer to emerge as the winner. In particular, the estimated return on the portfolio has to be adjusted downwards considerably if the other variables are not to be changed unrealistically. However, the average return of a global portfolio is probably the one that can be predicted with the greatest certainty under all assumptions.

And what if things go better for the tenant instead?

But things can also work out just as well for the tenant. Even small changes can significantly increase the tenant's assets. Let's assume that rent increases are only passed on to the tenant every 5 years instead of 4 and amount to an average of 2.1% instead of 2.2% per year. If the deposit also grows by 6.1% instead of 6% per year, the tenant's final assets in scenario 5 already amount to EUR 8 million instead of EUR 7 million. With a deposit growth of 6.2% and rent increases of 2%, the tenant's assets can even be increased to EUR 9 million. These adjustments do not seem so unlikely to me. Especially the better performance of the global portfolio.

A single household in Berlin

To conclude this series of articles, we take another look at other residential regions and situations. We stick to the realistic assumptions from Part 2, but adjust the purchase costs, ancillary purchase costs, rental prices and relocations accordingly. We start with a single household in Berlin - typical for very high-earning @getquin -employees such as @Eunoia or @mariechristines . Our single person expects to live in a 3-room apartment with 90 square meters for the next 60 years. Since 60 years is a long time, the apartment should be as modern as possible when we buy it. Does buying or renting make more sense?

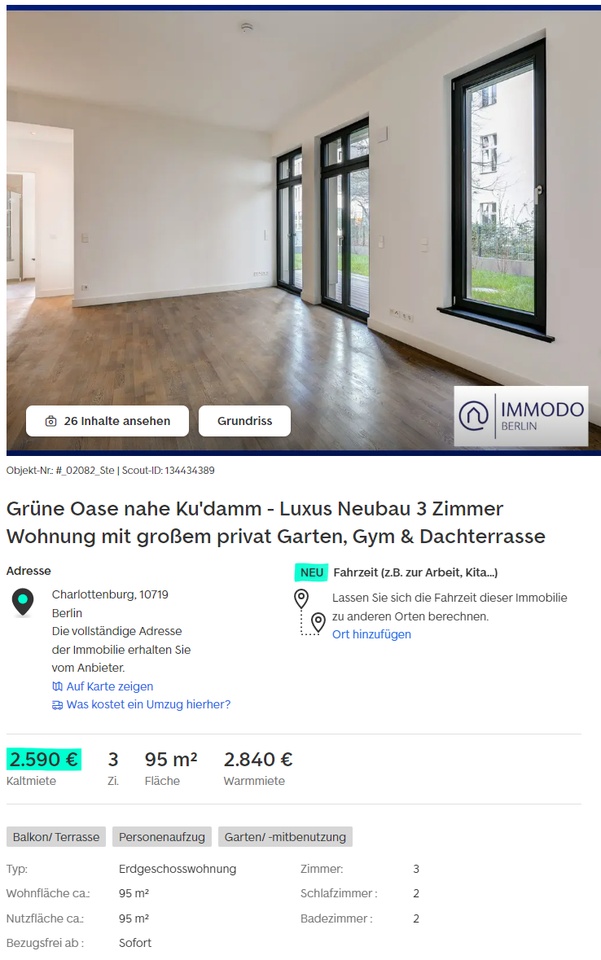

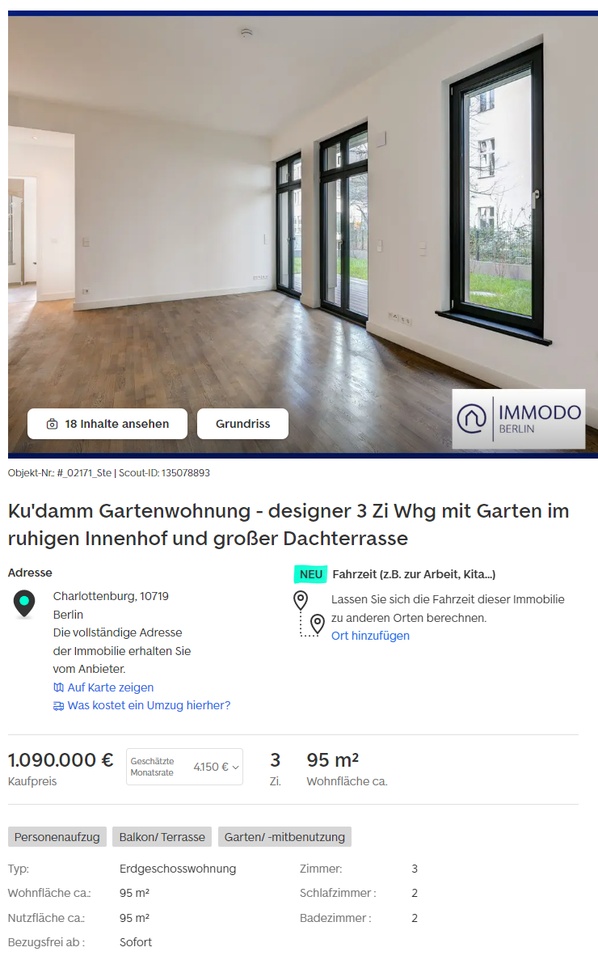

The challenge in Berlin is the incredibly wide price range of rental and purchase offers - even for similar properties in the same neighborhood. Fortunately, I was able to find 2 apartments in the same residential complex with identical layouts and furnishings on immoscout. One for sale and one for rent. We are talking about 95m² and 3 rooms on the first floor near Ku'damm. Year of construction is 2018, heated with district heating. The basic rent is 2,590 euros (7,770 euros deposit), the purchase price is 1,090,000 euros. Buyers bring equity of 250,000 euros with them. A screenshot of the properties can be found in the attachment.

We assume that the buyer will be able to reduce the price of the apartment to 1,000,000 euros. Estate agent fees, land register entry and notary fees are identical throughout Germany, only the land transfer tax is higher in Berlin than in Bavaria at 6%. Maintenance reserves of 237.50 euros are set aside + 12.50 euros for modernization, making an initial total of 250 euros. As this is an apartment, these maintenance costs must be paid up to the last year. The buyer must also set aside an additional 20 euros (+ inflation adjustments) for non-recoverable ancillary costs of an apartment (e.g. property management costs).

After 60 years, the tenant's deposit value amounts to approx. 5 million euros and grows until the last year. The value of the property is approx. 4.7 million euros. The result is therefore much tighter here, but this scenario also clearly favors the tenant due to the greater flexibility, the steady portfolio growth and the absence of cluster risk.

A childless couple with a desire for a garden and space in the country

So far, we have tended to look at modern and expensive properties. For the last example, let's take a look at Rhineland-Palatinate in the area around Pirmasens (thank you @Der_Leeh for the inspiration). A childless couple longs for a quiet life in the countryside and has no problem doing their own work on their dream home. So it can be a bit older. But with enough space, please.

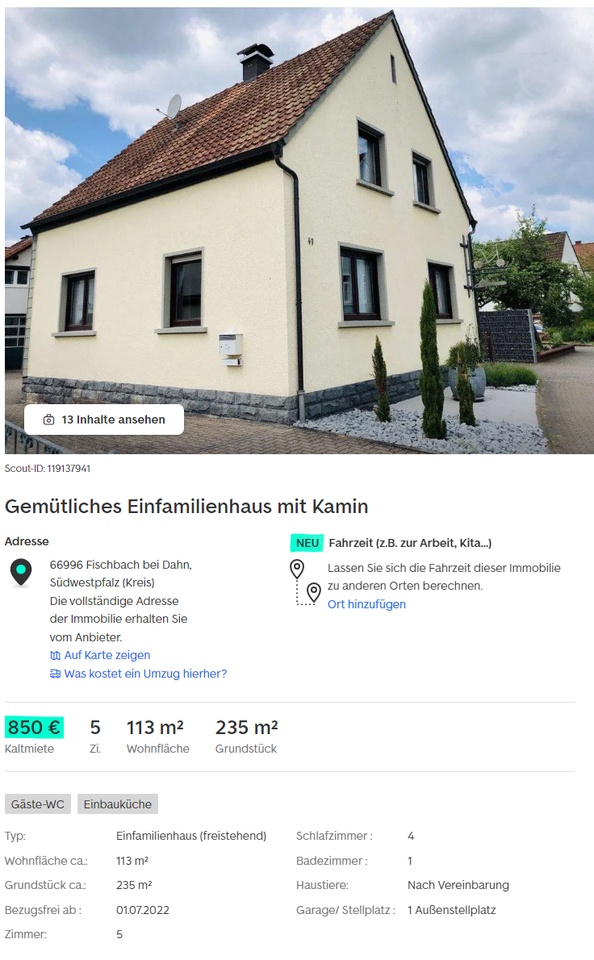

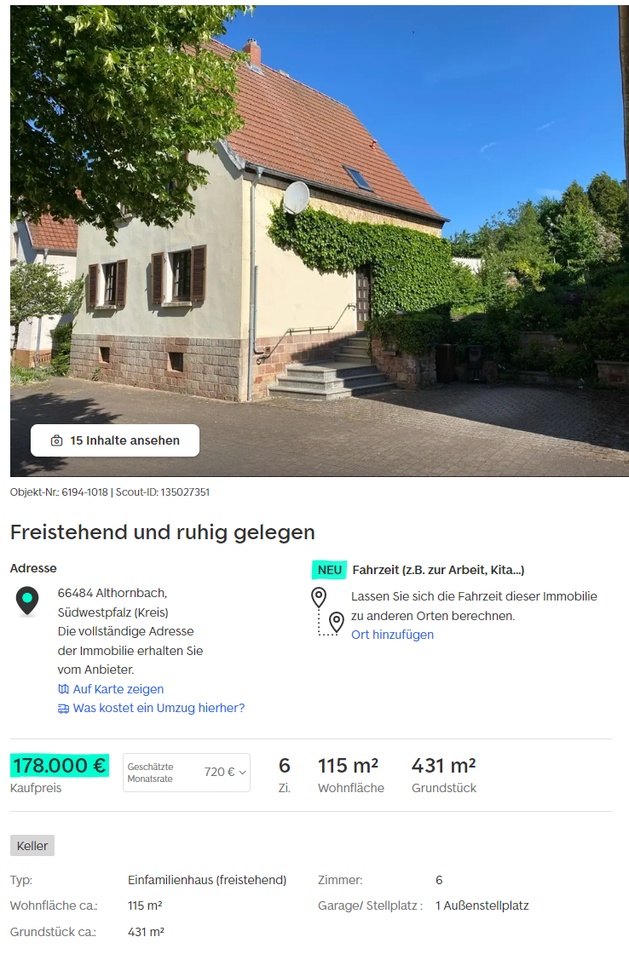

In contrast to Berlin, there are only a few offers around Pirmasens, which doesn't make the comparison any easier. Nevertheless, I found 2 reasonably comparable properties on Immoscout (screenshots attached to the article). They are both detached single-family houses with approx. 113m² (rental) or 115m² (purchase) of living space, 5 (rental) or 6 (purchase) rooms and 235m² (rental) or 431m² (purchase) of land. The apartment building was built in 1957 and last modernized in 2021 - among other things, the bathroom including underfloor heating was renewed. The house for sale was built in 1948 and is partially in need of renovation. For example, the large bathroom needs to be renewed.

The cost of the house for sale is 178,000 euros. Even if the purchase price can still be reduced, modernizations and renovations are imminent, which is why the total costs are calculated at 185,000 euros. Buyers bring 20,000 euros of equity with them and the land transfer tax in Rhineland-Palatinate is 5%. Maintenance costs are expected to be lower but at a higher percentage. These initially amount to 1,300 euros * 0.025 / 12 * 115 = 311.46 euros. The reserves for modernization should be set correspondingly higher due to the age of the property. In total, reserves of 375 euros are initially set aside, which are reduced to 150 euros / month after 50 years. A monthly payment of 850 euros and a one-off deposit of 2,550 euros are due for the apartment building. The remaining framework conditions are taken from the example in part 2.

In this scenario, the tenant's deposit actually falls to 0 euros in the 60th year. The tenant's savings are (just) not enough to pay the rent in the period under consideration. Accordingly, the buyer is probably in a better position in this case. Why presumably? Because the house is already 74 years old today. In 60 years, the house would be 134 years old, which is a very old age for a house, even with good and correspondingly costly maintenance. It is very likely that the house could still be lived in by the buyers in the last few years, but would then have to be demolished. The demolition costs must be offset against the rural property prices.

End of part 3

Thank you very much for reading my three really very long posts and commenting diligently ( @InvestmentPapa I'll never grumble about the length of your posts again). Personally, I am also faced with the decision of whether I should invest the equity I have saved up for a property for my own use in a global portfolio. So this series of posts was not entirely altruistic. The exchange with you has taken me a step further here and also the calculation of the various examples and the adjustment of the parameters has made it clear to me that this is a very individual decision per property.

If you have any tips or questions for me or have found any mistakes: Let me know in the comments. You can also simply leave me a carrot🥕 if you liked the series of posts. Otherwise: Don't worry, I promise you that I'll be back to lighter fare in the near future 😉.

#immobilien

#mieten

#alternative

#learn

#esel