$BTC (-0,51%)

@stefan_21

@TomTurboInvest

My dears,

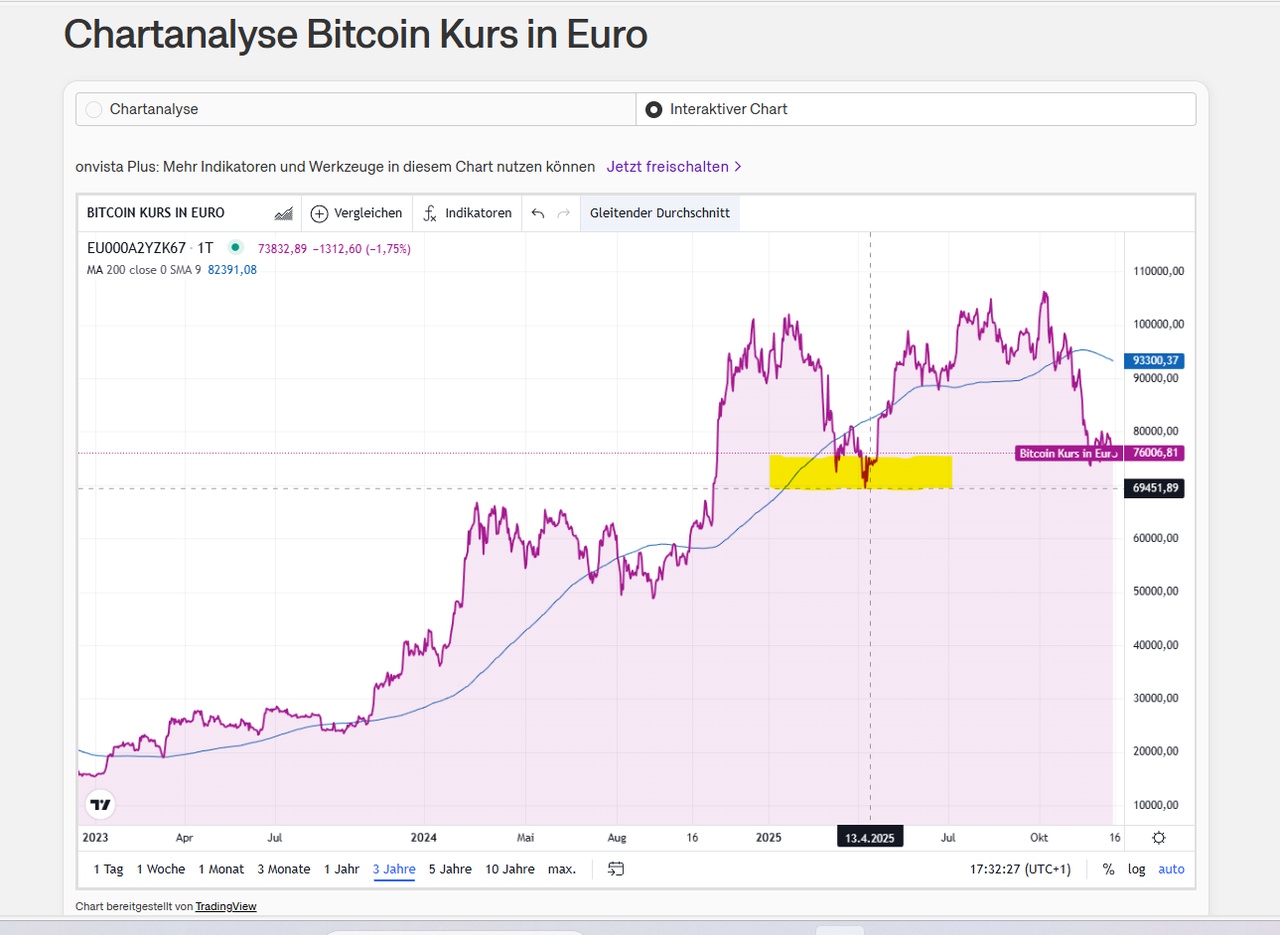

Things are getting very exciting for Bitcoin right now.

Will the important support level of €70,000 from April hold?

If it falls below 70,000, things could get uncomfortable again.

Market observers are speculating on everything from the smouldering conflict between the USA and Venezuela to fears of a collapse of holding companies such as Strategy.

Buying opportunity for Bitcoin?

Not a good outlook for Bitcoin, but some experts also see a buying opportunity in the current situation. For example, Tom Lee from Fundstrat recently expressed a positive view. The star analyst and head behind the Ethereum holding Bitmine expects the bull cycle to extend into 2026 and only then will new highs be reached.

Meanwhile, Gemini founder Cameron Winklevoss wrote on X (formerly Twitter): "This is the last time you can buy Bitcoin below 90,000 dollars!"

Dear all, on December 19, the Bank of Japan plans to raise interest rates.

₿ 4. impact on bitcoin & crypto

A stronger yen + rising Japanese interest rates means:

- Less cheap liquidity worldwide.

- Risk assets like Bitcoin often react with corrections.

Are you already buying Bitcoin or are you waiting for the reaction?

What do you think?