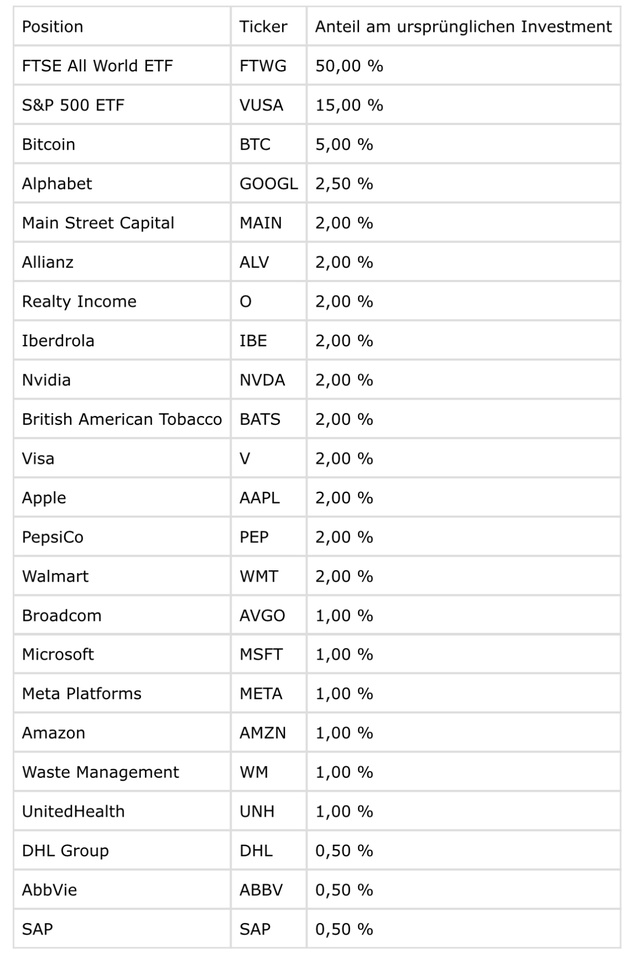

Hi Hi everyone, what does the swarm intelligence say about this fictitious portfolio? Focus on (dividend) growth + some high income players. High income is cool, but I don't want to leave any returns over this very long investment period. That's why the high-yield stocks are weighted quite low.

Half classically in Invesco's FTSE, where the dividends would be reinvested for the next few decades. Boost S&P to US + tech share. Otherwise it would be a bit too little for me. Otherwise of course a bit of Bitcoin, my favorite blue chips for exposure (incl. good divi growth :D)+ steady income stuff. Overall, I think the sector distribution + the country distribution are okay. Investment horizon is >40 years, so I can take the US cluster risk for now. The only thing that gives me a bit of food for thought is the weighting of the top 10 positions. That's a good 35%. Of course the Mag7 (well rather Mag6, Tesla falls a bit) + other blue chips and $BTC (-0,35%) . You can see the exact allocation by clicking on it below.

What do you think? Too much of a good thing? Too big a lump? I look forward to any feedback. :)