Hello everyone,

If you haven't read the first part yet, you should read this one first, because I'm going to refer to it directly and continue where I left off. $RKLB (+0,55%)

Part I: https://getqu.in/7y934F/

includes the points

1. foundation and history

2.the Electron success story

3.Neutron, a completely new dimension

this part is now about

4.Space Systems (Service), the true core

5.quarterly figures Q3 2025

6.personal assessment

4.Space Systems, the true core of Rocket Lab

I had previously perceived Rocket Lab as a rocket launch company, but when I looked at the balance sheets I realized something else:

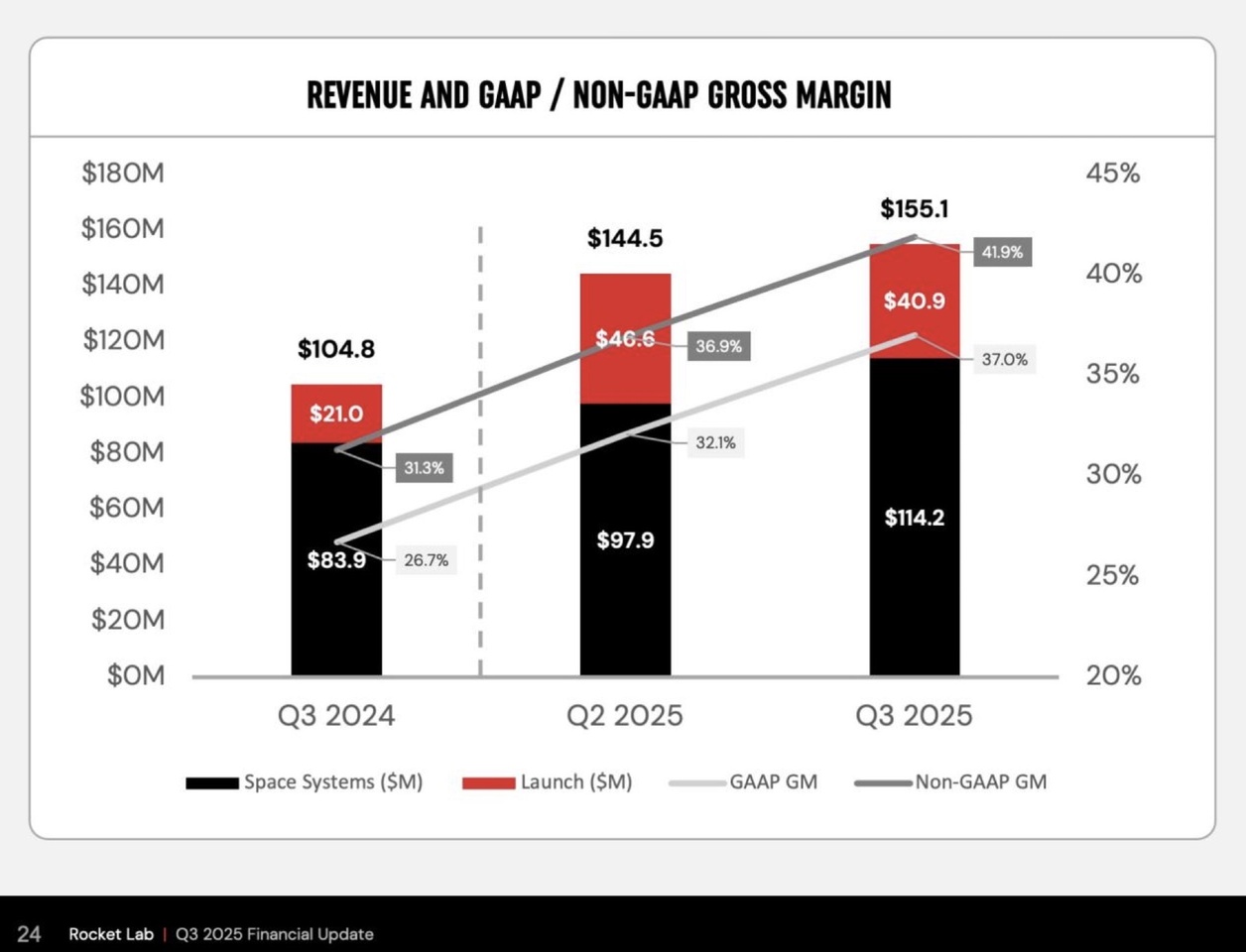

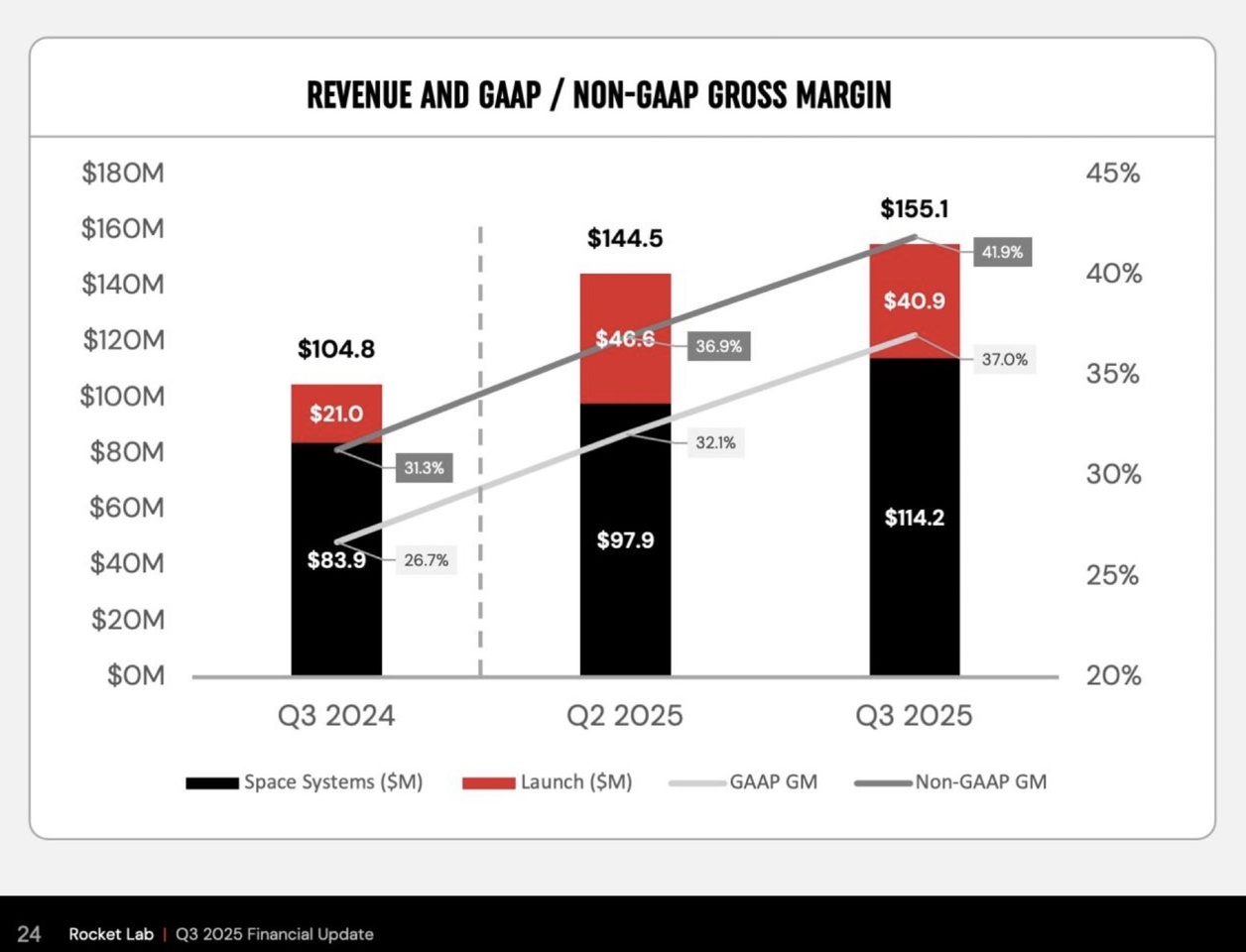

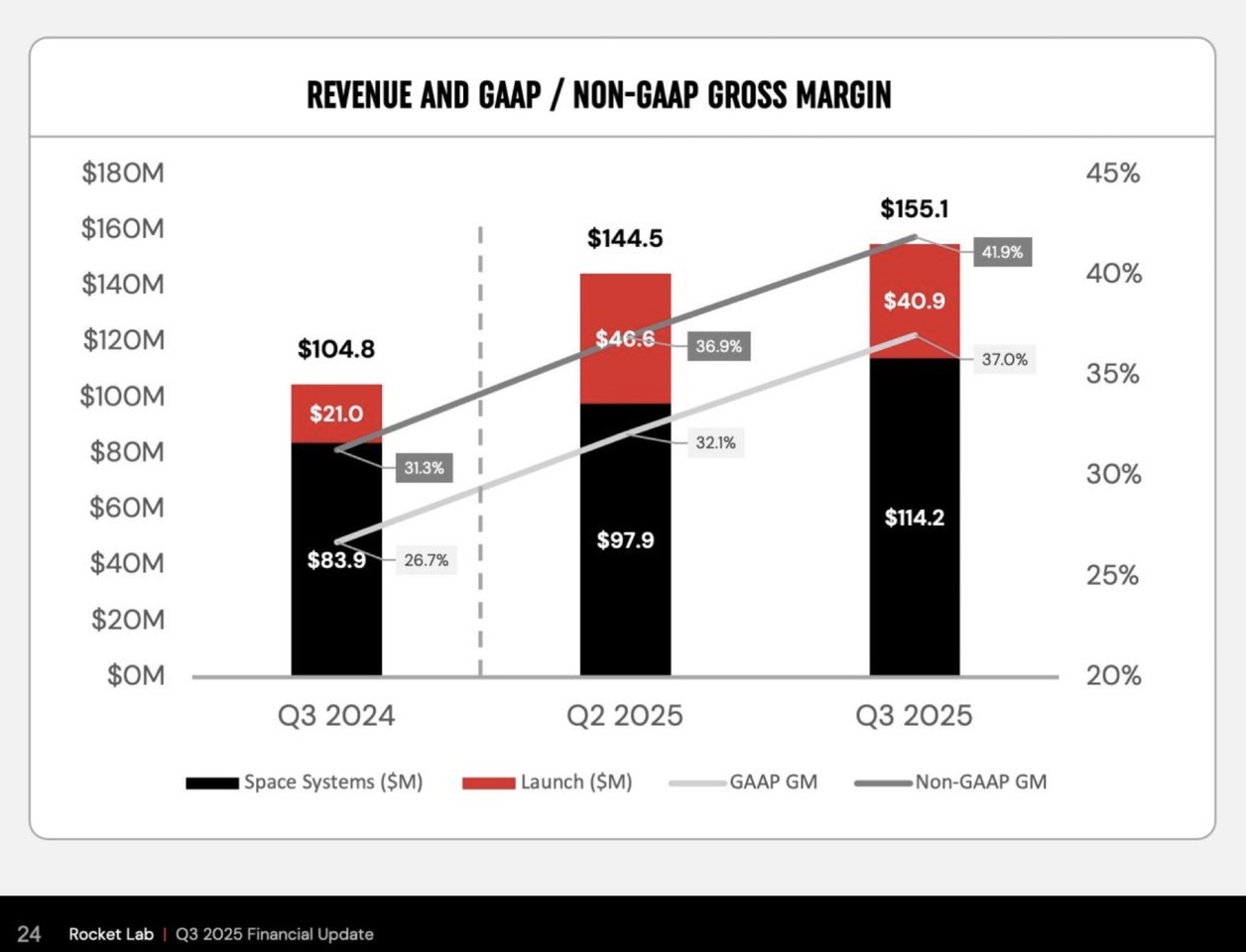

Just under 70% (that's the $114.2 million in black) of last year's revenue came from a division that wasn't really on my radar. Rocket Lab itself calls this division Space Systems. According to my research, this includes everything that has to do with the manufacture and maintenance of satellites, spacecraft and components such as solar panels for space.

For example Photon:

Photon is a "satellite bus" from Rocket Lab: in other words, a ready-made spacecraft platform with power supply, propulsion, communication and attitude control - based on the kick-stage of the Electron rocket.

This enables Rocket Lab to offer complete missions: Launch, transportation into orbit or even to the moon or interplanetary space, as well as operation and control of the payload - so customers do not have to build their own satellite hardware.

Space Systems also covers the area of data collected from space. This can be used, for example, to make statements about climate, weather, forest conditions, disaster forecasts, etc.

This means that Rocket Lab has a much broader base than I had initially assumed.

The advantage of this division is that you can achieve higher margins than in the launch sector and also generate recurring income.

Rocket Lab itself states that it wants to become an end-to-end provider.

In other words, the aim is to cover the entire value chain of satellites, space systems and constellations and thus generate stable, recurring revenue with a higher margin.

This segment also means that the company is not so dependent on individual large orders and rocket launches.

Another advantage is that you then have a better chance of winning larger government contracts, for example from NASA, because you can implement entire projects in one company.

Considering the growth of this segment, it makes perfect sense to me why the management at Rocket Lab has decided to place a clear focus on this area. Recently, Rocket Lab has acquired several companies to expand this area. I would be digressing too far if I were to include that.

In the course of the article, I will also calculate why this segment could possibly become even more lucrative than rocket launches (under point 6).

5th quarterly figures Q3 2025

The latest quarterly figures caused the share price to jump in the short term, even if the trend did not last long.

Nevertheless, I think it is worth taking a look at the figures.

Rocket Lab has clearly exceeded expectations for sales.

On a quarterly basis, turnover rose by 48 % compared to the previous year.

Just for comparison: SpaceX is forecast to grow 9-10% in 2025. (SpaceX had revenues of $14.2bn in 2024 and is expected to generate around $15.5bn in 2025)...

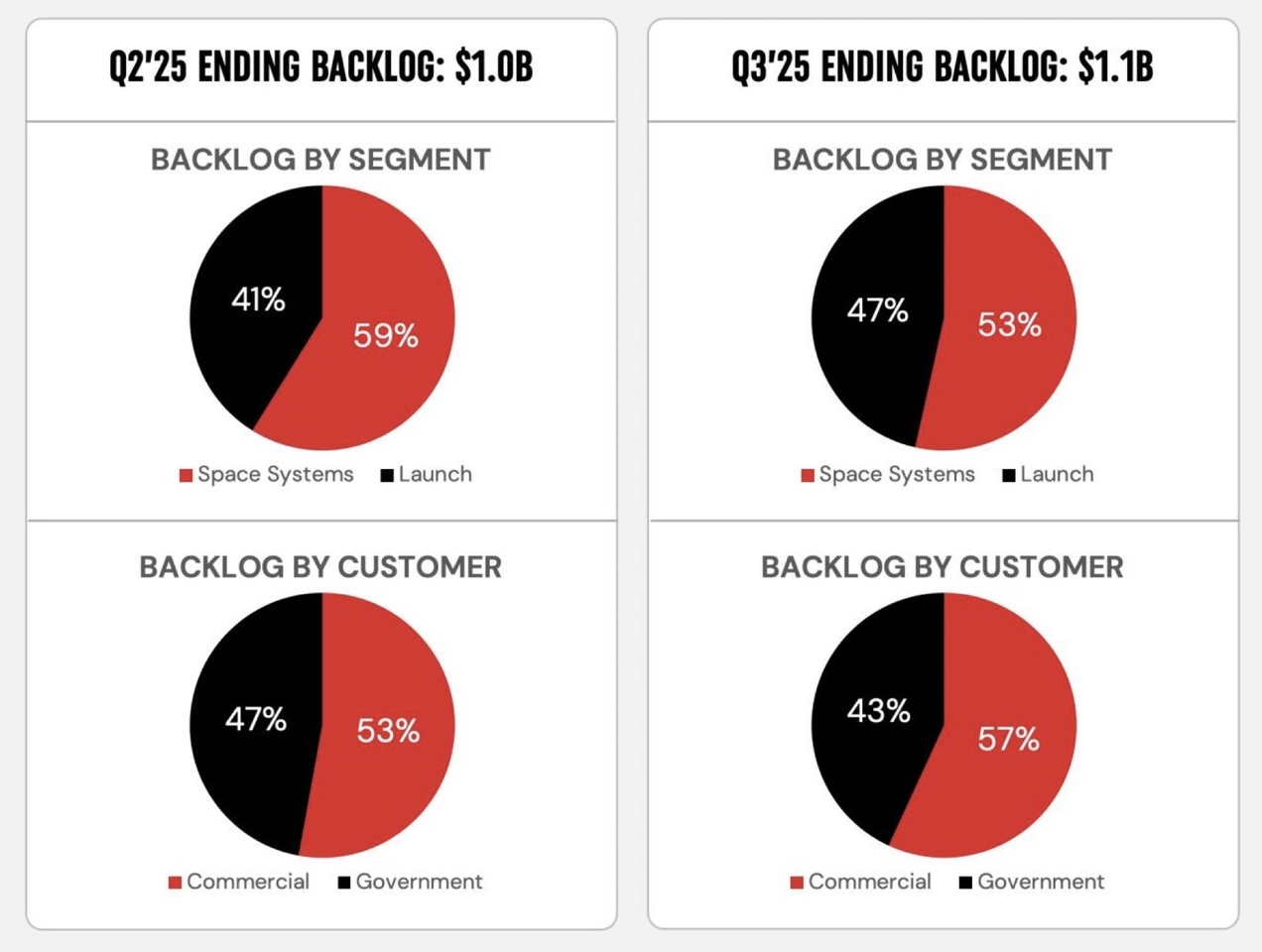

Rocket Lab was also surprised by the strong order backlog of around USD 1.1 billion, which is usually converted into sales within the next few quarters. The order backlog has grown by 10% compared to the previous year and shows a certain financial stability of the company!

This means that Rocket Lab will probably continue to present strong sales figures in the coming quarters.

Another point that struck me positively is the expansion of the gross margin to 37%, an increase of 10.3% compared to Q3 2024 (26.7% gross margin).

For me, these figures are a confirmation of the company's continued growth and long-term goals.

What disappointed some investors - and what I mentioned earlier:

The launch of the Neutron rocket has been postponed until the middle of next year. While progress has been made in the development and completion of Neutron, the company wants to minimize the risk of failure.

Of course, this represents a certain risk: If the management keeps postponing Neutron, the hoped-for growth spurt from Neutron could be postponed indefinitely.

If you have read this far, please write the word "Read" in the comments so that I can see if anyone here is interested! Thank you very much...

On the whole, however, I found the quarterly figures quite convincing, and I think the targets for the fourth quarter - to grow by another 15% or so compared with this quarter - are realistic and decent.

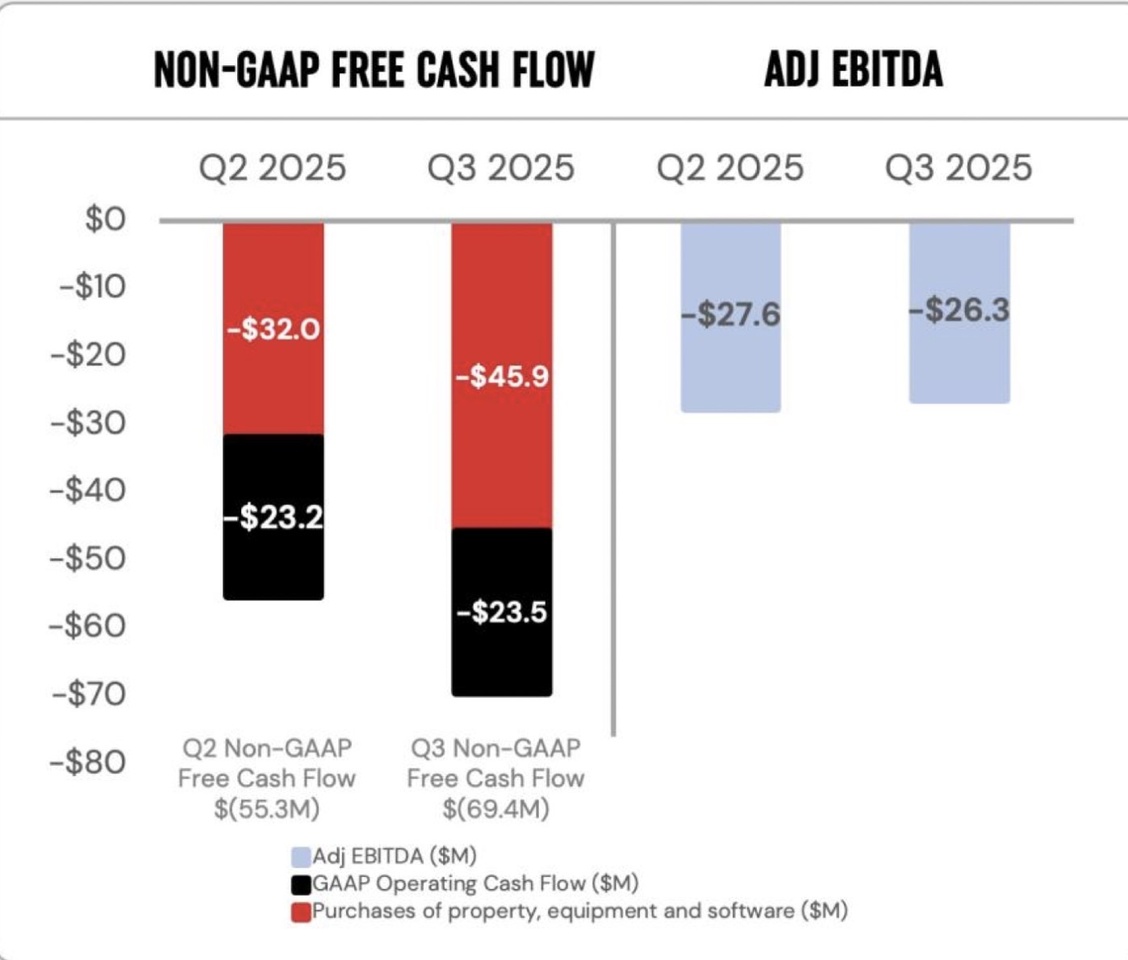

Another thing that should not go unmentioned is that Rocket Lab is not yet profitable. If Neutron were not in development, the company would already be making a profit, but the development of Neutron is still consuming a lot of capital and therefore Rocket Lab is not yet profitable at the bottom line.

Analysts see 2026 or 2027 as one of the years in which Rocket Lab is likely to be in the black for the first time. I think that this will also give the share another good boost!

6 My personal assessment

As you have probably read between the lines:

I am very optimistic about Rocket Lab! I see an exciting company here that is gaining market share - and has a real future project in the pipeline with Neutron. The development of the service segment and the solid growth have convinced me!

Here is a small calculation for the entire space industry:

Depending on the sources, I was able to find various figures on the internet for the size of the space industry as a whole.

In 2024, the space industry is expected to have a turnover of around 466 billion US dollars.

By 2030, the market is expected to grow to 700-1000 billion, i.e. 1 trillion US dollars.

I couldn't find a clear figure for the share of space services (i.e. everything except rocket launches). But it is estimated that around 80% of turnover in the space industry is accounted for by the service sector, at Rocket Lab the Space Systems sector, and not by rocket launches.

As mentioned above, the entire space industry is expected to roughly double in terms of capital over the next five years. I see a great opportunity to participate as an investor with Rocket Lab!

Let's assume that the calculation from the first part of my analysis is correct and that Rocket Lab will generate around $1.05 billion in revenue from launches in 2030 and that its share of total revenue will remain the same.

In that case

1.05 billion would account for 25-30% of sales, which would result in sales of $3.5-4.2 billion in 2030!

The best case scenario would of course be that Neutron launches successfully in the middle of next year and Rocket Lab can then quickly start commercial launches.

In addition, the Space Systems segment should be rolled out further and sales should be in line with expectations.

Then I am very optimistic that we will be talking about a market capitalization of 100-200 billion US dollars in 5-10 years.

Rocket Lab accounts for around 15-20% of my portfolio.

I currently see the market capitalization of around $20 billion as justified, but not significantly undervalued. Not a bargain, but a bet on the future✅ 📈.

I think it's important to mention that there are also risks - such as a Neutron failure, which could certainly weigh heavily on the stock. It's also important to keep an eye on costs so that the company is in the black as soon as possible. These are actually the two most important things I will be looking out for in the coming quarters.

I would also like to emphasize once again that it depends very much on your investment horizon whether you want to add the share to your portfolio! I have an investment horizon of probably over 40 years, and I'm actually pretty sure that a total loss through Rocket Lab won't destroy my social and family environment! The volatility and the risk are really high - but so is the chance of a tenbagger!

At this point, I would also like to recommend a read for anyone interested in Rocket Lab: Take a look at the article by @Shiya on the subject!

With this in mind, I wish you a lovely evening and a peaceful 1st Advent!

Please give me feedback so that I know what I can improve next time! As I said, this is my first analysis and your feedback is really important to me! In the next time following, the analyzes to $SOFI (+1,11%)

$IREN (+1,15%)

$PNG (+0,58%) and $HIMS (+0,83%) .

The positive response to the first post has really motivated me! Thank you very much!

Best regards, your small investor ✌️😁

@Tenbagger2024

@HoldTheMike

@Multibagger

@Hotte1909

@Semos25

@value_crafter_1628

@Shiya

@Aktienfox

@TheWorst

@TomTurboInvest

@TradingHase

@ImmoHai

@Seven0815

@Iwamoto

@SAUgut777

@EpsEra

@BamBamInvest

Sources:

https://www.eoportal.org/other-space-activities/rocket-lab

https://www.boerse-express.com/news/articles/rocket-lab-usa-aktie-insider-werfen-hin-845172

https://www.youtube.com/watch?v=fydHg0Z0TUw