Since dear @SAUgut77 nominated me, here are my #grüneostern .

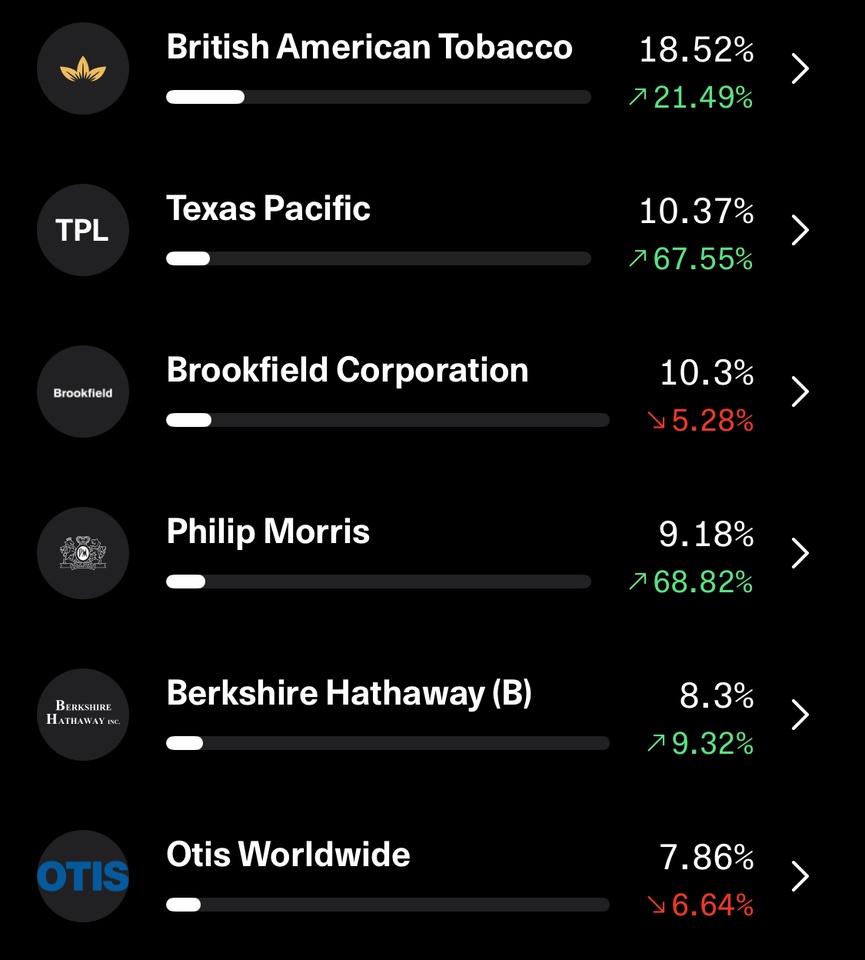

YTD is a small minus of 1.5%, in TTWROR even a small plus of 0.5%.

I slimmed down my portfolio quite a bit in the first few months of 2025 and the "crash" came in quite handy, even if I was very cautious.

I'm still staying away from big tech and somehow even the sale doesn't make the stocks palatable to me.

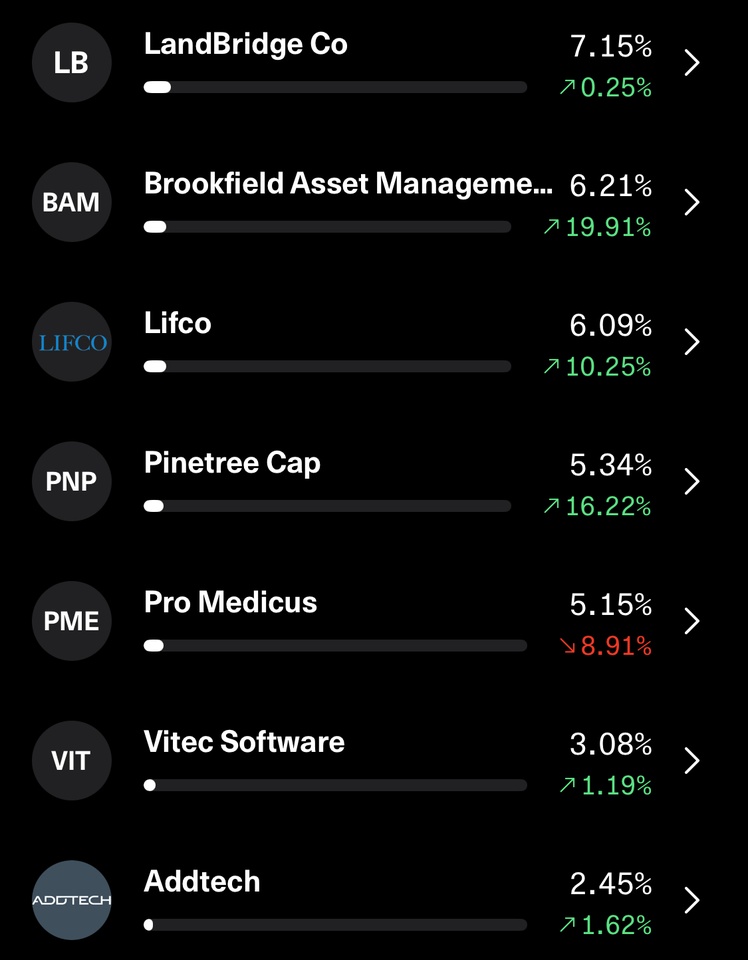

What I find really interesting at the moment $WPM (+0,47%) and other gold royalty companies. But also $BN (-0,37%) smiles at me.

Otherwise, I'm looking forward to the $PM (-0,89%) earnings (of course I'll have a great post about that)

So I'm completely satisfied.

I think most people have already been nominated and to be honest I can only think of the @ of @RealMichaelScott comes to mind