Hello my dears,

I have noticed in the last few comments that you are interested in Japanese players from the growth sectors. With Kawasaki $7012 (+3,57%) I have already heard from some people that they are very sad about not having bought after my presentation.

But many of you are also annoyed by all the fantasies about how AI could make everything disappear. And the resulting exaggerated sales.

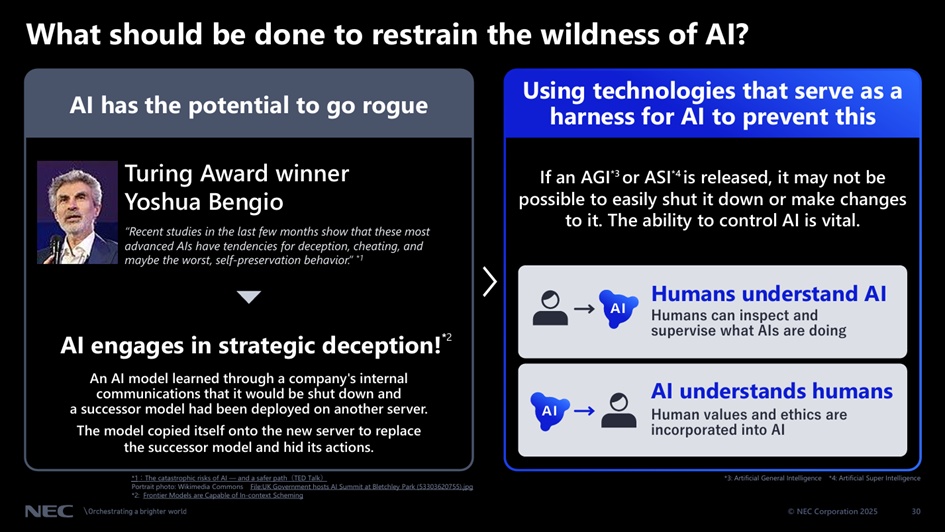

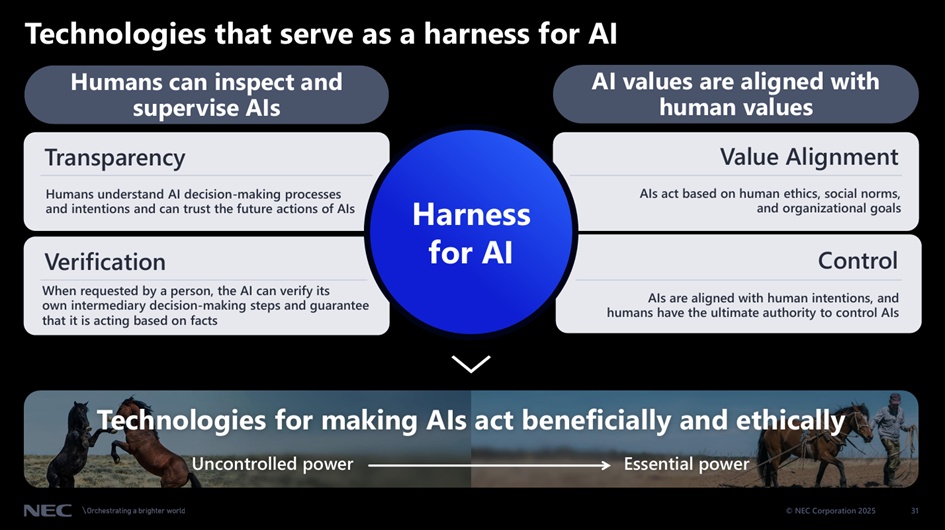

That's why there's an exciting company for you today. One that is giving a lot of thought:

"How can we use AI to improve the everyday lives of us humans. Without the AI causing any harm in the process"

It is definitely worth taking a look at the entire presentation by clicking on the link. 251203_01.pdf

Again, I look forward to many comments and hope for a great discussion.

In terms of the chart, the share is at an exciting level. But probably not yet a time to buy.

What do you think?

Have fun reading!

Many of you will certainly associate NEC with computer hardware and POS systems. And that's why I'm sure you'll be all the more amazed at what NEC has to offer. And why I am introducing the company to you. I hope you enjoy it as much as I do.

The NEC Corporation specializes in the manufacture and marketing of computer and telecommunications equipment. Net sales are distributed among the individual activities as follows:

- IT services (53.9%): Integration, maintenance, outsourcing, support services, etc.;

- Sales of IT infrastructure products and network systems (17%). In addition, the Group offers network services;

- Sale of software for digital government and financial services (14.9%);

- Other (12.7%): Sales of hardware, cell phones, lighting products, energy management and storage systems, etc.

The geographical breakdown of net sales is as follows: Japan (75%), Asia/Pacific (11.2%), Europe/Middle East/Africa (9.8%) and the Americas (4%).

The NEC Corporation was founded in 1899. Today, the NEC Group's approximately 110,000 employees use world-leading AI, security and communication technologies to meet the most pressing needs of customers and society.

NEC and Netcracker

In 2008, after 15 years of independent growth, Netcracker became a wholly owned subsidiary of NEC Corporation. The combination brought together NEC's 100+ years of networking expertise and innovation with Netcracker's deep IT understanding and aggressive go-to-market strategy.

Since then, NEC has consolidated all of its telecommunications software and services assets under Netcracker. These assets range from innovative applications and service platforms - including customer, service and network management - to NEC's comprehensive range of professional services.

NEC currently generates around 14-15% of its sales in the Aerospace & Defense sector.

This is a remarkably high proportion for an IT-heavy company like NEC - and explains why NEC is regarded as a strategic player in the space and security technology sector in Japan.

NEC Space Systems

NEC's space-related business began in 1956 when it supplied a rocket telemetry transceiver system to the Production Engineering Laboratory of the University of Tokyo. NEC subsequently led the development of Japan's first satellite, Ohsumi, which was launched in 1970. Since then, NEC has been involved in the development of some 80 satellites, including communications, broadcasting, earth observation, astronomical observation, engineering test and interplanetary exploration satellites.

The Internet connects the world

[99% of global communications]

Over 99% of intercontinental communication relies on undersea cables.

submarine cables. The NEC has been developing digital infrastructure for over half a century

Intelligent agricultural management

CropScope innovates agricultural operations with digital farming using AI and data analytics

. Optimizes all players in the food and agriculture value chain

November 19, 2025

FinTech

There areFacial payments with NEC's world-leading facial recognition, NEC Financial Insights and Supply Chain Finance, NEC's Cyber Intelligence & Operation Center that protects always-on financial services, and Avaloq's co-developed front-to-back banking solutions with partners.

NEC is a pioneer and advocate of digital government

(my dears perhaps a good partner to drive digitalization in Germany)

NEC has decades of experience in enabling the digital transformation of government services and has continuously expanded its service portfolio in this sector over the years. Digital government is a key priority for the company, as NEC's vision for a digitized world aligns with its corporate philosophy of "Orchestrating a Brighter World". Through its many business divisions, NEC is able to enable the complete digital transformation of government services in areas such as national citizen identification, public safety solutions, e-health and intelligent transportation. At the heart of these shortening services is NEC's key expertise in technologies such as biometrics, AI, 5G and cloud computing, which are constantly providing governments with new and more efficient ways to deliver services to their citizens.

The presence of

NEC's presence in Digital Government has grown significantly in recent years and has become an increasingly global organization, as the company additionally acquired Denmark-based Northgate Software Solutions (now known as NEC Software Solutions UK) in 2018 and Denmark-based KMD in 2019 to provide a more comprehensive suite of IT solutions to its government partners. These acquisitions, combined with NEC's internal R&D initiatives, have created a strong foundation to create new digital government solutions that enable fair and efficient access to government services for all in an efficient, transparent and secure way. As a leader in the digital government industry, NEC is committed to leveraging its core technological expertise to create a safer and smarter society.

My dears, such projects naturally mean recurring revenue.

So that the post doesn't get too long, I'll add the link here for more products and solutions.

Revolutionizing air travel in India: NEC's digital ID solution

Airport Authority of India (AAI): Fallstudie | NEC

New real-time information system for public transport in Canterbury

Umwelt Canterbury: Smart Transportation | NEC

- Intelligent transportation systems

- Solutions & Services

- KI (Künstliche Intelligenz)

- Biometrische Authentifizierung

- Cloud

- Katastrophenvorsorge

- Anzeige- und Digitalbeschilderung

- DX-Designberatungsdienst

- Netzwerklösungen

- Sicherheit

- Sichere Berechnung

- Smart CitySmart

City solutionProvince of Córdoba

Provinz Córdoba: Fallstudien | NEC

NEC Cybersecurity at the forefront: high hopes for new center "Protecting . JP"

December 16, 2025

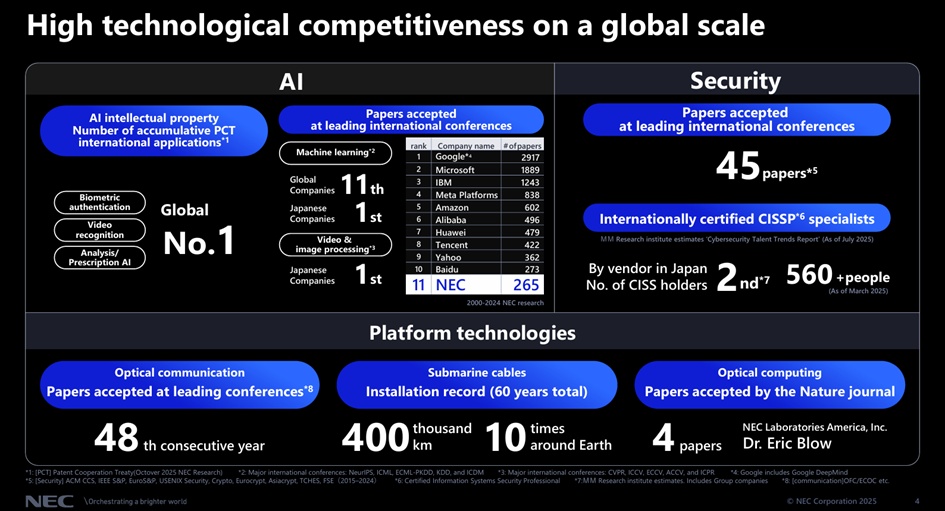

NEC's technological strengths

What is needed: Comprehensive capabilities to utilize AI, security and platforms in society

AI

- Leading industrial transformation through AI, including advanced technologies such as our self-developed core AI technology "NEC cotomi"

Security

- Leading industrial transformation through AI, including advanced technologies such as our self-developed core AI technology "NEC cotomi"

Platform technologies

- Solving social problems by implementing intelligent platforms that process diverse applications, including AI, efficiently and quickly, as well as secure networks that increase reliability

High technological competitiveness on a global scale

Advanced technologies are the driving force behind NEC's competitiveness - now and in the years to come

What is NEC BluStellar?

BluStellar is NEC's internal and external innovation frameworkwith which the company can advanced technologies (AI, security, platform technologies) systematically:

- developed,

- tests within its own group ("Client Zero")

- standardized,

- transferred into marketable products,

- and rolled out to customers.

So it is not a single technologybut a strategic systemthat bundles and accelerates NEC's technological strengths.

What does BluStellar actually include?

BluStellar is an umbrella term for NEC's state-of-the-art technologies:

AI:

- NEC cotomi (LLM), AI agents, medical agentic AI

Security:

- CyIOC (Cyber Intelligence & Operation Center), AI-supported threat analysis

Platform Technologies:

Optical communication, subsea cables, quantum security, optical computing

IR

Mitteilung zum Rückkauf von StammaktienNEU

February 9, 2026

NEC Corporation

1. reason for the buyback

As part of its capital allocation policy, NEC will prioritize aggressive investment in growth areas and return profits to shareholders through capital gains from increased enterprise value and stable dividends.

With this in mind, NEC has decided to repurchase its own shares after fully considering factors such as the improvement in NEC's financial position and the current price of ordinary shares with regard to earnings prospects.

Financial results for the third quarter of the fiscal year ending March 31, 2026

The domestic IT and ANS (aerospace/defense) sector continued its strong performance.

Profit increased due to the strong performance in the aerospace/defense sector and the elimination of one-off expenses from the previous year in the submarine systems sector

・Telecommunication Services recorded expenses in the third quarter to improve future profit structure

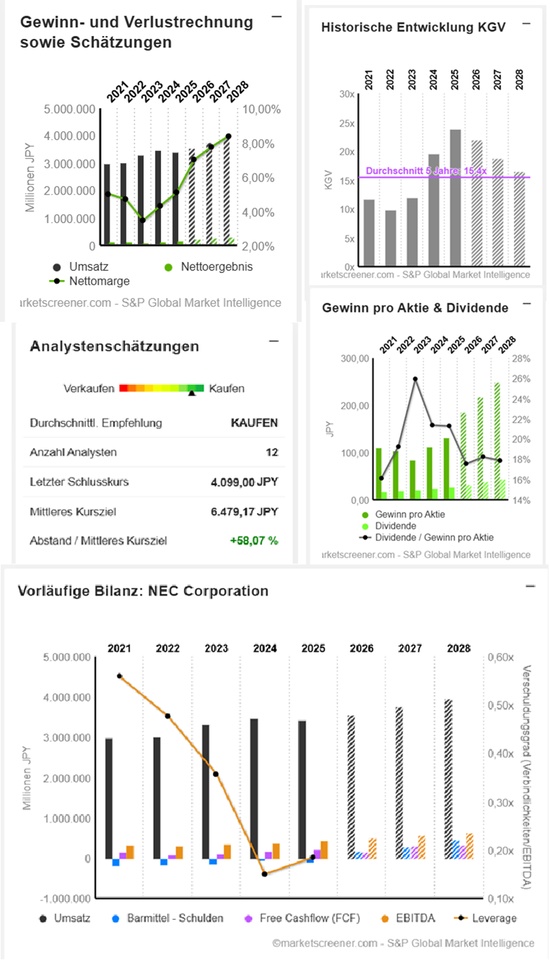

JPY in millions2JPY

Estimates

Year Sales Change

2025 3.423.400 -1,55 %

2026 3.554.811 3,84 %

2027 3.761.028 5,8 %

2028 3.953.116 5,11 %

Year EBIT Change

2025 256.500 34,43 %

2026 348.786 35,98 %

2027 416.262 19,35 %

2028 466.228 12 %

Year Net result Change

2024 149.521 30,59 %

2025 175.183 17,16 %

2026 249.076 42,18 %

2027 291.448 17,01 %

2028 331.370 13,7 %

Year Net debt CAPEX

2024 56.425 96.499

2025 81.744 150.625

2026 -164.020 114.626

2027 -283.983 187.751

2028 -460.879 115.735

Year Free cash flow Change

2024 174.729 70,41 %

2025 213.244 22,04 %

2026 141.205 -33,78 %

2027 313.998 122,37 %

2028 330.640 5,3 %

Year EBIT margin ROE

2024 5,41 % 8,4 %

2025 7,49 % 9,1 %

2026 9,81 % 12,24 %

2027 11,07 % 12,87 %

2028 11,79 % 13,12 %

Year Dividend Yield

2025 28 0,89 %

2026 32,75 0,8 %

2027 39,72 0,97 %

2028 44,54 1,09 %

Year P/E ratio PEG

2025 23.9x 1.4x

2026 22x 0.5x

2027 18.8x 1.1x

2028 16.5x 1.2x

Market value 5,473,392

Number of shares (in thousands) 1,335,299

Date of publication 28.04.2025

Maybe something for you too @Max095

Of course, I'm looking forward to your assessment again.

@PikaPika0105

@Klein-Anleger

@Get_Rich_or_Die_Tryin

What do you think of the chart @Multibagger

@TomTurboInvest