A crazy first month of the year lies behind us. Here is the report:

Asset Performances 01/26 (as of 30.01.)

3xEU50: +5.4%

3xQQQ: -2.7%

3xGLD: +23.0%

3xGTAA Depot

29.12.25: 103.300€

30.01.26: 115.600€

Wikifolio certificate

29.12.25: 159,00€

30.01.26: 177,61€

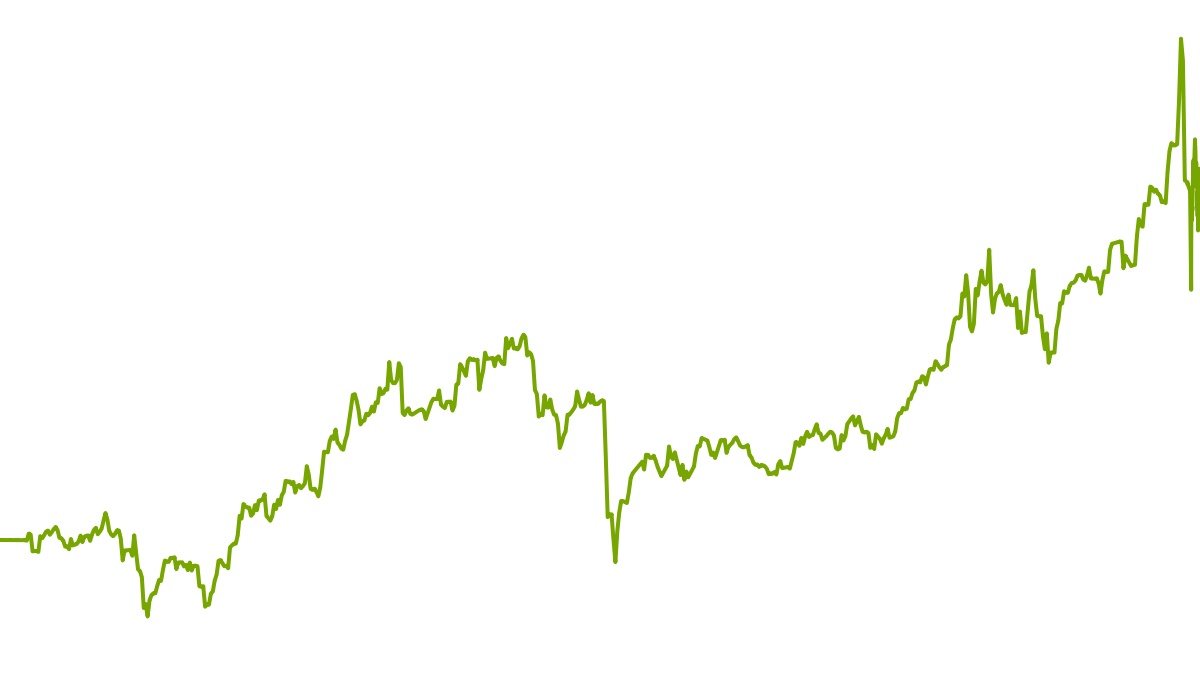

Month: +11.7%

YTD: +11.7%

Review 01/26

January was essentially characterized by the high volatility of gold. In the meantime, the performance of 3xGold was +100% in January, only to lose 2/3 of this within two days. That's the way it is with flagpoles. I was tempted to sell part of the gold position after the small recovery on the first day of the crash, but rules are rules.

The high gold volatility had a massive impact on the performance of 3xGTAA. From the high on 29.1. to the low on 30.1. the loss was around -22%. This should once again make every investor aware of the risks inherent in the strategy. In the end, however, it is like this: flagpoles are normal for strong uptrends and 3xGTAA is systematically invested in uptrends. So the current vola is a systematic part of the strategy. Or to put it another way: this is not only what you accept, but also what you want - to be in on the action.

Overall, the strategy has still had a very good month at +11.7%, with or without the gold spike.

Outlook 01/26

There is an interesting change in the 3xGTAA allocation: 2xWTI moves to the top 2 position of the Momenta, but 3xEU50 drops out. This means that on Monday, in addition to the rebalancing, there will be a reallocation for the new allocation: 3xGold, 3xQQQ, 2xWTI. I expect significant fluctuations in February, as the market seems to have lost its balance somewhat. We will see where they take us.

Report from the 3xGTAA workshop - The optimal weighting of the strategy

As already announced in the Wikifolio FAQ and requested by many, I would like to share a few thoughts on the optimal weighting of a strategy like 3xGTAA.

Most long-term investors among you weight intuitively, as it feels good and right. But feelings can be deceiving in the stock market. Intuitive private investors regularly occupy last place among investor types. This is also the case with 3xGTAA: most of them weight the strategy as it suits them, 2%, 5%, 10%. Even specific target weightings are just shot from the hip. Why is that? Studies show that a high proportion of stock market success depends on the weighting of asset classes and strategies. So if you don't want to leave this important aspect to chance, you should ask yourself the question: How do you determine the "objectively" best weighting of an asset in a multi-asset portfolio?

Modern Portfolio Theory (MPT) deals with this question. Explaining this in detail, including the basic assumptions of financial market theory, mathematical models, main and secondary approaches, would go too far here (perhaps material for a more detailed article?). So let's keep it brief and as simple as possible. First of all, you should decide what you actually want with your portfolio: maximum return, minimum risk or maximum risk/return ratio.

If you only want maximum return regardless of risk, you simply invest 100% in the asset from which you expect the highest return. The problem: there are risks (see FAQ for the Wikifolio), so a certain degree of diversification is always advisable.

If you want minimal risk, then simply invest 100% in the asset from which you expect the most security, e.g. overnight money. The problem: no risk, no return.

The optimum risk/return ratio lies somewhere in between. A key figure for this is the so-called Sharpe ratio (ratio of return and vola), which can be measured for a given portfolio and optimized by weightings. This sounds charming, but it has two problems: firstly, you need a lot of data, e.g. the monthly returns of the various assets and the correlations between them. This can be used to create a covariance matrix, which then calculates the optimal weights of the assets based on the "max. Sharpe ratio". This is quite complicated. But the real problem is a second one: The data comes from the past and the matrix only calculates the optimal weighting for the past. As long as future returns and correlations are unknown, such portfolios are likely to be too risky.

To avoid both problems, I find the "risk parity" approach interesting and simple. The idea behind it is that we are much less able to estimate the returns of an asset than the risk (= vola). We also know that diversification reduces the overall risk of a portfolio. The risk parity approach tries to do justice to both by attempting to weight the risks of the assets in the portfolio equally so that they balance each other out most efficiently. In other words, each asset brings the same amount of risk to the portfolio: double risk, half weighting. The actual calculation of an allocation can be simplified with a few assumptions, e.g. that all assets are equally correlated ("naive risk parity"). Two examples with 3xGTAA (works with all portfolios and allocations).

1st portfolio: MSCI World ETF, 3xGTAA

Step 1: Determine the average vola of both assets (10 years, e.g. on justetf.com, wikifolio.com):

MSCI World ETF = 15%pa

3xGTAA = 45%pa

Step 2: Weight both assets in inverse proportion to the vola.

Vola ratio: 1:3, i.e. weighting 3:1

Final equal risk weighting: 75% MSCI World ETF, 25% 3xGTAA

2nd portfolio: MSCI World, Gold, BTC, 3xGTAA

Step 1: Determine vola (10 years):

MSCI World = 15%pa

Gold = 15%pa

BTC = 60%pa

3xGTAA = 45%pa

Step 2: Inverse weights:

Vola ratio: 1:1:3:4, = (kgV 12) 12/1:12/1:12/3:12/4 = 12:12:4:3 (total = 31)

I.e. weighting: 12/31:12/31:4/31:3/31

Final equal risk weighting: 39% MSCI World, 39% gold, 13% 3xGTAA, 9% BTC.

The results are likely to deviate significantly from what most people's intuition would suggest. But, as I said, this is the basic decision that everyone has to make for themselves: Intuition or rationality.

I hope these considerations have shed some light on the optimum weighting of 3xGTAA. In my portfolio, by the way, it is around 25%.

Your Epi