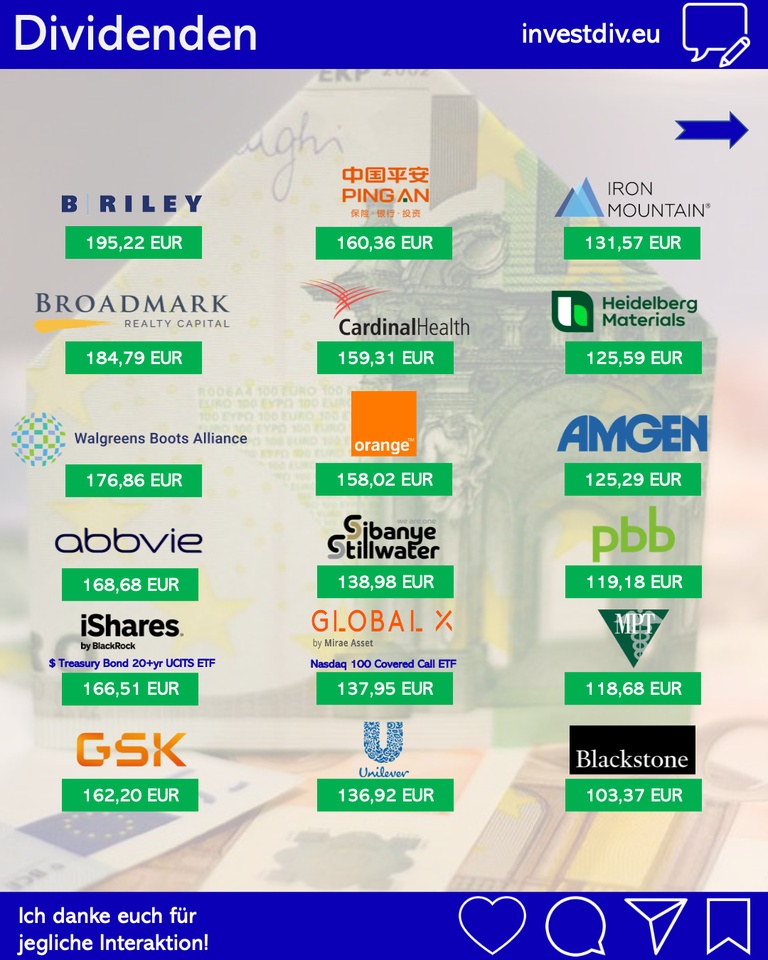

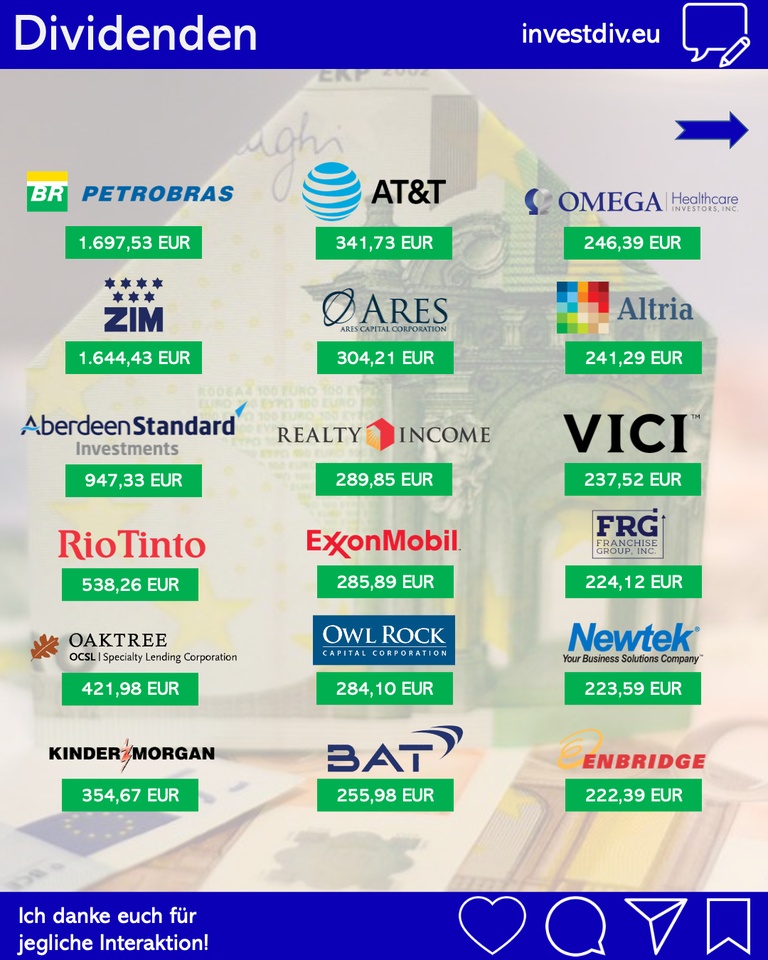

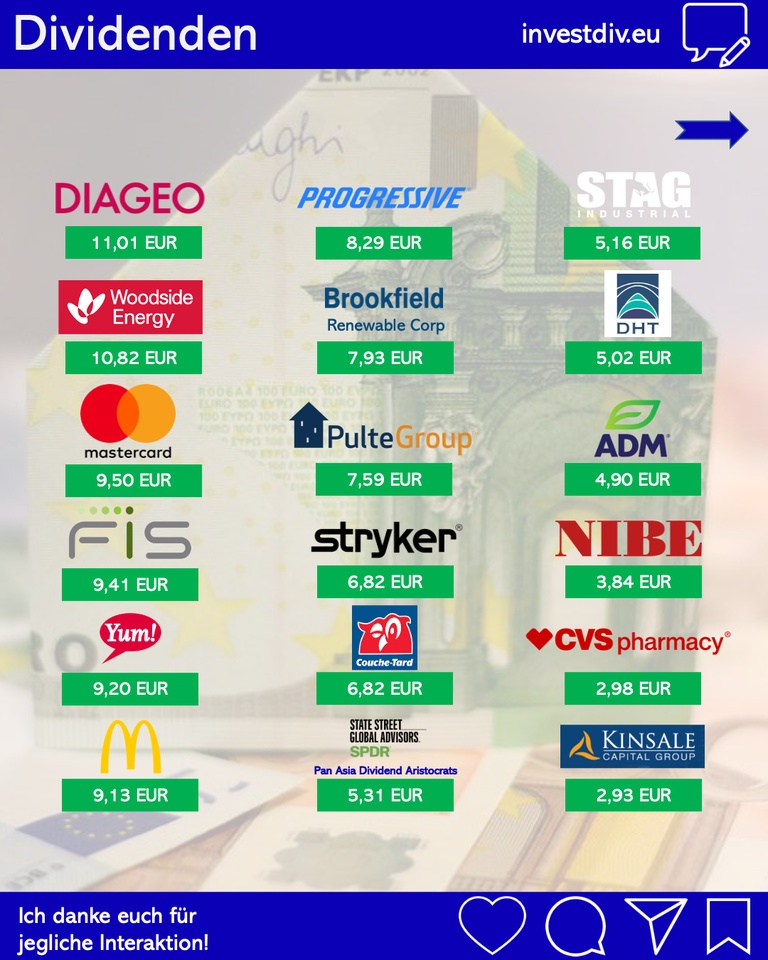

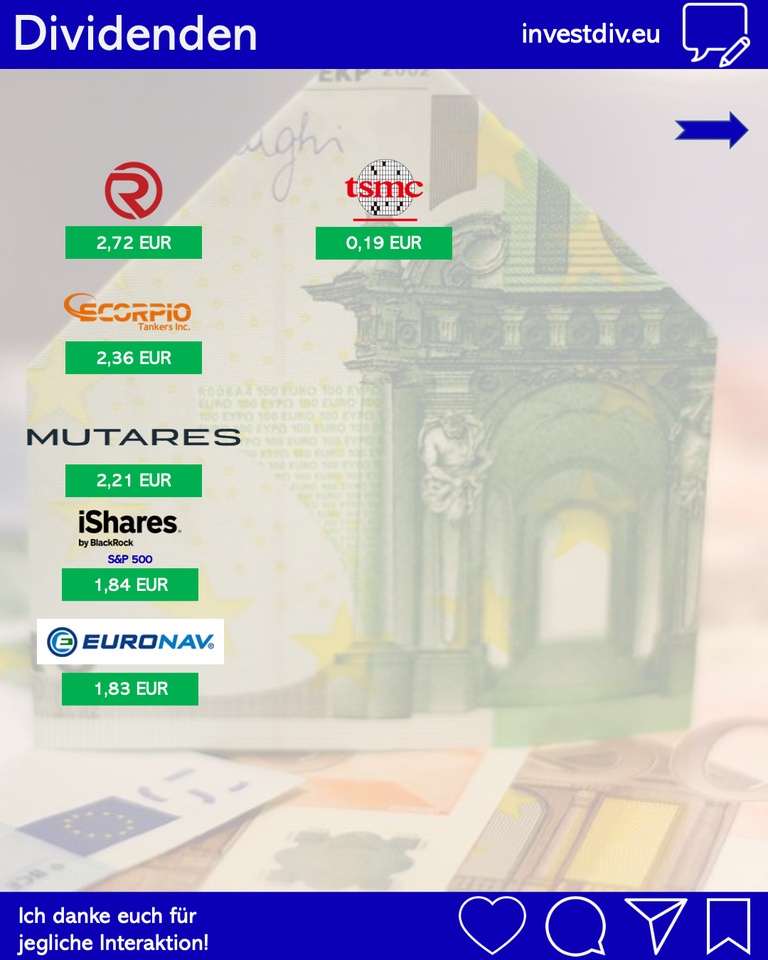

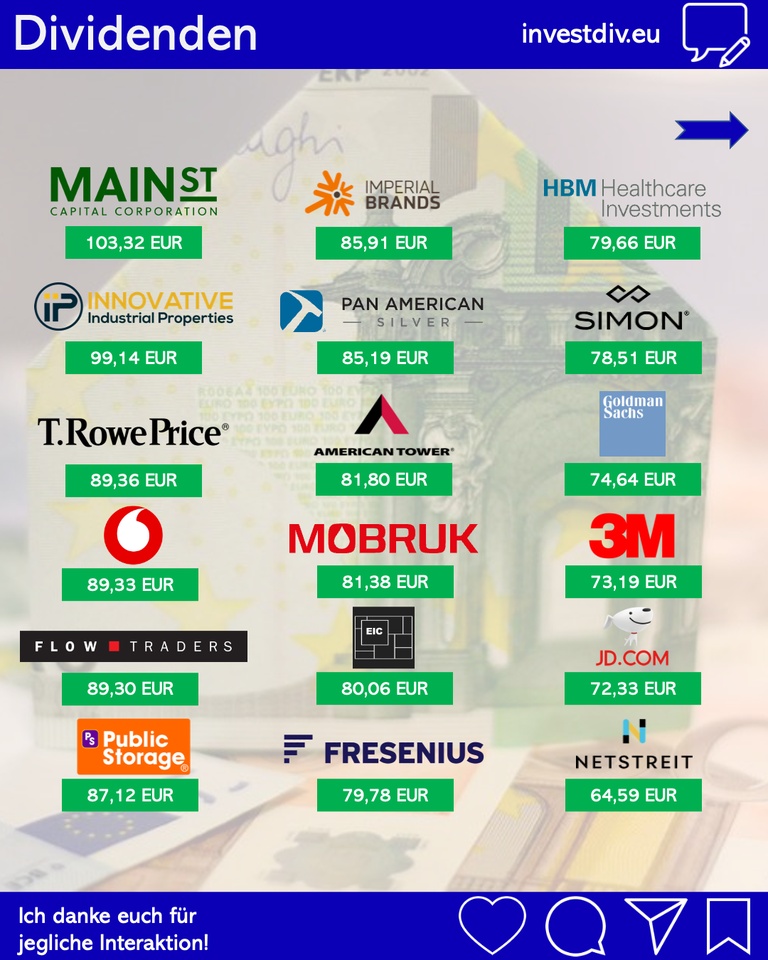

✌️ All dividends 2022 ✌️

Hi there and welcome to 2023 🙋♂️. For the past year I have again collected all dividends😅.

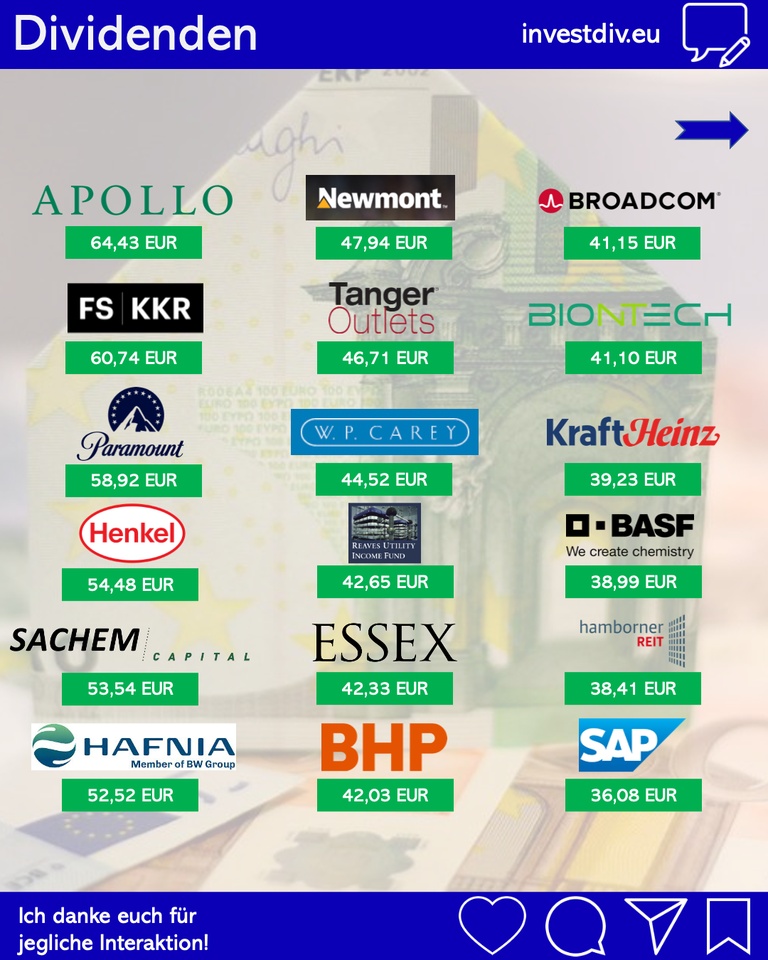

➡️ I took the data from Portfolio Performance, where I enter all dividends, interest, etc. (yes I do that in addition to getquin!). In total there are not quite 15,000 EUR.

➡️ The whole thing is net dividends, but of course there are still taxes open here and there.

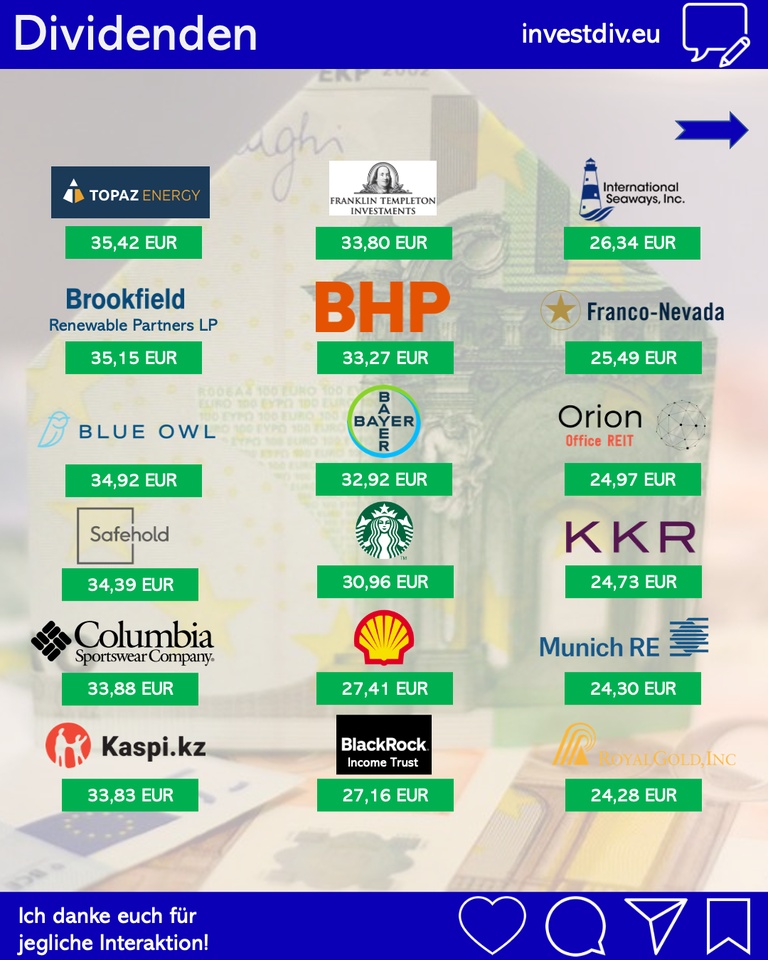

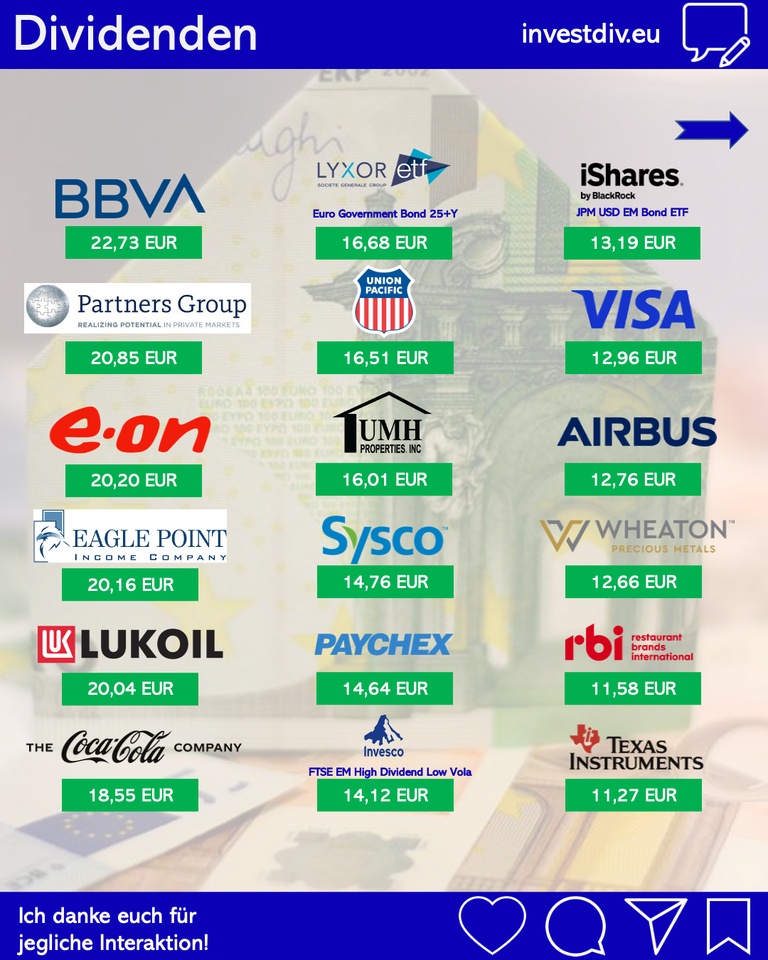

➡️ Some stocks are now no longer in the portfolio, e.g. Eagle Point Income or $PBB (+2,26%) .

➡️ Other values appear twice, for example Brookfield Renewable ($BEP and $BEPC) or BHP (Ltd and PLC).

How much dividends did you collect in 2022?