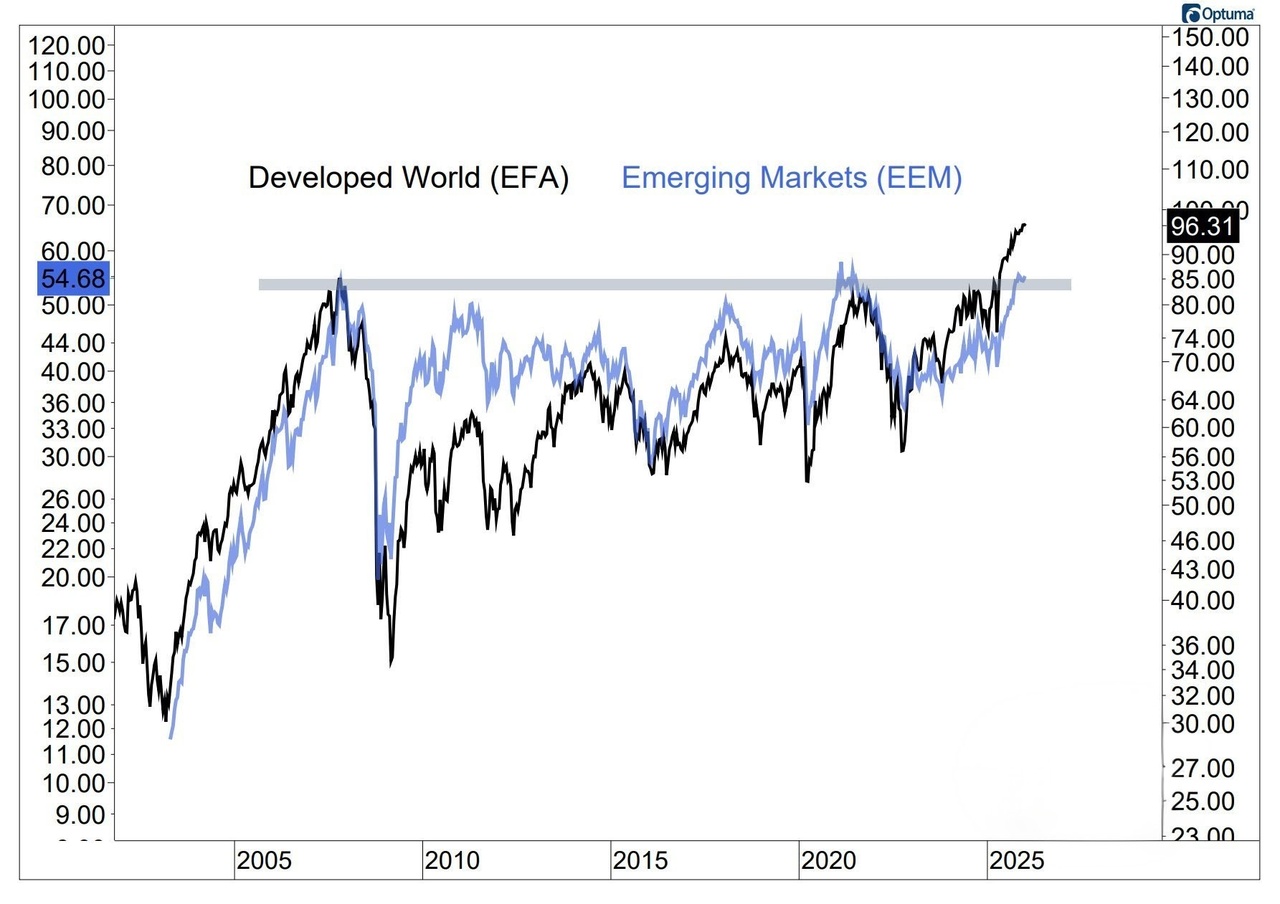

While $EFA (-0,89%) has already broken through its 20-year resistance, is $EEM (-0,73%) just before it. Technically speaking, this is an extremely bullish signal, which is also supported by fundamentals. The dollar index remains under pressure and has already lost around 10% of its value this year. $MS (-1,65%) The US dollar index is forecast to fall to 94 in the second quarter of 2026. This would massively reduce the pressure on EM debt and increase the attractiveness of EM currencies for carry trades. This benefits $EFA (-0,89%) from the massive AI infrastructures, such as $TSM (-4,34%), $005930. China's planned shift from export dependency to greater domestic consumption in 2026 is also a potentially powerful catalyst, if it happens.