Artificial intelligence (AI) is gaining widespread acceptance in the healthcare sector. "85% of organizations in the healthcare sector are starting to implement AI solutions," says Kristoffer Karl Unterbrunner, portfolio manager at Medical Strategy, a fund provider specializing in the healthcare sector.

The potential of AI in the healthcare sector is immense

While the global market for AI in the healthcare sector was worth around 29 billion US dollars in 2024, according to the market research institute Fortune Business Insights, sales are expected to increase by an average of 44% annually to 504 billion US dollars by 2032.

The potential of AI is particularly high in the field of radiology. Integration into imaging procedures such as MRI makes diagnoses faster and more precise.

The pioneers include Siemens Healthineers

$SHL (+0,17%) from the leading German DAX index .

"The company is benefiting from the sharp rise in demand for AI-supported diagnostics and strict European regulation, which is boosting confidence in its solutions," says Jens Klatt, analyst at online broker XTB.

Analysts rate Siemens Healthineers positively

Siemens Healthineers, the global market leader for CT, MRI and X-ray systems, has access to billions of medical image and laboratory data every day. This anonymized data flows into the company's own AI system "Sherlock". The Erlangen-based company has already integrated more than 80 AI applications into its imaging systems.

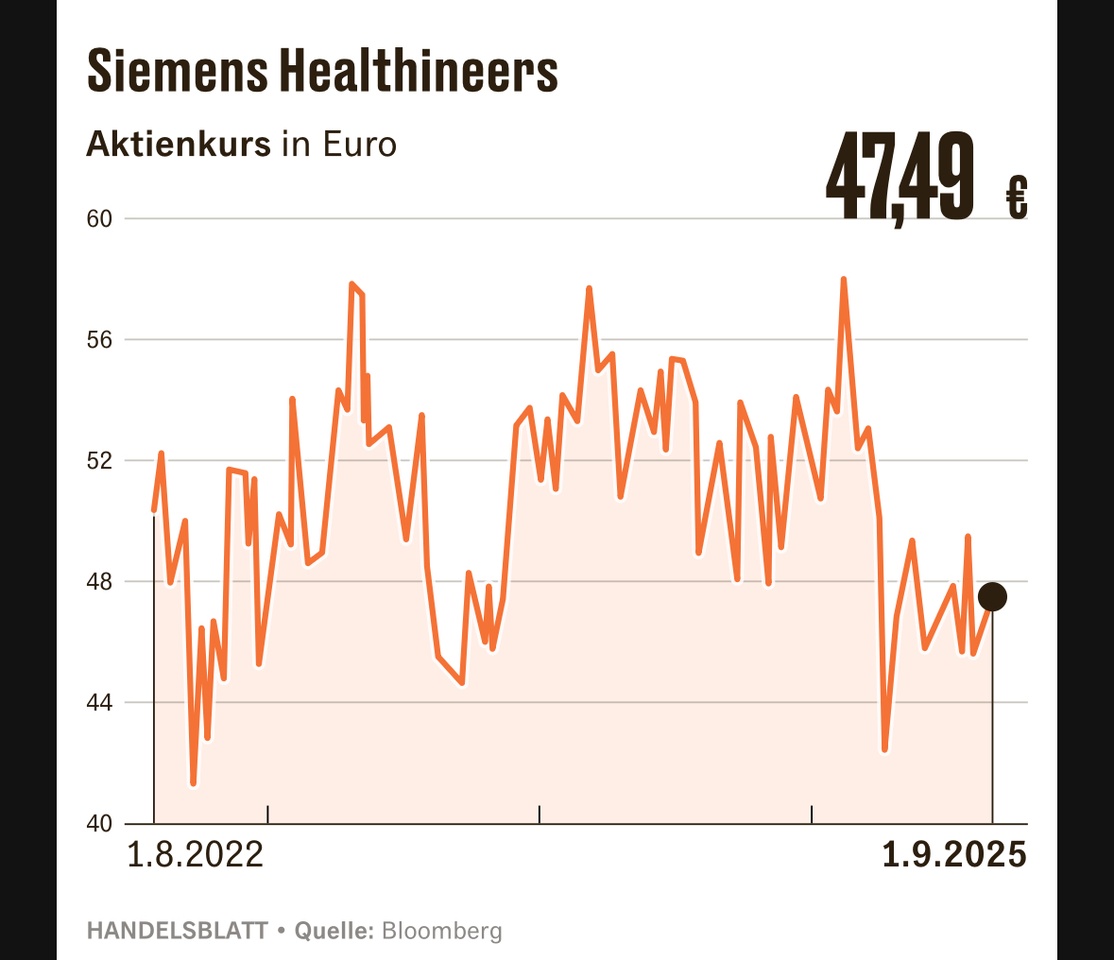

Siemens Healthineers exceeded analysts' expectations in the past quarter with a 7.6 percent increase in revenue to 5.7 billion euros compared to the previous year. Net profit rose by 18 percent to 556 million euros.

The analysts' assessment is positive. With an average analyst price target of 62 euros for the next twelve months, there is still potential of around 33 percent. According to the financial data provider LSEG, 20 analysts recommend buying the share, two are neutral and one advises selling.

AI is also finding its way into surgery

This is what the US company Intuitive Surgical

$ISRG (+1,23%) . It is known for its Da Vinci platform. This is a robot-assisted surgical system that supports surgeons in their work. Intuitive Surgical has developed the system over decades and also uses AI.

Da Vinci can even compensate for minimal tremors in the human hand. "The system can process enormous amounts of data and gain insights that improve the training of surgeons, optimize surgical techniques and standardize results," says Tom Riley, Chief Equity Strategist at fund provider Axa Investment Managers.

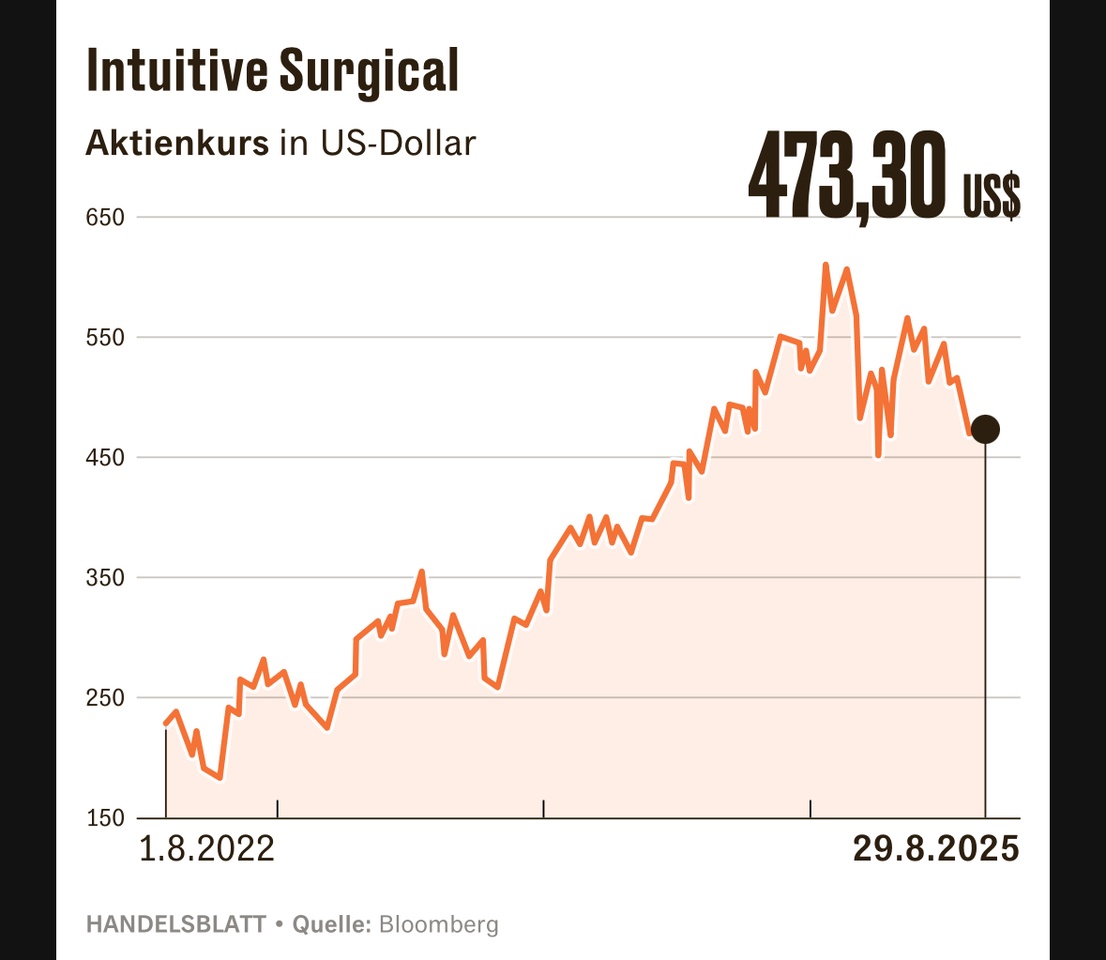

The global market leader exceeded expectations in the second quarter. Turnover rose by 21 percent to 2.4 billion dollars. Earnings per share increased by 23 percent to 2.19 dollars. However, the share is valued extremely ambitiously with a price/earnings ratio of 58 based on the profits expected for 2025.

According to LSEG, 22 analysts recommend Intuitive Surgical as a buy, eleven recommend holding the stock and one advises selling. With an average target price of 594 US dollars, there is a potential upside of 25 percent.

Source text (excerpt) & graphics: Handelsblatt, 02.09.25