Once a celebrated shooting star, now in the crossfire of the AI debate. Is the winning streak of Shopify in danger?

The flag may fly again tomorrow

Shopify belongs to a group of Aktienwhere the narrative changes completely at irregular intervals.

There were times when the company was seen as an alternative to Amazon as an outdated and unprofitable problem candidate, at times no price could be too high, then none too low.

In the last 2-3 years, the share has experienced a renaissance. The operating successes were remarkable and the share price increased almost tenfold.

For some time now, however, a new narrative has emerged and the share has come under significant pressure.

The stock market is currently dominated by one topic. There is growing concern that traditional software providers and SaaS platforms such as Shopify will be replaced by new, KI-focused competitors or alternative technologies.

This debate has led to a veritable "bloodbath" in the software sector. With share price losses of just over 30%, Shopify has come off relatively well compared to many other companies in the sector.

I will spare you the debate about possible disruption at this point. We have already examined this topic in detail using a number of other examples.

There is a certain risk of disruption for almost every company, and this risk has always been above average in the software sector, as small teams of developers repeatedly bring outstanding products to the market - in case of doubt, a single brilliant mind is enough.

Understanding disruption risk: Checklist for investors

However, it may be helpful if I provide you with a checklist that you can use to assess the risk of disruption for companies.

Factors that can Risiko can reduce the risk:

- A fundamentally high level of customer loyalty and a strong contract commitment.

- High switching costs for customers (monetary, training, data migration).

- Deep integration into the customer's existing IT landscape or work processes.

- Customer loyalty through a community, ecosystems, data, networks or additional services.

- The software is a core component of critical business processes.

- High dependency on company-specific data.

- Customizing / tailored workflows and applications.

- Complexity of core functions (difficult to replicate using AI).

- Proprietary algorithms or models.

- High regulatory hurdles in the background.

- Regulated industries / safety-critical software.

- Long project durations for customers.

- Exclusive database / first-party data.

- Strong brand / market leadership.

- Unique selling points that are difficult to copy.

- Highly specialized solutions.

- Integration of AI in own offerings.

On the touchstone

These are the first points that come to mind. In essence, it can be summarized as follows:

The deeper the software is integrated into the customer's work processes and the higher the switching costs, the less likely disruption is. The lower the potential savings, the less interesting a change is.

The risk is particularly low if the software provider can offer an exclusive database or network, as this cannot be copied.

In contrast, the risk of disruption is particularly high when it comes to standardized and interchangeable products. Especially open, easily reproducible functions or low-code.

The hardest hit could be software that has previously performed tasks that can be automated by AI. Such systems could effectively become obsolete.

What does this tell us about Shopify?

Anyone evaluating Shopify on the basis of the previous list, which by no means claims to be exhaustive, will come to a mixed conclusion.

Shopify's customer loyalty is high for a number of reasons and so are the switching costs. Anyone who has ever switched a website from one system to another knows what I'm talking about.

Many merchants use Shopify for core processes such as order processing, warehouse management, payment processing. Payments, taxes and issues such as legal compliance require a stable platform and trust - this cannot be replicated overnight.

In addition, Shopify's range of services is so large that it would be very difficult for an AI startup to copy everything.

On the other hand, it can be argued that new AI providers could put a strain on new business in the future.

For example, if you look at how quickly you can create websites and online stores with the help of AI, the question naturally arises as to whether this will have a negative impact on Shopify's growth.

The same applies to marketing campaigns and other individual features. Shopify customers don't have to move their entire store to the competition. It is enough that individual services are no longer used and are replaced by other providers.

Shopify is booming

Countless AI start-ups are working day and night to make life difficult for Shopify. But this is nothing new, it's been a matter of course since the launch of ChatGPT in 2022 at the very latest.

If you look at the business figures, Shopify's competitors have not been successful so far,

In the time since AI has become ubiquitous, Shopify has significantly increased its revenue from USD 7.06 billion to USD 11.56 billion.

Free cash flow has more than doubled from USD 0.94 to USD 2.15 per share.

No problems were evident in the financial year just ended. At the bottom line, sales increased by 30% to USD 11.56 billion and the operating result by 36% to USD 1.47 billion.

Free cash flow improved by 26% to USD 2.01 billion.

The value of all goods and services processed via Shopify's systems climbed to the impressive sum of USD 378.4 billion in 2025 (compared to USD 292.3 billion in the previous year).

There was also no sign of a slowdown in growth momentum over the course of the year. In the final quarter, growth amounted to 31%.

The operating result rose disproportionately, which also indicates that Shopify is still able to hold its own against the competition.

First cracks?

The only blemish is the FCF margin, which fell slightly from 18% to 17% in the last financial year.

Shopify attributes the decline primarily to increased investment in AI tools and platform development to secure future growth.

The much bigger problem, in my view, is that this trend could continue.

For the first quarter, Shopify is forecasting an increase in revenue in the "low 30 percent range", i.e. continued high growth.

However, gross profit is expected to increase at a somewhat slower rate, in the "high 20 percent range".

The FCF margin should even fall slightly over the course of the year

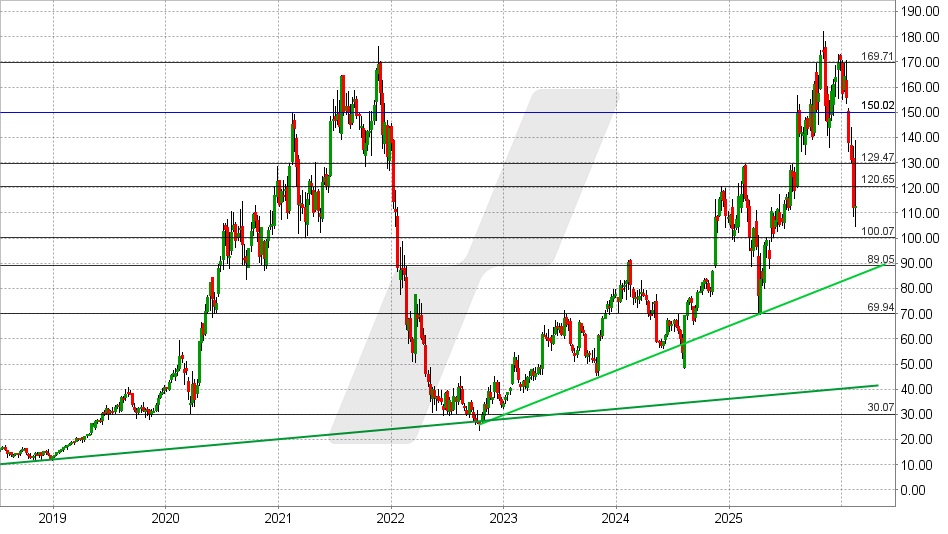

Shopify share: Chart from 16.02.2026, price: USD 112.70 - symbol: SHOP | source: TWS

Changes on this scale should not be overestimated, but it could be a first sign that competition has become tougher.

It is equally possible that this is not due to external effects, but simply to the fact that the Merchant Solutions segment is currently growing faster than the even more profitable Subscriptions Solutions division.

According to consensus estimates, FCF is likely to increase by 32% to USD 1.87 per share in the current financial year.

Shopify therefore has a multiple of 60 and is therefore unlikely to be an option for many investors.

However, it is also true that Shopify has almost been Börsengang just over ten years ago, Shopify has been valued almost consistently higher.

The same applies to other Kennzahlen. The P/E ratio is currently 12.3, for example. The long-term average was 17.7 and the average over the last five years was 16, despite the share price collapsing in the meantime