Hello dear 3XGTAA fans,

EDIT: there are still a few misconceptions in the model, if they are clarified I will delete the amount and repost it corrected.

now that you have seen in my first part(https://getqu.in/fPyOV5/) how I synthesized the assets, today it's about the backtest of the strategy itself.

3xGTAA

As the 3xGTAA has changed several times over time, here is a short and clear summary of the strategy:

The assets of 3xGTAA

- 3x Nasdaq 100

- 1x Bitcoin (BTC) (as of 2018)

- 3x Gold

- 1x money market

- 7x USD / EUR

- 7x EUR / USD

- 2x oil

- 5x US Treasuries (TLT)

- 3x Euro Stoxx 50

- Money market

Rules of 3xGTAA

On the first trading day of the month, take all assets that are above the 150SMA.

Sort them according to the 1+3+6+9 month momentum in descending order.

Select the top 3 assets and hold them each with 1/3 of the capital, special rule if no 3 assets are above the 150SMA money market is bought.

The marginal assumptions of the backtest

My aim for this backtest was to replicate the strategy as realistically as possible. This means that I tried to take into account all costs and fees that would be incurred in a real trade.

These include:

- Spread, I have set this at 0.2% per trade.

- Ongoing costs of the wikifolio (0.95% p.a.)

- The Highwater Mark fee of the Wikifolio (5% of the profit), unfortunately this is calculated on a USD basis and not in euros, which can lead to small inaccuracies - but all in all these should be negligible.

- At the end of the term, I tax the profits of the wikifolio at a flat rate of 26.375% (capital gains tax + solidarity surcharge), but I always give you the result before taxes.

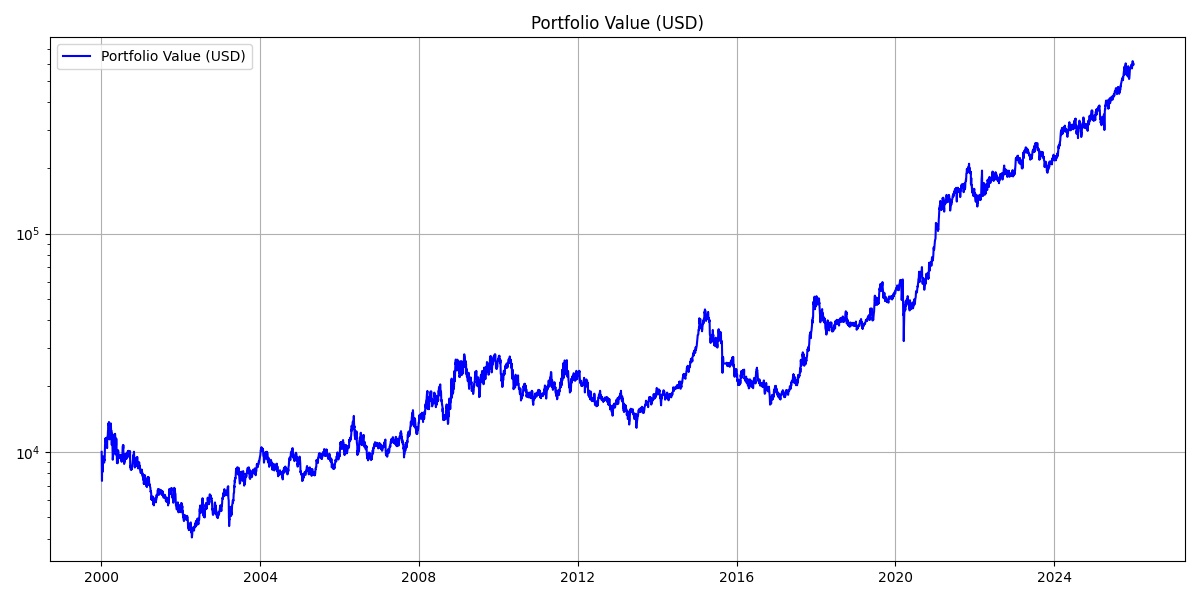

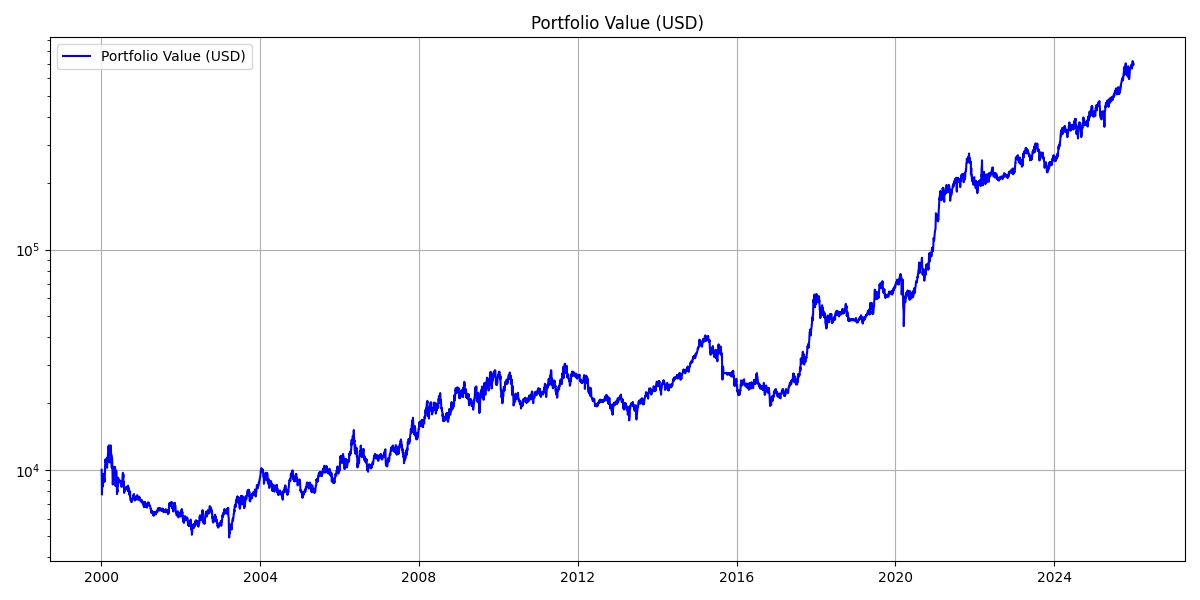

Key performance figures (2000 - 2025)

- Gross CAGR (USD): 17,07%

- Net CAGR (USD): 12,57%

- Gross CAGR (EUR): 16,39%

- Net CAGR (EUR): 12,06%

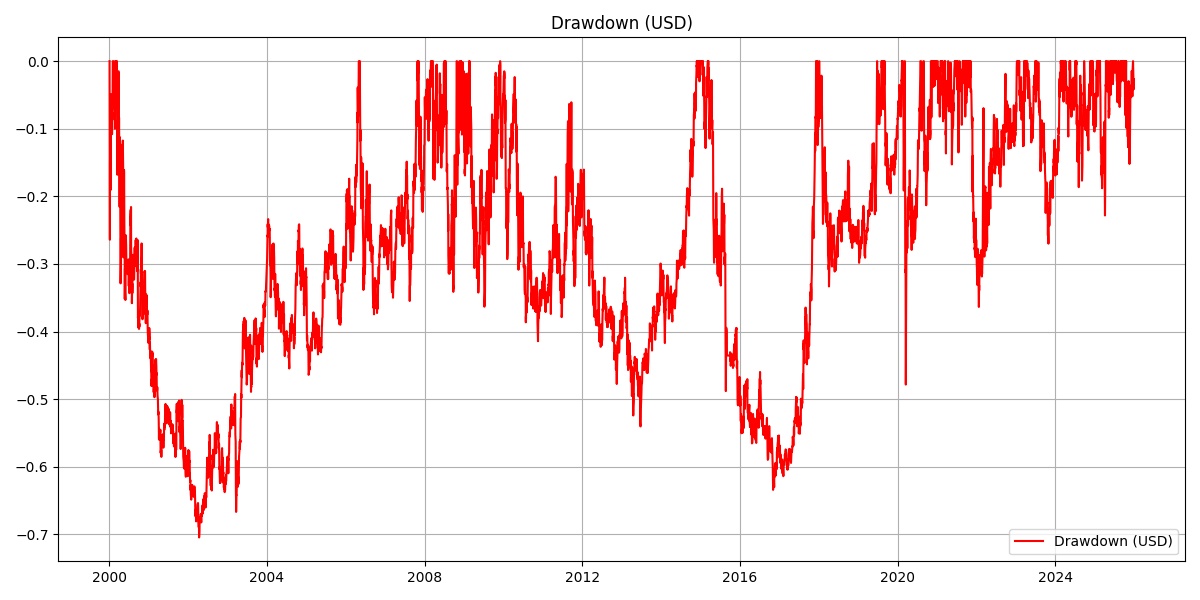

- Max. Drawdown (USD): -70,45%

- Max. Drawdown (EUR): -69,69%

Getquin does not support Markdown so you will have to live with the screenshot.

These results are completely acceptable in terms of return, but the drawdown is clearly too high.

In addition, this occurs during the dotcom crash - the 3xGTAA is actually an anti-cyclical strategy and should not actually fall so sharply in such phases.

The problem here is that we can only rebalance at the beginning of the month and therefore cannot react to the crash dynamics. I don't yet know whether there is a solution to this, but I would like to go into this in more detail in a later article.

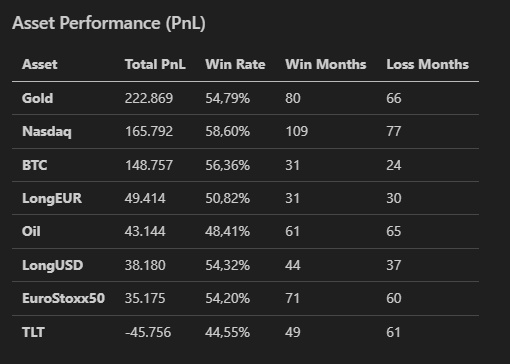

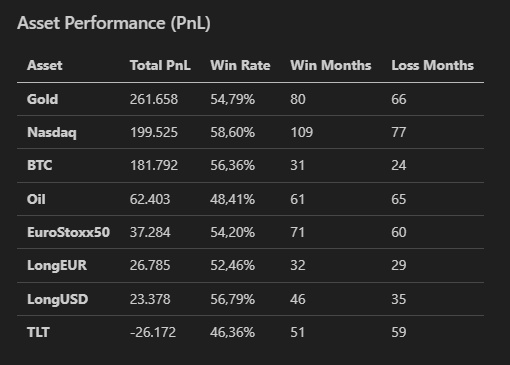

The culprits

As you can clearly see in the PnL table, TLTs are the main problem child. The high leverage leads to massive drawdowns in volatile market phases, which are not sufficiently compensated for by the return. In general, leverage above a factor of 3 is the devil's play for me and should only be used with extreme caution.

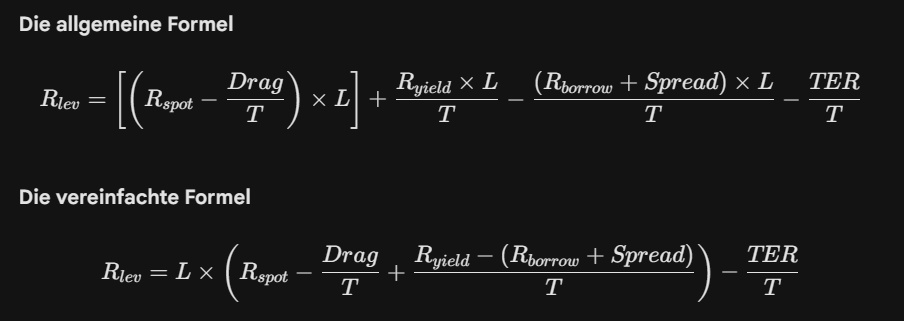

3-factor leverage construction

To build a stable 3x leverage from existing certificates (e.g. a 5x or 7x long), you use cash or the unleveraged underlying (1x) for "dilution".

The formula is: Target leverage (3x) = Leverage_A * (1 - p) + Leverage_B * p

From 5x to 3x (with 1x): 3 = 5 * (1 - 0.5) + 1 * 0.5 -> 50% 5x certificate + 50% 1x certificate.

Thanks to the monthly rebalancing in the Wikifolio, the effect of path dependency is kept within limits, even if the construction does not mathematically deliver exactly 3x every day.

3xGTAA better stay 3xGTAA

For the sake of completeness, here are the assets again:

- 3x Nasdaq 100

- 1x Bitcoin (BTC) (as of 2018)

- 3x Gold

- 1x money market

- 3x USD / EUR

- 3x EUR / USD

- 2x oil

- 3x US Treasuries (TLT)

- 3x Euro Stoxx 50

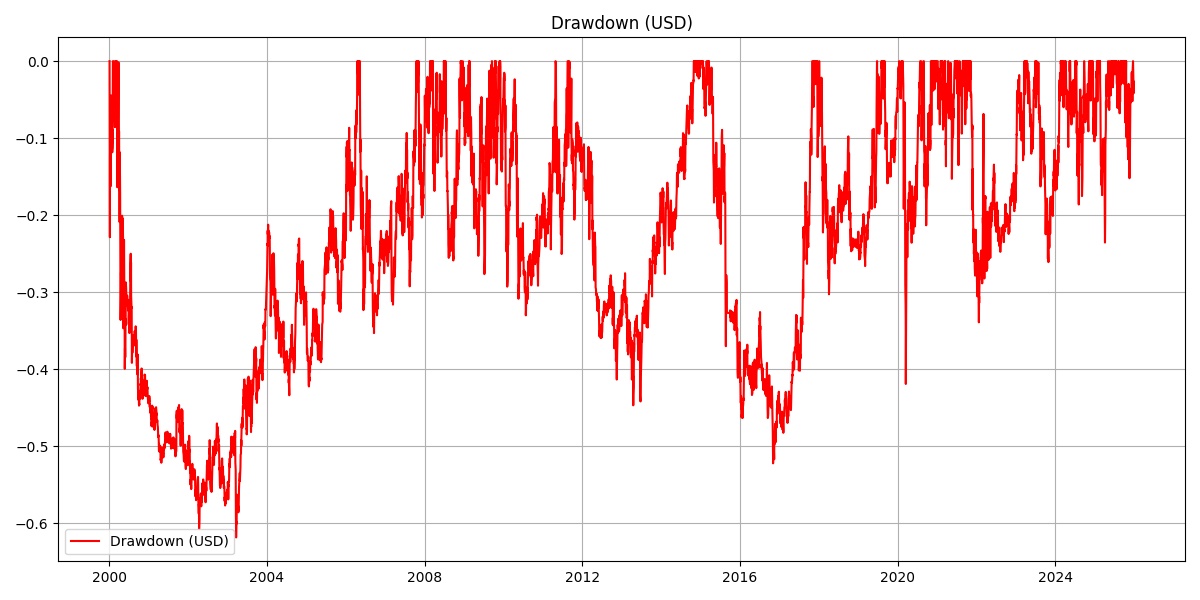

Here are the results of the optimized 3xGTAA:

Key performance indicators (2000 - 2025)

- Gross CAGR (USD): 17,75%

- Net CAGR (USD): 13,07%

- Gross CAGR (EUR): 17,06%

- Net CAGR (EUR): 12,56%

- Max. Drawdown (USD): -61,85%

- Max. Drawdown (EUR): -65,31%

As you can see, a 3xGTAA which does not go beyond leverage 3 beats the current 3xGTAA in MaxDD as well as CAGR and is therefore better in both of our target dimensions.

Conclusion and outlook

The 3xGTAA has a higher drawdown than expected, but this can be remedied by adjusting the leverage of the 5x and 7x assets to 3x.

There are many other things to consider, for example the performance of the strategy is significantly worse if the sigans are not evaluated on the 1st trading day of the month but on the Xth trading day of the month.

You can see exactly what the problem looks like in the next part of this series - I don't know if there is a solution yet, but I will find out.

I also need to take a critical look at how the 3xGTAA assets are selected, especially with regard to overfitting and survivorship bias.

As you can see, there is still a lot to do!