Hello my dears,

Today I've been looking for another "fallen angel" for you.

AI is here to stay and has also arrived in Germany. By now, word should have gotten around in companies that AI implementation makes working life easier and more efficient.

Even though software shares are not in high demand at the moment, I see momentum emerging in the share I am presenting to you today.

Perhaps investors have realized that this software should only benefit from AI.

Dear readers, what do you think?

I look forward to many comments.

(@Get_Rich_or_Die_Tryin , @Klein-Anleger )

EXASOL AG is a company based in Germany. The company is active in the field of analytical database management software. The company's product is Exasol, a memory-oriented, column-oriented, relational database management system.

Number of employees: 157

Whether as a standalone data warehouse, analytics accelerator or AI/ML model enabler, Exasol ensures reliable, high-performance analytics in both on-premises and hybrid environments.

Madeleine Corneli leads product development for AI and ML at Exasol. She focuses on opening up critical AI and ML use cases for customers and expanding Exasol's value proposition. She focuses on classic machine learning and generative AI across all industries. Madeleine has extensive experience in analytics and deeply understands how data can empower people and solve problems.

Exasol positions itself in the market as a specialist in high-speed analytics. The core of its business model is an in-memory database technology designed to process complex data queries extremely quickly. Exasol solves the widespread problem of slow business intelligence dashboards for customers. A central component of the current portfolio is "Exasol Espresso". This solution acts as a plug-and-play accelerator for existing BI tools such as Tableau or Microsoft Power BI, without customers having to replace their entire existing data infrastructure. This approach significantly lowers the barriers to entry for new customers, as it does not require costly "rip-and-replace" projects, but integrates seamlessly into existing cloud or on-premise architectures.

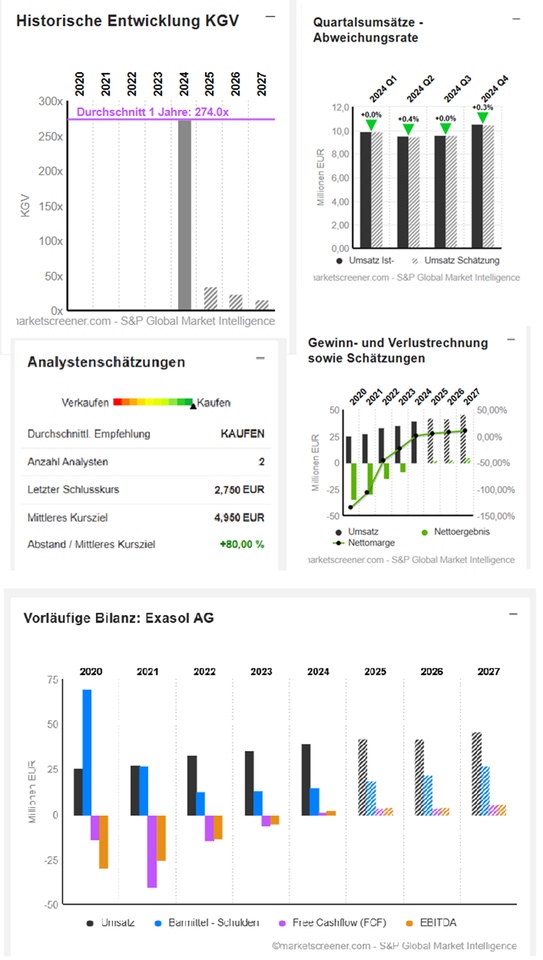

On January 26, Montega AG added the share to its rating with a "buy" recommendation and a target price of EUR 3.60. In their assessment, the experts pointed out, among other things, that Exasol has been able to report annual sales growth of 12.9% since 2019. After a transition phase, the profitable and more predictable growth path could be resumed. The analysis states: "In the future, the expected sales growth (CAGR 2024-2031e: 7.9%) should lead to pronounced earnings growth (EBITDA CAGR 2024-2031e: 29.0%) due to the strong scaling of the cost base with high marginal margins. According to our DCF model, these assumptions result in a fair value of EUR 3.60 per share. In our view, the current EV/EBITDA of 13.0 (2025e) does not reflect the strong earnings growth with high cash conversion due to negative working capital and minimal CAPEX requirements."

On the chart, the breakout above the GD 20 and a resistance line on January 26 already gave two procyclical buy signals.

Exasol_Trading_Update_9M_2025.pdf

EUR in millions of EUR

Estimates

Year Turnover Change

2024 39,63 11,95 %

2025 42,15 6,36 %

2026 41,65 -1,19 %

2027 45,85 10,08 %

Year EBIT Change

2023 -8,3 44,3 %

2024 0,2324 102,83 %

2025 2,4 908,78 %

2026 3,45 43,75 %

2027 5,3 53,62 %

Year Net result Change

2023 -8,217 45,22 %

2024 0,2293 102,79 %

2025 2,2 859,27 %

2026 3,05 38,64 %

2027 4,65 52,46 %

Year Net debt CAPEX

2023 -13,3 0,1

2024 -15 0,18

2025 -18,6 0,2

2026 -21,9 0,25

2027 27,1 0,25

Year Free cash flow Change

2023 -6,392 56,1

2024 1,203 118,82 %

2025 3,6 199,25 %

2026 3,35 -6,94 %

2027 5,15 53,73 %

Year EBIT margin ROE

2023 -23,45 % -166,44 %

2024 0,6 % 5,11 %

2025 5,69 % 42,8 %

2026 8,28 % 41,9 %

2027 11,56 % 41,35 %

Year Earnings per share Change

2023 -0,3056 50,25 %

2024 0,0085 102,78 %

2025 0,08 841,18 %

2026 0,115 43,75 %

2027 0,175 52,17 %

Year P/E ratio PEG

2023 -10.3x 0.2x

2024 274x -3x

2025 34.4x 0x

2026 23.9x 0.5x

2027 15.7x 0.3x

Market value 73.11

Number of shares (in thousands) 26,584

Date of publication 18.03.2025