2 months ago I shared that I had broken the 30k. Now the 40k has also been broken. Before the end of the year I hope to reach 50k.

On to more!🤩🦍

$BTC (+0,78%)

$TDIV (+0,16%)

$VWRL (+0,61%)

$VUSA (+0,86%)

$JEGP (-0,27%)

$JEPI

Postos

472 months ago I shared that I had broken the 30k. Now the 40k has also been broken. Before the end of the year I hope to reach 50k.

On to more!🤩🦍

$BTC (+0,78%)

$TDIV (+0,16%)

$VWRL (+0,61%)

$VUSA (+0,86%)

$JEGP (-0,27%)

$JEPI

Dear community,

Due to circumstances in my job, I am now able to invest EUR 1200 per month in my income portfolio.

Unfortunately, I am at an impasse with my ideas and somehow need fresh input.

About me: Through individual shares (e.g. $O (-0,13%) , $MAIN (-0,18%) , $KO (+0,04%) , $HAUTO (+1,12%) , $PEY (+1,33%) etc.) I currently receive an average monthly net dividend of EUR 206.

My investment objective is to build up passive cash flow. I am currently investing this independently in other assets or buying individual shares. If everything goes well, I would reduce my job in the future (5-10 years) thanks to the dividends.

My interest is a hybrid strategy (approx. 60% in dividend ETFs with (hopefully) growth and 40% in covered calls).

After much deliberation, I have now arrived at the following weighting:

$VHYL (+0,24%) - 25% - 300,-

$FGEQ (+0,88%) - 5% - 60,-

$DEM (+0,17%) - 10% - 120,-

$TDIV (+0,16%) - 20% - 240,-

$JEGP (-0,27%) - 20% - 240,-

$JEPI - 10% - 120,-

$QYLE (-0,01%) - 10% - 120,-

I don't like the $FGEQ (+0,88%) (dividend growth is not really good) and the $QYLE (-0,01%) (poor performance). What do you think of the weighting? I would be more than grateful for any ideas, suggestions etc. Muchas gracias.

According to the article "JEPI: 2 Reasons To Buy It Right Now" (published August 22, 2025), there are two clear arguments for getting into the JPMorgan Equity Premium Income ETF (JEPI) now:

Low cost & wide diversification $JEPI has a relatively low expense ratio and spreads its investments across leading blue-chip companies, making the fund both cost-efficient and diversified.

High monthly yields

The fund offers an attractive high yield as well as monthly distributions. This makes JEPI particularly interesting for those looking for regular investment income.

. First, the fund offers a high monthly payout, providing investors with a stable and predictable income stream. This is particularly valuable for those seeking cash flow, such as retirees or investors seeking additional income. Second, JEPI combines these distributions with low costs and broad diversification across quality blue-chip companies. This reduces risk while maintaining attractive returns. This combination of reliability, diversification and return makes JEPI an interesting choice for defensive as well as income-oriented investors.

Source: Seeking Alpha - "JEPI: 2 Reasons To Buy It Right Now" (Aug. 22, 2025)

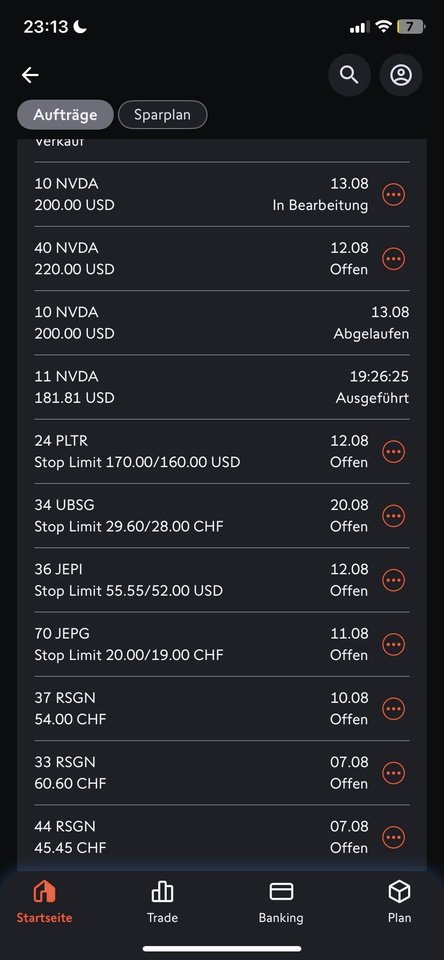

Small sale of $NVDA (+1,38%) .

129 shares and 200 stock options remain (2x long call contracts, 06.2026, 102 strike). So only 3% were sold.

Stop limit trades were also recorded.

The CC Funds ($JEPI

$JEGP) (-0,27%) have become too hot for me under Trump and expected strong setbacks if he intervenes even more in the markets simply do not work with CC Funds. Was planned for sideways markets.

$PLTR (+1,97%) is a "hot commodity".

$UBSG (-0,53%) I have a large residual position and will adjust it a little if necessary. If necessary, I'll tighten the stop.

$RSGN I will set stop trades at 45 from a price of 50. I think that's still within a year's time.

Primary reason for the general liquidation thoughts: Tw. repayment of the Lombard loan.

Lombard loan key data:

Portfolio value: 247k

Lombard loan: 27.1k remaining amount, 30k max. Value to date.

Interest in CHF: 3.0%, p.a.

So around 11% of the current portfolio, or 12.3% of the loaned assets.

Primarily taken out in mid-April - May, around 15% return on average assets since then.

Even better: The loan was primarily used to make 2 trades (NVDA calls, 6k stake (170% return currently) & RSGN, 7k stake (24% return currently), which contribute strongly to the overall performance.

Calculated with the 15%, in 4 months, the Lombard (30k) brought me an additional 4.2k.

I don't have to pay it back - let it run a little longer if necessary...

Here is a weekly update from my holiday address, not ideal but still wanted to give a small update.

#dividend

#dividends

#dividende

#invest

#investing

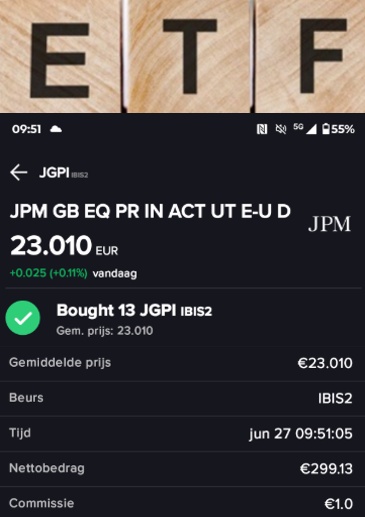

Today I bought the $JEGP (-0,27%) etf, 11 shares at an average price of €23,010 each (including transaction costs).

I currently own 210 shares, which currently yields +- €357 per year in dividends.

Today I bought the $JEGP (-0,27%) etf again, 13 shares at an average price of €23,086 each (including transaction costs).

I currently own 188 shares, which currently yields +- €319 per year in dividends.

Principais criadores desta semana