$LYPG (+0,92%) not tradable for days at #traderepublic . Does anyone know what's going on?

Amundi MSCI World Information Tech ETF A

Price

Discussão sobre LYPG

Postos

13Hello everyone,

I recently started my first job (3 months ago) and have been thinking about a savings/investment strategy. Could you please comment on it (also constructively negative) so that I can learn from your shared experience?

I specifically tried to make the strategy a bit more risky/risky as I think I should do that as a young person to get slightly better returns.

Specifically:

- 200 $IWDA (+0,55%)

200 $LYPG (+0,92%)

200 $QDV5 (-0,18%)

200 $UST (+1,18%)

300 $BTC (+0,71%)

300 $BATS (+0,8%)

Is there anything else I should add/change?

Hello everyone,

I need your help.

I have been saving for a custody account for my daughter since last year. She was born 5 weeks ago.

At the moment the custody account is still in my name and I want to keep it that way for the time being. (Yes, I am aware that this reduces the return due to tax compared to a junior custody account, but I feel more comfortable with it at the moment).

I'm currently saving €50 plus X. Money that was given as a birthday present was added on top.

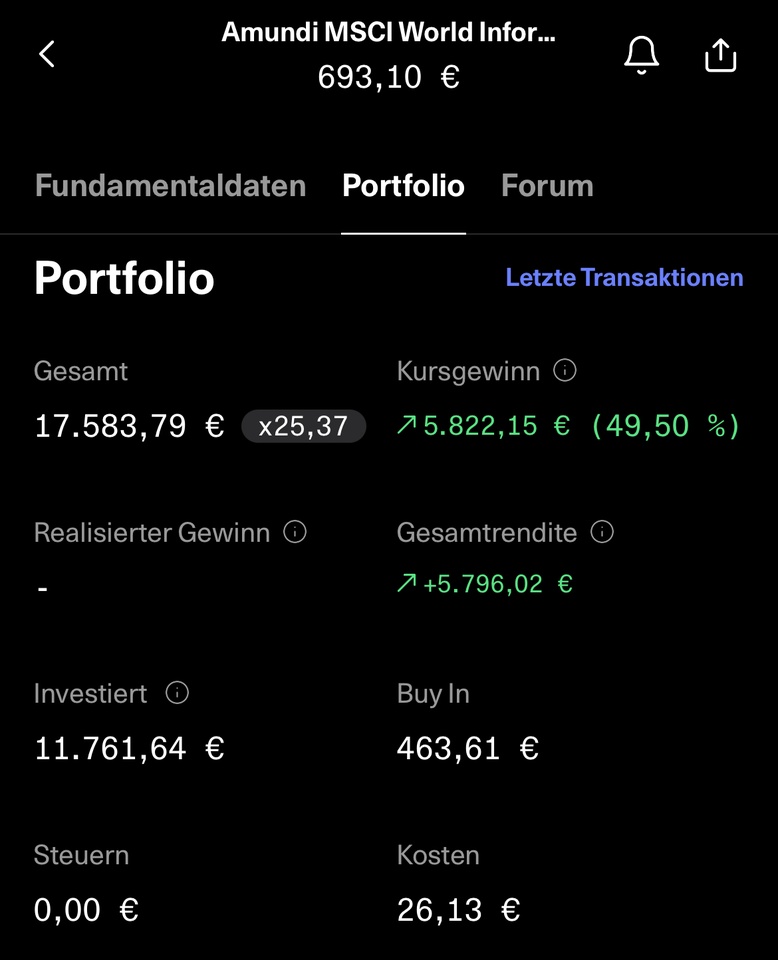

You can see the portfolio attached.

I started with 50% $LYPG (+0,92%) and 50% $ACWI .

Then later I added the $IEMA (+2,88%) added later.

At the moment I am saving about 45% of the $ACWI and the $IEMA (+2,88%) and with 10% the $LYPG.

Now Grandma would also like to save 50 per month and we have agreed (for reasons) to do the whole thing on my custody account. (Again, I am aware of the advantages and disadvantages).

Now to my question:

What would you guys recommend grandma should save in if it's going to be her own position(s)? How would you divide up the €50? Just take another All World and EM? Or would you rather include a sector ETF?

Many thanks for your support and your patience in reading so much text.

Greetings

aah91

$LYPG (+0,92%) - I would like your opinion, maybe you even have another idea.

I'm toying with the idea of "parting" with my shares in the tech sector ETF mentioned and have recently been going through a few options.

Background: In the meantime, I think I'm too IT-heavy, I'm also buying individual stocks in parallel (60-70% ETFs) and would like to diversify more and also reduce the lumpy USA risk somewhat. Furthermore, I now find the TER a little too high, the synthetic replication also harbors risks that should not be neglected and I am no longer 100% behind it. This currently applies to sector ETFs in general.

On the other hand, of course, there is the current good performance (what else) and potential taxes when selling.

I'm toying with the following ideas, what do you think?

a) 👍 Sell my shares, take the profits and pay taxes, put the sum into the $VWCE (+0,8%)which I am also saving for

b) ❤️ stop saving in it and leave it and not take any profits (and only sell it if it falls again so far that the taxes to be paid are minimal). To increase the savings plan of the $VWCE (+0,8%) increase

c) 🚀 Throw thoughts overboard and continue to save via a savings plan, but reduce tech individual shares if necessary.

d) ...?

Thank you for your (honest) opinions.

Títulos em alta

Principais criadores desta semana